OGJ Newsletter

General Interest—Quick Takes

IEA's Russian oil production forecast 'optimistic'

A recent International Energy Agency forecast of Russia's crude oil production is "unjustifiably optimistic," argued a report from Energy Security Analysis Inc. (ESAI), Boston.

IEA projected Russia's 2005 crude production to average 9.64 million b/d, implying growth of 420,000 b/d relative to 2004. ESAI sees incremental crude output in 2005 growing by a maximum of 200,000 b/d, with the possibility that emerging factors could reduce this forecast further.

"After reaching an absolute post-Soviet peak of 9.49 million b/d in September, Russia's average daily production has been falling for 2 consecutive months, and November's drop was the largest single-month decline since January 1999," said Yulia Woodruff, ESAI's Russian analyst.

Data for the first week of December suggest that the decline will continue in the immediate future, ESAI added.

"The sharp slowdown in growth cannot be attributed to either an unfavorable tax environment or to export capacity constraints," said Woodruff. Instead, ESAI contends the two main factors are the campaign against OAO Yukos and the limited availability of easily accessible, commercially recoverable reserves.

"Last year, Yukos was a major source of Russia's production growth," Woodruff said. "In the first 10 months of 2003, the company added 485,000 b/d, but in the same period in 2004 there was a tenfold drop in the rate of growth."

At the same time, growth rates for companies that have not been targeted by authorities, such as OAO Sibneft, OAO Lukoil, and OAO Rosneft, have declined as well, ESAI said.

"As this decline has taken place in an extremely favorable price environment, the concern is that what we are seeing is not just a bump in the road, but a reversal of the trend," Woodruff said.

Consider expansion of OCS leasing, Senators urge

US Sens. Lamar Alexander (R-Tenn.) and Mary L. Landrieu (D-La.) called for discussion of expanded leasing on the Outer Continental Shelf, including areas currently off-limits, to address increasingly tight supplies of natural gas.

In a letter to US Sec. of the Interior Gale Norton, the two federal lawmakers recommended that comments be solicited on whether it would be appropriate to widen OCS leasing, including possibly issuing gas-only leases in areas covered by moratoria.

The Department of the Interior opened a public comment period, beginning last month, on its 5-year OCS oil and gas leasing program for 2007-12, Alexander and Landrieu noted.

They released their letter the day after Senate Energy and Natural Resources Committee Chairman Pete V. Domenici (R-NM) called for legislative proposals to solve a looming gas-supply crisis.

He invited industry and government officials, public interest groups, and private citizens to submit written proposals to the committee by Jan. 7, for staff review. The most promising ideas will be discussed at a half-day meeting tentatively scheduled for Jan. 19, Domenici said.

"We encourage the use of natural gas in America to meet our energy needs and environmental goals," said Alexander, who chairs the committee's energy subcommittee, as he and Landrieu released copies of their letter to Norton. "However, we have ignored the supply side of the equation. We have pursued a policy that is in conflict with itself.

"The energy supply imbalance our country faces has not happened overnight, and the solution will not be quick or simple," said Landrieu, who also is a member of the full committee and comes from a major producing state. "For years, our country has encouraged the use of natural gas but neglected to adequately address how to meet that goal."

Brazil, Russia sign oil, gas cooperation agreements

During a visit to Brazil last month, Russia's President Vladimir Putin signed cooperation agreements with Brazil in the oil, natural gas, electric power, and renewable energy sectors that could lead to Russia's OAO Gazprom building a natural gas liquefaction plant in Brazil, Brazilian government sources told OGJ.

Brazil also signed agreements to exchange know-how on transmission lines, oil and gas pipelines monitoring systems, and waste-to-power.

Gazprom and the Brazilian Mines and Energy Ministry will meet in Russia in the first half of this year to discuss gas regulations, exploration, transport, and liquefaction processes.

Petróleo Brasileiro SA (Petrobras), Brazil's state-owned oil giant, signed a 2-year cooperation agreement with Russian companies Tise and Zarubezehnest whereby the companies will study development of joint projects including exploration and production operations, oil and gas transport, monitoring and stockpiling, and fuel distribution.

A Petrobras source told OGJ the parties discussed negotiating an accord of more than $3 billion between Petrobras and representatives of a Russian consortium that would include the construction of a refinery in Brazil with Russian equipment and technology.

Brazil fights Bolivian hydrocarbons bill

The Brazilian government issued a statement saying that it has been lobbying Bolivia on behalf of international investments made by Petrobras.

The Bolivian government is debating hydrocarbons legislation that could nationalize management of oil and natural gas. Parliamentary debate on the law began in November.

Brazilian presidential special envoy Marco Aurelio García met with Bolivia President Carlos Mesa and with Evo Morales, the main advocate of confiscatory hydrocarbons legislation, on behalf of Petrobras.

After that meeting, Morales said he was willing to support a more moderate proposal. He said he changed his mind because of an energy integration project with Brazil.

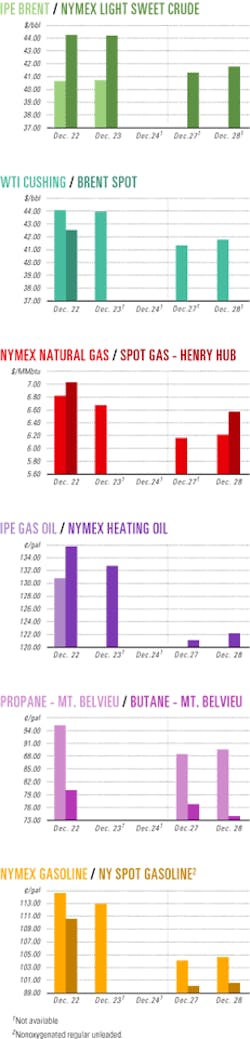

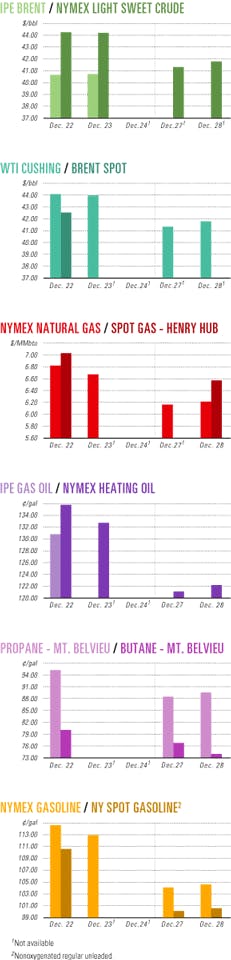

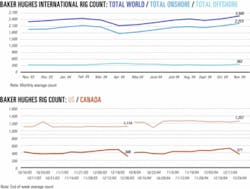

Industry Scoreboard

null

null

null

Exploration & Development—Quick Takes

BPTT unit reports gas find off Trinidad

BP Trinidad & Tobago LLC (BPTT) reported that a gas discovery 50 miles off the east coast of Trinidad and Tobago cut 1,400 ft of pay in four main reservoirs.

Testing is under way of the Chachalaca well, drilled by the Global Santa Fe Constellation 1 jack up to 15,632 ft subsea in 330 ft of water. The Columbus basin well is in the East Mayaro license area, 7 miles southeast of BP's 2.1-tcf Mahogany gas and condensate field. Mahogany produces 20,000 b/d of condensate.

Robert Riley, chairman and CEO of BPTT, called it "a world-class discovery."

BPTT is owned by a holding company in which BP PLC has a 70% interest and Repsol YPFSA has 30%.

ConocoPhillips plans joint study

ConocoPhillips signed a memorandum of understanding with OAO Gazprom outlining how the companies will jointly study development of giant Shtokman gas field in the Russian area of the Barents Sea.

Reportedly one of the largest gas fields in the world, Shtokman lies in the Arctic about 500 km from Murmansk. Russia plans to develop Shtokman with an LNG terminal at Murmansk and export the LNG to the US (OGJ, Aug. 25, 2003, p. 100).

The project has been on hold since 1992 because of financial, legal, and technical problems associated with development in the hostile environment.

Shtokman field, discovered in 1988, is 350 miles off the northwest coast of Russia in 1,000 ft of water. Full development is expected to require three or four phases.

Gazprom previously signed agreements with other companies, including Norsk HydroASA (OGJ Online, June 4, 2004).

ConocoPhillips OKs Bohai Bay Phase II

ConocoPhillips will invest about $1.8 billion in cash capital commitments for the multiyear second development phase of Peng Lai 19-3 field in China's Bohai Bay.

Final project sanction is subject to approval of the overall development plan by the Chinese National Development and Reform Commission.

Phase I development began production in December 2002. The field is producing about 20,000 b/d of oil (OGJ Online, Jan. 3, 2003).

ConocoPhillips and CNOOC signed a contract in December 1994 granting ConocoPhillips exploration rights to 1.6 million-acre Block 11/05 in Bohai Bay.

Operator ConocoPhillips holds a 49% interest in the PL 19-3 development, while CNOOC holds the remaining 51%.

Repsol tests gas strike in Venezuela

Repsol YPF, discovered gas with the first of 11 wells it plans to drill on the Barrancas exploration block 225 miles southeast of Maracaibo, Venezuela.

The Sipororo 2X exploration well tested 35.3 MMcfd of gas, a rate much higher than Repsol YPF expected, from 18,840 ft. Gas from the well initially is to feed an 80 Mw power station set for completion in the second quarter of 2005 in Portuguesa state.

The well is near the Sipororo 1X discovery drilled by Petroleos de Venezuela SA in the 1990s.

Repsol is authorized to produce nonassociated gas on the block, which it acquired in 2001 in the Barinas-Apure basin in Barinas, Portuguesa, and Trujillo states. Block production is to reach 71 MMcfd by 2006 and will also be used to supply a thermoelectric power station of up to 450 Mw to be installed at Obispos, Barinas state.

Repsol said its 100% owned Barrancas block has five potential fields: Sipororo, Guaramacal, Guaramacal Sur, Barrancas, and La Yuca. It plans to acquire 3D seismic data. Next up for drilling is Guaramacal in the second exploration phase.

Repsol produces 100,000 boe/d in Venezuela from the Quiriquire, Quiamare-La Ceiba, Guarico Occidental, and Mene Grande blocks.

Marathon has find off Equatorial Guinea

Marathon Oil Corp. subsidiary Marathon E.G. Production Ltd. made a natural gas and condensate discovery on Alba Block Sub Area B off Equatorial Guinea.

The Gardenia discovery well, about 11 miles southwest of Alba field in 320 ft of water, proves additional resource potential in the Alba field area, Marathon said.

Drilled to 15,175 ft TMD, the well encountered 150 ft of net gas-condensate pay in the Upper Isongo section. A 60-ft net pay interval was tested at a stabilized rate of 18.6 MMcfd and 1,300 b/d through a 40/64-in. choke.

Infrastructure on site makes prompt field development possible.

"A potential development scenario includes production through the Alba field infrastructure and the future [LNG] facility on Bioko Island," said Philip Behrman, Marathon senior vice-president, worldwide exploration.

Operator Marathon holds a 63% interest in Sub Area B. Noble Energy Inc. subsidiary Samedan of North Africa Inc. owns 34% interest in the block, and Equatorial Guinea national oil firm GEPetrol holds 3% interest.

FCP tests gas-condensate well in Algeria

Production test results from First Calgary Petroleums Ltd.'s exploration well MZLS-1, on its 100% held Ledjmet Block 405b in Algeria confirmed 19,422 boe/d of natural gas and condensate, which includes 72.6 MMcfd of gas and 7,321 b/d of condensate, normalized to 2,000 psi flowing wellhead pressure.

The combined production test results from nine wells on Block 405b, including MZLS-1, total about 196,000 boe/d.

Engineering firm DeGolyer & MacNaughton is assessing reserves on Blocks 405b and 406a. Reserves estimates are expected by yearend.

FCP currently is testing the LEW-1 exploration well and drilling two appraisal wells on Block 405b: LES-2 and MLE-6. The LEW-1 test results and the LES-2 logging results are expected this month. The MLE-6 logging results are slated for January.

Tub-Karagan to drill new Caspian well

Kazakhstan operator Tub-Karagan Operating Co. BV, a subsidiary of KazMunaiGas and Lukoil Overseas Holding Ltd., plans to begin drilling an exploration well in spring 2005 in the 1,372-sq-km Tub-Karagan sector in the Caspian Sea off Kazakhstan.

GeoTeniz of Kazakhstan completed field engineering and geological operations in mid-December.

Tub-Karagan said it would drill to 2,500 m to assess the oil and gas potential of Jurassic, Cretaceous, and Triassic sediments.

Astrakhan-based Lukoil-Shelf has mobilized its Astra jack up rig for drilling in water 7-10 m deep.

Drilling & Production—Quick Takes

Terra Nova FPSO resumes production

Petro-Canada, which received Canada-Newfoundland Offshore Petroleum Board approval in mid-December to resume operation of its Terra Nova floating production, storage, and offloading (FPSO) platform, has restored production to the FPSO's 160,000 b/d preshutdown level.

The Nov. 21, 2004, shutdown was precipitated by a discharge of oily water from the platform (OGJ Online, Nov. 29, 2004).

The Terra Nova FPSO operates in deep water 350 km east-southeast of St. John's, Newf., in the Jeanne d'Arc basin.

Gas flow starts from Xyris gas field

ARC Energy Ltd., Perth, has brought on stream Xyris gas field in the northern Perth basin in Western Australia. Xyris is flowing 9.3 MMcfd of gas.

The gas flows through the Parmelia pipeline to Perth and southwestern Western Australia.

Xyris field, discovered in April 2004, is the first greenfield gas development in the Perth basin since the nearby Beharra Springs field began production in 1990.

ARC has a 50% interest in Xyris, with Origin Energy Developments Pty. Ltd., Sydney, holding the other 50%.

Beach-Anzon contracts FPSO off Victoria

A joint venture of Beach Petroleum Ltd. and Anzon Australia Ltd. has contracted the use of the Crystal Ocean FPSO vessel for development of its Basker, Manta, and Gummy oil and gas fields in the Gippsland basin off Victoria—the first use of an FPSO in Bass Strait since production began off Victoria in the 1960s.

The combine will have use of the vessel until mid-January 2008, but deployment is subject to the successful drilling of the Basker-2 appraisal well during the first half of this year.

Initial plans call for the vessel to conduct an extended production test of Basker-2. If this well performs as expected, more wells will be drilled and tied into the vessel during 2005-06 to increase production to a peak of about 20,000 b/d of oil.

Crystal Ocean, built in Glasgow, Scotland, in 1999, is purpose-built for development of small fields. It is capable of processing as much as 40,000 b/d of oil and 50 MMcfd of gas. The vessel, currently in Norway, is slated to arrive in Australia in mid-2005.

Adelaide-based Beach and Sydney-based Anzon formed a joint venture a few months ago following Anzon's purchase of the three eastern Bass Strait fields from Woodside Petroleum Ltd. of Perth in early 2004.

Basker, Manta, and Gummy fields were discovered by Shell Australia Ltd. in 1983, 1984, and 1990, respectively, but were deemed noncommercial at the time.

The fields are held in retention leases Vic RLs 6, 9, and 10, which lie just east of the ExxonMobil Corp.-BHP Billiton producing fields.

Basker is primarily oil; Manta, both oil and gas; and Gummy, predominantly gas. The three fields have proved and probable reserves of 23.3 million bbl of oil plus an identified contingent gas-condensate resource of about 19.2 million boe.

Oil production will be sent directly to one of the two refineries near Melbourne. Gas initially will be reinjected into the reservoir until arrangements can be made for its production either through existing Bass Strait infrastructure or new facilities at a later date.

Anzon has a 75% interest in the three fields and Beach 25%. Beach also owns a direct 9% shareholding in Anzon.

Processing—Quick Takes

BP to close linear alpha olefin plant

BP said last month that it would close its linear alpha olefin (LAO) production facility in Pasadena, Tex., by yearend, reducing the firm's global LAO capacity by 500,000 t/y.

BP said it would continue to produce LAOs at its other two facilities in Alberta, Canada, and Feluy, Belgium.

The closure is "the result of an extensive review of the company's global [LAO] business and prospects for the LAO industry," a company executive said.

"The LAO industry has faced a very difficult environment for the past few years, with overcapacity, slow demand growth, and high feedstock and energy costs. The Pasadena site is our oldest production site, and the closure of these older assets will allow our LAO business to focus resources on keeping our two newer sites at Feluy and Joffre competitive," he said.

BP's worldwide production capacity grew to 1.05 million t/y with the start-up of the Joffre plant in 2001. Expansions by BP and other producers during the last several years have added over 450,000 t/y of capacity, resulting in overcapacity, BP said.

BP's Pasadena plant is the oldest of its three operating LAO plants. In 2002 BP ceased production of linear alcohols at the facility.

After the restructuring, BP will have an LAO production capability of 300,000 t/y at Feluy and 250,000 t/y at the Joffre plant.

Formosa Plastics plans Taiwan refinery

Formosa Plastics Corp. (FPC) plans to spend $3.72 billion to build a 600,000 b/d refinery in Yunlin County, Taiwan. The site is 2,000 ha of reclaimed land adjacent to parent Formosa Plastics Group's (FPG) Mailiao Petrochemical Zone.

The new refinery will increase FPG's refining capacity to 1 million b/d and make the group Taiwan's largest supplier of oil products.

The prime contractor for the project will be FPG unit Formosa Heavy Industries Corp.

Flint Hills to enlarge refinery capacity

Flint Hills Resources LP plans a $100 million expansion of its Pine Bend refinery in Rosemount, Minn., that will increase the refinery's crude oil processing capacity to 330,000 b/d from 280,000 b/d.

The increased capacity, expected to come on line in mid-2007, will help meet growing demand for gasoline and diesel in Minnesota, Wisconsin, Iowa, South Dakota, and North Dakota, the company said.

The project also will enable Flint Hills Resources, Wichita, Kan., to utilize an anticipated increasing supply of Canadian crude oil in 5-7 years.

Flint Hills Resources, a wholly owned subsidiary of Koch Industries Inc., also owns refineries in Texas and Alaska, a chemical facility in Illinois, and has an interest in a base oil facility in Louisiana.

Transportation—Quick Takes

FERC approves Sabine Pass LNG terminal

The US Federal Energy Regulatory Commission has approved construction of the 2.6 bcfd LNG regasification terminal proposed in Cameron Parish, La., by Sabine Pass LNG LP, a unit of Cheniere Energy Inc., Houston.

FERC also approved construction of a 26-mile pipeline proposed by Cheniere Sabine Pass Pipeline Co. connecting the LNG terminal to an existing gas pipeline.

Sabine Pass LNG has said construction of the terminal might begin in the first quarter (OGJonline, Sept. 9, 2004).

The project is the third new US LNG terminal to receive FERC approval. The commission approved the Cameron LNG LLC project by Sempra Energy LNG Corp. near Hackberry, La., in September 2003, and the Freeport LNG Development LP terminal on Quintana Island, near Freeport, Tex., in June 2004.

Qatargas awards LNG train contracts

Qatar Liquefied Gas Co. Ltd. II (Qatargas II) has awarded a $4 billion contract to a joint venture of Technip SA and Chiyoda Corp. to perform engineering and construction of Trains 4 and 5 at the Qatargas LNG liquefaction plant in Ras Laffan, Qatar.

The trains, each expected to produce a minimum of 7.8 million t/y of LNG, will be the world's largest. Technip claims the contract is the largest service contract signed in the industry. Start-up of Train 4 is scheduled for late 2007 and Train 5, about 9 months later.

The LNG will go to the UK, where the £500 million South Hook regasification terminal at Milford Haven, Wales, will be built by affiliates of Qatargas, ExxonMobil Corp., and Chicago Bridge & Iron, The Woodlands, Tex.

Qatargas II has invested in North gas field development off Qatar, the Qatar LNG storage facilities, and LNG carriers (OGJ Online, July 11, 2003). The Qatargas II LNG plant site, where the two new trains will be built, came on stream in 1996. The three existing trains currently produce more than 8 million t/y of LNG.

Financing of the $7.6 billion Qatargas II project is being provided by 57 financial institutions with White & Case, London, representing Qatergas II sponsors Qatar Petroleum 70% and ExxonMobil Qatargas Inc. 30%.

Hazira LNG terminal commission delayed

Contractor-generated delays caused Royal Dutch/Shell Group subsidiary Hazira LNG Private Ltd. to miss commissioning the $680 million LNG receiving terminal at Hazira in Gujarat state by the yearend 2004 deadline.

Commissioning has been rescheduled for late February or March, a senior company official told Lloyd's List. Total SA recently acquired a 26% interest in this facility.

French firms Hazira Cryogenic Engineering and Hazira Marine Engineering will pay a penalty for the delay as stipulated in their contract with Shell, the official said, refusing to specify the penalty amount.

Shell said it would source the LNG from Oman, Qatar, Malaysia, or Nigeria for sale in India from first quarter 2005. "Expansion is under way at our Malaysia, Nigeria, and Oman natural gas liquefaction units," the official said.

Shell also plans to increase the Hazira terminal's capacity to 10 million t/y from 5 million t/y—originally 2.5 million t/y—because of India's huge natural gas demand (OGJ Online, Oct. 20, 2004). Space has been provided at the Hazira terminal for two additional LNG storage tanks of 2.5 million tonnes each.

Two LNG vessels, collectively valued at $400 million, likely will be brought in from West Asia. According to the project plan, Shell subsidiary Hazira Port Private Ltd. will set up the private multicargo port at a cost of $200 million.

The import terminal and the 17-km pipeline that connects it to the gas grid of Gujarat state firm Petronet LNG Ltd. are to be completed by yearend at a cost of $320 million.

The first ship carrying imported LNG to Hazira is scheduled to unload its consignment in the first quarter, and deliveries are to become regular by June.