Consultant: VLCC rates have resumed their climb

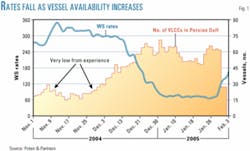

Tanker rates for very large crude carriers (VLCC; larger than 220,000 dwt) trading internationally fell precipitously at yearend 2004 to $35,000/day, after reaching record highs earlier in the year of more than $200,000/day (Fig. 1). An analysis by New York-based shipping consultant Poten & Partners, however, shows that movement as temporary.

Vessel inventory in gulf

In a report released early last month, Poten noted that VLCC rates tend to increase when the number of ships on the spot market in the Persian Gulf plus those expected to arrive there within 30 days falls to fewer than 30 vessels.

"The exigency of matching a ship to a cargo clearly works against charterers when there is a reduced pool of vessels to choose from," said the report. November 2004 saw an extended period of relative scarcity of vessel availability in the market. "Clearly the rise in vessel availability in late December correspondingly contributed to the fall in rates," the report said.

Rates also fall when less cargo is moving, it said, a point illustrated in Fig. 2 which shows daily fixture activity over this period of time. (A fixture is fixed charter contract for a given vessel.)

The holiday season at the end of December was actually not the time, said the report, that charterers and owners took it easy; fixture activity actually fell significantly before the season. This event coincided with the appearance of a larger number of available vessels, it said. Predictably, said the consultancy, as Fig. 3 shows, "when fixture activity drops VLCCs begin to pile up" in the Persian Gulf.

West Africa factor

Fig. 3 shows that vessel availability was plummeting in the gulf just as fixture activity was increasing at the end of January. "Naturally rates rose," said the report, "but why so fast?" The answer lies in the other main VLCC load zone, West Africa.

Spot-market West Africa liftings, the report said, have steadily increased to close to 40/month from about 25/month in 2002. "But the actual fixture dates for these liftings [are] quite variable," it said.

In a relatively calm December 2004, charterers fixed only 18 vessels. In January, said the report, they fixed 38. In only 2 days (Jan. 26-27), "charterers fixed eight VLCCs for spot voyages ex-West Africa" (although three later failed, said the report), "adding further pressure to worldwide VLCC rates."

Poten said its analysis suggests that in a market with a tight supply-demand balance, "rate moves can be quite volatile. It appears that just as a combination of greater ship availability and falling fixture activity led to a fall in rates at the end of December, less tanker availability and rising fixture activity has resulted in a rise in rates."

Since reaching their 18-month lows in January 2005, said the consultancy, rates have come up "quickly and decisively on the back of stronger vessel demand on both sides of the Suez and a tighter tonnage supply picture."

In late January, however, rates seemed to have paused their ascent. But they "will probably stay strong in the near term as long as the tonnage supply picture remains tight and crude oil liftings" from the Persian Gulf and West Africa keep growing.