FASB 143 rules will change decommission liability

DECOMMISSION OBLIGATIONS—1

The US Financial Accounting Standards Board (FASB) recently issued a comment that will change the manner in which oil and gas companies account for dismantling and removing oil and gas facilities.

The proposed implementation of FASB Statement No. 143, Accounting for Asset Retirement Obligations, if adopted, would take effective no later than the end of the fiscal year, which ends Dec. 15, 2005.1

This first in a two-part series will describe FASB 143 and factors that influence decommissioning. The second part will present cost functions to help operators estimate offshore liability and present an estimate of the fair market value for the decommissioning liability for several Gulf of Mexico operators.

FASB 143

On June 17, 2004, the FASB, a private-sector body that sets generally accepted accounting principles, issued for comment a proposed implementation FASB Statement No. 143.

FASB 143 initially dealt with the accounting for nuclear decommissioning costs, but later the board decided to apply it to many long-lived assets in other industries.

In 1996, FASB issued an exposure draft, Accounting for Certain Liabilities Related to Closure or Removal of Long-Lived Assets, and after a comment period and further deliberation, a revised exposure draft, Accounting for Obligations Associated with the Retirement of Long-Lived Assets, was released in 2000.

A revised draft further extended the project scope to include obligations arising at any time during the life of an asset.2

Accounting for DR&A costs

Many businesses employ an income-statement approach to account for the retirement liability of long-lived assets, in which the costs related to closure obligations is rated as a component of depreciation or expensed as incurred.3

According to a 2001 PricewaterhouseCoopers (PWC) survey of US petroleum accounting practices,4 nearly 80% of companies with offshore operations either make no provision for future dismantling, removal, and abandonment (DR&A) costs until they are incurred, or employ an "adjusted amortization method" or "negative salvage value method," under which the related assets depreciation base is increased for estimated DR&A costs.

FASB 143 shifts the focus to a balance-sheet approach, requiring businesses to recognize a liability for a retirement obligation when it is incurred. In the "liability method," a company estimates the future DR&A costs at the time of the asset's installation or construction, and then capitalizes the estimated amount and recognizes a corresponding liability. The capitalized amount is amortized as the related reserves are produced.

Differences between previously recorded expenses and expenses that would have been recorded had FSAB 143 been followed in prior years will require a cumulative-effect adjust- ment.56

Implementation issues

FASB 143 requires entities to record the "fair value" of a liability for legal obligations stemming from the eventual retirement of a tangible long-lived asset. The company must estimate the cash flows required to settle a retirement obligation with information and assumptions that the marketplace participants would use, such as incorporating explicit assumptions on inflation, technology advances, discount rate, and other factors.

To implement FASB 143, oil and gas companies need to determine whether the entity has a legal obligation related to the retirement of oil and gas structures, and then:

Well protectors refer to structures that provide support through a jacket to one or more wells (Fig. 2). Photos from Twachtman Snyder & Byrd Inc.

1. Estimate the costs related to retirement obligation.

2. Prepare a range of estimated cash flows related to settlement of the obligation and weight them according to their probabilities of occurrence.

3. Discount the cash flow data to the date the liability is estimated to be incurred with a risk-free interest rate adjusted for the entities credit standing.

Gulf of Mexico infrastructure

In the Gulf of Mexico companies commonly employ three categories of structures: caisson, well protector, and fixed platform.

A mobile offshore drilling unit normally drills wells associated with caissons and well protectors. These structures usually do not support significant production equipment or drilling facilities.

Fixed platforms are large, complex, and self-contained structures that include facilities for drilling, production, and combined operations.

At the end of 2003, the gulf had 2,175 active (producing) structures, 898 idle (nonproducing) structures, and 440 auxiliary (never-producing) structures on 1,356 active leases; and 329 idle structures and 65 auxiliary structures on 273 inactive leases (Table 1). Table 1 does not include a few dozen deepwater structures classified as compliant tower, spar, tension-leg platform, mini tension-leg platform, floating production and storage unit, and semisubmersible.

An active structure produced hydrocarbons in 2003; an idle structure once produced hydrocarbons but has not been productive over the past year; and an auxiliary structure has never produced hydrocarbons but serves in a support role, as a quarter facility, flare tower, storage platform, etc.

Federal regulations

Different government bodies regulate the decommissioning and abandonment of offshore structures, and the regulatory body with primary responsibility depends on the physical location of the structure. State agencies are responsible for structures in state waters, while the Minerals Management Service (MMS) is the federal agency responsible for decommissioning activities in the US outer continental shelf.

The general requirements for decommissioning specify that all wells be permanently plugged and abandoned, all platforms and other facilities be removed, and the seafloor cleared of all obstructions created by the operations within 1 year after the lease or pipeline's right-of-way terminates.7

Typically, a lease is terminated when production on the lease ceases, but if the operator intends to rework wells or is pursuing drilling activity on the lease or the lease contains an active pipeline, conditions may warrant the MMS to grant an extension of the lease termination.

Because a lease typically contains several structures, a company is only required to remove all structures when production ceases on the last structure. Operators typically plug and abandon non-producing wells and may remove infrastructure on a productive lease early, but removal of all structures is required only after the lease is terminated.

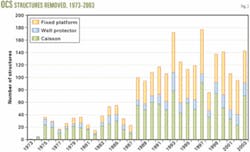

Since 1947, companies have removed more than 2,300 structures from gulf, and during the last decade, removals have averaged 125 structures/year (Fig. 3).

Decommissioning operations

Decommissioning operations generally are routine, involving standard, low-technology methods, over distinct stages and short time horizons. The three primary stages of decommissioning are: plugging and abandonment, structure removal, and site clearance and verification.8 9

Operating offshore is more uncertain and more costly than onshore due to the hostile ocean environment, and a greater potential for harm to human, marine mammal, and other sea life exists.

The main areas of concern in onshore environmental liability include:10

1. Groundwater contamination from production and injection wells or pits.

2. Inability to make property improvements because of construction requirements and regulatory constraints.

3. Failure to comply with existing construction or facilities regulations and to conduct monitoring and reporting programs.

These concerns are generally minimal or nonexistent offshore.

Factor description

The time and cost to plug and abandon wells, remove platform infrastructure, and clear and verify a site depend on such factors as the physical characteristics of the well and structure, location, contract type, disposition options, operator preferences, market conditions, construction practices, preparation, the occurrence and duration of exogenous events, contract specification, and negotiation strategies.

There is no way to identify all of the characteristics that affect each stage of decommissioning, but we can observe many characteristics, and in practice, it is only necessary to identify factors that describe the essential elements of the process.

Well complexity

Well complexity is a key factor in determining the number of bridge-cement plugs that have to be set and the number of casing strings to recover and remove.

Well complexity is not a uniquely-defined measure, however, and depends as much on the experience and contingency planning of the service company as on the downhole conditions encountered.

The availability of good records is essential to planning and executing a plug and abandonment (P&A) job, but if good records are unavailable or do not match the well configuration, planning success may be impacted.

Ideally, operators should develop an abandonment plan before the well is drilled, which should then be updated when the well's mechanical configuration is changed.

Structure characteristics

The primary physical characteristics of offshore structures that affect the cost and time of removal include the deck size and weight; jacket size and weight; the number of piles, skirt piles, conductors, wells, and pipeline attachments; and the diameter and weight of piles and conductor strings.

The size and weight of the deck and jacket are important because they determine the size and type of construction equipment required for the operation.

A company selects the derrick barge based on the water depth in which the barge can safely operate, the lift capacity of the cranes, and market availability. The minimum barge required is determined by the maximum load weights expected during the operation. In shallow water, the deck is normally the heaviest lift, while in deep water, the jacket weight normally exceeds the deck weight.

Lifts must be engineered to ensure a safe operation within the capacity of the crane. The load weight and dimensions, center of gravity, rigging, and crane capacity limits are charted to verify that the crane can complete the lift.

Location

The location of the structure is important because location determines the distance to shore, water depth, and proximity to the nearest reef site. Distance to shore is important because it determines the time and cost for mobilization-demobilization, offloading and transport, and service cost.

For most structures in the gulf, it usually takes about 1 day to arrive at site and to prepare for the operation, and therefore the site location is not expected strongly to influence the cost estimates.

Structures that are more than 15 miles from shore are typically out of range for daily shift changes by crew boat and will require accommodations during decommissioning.

The structure's location relative to shipping lanes and artificial reef sites also affects the removal options available to the operator, and subsequently, the cost of removal.

Water depth

Water depth is a primary variable in offshore construction and P&A activities because increasing water depth generally requires the size of the rig to increase, which reduces operational flexibility and increases the cost of the operation.

In P&A operations, water depth is not expected to be a significant factor in waters shallower than 600 ft because at this depth the operation is homogeneous in terms of the type of rig required.

Water depth correlates with the size and weight of the structure, increasing the size of the derrick barge required in removal operations.

Increasing water depth will increase diving cost and generate constraints on diving time and operating procedures and in general will increase the sensitivity of the operation to environmental factors.

Disposition

Many options exist for topsides removal and disposal (Fig. 4). A company may scrap or store ashore the deck and jacket structure, reinstall them at a new location, sell them to another operator, or convert them to an artificial reef.

All US Gulf Coast states maintain artificial reef programs, and to date companies have donated more than 200 offshore structures that were converted to reefs, representing about 20% of the total number of structures decommissioned since the "rigs-to-reefs" programs were created.

Most rigs-to-reefs structures are off Louisiana (125) and Texas (73), with smaller numbers scattered off Alabama, Mississippi, and Florida.

Louisiana has nine designated sites for the disposition of artificial reefs,11 while Texas uses an exclusion approach, under which any area is assumed to be an appropriate site unless excluded because of alternative uses such as navigation or pipeline lanes.12

Removal method

After the conductors and piles have been removed, decommissioning involves lifting the jacket structure out of the water and welding it to a materials barge for transport to shore or a reef site. In some cases, companies topple the jacket in-place after cutting off the piling, while in other cases, the companies cut the jacket in half in the water column and place the top-half of the structure on the seabed near the bottom half.

A structure "toppled-in-place" proceeds much like a complete removal operation, except that after the piles are cut and removed, the structure is pulled over and placed on its side on the seafloor.

In a "partial removal," the bottom-half of the structure is left standing vertically in the water column while the top-half section of the jacket is severed and placed next to the base or removed to shore.

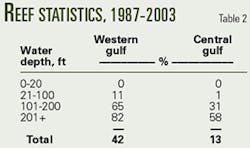

The likelihood that a company converts a structure to an artificial reef increases with the water depth and varies with the planning area (Table 2). Operators that transfer a platform into an artificial reef can often lower the cost of decommissioning below the cost that they would incur in bringing the platform to shore, and the usual practice is for the state and operator to split the savings.

Companies that transfer platforms to a reef program are required to donate one-half of the expected savings from reefing directly into the state's trust fund.

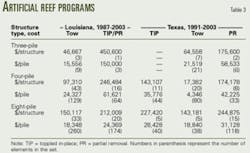

Table 3 summarizes cost statistics for the Louisiana and Texas artificial reef programs, providing an indication of the savings associated with this option.13

Reuse markets

The physical characteristics of a structure determine if the component is a candidate for reuse opportunities. Reuse markets for decks, piles, conductors, and jackets are generally thin and fragmented, and as the age of a structure increases, the likelihood its equipment, deck, or jacket will be reused greatly diminishes.

Companies always explore opportunities for reuse, but the opportunities remain limited by the costs of refurbishment and the evolution of stricter technical standards.

Unless an operator has or knows of an upcoming field development whose parameters approximately match the facility to be decommissioned, immediate reuse of the deck or jacket is unlikely. The refurbishment cost of old structures and equipment likely will exceed replacement cost and structural specifications will usually not match available opportunities.

Timing and scheduling are other major complicating factors for the reuse of structural components. Subsea wellheads, production manifolds, and equipment designed to high specification and deployed for a short production life, such as 10 years or less, usually are the best candidates for reuse.

Environmental conditions

The offshore oil and gas industry is both "weather and ocean sensitive" and "weather and ocean-information sensitive."

Weather and ocean sensitive organizations suffer losses because of adverse weather, and weather and ocean-information sensitive organizations can reduce these losses by taking protective action.

The more variable (uncertain) the weather and the more severe the climate, the higher are the costs of the action. Wind, waves, current, and weather affect offshore operations in the gulf throughout the year, especially during the peak hurricane season, Aug. 15-Oct. 15, and the winter season, Nov. 30- Mar. 31.

Drilling and construction activities particularly are at risk during these times, and although the offshore industry is known for its ingenuity, technological advancements, and ability to withstand harsh environments, extreme weather is one of the few factors that cannot be overcome.

Ocean forecasts are not as reliable or accurate as land-based forecast, and although companies can mitigate some of the uncertainty through equipment selection and avoidance scheduling, the extent of long-term planning remains significantly constrained.

Weather may delay an operation or require the crew to demobilize to shore. The party who accepts the weather risk will usually require a higher risk premium to manage the potential delay.

Technology options

The application and use of advanced technology vary with the contractor and job specification. A tradeoff usually exists between the cost-saving potential associated with the new technology vs. the premium of application and the additional cost of learning.

In P&A operations for instance, the traditional approach involves using a rig, where the derrick, draw works and surface equipment of a drilling or workover unit is brought to the site (or is already onsite).

In the rigless approach, the decommission process uses a crane to pull pipe, and coil tubing and wireline and electric line units to assist with the placement of cement plugs. The rigless approach is used primarily offshore and is normally less expensive than the rig method, although engineering requirements, contractor preference, or equipment availability dictate the method selected. Many options also exist for cutting operations.14

Exogenous conditions

Technical complications may delay the operation, especially if site conditions differ from the contract specification. Extra work rates normally apply outside the turnkey contract; for example, if the jacket is unable to withstand the stresses of removal, additional work will be required to reinforce the structure before lifting.

In P&A operations, it is not uncommon to find downhole obstructions in the production tubing, leaks, and corrosion. Failure to cut and the associated contingencies are normally specified in the contract terms.

The use of explosives to cut piling and conductors requires the water column and general vicinity of the structure to be clear of mammals and sea turtles. If mammals or sea turtles are spotted in the vicinity of the structure before detonation, regulations ensure that the marine life is not harmed.

Management decisions

Management decisions regarding how a field is abandoned are reflected in how structures are grouped for abandonment, the value of delaying removal, and ultimately, the terms of the contract.

The salvage value associated with the equipment, deck, and jacket will affect the net decommissioning cost and depends as much on luck and the timing of removal, as on the strategic decisions of operators and project managers.

Operator preference

The project management team overseeing the decommissioning activities, in consultation with the operator, prepares the bid package and specifies the work requirements to be performed. This information will include special requests, such as platform and jacket disposition, and preference (if any) for the severance method to be employed.

The operator also may have special concerns or preferences that dictate that a specific method be employed. For example, between Nov. 15, 2000, and Aug. 1, 2002, some operators, such as Shell Exploration and Production Co., ExxonMobil Corp., and El Paso Corp. specifically requested that contractors use nonexplosive methods for cutting because federal regulations concerning the incidental take of bottlenose and spotted dolphins expired and the NMFS could not issue Letters of Authorization for structure removal activities.15

As a result of the expired regulation, operators were potentially exposed to penalties and could be held criminally liable should a take be recorded due to an underwater detonation.

Project management experience

The experience and expertise of the project management team overseeing the operation is important in managing the cost of the operation and ensuring the removal plan satisfies the company objectives.

The project management team acts as the agent of the operator and is responsible for:

Examining all available alternatives for decommissioning.

- Grouping similar salvage and capital tasks into common work packages to achieve scale economies and shared mobilization costs.

- Completing work packages with minimum cost equipment spreads.

- Utilizing regulatory options available to perform the scope of work.

- Maximizing the value of salvaged structures, pipelines, and equipment.

Market conditions

Construction equipment used in removal operations ranges from lift-boats to derrick barges. Derrick barges are large, oceangoing vessels usually towed by tugboats and equipped with revolving cranes built into the hull of the vessel.

Crane capacity on a lift boat ranges from 10 to 70 tons, while for a small derrick barge it can range from 150 to 300 tons. Large hull vessels have crane lift capacities of 600-1,600 tons. A few large derrick barges in the gulf have lifting capability greater than 2,000 tons.

The number of vessels available in the gulf change with the supply and demand conditions in the region and other offshore regions such as the North Sea and West Africa.

Market rates for derrick-barge spreads depend on depth rating and crane vessel capacity. Day rates are useful indictors of supply and demand trends, but because most decommissioning projects are bid on a lump-sum basis, they are not as meaningful as the bid price or actual cost incurred in the operation.

Contract specification

P&A contracts are on either a day rate or turnkey basis and both types are popular in the gulf. In a day-rate contract, the service company performs activities under the supervision of the operator who "holds" the downtime, weather, and problem well risk. In a turnkey contract, the service company bids a "lump sum" for the completed job and is exposed to the full risk of the operation. Hybrid contracts also exist but are not prevalent.

For two jobs identical in all respects except contract type, the cost of a turnkey contract will be more expensive than a day-rate contract because the service company is fully exposed to capital, environmental, and technical risk.

The risk premium of the contract varies with the market and experience of the contractor, job specification, and other factors.

The team in charge of structure removal will let out a contract on the job according to one or more functional activities.

The project management team specifies the work requirements of the bid based upon the information available at the time. In most cases, the contractor is responsible to furnish all labor, equipment, and material, including a crane vessel with sufficient capacity, cargo barges, tugs, and necessary construction equipment to perform the operation.

The contractor generally will specify the severance procedure to be used and may provide various options if requested by the operator. If the operator specifies the severance method, this may result in the contractor's qualifying the bid to transfer the severance risk to the operator.

Typically, a lump sum bid includes weather downtime, except downtime due to named tropical storms, for work during the prime season, May 15 to Oct. 15.

The base bid will normally assume that the contractor will dispose of all platform components, while the operator will accept the cost of the National Marine Fisheries Services observers and aerial survey required for the use of explosives and any delays associated with the severance specification.

A lump sum optional bid also may be offered that gives the contractor the ability to quote an alternative decommissioning method not specified in the scope of work but which still meets all specifications and goals of the job.

The operator preferences and perceived risk of the operation depends on the decommissioning mode selected and the written contract specifications.

The terms of most deconstruction contracts in the gulf are turnkey with extra rates specified in the bid. In the bid selection process, the project management team is not necessarily a cost minimizer because other factors play a role in the selection decision, including operator preference, management expertise, contractor reputation, and experience.

Negotiations

Each contract is site, time, technology, and operator-specific, thereby making it difficult to quantify the final negotiation process that occurs. In general, however, the operator will try to write a contract as specific as possible to eliminate contingencies and minimize the cost and risk of unforeseen events in the operation.

Contractors prefer operational flexibility, a wide time window, and contingencies when uncertainty exists. A wide time window allows contractors to schedule operations to efficiently use their service vessel fleet, allowing them to bid more competitively and ensure extra time for unforeseen events.

Contractors also prefer the operator to accept any unexpected cost and risk associated with the operation such as if explosive methods are used, the operator will frequently incur all the cost associated with marine observers, aerial surveys, diver surveys, as well as any delays associated with the presence of sea turtles, marine mammals, nighttime restrictions, pile flaring, etc.

The final negotiation is a give-and-take process based upon the contract terms, precedence, market conditions, negotiation strategy, and the history of the relationship between the operator, project management team, and contractor. F

References

1. Financial Accounting Series. Exposure Draft. Proposed Interpretation. Accounting for Conditional Asset Retirement Obligation. FASB No. 1099-011, June 17, 2004.

2. Alexander, E.R., "Accounting for asset retirement obligations: FASB 143 Explains It All," Journal of Accountancy, December 2001.

3. Gallun, R.A., et al., Fundamentals of Oil & Gas Accounting, 4th Edition, Tulsa, Okla.: PennWell Corp., 2001.

4. Coe, T.L., et al., 2001 PricewaterhouseCoopers Survey of U.S. Accounting Practices, Denton, Tex.: Institute of Petroleum Accounting, University of North Texas.

5. Chewning, E.G., Jr., and McKie, A., "Accounting for asset retirement obligations," The CPA Journal, May 2002.

6. Johnson, J., and McKay, J., "Who said retirement is easy? FASB proposes to interpret asset retirement accounting," Deloitte Heads Up, Vol. 11, Issue 4, July 6, 2004.

7. Federal Register, 67(96), 35398-35412, Department of Interior, Minerals Management Service, 30 CFR Parts 250, 256, Oil and Gas and Sulphur Operations in the Outer Continental Shelf-Decommissioning Activities; Final Rule, May 17, 2002.

8. Manago, F. and Williamson B. (Editors), Proceedings: Public Workshop, Decommissioning and Removal of Oil and Gas Facilities Offshore California: Recent Experiences and Future Deepwater Challenges, September 1997, MMS OCS Study 98-0023, 1997.

9. Pulsipher, A.G. (Editor), Proceedings: An International Workshop on Offshore Lease Abandonment and Platform Disposal: Technology, Regulation, and Environmental Effects. New Orleans, 1996.

10. Russell, R.M., "Environmental liability considerations in the valuation and appraisal of producing oil and gas properties," JPT, January 1989, pp. 55-58.

11. Wilson, C.A., and Van Sickle, V.R., "Louisiana State Artificial Reef Plan," Louisiana Department of Wildlife and Fisheries, Technical Bulletin, No. 41, 1987.

12. Stephan, C.D., et al., "Texas artificial reef management plan," Management Data Series No. 3, Texas Parks and Wildlife Department, Coastal Fisheries Branch, Austin, 1996.

13. Kaiser, M.J., and Pulsipher, A.G., "Rigs-to-reef programs in the Gulf of Mexico, Ocean Development and International Law, to appear.

14. Kaiser, M.J., and. Pulsipher, A.G, "GOM Decommissioning—Various factors affect severance selection," OGJ, Sept. 27, 2004, p. 37.

15. Guegel, A., "Cutting to the chase in Gulf," Upstream News, Dec. 7, 2001, p. 25.

The author

Mark J. Kaiser (mkaiser@ lsu.edu) is an associate professor-research at the Center for Energy Studies at Louisiana State University, Baton Rouge. His primary research interests are related to policy issues, modeling, and econometric studies in the energy industry. Before joining LSU in 2001, he held appointments at Auburn University, the American University of Armenia, and Wichita State University. Kaiser holds a PhD in industrial engineering and operations research from Purdue University.