Market Movement

OPEC's surprise production cut

Energy prices jumped after the Organization of Petroleum Exporting Countries, meeting Feb. 10 in Algiers, unexpectedly decided to reduce its oil production quota by 1 million b/d to 23.5 million b/d of oil, effective Apr. 1, as well as curb its overproduction of 1.5 million b/d.

World energy markets were almost resigned to no production cuts from OPEC. "However, in view of the projected significant supply surplus in the seasonally low-demand second quarter, the conference decided that remedial supply responses are needed to maintain market balance and avert downward pressure on oil prices," OPEC News Agency reported. OPEC ministers said they would review world oil markets at their next meeting on Mar. 31 in Vienna. Another extraordinary meeting is scheduled June 3 in Beirut.

Purnomo Yusgiantoro, Indonesia's energy minister and OPEC conference president, defended the cut but said the group remains sensitive to "calls of concern" from the global energy community and fears of "negative political and economic impact" if oil prices exceeded OPEC's target of $22-28/bbl "for a long period." OPEC's basket price has remained above that target since late last year, gaining 66¢ to $28.75/bbl immediately after the proposed production cut was announced.

OPEC controls markets

"OPEC ministers can say things and make the oil price rise, even without taking any action," noted Frederick P. Leuffer, an analyst with Bear, Stearns & Co. Inc., New York. "We saw this in December when oil ministers took no action on quotas, production, or even the ceremonial election of a secretary general but merely mentioned that the [US] dollar was weak and that this justified a higher oil price. Speculators promptly bid prices higher."

He said, "OPEC's message has been simple and straightforward: It wants oil prices to stay high, at least for now. The question is, will OPEC take action when it is required?"

"OPEC is working on the basis that the market is a pale and sickly creature. We believe that view is seriously misplaced," said Paul Horsnell, head of energy research, Barclays Capital Inc., London. "The market is in rude health and likely to get too boisterous."

Bearish data

Horsnell faulted OPEC ministers for relying on market data from the International Energy Agency, "which is by far the most bearish in terms of the outlook" for the second quarter of this year.

He cited "a systematic and consistent pattern of upward revisions in demand and downward revisions in supply." He said, "On the day of the OPEC meeting, the US Department of Energy increased its forecast of the call on OPEC crude in the second quarter by 800,000 b/d. The day after the meeting, the IEA itself increased its estimate of the second quarter call by 400,000 b/d and for good measure increased [first quarter demand] by 400,000 b/d and [third quarter demand] by 600,000 b/d."

Horsnell said, "OPEC has at least an extra 2 million b/d of room for maneuver beyond that implied by the IEA. We were confident that there would be a high floor to prices [during the second quarter] even if there were no quota cut and only a very limited reduction of actual output. Given that, we view the OPEC decision as adding a rather superfluous extra floor, as well as skewing second quarter price risks to the upside."

Meanwhile, Leuffer noted, "There is little incentive [for OPEC members] to produce within quota today. Oil prices already are high. A production cutback might drive prices to levels that could harm economic growth and, consequently, reduce oil demand. Higher oil prices could anger oil importing nations such as the US, Germany, Japan, and China. Also, why give up market share now, when OPEC nations realize that inevitably they will have to make room for higher Iraqi output?"

Some analysts claim Iraq may have a hard time maintaining production at the January level of 2 million b/d, however, much less a significant increase. "Assuming no increase in Iraq's production, this would leave a 'call' on [the remaining] OPEC 10 oil of 22.9 million b/d, or 600,000 b/d below the new quota and more than 3.2 million b/d below estimated January production," Leuffer said.

At the Feb. 10 opening of Cambridge Energy Research Associates annual energy conference in Houston, CERA Director James Burkhard cited a convergence of five factors, including OPEC's price defense, that support strong oil prices. The other factors are:

- Rapid economic growth that is expected to boost world oil demand by 1.3 million b/d in 2004.

- Constrained Russian export capacity.

- Slower future growth of Iraqi oil production.

- Renewed terrorism threats in Saudi Arabia.

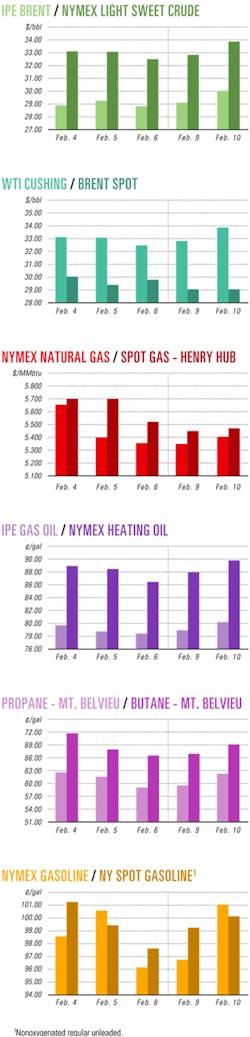

Industry Scoreboard

null

null

null

Industry Trends

THE PLANNED EXPANSION of oil sands development in Alberta could result in a twofold increase in production to 5 million b/d.

That production hike could help meet 16% of North American crude oil demand by 2030, according to a report released Jan. 30 by the Alberta Chamber of Resources (ACR).

The report, entitled "The Oil Sands Technology Roadmap," outlines what ACR calls "an unparalleled third wave of industry growth" following nearly 40 years of commercial production that encompassed two distinct growth phases.

ACR projects that anticipated increased production could generate an additional $40 billion (Can.)of economic growth in Canada and produce $90 billion in new investment during the next 30 years.

The first wave of oil sands production in Canada, ACR noted, began 40 years ago, when oil sands began to play an increasingly important role supplying that country's energy needs. In 1996, a second wave of development began as outlined in a plan set out by the National Oil Sands Task Force in 1995. That wave is expected to culminate in the production of 2 million b/d of synthetic crude oil from oil sands by 2012, ACR said. Increasing demand and declining production of crude oil from conventional sources are driving the third wave, ACR added.

The report calls for greater cooperation among governments, industry, academia, and Canada's research and development organizations to achieve the country's ambitious oil sands goals.

"The Chamber of Resources believes the experience and process of oil sands development could serve as a model of how industry, government, and society can work together to generate and share significant economic opportunity without compromising important social values or environmental integrity," ACR said.

US PRODUCTION of some key petrochemicals in the fourth quarter of 2003 increased 3% to 52.4 billion lb over production in the third quarter, according to a study released Jan. 29 by the National Petrochemical & Refiners Association.

Veris Consulting LLC of Reston, Va., which conducted the survey for NPRA, based the regular quarterly petrochemical survey on 19 petrochemicals produced in the US, including ethylene, propylene, butadiene, benzene, and mixed xylenes.

Total production of these 19 petrochemicals during the fourth quarter was up 10% vs. fourth quarter 2002 production of 47.5 billion lb for 20 reportable petrochemicals. (NPRA noted that, if the comparison were based on 19:19 reportable petrochemicals, the increase in production compared with fourth quarter 2002 would have been 12%.)

"From the third quarter of 2003 to the fourth quarter of 2003, production of 12 of the 19 petrochemicals surveyed and reportable increased; inventories of 3 of the 6 petrochemicals surveyed decreased," NPRA reported.

Total fourth quarter 2003 inventories of the 6 petrochemicals surveyed and reportable was 3.6 billion lb, a decrease from third quarter 2003 inventories of 5.1 billion lb for 7 reportable petrochemicals, the study said. "Compared with fourth quarter 2002 inventories of 5.2 billion lb for 7 reportable petrochemicals, the decrease is 30%."

Government Developments

US Senate Energy Committee Chairman Pete Domenici (R-NM) Feb. 10 said he has trimmed back a pending comprehensive energy bill, but it is unclear when the full Senate will consider the measure.

Domenici said the estimated cost of the tax package now is $14-15 billion, compared with the earlier $31 billion price tag of the measure that failed last November.

Fiscal conservatives and the White House balked at the cost of the November bill.

Domenici also agreed not to attempt to attach the revamped bill to a pending highway-funding plan now under consideration by Congress. He said in a statement that he respected the wishes of Sen. James Inhofe (R-Okla.), chairman of the Environment and Public Works Committee, who opposed adding energy legislation to the highway bill.

Domenici's new plan, when or if it is considered this session, does not include liability protections for methyl tertiary butyl ether or ethanol and the related additive ethyl tertiary butyl ether.

The MTBE liability issue is controversial; the earlier Senate bill was stymied by the provision, strongly endorsed by House Republican leaders.

Even if the Senate passes the new energy bill, it is unclear whether the House will accept any version that does not include MTBE protections.

Sources close to House Republican leaders in fact have suggested that if the Senate takes the MTBE provision off the table, the House may try to make its own revisions. That could mean trying to include a deal-busting provision to allow leasing in a portion of the Arctic National Wildlife Refuge, for example.

Meanwhile, NPRA said it is "extremely disappointed" with Domenici's decision.

Domenici's new version delays several oil and gas provisions. A measure that would expand the Minerals Management Service's new deep-well, shallow-water provision would be delayed until fiscal year 2005, for example. Similarly, provisions designed to expand marginal well production and royalty-in-kind programs also would be delayed until FY 2005, which is supposed to start this October.

It's unclear what oil and gas tax provisions remain in the bill; industry lobbyists speculated that lawmakers may revert back to the Senate title that passed the chamber in 2002 and then again in 2003. That bill allowed for $4 billion in tax breaks to US oil and gas producers. But there may not be the same support to provide financial incentives for a proposed Alaska gas pipeline.

The new proposal also delays two measures to FY 2009. The first is a provision authorizing certain leaseholders in the Gulf of Mexico to withhold royalties to offset interest owed them by the federal government, as outlined in a Department of the Interior opinion. The second plan delays a provision that reimburses industry for environmental reviews associated with the National Environmental Protection Act.

Quick Takes

BP PLC unit BP Exploration (Angola) Ltd. has awarded two major contracts for development of six fields on Block 18 off Angola. The action followed approval by state-owned oil company Sonangol, with which operator BP and its 50:50 partner Royal Dutch/Shell Group have a production-sharing contract.

The deepwater fields Galio, Cromio, Paladio, Plutonio, Cobalto, and Platina—collectively known as Greater Plutonio—will be developed with a single floating production, storage, and offloading vessel linked by risers to a network of subsea flowlines, wells, and manifolds in the fields.

Kellogg Brown & Root will perform engineering, procurement, construction, and management, working from its Leatherhead, UK offices, and Hyundai Heavy Industries Ltd. will fabricate the FPSO hull and topsides at its Ulsan shipyard in South Korea.

BP will award contracts in a few weeks for the subsea production system and umbilicals, risers, and flowlines and will award the integrated drilling contract later this year.

First production is targeted for 2007.

Shell Exploration & Production Co. awarded a flowline burial contract to Cal Dive International unit Canyon Offshore Inc., Houston, for further development of Sepco's Glider field on Green Canyon Block 248 in the Gulf of Mexico. Cal Dive will trench and backfill 32,000 ft of 8-in. flowline in 3,000-3,300 ft of water, making it, according to Canyon Offshore, the deepest flowline burial project to date. Work is under way and slated for completion by late February. Canyon Offshore will provide all preengineering, survey, project engineering, project management, and remotely operated vehicle support for the project. Flowline burial reduces the amount of required flowline insulation and has been used as an alternative to pipe-in-pipe or bundled flowlines, Shell said.

THE US EXPORT-IMPORT BANK has approved a loan guarantee for more than $10 million to finance construction of Phase 1 of the proposed 12,000 b/d Amakpe modular refinery project at Eket in Akwa Ibom State in Nigeria. The plant will be Nigeria's first privately financed refinery (OGJ Online, Mar. 5, 2001).

A consortium of Energy Management Corp. of Houston and Ventech Engineers International will operate and manage the Amakpe refinery for 7 years.

Phase 1, to cost about $29.8 million, covers the manufacture and installation of a 6,000 b/d crude distillation unit, a 120,000 bbl capacity tank farm, pipelines, boiler and blower systems, and desalter and cooling tower systems. Production is scheduled to start by February 2005.

The $35.2 million Phase 2 will involve installation of an additional 6,000 b/d distillation unit, a 4,000 b/d catalytic reformer-hydrotreater, a 3 Mw power plant, and a 120,000 bbl capacity tank farm and accessories. Phase 2 completion and integration into Phase 1 are slated for completion by January 2006, and production start-up is expected by February 2006.

The Amakpe refinery will process 35.8° gravity Qua Iboe crude oil from ExxonMobil Corp.'s Qua Iboe terminal.

SHELL CANADA LTD. has received environmental approval for Phase 1 of its Jackpine oil sands mine project, nudging it closer to its goal of producing 500,000 b/d from its Athabasca oil sands leases in northern Alberta.

After provincial and federal governments approve it, Shell Canada will begin feasibility studies.

Development, scheduled for completion by 2010, involves expanding total Muskeg River mine bitumen production to 225,000 b/d from 155,000 b/d.

Phase 1 includes a stand-alone, 200,000 b/d mining and extraction facility to be built on the eastern portion of Lease 13. Phase 2 includes mining additional resources on Leases 88 and 89 as an extension of Phase 1, enabling additional production of 100,000 b/d. Development of Leases 88 and 89 requires additional regulatory approval.

Total SA's 38-year old production platform that sank in the Gulf of Mexico in September 2002 has been removed. Hurricane Lili, a Category 4 storm packing 140 mph winds, toppled the structure in 180 ft of water as it was undergoing decommissioning and removal from Eugene Island 275A some 70 miles off Louisiana (OGJ Online, Oct. 22, 2002). Total secured a Special Artificial Reef Site permit to leave part of the platform in place, and Stolt Offshore Ltd., Houston, which conducted salvage operations, removed enough of the jacket and equipment to ensure clearance of 85 ft from the water's surface for safe navigation purposes and completed plugging and abandoning the remaining four wells. Stolt Offshore completed salvage operations within 60 days of initiation, using what it described as the "first platform salvage using only mechanical cutting devices."

null

THE US MINERALS MANAGEMENT SERVICE is trying to determine if there is any interest among companies in exploring for oil and gas in the Chukchi Sea, Hope basin, and Norton basin, all little-explored areas of the Alaska Outer Continental Shelf. MMS issued a call for information and nominations in late January, setting an Apr. 29 deadline for responses.

Although the Chukchi Sea and Norton basin have great potential as sources of oil or gas, high costs due to the distance from any infrastructure make them "challenging areas to lease," MMS said. The agency may offer economic incentives similar to those offered last September in Beaufort Sea Sale 186.

If there is interest, a sale will be designed. "If no one expresses interest, we save a lot of work and money," said MMS Alaska Regional Director John Goll.

The New Zealand Ministry of Economic Development has awarded Houston-based Pogo Producing Co. an exploration license on three blocks in New Zealand's September 2003 bidding round. There were 23 total bids submitted on 14 blocks in the bidding round, according to New Zealand authorities. Pogo's three 100% owned licenses, Blocks E, G, and I, lie in the Taranaki basin off the western coast of New Zealand's North Island. The bids provide for 5-year initial exploration terms, subject to extensions, and include a plan to acquire at least 1,000 sq km of new 3D seismic within the first 2 years across the three licenses. Drilling decisions will be based on results of the seismic analysis, Pogo said. The blocks lie in less than 100 m of water. OMV New Zealand Ltd., subsidiary of OMV AG of Austria, was the successful bidder for PEP 38485 (Block A) in the 2003 Taranaki basin license round. Block A is 70 km off North Island. OMV, which is operator, obtained a 33.3% stake in a joint venture with Origin Energy Resources Ltd. 33.3% and Todd Petroleum Mining Co. Ltd. 33.3%. The companies plan to conduct comprehensive seismic surveys over the next 2 years. OMV also is assessing development of Maari oil field in the Taranaki basin and expects to begin production in 2006 from Pohokura, New Zealand's largest undeveloped gas field.

VANCO MOROCCO LTD., a subsidiary of Vanco Energy Co., Houston, has signed an agreement with ENI Morocco BV to begin drilling the first deepwater well on the Ras Tafelney exploration permit off Morocco.

Ras Tafelney licensees are operator Vanco 45%, ENI 30%, and Morocco's national oil company Onarep 25%. Interest has been heightened off Morocco because of its geological similarities with the productive Scotian shelf off eastern Canada (OGJ, Feb. 24, 2003, p. 44).

ENI's Saipem 10,000 drillship is scheduled to arrive in late April to drill the first well 130 km offshore in 2,120 m of water on the Shark B prospect—one of several 3D seismic-identified prospects within the license. The well's main objective will be the Top Cretaceous and Albian reservoirs, while a Lower Tertiary turbidite play at shallower depths is a secondary target, Vanco said. The well will be drilled to 4,162 m TD.

CHEVRONPHILLIPS CHEMICAL CO. LP has licensed its loop slurry technology to China Petrochemical International Co. Ltd. (Sinopec) for a 350,000 tonne/year, high-density polyethylene plant to be built in China. The plant will be constructed at Sinopec's Maoming Petrochemical complex in China's Guangdong Province. Financial terms were not disclosed.

BIOGAS FROM DAIRY MANURE will be used as feedstock for a gas processing plant being planned at Rupert, Ida., the state's first such facility.

The owner, renewable energy company Intrepid Technology & Resources Inc. (ITR), Idaho Falls, said design is well under way on the plant, which will use a proprietary anaerobic digestion process when first production begins in late July. Construction is scheduled to begin Mar. 30, following spring ground thaw.

The 28 MMcf/year facility is being designed to process enough biogas with 80% methane content to back out the equivalent of 335,000 gal/year of propane, ITR said. About half of the gas will be used at the dairy, and the balance sold to current propane users in the area.

ITR said it plans additional digester facilities with dairy and feedlot operators in the western US.

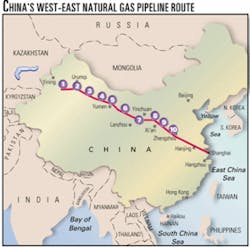

PETROCHINA CO. LTD. can expect delivery next month of the first two compressor packages for its $8.5 billion West-East natural gas pipeline project (WEPP)—one of the largest projects currently under way in China (OGJ, Mar. 17, 2003, p. 68). Design throughput capacity is 1.2 bcfd.

Rolls-Royce PLC, London, has a $150 million contract to provide gas compression equipment for 10 compressor stations along the western portion of the 3,900 km, 1,016 mm pipeline. It will install two gas turbine packages at 6 compressor stations and motor-drive sets at the remaining four. The project also includes 18 distribution stations along the downstream trunkline. Pipeline construction began in late 2002 and is scheduled for completion this year.

When completed, WEPP will extend from the gas-rich Tarim basin in the West Gobi desert in the Xinjiang Autonomous Region of far western China to Shanghai and other markets in eastern China. The gas reserves life of the Tarim basin is pegged at 20 years at current production.

Dolphin Energy Ltd. recently awarded Rolls-Royce a $107 million order for six industrial Trent gas turbine compressor sets to be used for the subsea section of the gas pipeline to deliver gas from Qatar's giant North field to the UAE. Gas fill for the line will begin in 2006 (OGJ Online, Feb. 6, 2003).