Study shows rising growth in North American compressor market

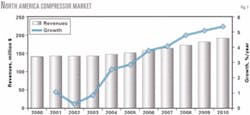

A new analysis from Frost & Sullivan, "North American Markets for Compressors in the Oil and Gas Industry," shows that this market will increase its revenue to $192.1 million in 2010, up from $148.8 million in 2004 (Fig. 1).

The compressor market for the North American oil and gas industry experienced flat growth during 2000-03, according to the analysis. Although the US economy was stagnant, the oil and gas industry due to its inherent strength did not experience declining sales. Sales revenues in the compressor market were flat during this time.

Due to overall expected growth in the oil and gas industry, the compressor market will improve to a compound growth of 4.1%/year in revenue during 2004-10, according to Frost & Sullivan.

The main reasons for this growth include:

- A steadily improving economy in the US and Canada, with growth of 3.5-4.0%/year.

- The potential for increased exploration efforts in view of the increasing cost of crude oil and natural gas.

- More stringent refined-product- quality specifications, especially for gasoline and diesel, leading to more desulfurization capacity and therefore higher hydrogen compression requirements.

- An expected increase in natural gas and LNG movement due to higher natural gas consumption, especially in the power generation sector.

Market segmentation

The North American market for compressors in the oil and gas industry consists mainly of three segments: exploration and production, refining, and storage and pipelining installations.

Frost & Sullivan analyzed the market growth potential of the compressor market in terms of various types of segmentation including equipment type, geographic location, and end user.

The US accounts for nearly 78% of equipment sold, and Canada accounts for 22%. This is primarily because the bulk of the energy industry is concentrated in the US.

The main types of compressors are:

- Turbocompressors, centrifugal and axial.

- Reciprocating.

- Rotary screw.

In 2003, turbocompressors accounted for about 50% of total compressor revenues, followed by reciprocating compressors with 34%, and rotary screw compressors with 16%, according to the analysis. Frost & Sullivan expects this trend to continue in 2004-10 with only minor variations.

Although significant technological advances have not occured in the compressor industry, unique products have led to improved efficiencies and lower operating costs. A typical example is Dresser-Rand Co.'s Datum compressors. Higher efficiencies help reduce power consumption and indirectly lower emissions from the drive equipment (if they are gas or steam turbines).

Another advancement in the compressor business is the establishment of testing facilities that can produce the necessary power for testing new compressors. The compressors are therefore fully tested and proven at expected operating conditions before being shipped. Several major companies conduct rigorous product testing.

Advancements in control systems produced by compressor manufacturers comprise another area experiencing rapid progress. Digitally controlled, state-of-the-art programmable logic controllers continuously monitor equipment health in terms of surge control, vibration levels, lubricating oil and gas temperatures, overspeed trip protection, and turbine governor control.

Although there are other types of compressors, the Frost & Sullivan study only analyzed the three major types.

End-user trends

In 2004-10, the forecast period, Frost & Sullivan expects most growth to occur in the refining segment. This is because refiners primarily use large, high-priced turbocompressors.

Product-quality specifications for gasoline and diesel are becoming increasingly stringent in terms of requirement for lower sulfur content. This has led to more capacity additions in the form of new and revamped desulfurization units, according to Frost & Sullivan. And because desulfurization requires the use and compression of large quantities of hydrogen, it directly translates into more compressor sales to refiners.

"Although new grassroots refineries are not likely to be set up and additional refining capacities are expected only through the expansion of existing ones, the increased demand for compressors is still expected to be substantial," said Frost & Sullivan Industry Analyst T.R. Sudharshan.

Another factor that could enhance sales of compressors is the likely development of gas-to-liquids (GTL), according to the analysis.

The exploration and production and storage and pumping installations segments also have a significant market share due to the expected large-scale increase in the movement of natural gas and LNG as well as crude oil and petroleum products.

An improving economy and slow-to-develop alternative energy sources will increase demand for oil and gas in North America, according to the study. These factors will result in increased exploratory efforts to obtain more crude oil and natural gas supplies, both from existing wells and new ones.

Frost & Sullivan felt there could be more exploration activities for indigenous sources of natural gas, as well as its greater transmission, especially from Alaska and the Rocky Mountains. These developments could boost the demand for compressors.

Manufacturers, while catering to this increased demand, should also be careful about preventing inventory overhang due to the cyclical nature of the industry. The excess inventory locks up the capital, which, in turn, reduces profits.

"It is important for manufacturers to dynamically change their production strategy to reduce overcapacity," said Sudharshan. "Developing new fields as well as deepening wells is significantly expected to push demand for additional compressors, and thereby substantially improve profit margins."

Industry challenges

Future growth of the North American compressor market will depend in part on the industry's actions towards key market challenges, according to the analysis. These include:

- Increased competition leading to price erosion and low profitability.

- More stringent refined product specifications and refiners' ability to meet them.

- The cyclical nature of the oil and gas industry, which can result in excess compressor inventories and lower profitability.