Report: New propylene production technologies hold great promise

New process technologies for propylene production show great economic promise, according to a new report from Nexant Inc., White Plains, NY.

The recently published report predicts that propylene demand will grow faster than supply. More than 25% of the new crackers currently planned for start-up in 2003-06 are based on ethane and will therefore produce little propylene.

On-purpose propane dehydrogenation (PDH) technology produces propylene, but this route generally requires favorable feedstock pricing to be competitive; the amount of propylene produced is small compared to other sources.

The report stated that new routes to propylene or propylene "add-on" processes to existing technologies are needed to satisfy the shortfall in demand from existing plants and process routes.

Propylene processes

Propylene production processes include coproduct technologies and on-purpose technologies. Coproduct processes use conventional processes and feedstocks.

According to the report, new process technologies—including olefin metathesis and olefin interconversion—are designed to increase propylene yields from conventional steam cracking.

Catalytic pyrolysis is another coproduct process alternate to conventional steam cracking that has a significantly higher selectivity to propylene than traditional naphtha cracking.

Nexant evaluated the technologies, operating conditions, and capital and operating costs for each of the foregoing technologies.

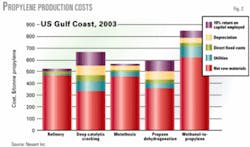

Their findings indicate that those processes that increase propylene production from an existing steam cracker by converting coproducts (e.g., ethylene for metathesis, and C4s and C5s for olefin interconversion) are cost-effective for a typical US Gulf Coast location (Fig. 1).

Catalytic pyrolysis exhibits even better returns than conventional steam cracking even with the capital expenditure associated with a grassroots plant, according to the report. Catalytic pyrolysis technology is in an early stage of development.

Conventional and on-purpose or standalone technologies in development include:

- Upgrading refinery-grade propylene.

- Deep catalytic cracking.

- Propane dehydrogenation.

- Methanol-to-propylene.

Metathesis is also a viable process with transferred ethylene as a standalone unit, such as integrated with an FCC unit.

Nexant reported that these technology options will probably link to large-scale steam crackers that primarily produce ethylene.

The economics are complicated because the cost and revenue contribution of the secondary propylene technologies to the entire olefin production process tends to be overwhelmed by standard steam cracking investment elements and operational costs.

Nevertheless, according to the report, propylene-enhancing technologies such as metathesis and olefin interconversion reduce the cost of producing ethylene due to an increase in propylene production vs. the base medium-severity naphtha cracker with a propylene-to-ethylene ratio of 0.5.

And, although the decrease in ethylene production cost is small for the two add-on technologies, both enable the production of additional higher-value propylene.

For catalytic pyrolysis, the improved economics result from a higher-value combined product slate.

Propylene production

For these technologies, current economics along the US Gulf Coast show that upgrading refinery propylene to polymer-grade propylene has the lowest cost (Fig. 2).

According to the report, the next lowest-cost method would be the metathesis process of converting ethylene and butenes to propylene.

The high cost of deep catalytic cracking is due to higher capital requirements compared to other on-purpose technologies.

One scenario that avoids this high capital expenditure is the conversion of an existing FCC unit to a deep catalytic cracking unit. The investment cost for most of the equipment and off sites facilities is a "sunk cost"; therefore, there is only an incremental cost to increase propylene production.

The methanol-to-propylene process, the report said, is the most costly due to the high cost of natural gas on the US Gulf Coast, which drives up the cash cost of methanol production.

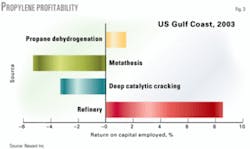

In 2003, however, only refinery propylene upgrade and propane dehydrogenation processes showed a positive return on a fully costed basis, including depreciation and return on capital employed (Fig. 3).

Regional comparison

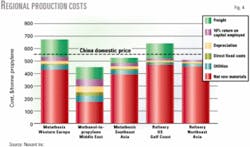

The report compared the export implications of various on-purpose propylene processes (Fig. 4).

The Middle East and Southeast Asia have a competitive advantage in providing low-cost propylene to Northeast Asia, which will become a major importer. In the Middle East, the methanol-to-propylene process could be competitive based on the availability of low-cost natural gas, even though the technology is not commercialized. Propane dehydrogenation is also competitive in that region, according to the report.

Southeast Asia also has an advantage in providing low-cost propylene to importing regions. The current and projected ethylene-to-propylene price ratios favor the metathesis process in Southeast Asia.

Cost structures in Western Europe and the US Gulf Coast are too high on a fully costed basis to support steady export into Northeast Asia, the report said.

Propylene derivatives

The report assessed propylene derivative technology developments. Even though there are cost-saving technology improvements and alternatives, they will have little effect on propylene demand.

Nexant reviewed and analyzed these alternate process routes and feedstocks to conventional commercial technology:

- Direct conversion of propylene to propylene oxide.

- Nonphosgene routes to polycarbonate.

- Propane ammoxidation to acrylonitrile.

- Catalytic distillation to cumene and phenol.

- Developments in acrylic acid technology.

- Developments in oxo alcohol technology.

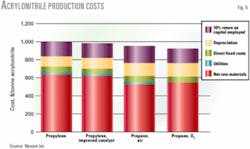

Although lower-cost options are available, the report predicts that only propane ammoxidation route to acrylonitrile will affect propylene consumption.

Depending on the price difference between propane and propylene, the propane route is a lower-cost alternative and should gain capacity share when new plants are built (Fig. 5).

Several other derivative processes also show great economic promise and will gain market share, according to the report.