OGJ Newsletter

Market Movement

IEA says world oil supplies remain level

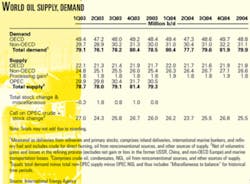

World oil supplies remained relatively level at 82.1 million b/d during January, with production from the Organization of Petroleum Exporting Countries falling by 145,000 b/d and non-OPEC production up by 130,000 b/d, said officials at the International Energy Agency, Paris, in their latest monthly report.

But IEA officials boosted the estimated growth of world oil demand by 220,000 b/d to 1.44 million b/d in 2004. That would put total world oil demand at 79.9 million b/d this year. IEA raised its projected 2003 world demand growth by 50,000 b/d to 1.5 million b/d.

"Oil demand growth is surging in some developing economies—led in part by strong economic growth in China and the [Asian] region—but appears to be temporarily slowing [among member countries of the Organization for Economic Cooperation and Development], due to the reversal of one-off factors that boosted growth last winter," IEA reported. Those factors included unusually cold weather and problems with nuclear power output in Japan, natural gas supply and prices in the US, and hydroelectric power generation in Europe, officials said.

"Non-OECD demand growth is forecast to accelerate to 1.1 million b/d, or 3.7%—the fastest since 1997—in 2004, from an estimated 800,000 b/d in 2003," said IEA. However, it expects OECD demand growth to slow to 340,000 b/d from 700,000 b/d in 2003, "though growth appears set to regain momentum in the second half of the year," officials said.

Production from the 10 OPEC members covered by output quotas (which excludes Iraq) averaged 25.8 million b/d in January, exceeding the target quota of 24.5 million b/d that the group set last November. Earlier this month, OPEC member voted to cut production to 23.5 million b/d by Apr. 1 and to eliminate some 1.5 million b/d of current overproduction (OGJ Online, Feb. 10, 2004).

IEA reported that production by Iran, Saudi Arabia, Kuwait, UAE, and Algeria diminished during January, while Iraq's output increased by 70,000 b/d. It assessed OPEC's combined spare production capacity at 1.5 million b/d.

The increase in non-OPEC production "came from strong Russian growth and a recovery in both North Sea and deepwater Brazilian output," said IEA officials. OECD industry oil stocks were drawn down by 1.26 million b/d in December, closing at 56 million bbl above the previous year's level. Forward demand cover remained at historical lows of 51 days.

IEA numbers questioned

However, Paul Horsnell, head of energy research, Barclays Capital Inc., London, claimed that IEA's numbers are "by far the most bearish in terms of the outlook" for the second quarter. Instead, he cited "a systematic and consistent pattern of upward revisions in demand and downward revisions in supply" among various other sources.

"OPEC has at least an extra 2 million b/d of room for maneuver beyond that implied by the IEA. We were confident that there would be a high floor to prices [during the second quarter] even if there were no quota cut and only a very limited reduction of actual output. Given that, we view the OPEC decision [to cut production] as adding a rather superfluous extra floor, as well as skewing second quarter price risks to the upside," Horsnell said.

US imports jump

Meanwhile, the American Petroleum Institute reported that US petroleum imports jumped by nearly 11% in January from year-ago levels, marking the first time since October that monthly imports exceeded 12 million b/d.

Crude imports into the US rose by 12.5% to more than 9.6 million b/d during that period—a new high for January but not as high as imports of more than 10 million b/d during July-October 2003, said API officials in a Feb. 19 report. Imports of petroleum products increased by 5.1% to almost 2.6 million b/d, they said.

US imports of gasoline and gasoline blending components last month declined by some 23% from record levels in January 2003, while distillate imports increased to nearly 400,000 b/d, the highest level for January in 3 years, API reported. Imports of residual oil also were strong, increasing by more than 80,000 b/d to more than 360,000 b/d in January.

Total deliveries of petroleum products fell slightly short of year-ago levels in January, as they had in December. API officials blamed winter storms, higher retail prices, and stifled demand for gasoline. Distillate deliveries slipped despite colder winter weather in the US Northeast compared with a year ago.

However, jet fuel deliveries rose more than 5% against "particularly weak deliveries" a year ago, said API, while residual oil deliveries jumped by more than 20% as natural gas remained expensive or unavailable for electric utilities and industrial users with the capability to switch from gas to oil.

Utilization exceeded 90% of operable US refining capacity during January, a period when refinery activity often slows as the end of the heating season nears. Production of gasoline and jet fuel increased by 1% each during the month, while output of distillate fuel oil jumped by nearly 7%, API reported.

Commercial US oil inventories averaged 267 million bbl during most of January. "Even with a temporary jump in the last week of the month, crude oil inventories remained on the lower end of recent historical experience. Refineries, however, continued to run without any major supply-related incidents reported," API said.

"Historically, January has often been a month for builds in gasoline inventories, but this January inventories slipped about 1 million bbl. They ended the month about 11 million bbl below the recent-year range," it said.

US crude production slipped by 1.7% in January from year-ago levels, despite a 1.9% increase in production of Alaskan crude, which surpassed 1 million b/d for the first time since June, said API. However, Alaska's increased production was more than offset by a 2.4% decline in the Lower 48.

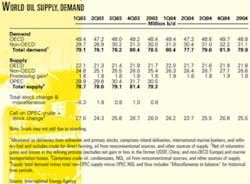

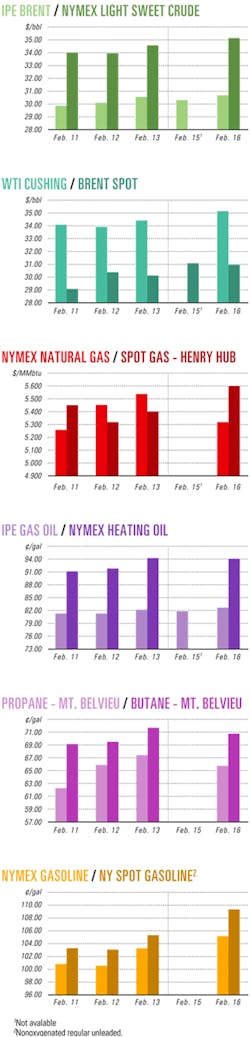

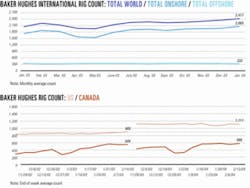

Industry Scoreboard

Due to a holiday in the US, data for this week's Industry Scoreboard are not available.

null

null

Industry Trends

HIGH COSTS associated with the decommissioning of oil and natural gas platforms could threaten future asset deals in the North Sea, an Ernst & Young LLP oil and gas taxation partner said.

Derek Leith told a recent decommissioning conference in Aberdeen that the UK Offshore Operators Association estimates the cumulative costs of decommissioning at £9 billion. Costs are believed to be rising at £500,000/year.

"We believe that legislation—which was drawn up over 20 years ago when the prospects for the development of the North Sea and the players in it were very different—needs to be reexamined. Let's not have a reason to deter investment just at the time when it is most needed," Leith said.

He called for a review of the tax laws, saying change is needed, "to ease the pressure on the independents and allow the full development of the North Sea, with all the implications that it has for jobs and the economy, and not least of all, for future higher tax revenues for the [UK] Treasury."

"As midtier and small companies have to post security for abandonment, it places an additional strain on their borrowing facilities and can hamper deals," Leith said.

As the majors pull out of the North Sea and the region's production lies increasingly with independents, the vast monetary sums required for decommissioning are becoming a more critical issue.

"Whereas major oil companies have the credit ratings to avoid any impact on their ability to borrow, less established players are not in such a favorable position," Leith said. The existing rules do not allow companies tax relief on the financial provisions made for decommissioning until the process actually starts—potentially decades later.

The North Sea is dominated by offshore structures commissioned in the 1960-70s to deal with the harsh environment. At that time, little consideration was given to how the structures would be removed, Leith said.

"As the UK continental shelf is in a mature phase with declining production, this perceived long-term issue is fast becoming a close reality for many structures in the region. It is also proving to be a barrier to the successful transition of ownership to smaller, independent operators," he said.

EUROPEAN NATURAL GAS competition could be reduced by emerging trends that threaten to reduce depleting spot gas availability.

Jean Syrota, president of France's Commission de Régulation de l'Energie, in Paris said that a recent development could reduce independent natural gas offers on Europe's market.

With Britain's spot prices higher than long-term gas contract prices, the flow of the Interconnector pipeline between Zeebrugge, Belgium, and Bacton, UK, increasingly is being reversed from the European continent to the UK.

Meanwhile, the US is absorbing most LNG cargoes. Syrota said the "fundamentals are unfavorable over the next 3 years, as both British and American production declines." New infrastructures scheduled to be on stream beginning in 2007 would reverse the trend but also might contribute to a gas bubble in Britain, Spain, and Italy, he warned.

Government Developments

A US FEDERAL APPEALS court has ruled that companies—rather than government agencies—must pay for pipeline relocations to accommodate a deepening and widening of the Houston Ship Channel.

The decision "vacated in part" a summary judgment made by US District Judge Lynn Hughes 2 years ago. Hughes favored the pipeline companies in a 1998 lawsuit against the US Army Corps of Engineers and the Port of Houston Authority.

The Fifth Circuit Court of Appeals in New Orleans ruled Jan. 30 that the corps and the port were not responsible for the cost of relocating 130 pipelines that carry various chemicals, petrochemicals, crude oil, and natural gas.

The port argued successfully that federal law—the Rivers and Harbors Acts of 1899—as well as locally issued pipeline licenses required the pipeline owners to pay the estimated $100 million in relocation costs.

"The corps has the authority, under the federal navigational servitude, to require owners to pay the relocation costs according to the original permits, as necessitated by the project," the appeals court ruling said.

Port Authority Chairman Jim Edmonds said, "As owner of the land under the ship channel, the port authority sought to protect the interest of Harris County taxpayers."

In 1996, the US Congress authorized a project to deepen the ship channel to 45 ft from 40 ft and to widen it to 530 ft from 400 ft. The $130 million project is intended to make room for larger international cargo vessels.

More than 20 companies are plaintiffs in the lawsuit. They include Air Liquide America Corp., EGP Fuels Co., Equilon Pipeline Co. LLC, Exxon Pipeline Co., Florida Gas Transmission Co., Houston Pipe Line Co., HSC Pipeline Partnership LP, Mobil Chemical Co., Chevron Pipeline Co., and Dynegy Midstream Services. Plans for appeal were uncertain at presstime.

UKRAINIAN OFFICIALS decided against reversing the Odessa-Brody crude oil pipeline. The decision reaffirmed Ukraine's intention to use the line to carry oil north from the Black Sea to Europe and eventually to the Baltic Sea.

The Ukrainian Cabinet of Ministers Feb. 4 ignored the recommendations of a feasibility study into the proposed pipeline reversal. The Ukrainian Fuel and Energy Ministry had commissioned that study.

The cabinet decision "should bring to an end months of uncertainty, during which a debate raged within the country over whether the pipeline, which has lain idle since its construction, should be reversed to carry Russian oil to Ukraine's new Black Sea terminal at Pivdenne," said the London-based Centre for Global Energy Studies.

But if oil does not start flowing north within a few months, then the question of the line's reversal could be raised again, CGES said in a research note.

The 667-km pipeline runs from Pivdenne to a pump station on the southern branch of the Druzhba export pipeline at Brody. The $645 million line, with a capacity of 240,000 b/d, was built as a speculative investment by Ukraine, but it has yet to be used (OGJ, Oct. 6, 2003, p.62).

Quick Takes

A GAS PIPELINE LEAK, not a boiler malfunction, was officially deemed the cause of an explosion last month at the Skikda, Algeria, LNG complex, Algerian Energy and Mines Minister Chakib Khelil told reporters at a mining and environment seminar in Algeria last week.

OPEC News Agency reported Feb. 18 that Khelil said the failed gas pipeline was the preliminary conclusion of an interministerial commission of inquiry that had been set up to investigate the Jan. 20 explosion. The blast killed 27 people, injured 74 others, destroyed three of six LNG trains at the complex, and heavily damaged a nearby LNG tanker berth.

Officials at Sonatrach, Algeria's state-owned oil and gas company, initially had blamed a faulty boiler for the explosion (OGJ Online, Jan. 20, 2004). Sonatrach officials as well as an insurance company and foreign experts are assisting the commission, which Khelil said would release the final report in about 3 months, OPECNA reported.

The us MINERALS MANAGEMENT SERVICE has issued its final notice of Sale 190—to be held in New Orleans Mar. 17—covering the sale of oil and gas leases incorporating 4,324 blocks in the central Gulf of Mexico off Louisiana, Mississippi, and Alabama.

The area covers about 22.7 million acres 3-210 miles offshore in water 4-3,425 m deep. Initial exploration periods will be 5-10 years, depending on water depths.

The final notice includes a new royalty-suspension provision affecting shallow-water, deep-gas production not included in the original notice. MMS said expanded royalty suspension provisions, effective Mar. 1, would apply to 2,400 existing leases and Sale 190 leases in waters less than 200 m deep where new production commences by Mar. 1, 2009.

The final notice also includes information about three applications for deepwater port and LNG facilities in the sale area, two of which the US Maritime Administration has approved—ChevronTexaco Corp.'s Port Pelican on Vermilion Area Blocks 139 and 140, which are unleased and available in this sale (OGJ Online, Nov. 18, 2003), and Excelerate Energy LP's Energy Bridge project on West Cameron Area, South Addition, Block 603, which is leased (OGJ Online, Jan. 8, 2004).

THE US DEPARTMENT OF ENERGY awarded 6-month contracts to Atlantic Trading & Marketing Inc., ExxonMobil Corp., Glencore Ltd., Koch Supply & Trading LP, and Shell Trading (US) Co. to deliver oil to the Strategic Petroleum Reserve this spring under the royalty-in-kind (RIK) exchange program.

Crude deliveries of 104,000 b/d are slated to begin in April. DOE said it expects the SPR will reach its 700 million bbl capacity in 2005, up from the current 643 million bbl.

The crude will come from exchange arrangements that the companies make for RIK crude produced from federal leases in the Gulf of Mexico and owed to the US government. MMS manages the RIK program and tracks federal leaseholder royalty obligations.

Under the RIK program, federal Outer Continental Shelf tracts are leased to crude oil producers who deliver royalty oil from designated Gulf of Mexico platforms to market centers along the Gulf Coast. The companies then receive crude from the market centers and deliver in-kind oil to the SPR. Actual volumes delivered to the SPR take into account adjustments for transportation and quality differentials.

Critics contend that the SPR fill program contributes to high oil prices. The Air Transport Association has urged the White House to slow SPR deliveries when fuel prices are high. The group alleged last December that jet fuel prices could spike if the SPR fill continues on its current course. DOE rejected that contention, saying SPR deliveries represent a very small percentage of world crude supplies.

Meanwhile, some state governments that rely on oil and gas royalties for a portion of their budgets have maintained that RIK programs do not give taxpayers or states the fair market value of the royalty oil.

Officials of those states would prefer that all royalties be paid out on a cash basis. But DOE and MMS say companies in certain cases should be allowed to meet their royalty obligations by giving the government crude instead of cash.

CONOCOPHILLIPS began production of first liquids Feb. 10 from Bayu-Undan field in the Timor Sea Joint Petroleum Development Area (JPDA) shared jointly by Australia and East Timor (OGJ Online, Mar. 10, 2003).

Natural gas production and preparation of the Liberdade floating storage and offloading vessel began earlier this year (OGJ Online, Jan. 16, 2004).

The gas-condensate field contains recoverable hydrocarbons estimated at 400 million bbl of condensate and NGLs and 3.4 tcf of natural gas. Straddling the 03-12 and 03-13 production-sharing contract areas in the JPDA between Timor-Leste and Australia, Bayu-Undan lies about 250 km south of Suai, Timor-Leste, and 500 km northwest of Darwin.

The liquids production is the first of a two-phase project.

In the $1.8 billion first phase, the gas recycling facility by third quarter will produce and process 1.1 bcfd of wet gas, separate and store 115,000 b/d of condensate, propane, and butane combined, and reinject 950 MMcfd of dry gas into the reservoir.

In the second phase—a $1.5 billion LNG development project—gas will be delivered via pipeline from the field to an LNG liquefaction plant under construction at Wickham Point, near Darwin. The 3.52 million tonne/year capacity plant is expected to be complete in early 2006, at which time the first LNG cargo is scheduled for delivery to Japan (OGJ, June 30, 2003, p. 64). The Tokyo Electric Power Co. Inc.-Tokyo Gas Co. Ltd. joint venture, which assumed a 10.08% ownership interest in the project, has contracted to purchase the project's LNG production of 3 million tonnes/year for 17 years. ConocoPhillips holds a 56.72% interest in the project. Other partners are ENI SPA unit Agip SPA 12.04%, Santos Ltd. 10.64%, Tokyo-based Inpex Corp. 10.53%, and Tokyo Electric-Tokyo Gas JV, 10.08%.

THE CHAD-CAMEROON OIL FIELD and pipeline project is on target to achieve full production in the first quarter, said operator Esso Chad Inc. Reporting project progress for the fourth quarter of 2003, Esso Chad said nine tankers laden with Chadian crude oil had sailed from the port of Kribi, Cameroon. The first oil shipped through the 1,070 km pipeline from southern Chad arrived at Kribi in mid-September, and the first tanker to sail carried 950,000 bbl of oil (OGJ Online, Oct. 13, 2003).

The first 6 wells in Miandoum field began producing around the end of June 2003. By yearend, 115 wells were drilled in the project's three fields, and drilling was completed in Miandoum field and had begun in Kome field with five rigs running there. The company also drilled the first few wells in Bolobo field. With central oil field facilities 99% complete at Kome at yearend, that field is to begin producing this quarter, the company said. A total of 250 wells are planned in the three fields. A study showed that in 2002, the peak construction year, economic effects due to the project were equivalent to 20.7% of Chad's gross domestic product for the study's baseline year of 2000. The study showed that this effect will rise to 26% in 2005, expected to be the first full year of peak oil production. Esso Chad did not provide production or export rates, but the export of 9 million bbl of oil from July through December implies that production averaged at least 75,000 b/d during the period. Peak project rate is 225,000 b/d. The project is a partnership of Chad and Cameroon, the World Bank Group, and sponsors Esso Exploration & Production Chad Inc. 40%, Malaysia's national oil company Petronas Carigali Sdn. Bhd. 35%, and ChevronTexaco Corp 25%. Esso Chad is a subsidiary of ExxonMobil Development Co.

ChevronTexaco Corp. unit Chevron Nigeria Ltd. plans to return soon to the six West Niger Delta oil fields it shut in 11 months ago during violent civil unrest. Chevron operated the fields on behalf of itself and joint venture partner Nigerian National Petroleum Corp. The company's return follows assurances by national and state governments that the area is secure and there is a lasting peace in the oil fields. Oil production, however, will not resume "for some time," ChevronTexaco said, pending damage assessment and restoration of production and transportation facilities. Militants fighting in the Niger Delta area in March 2003 had killed 100 people, damaged pipelines and other facilities, and forced oil companies to curtail operations (OGJ Online, Mar. 24, 2003).

STATOIL ASA has chartered the Transocean Leader semisubmersible drilling rig from Transocean Inc. for a 15 month drilling project on the Norwegian continental shelf (NCS). The contract, valued at 600 million kroner, has an option for a 90-day extension to cover the drilling of another well, which would add 110 million kroner to the charter value.

null

The sequence of prospects to be drilled has not yet been finally determined, Transocean said.

Work for the Statoil group is scheduled to begin in May. The rig, currently in the UK, will be modified for NCS operations. Transocean Leader was built in 1987 to drill on the NCS. Statoil chartered it most recently in 1999 for use on the Statfjord satellites in the North Sea.

HUSKY ENERGY INC., Calgary, reported Feb. 16 that it would proceed with the construction of a $90-95 million ethanol facility adjacent its heavy oil upgrader at Lloydminster, Sask. The 130 million l./year plant is scheduled to begin operations by yearend 2005. It would be the largest in western Canada.

"This initiative willUsupport our current program of ethanol-blended fuels marketed under our Mother Nature's Fuel brand," said John C.S. Lau, Husky Energy president and CEO. Ethanol-blended gasoline is available at Husky and Mohawk branded service stations across Canada.

Suncor Energy Inc. unit Suncor Energy Products Inc., Calgary, has received preliminary government approval of a $22 million grant towards construction of an ethanol production facility near Sarnia, Ont. Suncor plans a world-class, $120 million plant capable of producing more than 200 million l./year of ethanol, which would be blended into its Sunoco gasolines sold in Ontario. Should the project receive final approvals, construction would begin by midyear and be omplete by mid-2006. The funding is being given under Canada's Natural Resources Canada ethanol expansion program.

COLUMBIA GAS TRANSMISSION, a unit of NiSource Inc. and operator of the Millennium pipeline, is planning a two-phase delivery expansion program whereby Buffalo, NY-based National Fuel Gas Co.'s Empire State Pipeline will be a key upstream supply link and Brooklyn-based KeySpan Corp. a major new anchor customer. KeySpan plans to subscribe for as much as 150 MMcfd of natural gas transportation service on Millennium.

Phase 1, which will transport 500 MMcfd of natural gas from the Dawn, Ont., trading hub and several supply and storage basins, is expected to be in service by November 2006. It includes the upgrade of a 186 mile Corning-Ramapo, NY, pipeline section on Millennium, which will replace an existing Columbia Gas line, and an 83 mile extension of the 24-in. Empire system from a point near Rochester to Corning, NY.

Phase 2, which involves a crossing of the Hudson River to New York City, is on hold pending an appeal in US Federal District Court of a US Department of Commerce ruling related to the crossing.

SASOL POLYMERS, Johannesburg, plans to expand its polypropylene facilities in Secunda, South Africa. The new plant, which will have capacity of 300,000 tonnes/year, will produce homopolymers, random copolymers, and impact copolymers. Start-up is expected in 2006.

In conjunction with the expansion, Sasol signed an agreement to license BP PLC's Innovene polypropylene process technology and will use BP's proprietary CD catalyst in tandem with the technology.