Russia's oil exports fuel production, strain refineries

Russia's steadily growing crude oil exports will continue to stimulate its crude oil and condensate production, predicts Moscow-based PetroMarket Research Group (PMR), which collects and records the country's energy statistics and issues its findings in the quarterly report "Russia's Oil Balances."

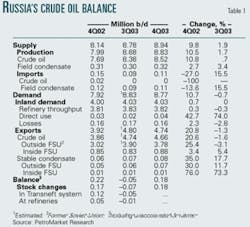

"Given the everlasting favorable spread between higher world oil prices and lower export-related costs, during 4Q03 producers of Russian crude will keep on exporting all available oil by all available means, trying to keep pace with the ever-increasing output," PMR said in its latest report, which tracked the third quarter 2003 and predicted trends for the fourth quarter (Table 1).

Top producer

Russia last year produced 7.7 million b/d of crude oil, becoming the world's top crude producer and the second largest oil exporter, with 3.8 million b/d exiting its borders, some of it to former Soviet Union states (see chart, OGJ, Oct. 6, 2003, p. 62).

In third quarter 2003, Russia produced 8.76 million b/d of liquid hydrocarbons, including crude oil, condensate, and natural gas liquids. Of this amount, it consumed 2.16 million b/d and exported 6.67 million b/d. It imported 110,000 b/d of oil.

As a result of expanded oil exports, the country's third quarter 2003 oil production rose almost 12% from third quarter 2002. Fourth quarter 2003 production of all petroleum liquids was estimated at 8.83 million b/d to bring the average for 2003 to about 8.5 million b/d.

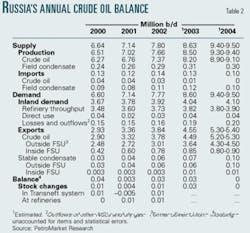

In 2004, Russia is expected to produce 9.4-9.5 million b/d of liquid hydrocarbons, consuming about 2.3 million b/d and exporting 6.9-7.1 million b/d. Imports would be limited to 120,000 b/d (Table 2).

PMR said that the attacks by Russia's law-enforcement agencies against top OAO Yukos management would not significantly affect the company's operations at yearend 2003.

Russian exports rising

A drop in the export duty on crude oil to $3.43/bbl from $3.66/bbl in early August was said to encourage exports to all destinations except Kazakhstan and Belarus, which enjoy duty-free status because of a customs agreement with Russia. A temporary increase in the export duty starting Oct. 1—to the equivalent of $4.62/bbl but dropping back to $4.27 in December—was not expected to affect the volume of Russian exports, PMR said, although it could affect exporters' revenues. Outside the FSU, exports would soar.

"The more-attractive exports outside the FSU have recorded an all-time peak of over 3.9 million b/d, having risen by more than 18% on a yearly basis and by over 8% compared with 2Q03," PMR reported. The group anticipated that these deliveries were likely to level off in 4Q03, resulting in an average for the year of 3.64 million b/d, while exports within the FSU were projected to increase by 850,000 b/d.

In 2004, exports outside the FSU could reach 4.5 million b/d, the group forecast. Plans for new export infrastructure will expand export capability by at least 280,000 b/d:

AK Transneft's expansion of the Primorsk terminal's loading capacity to 600,000 b/d from 360,000 b/d.

UkrTransNafta's addition of 170,000-180,000 b/d of capacity on the Kremenchug-Odessa pipeline, in lieu of an Odessa-Brody reversal scheme.

The launching of OAO Lukoil's 220,000 b/d crude oil and petroleum products terminal at Vysotsky on the Gulf of Finland in late November (OGJ Online, Dec. 15, 2003).

Oil products balances

Increased oil exports that limited domestic supply, along with rising domestic crude oil prices—up to $16/bbl in September from $10/bbl in July—made third-party Russian refining economically less attractive and capped further growth of refinery runs, PMR said, even lowering them in the Urals region.

After a midyear slump, however, Russia's refinery runs recovered in third quarter 2003 to 3.83 million b/d. Seasonal winter weather conditions that impede transportation will partly limit exports this winter and, along with sliding domestic crude oil prices, "will lead to stabilizing refinery runs at around 3.82 million b/d and to a substantial buildup of crude oil stocks" to better feed the "starving" refineries, PMR reported. That figure for the fourth quarter also was predicted as the average for all of 2003.

In the third quarter, motor gasoline output increased to 690,000 million b/d, 4% over the second quarter, where it was estimated to remain through yearend.

"With economic and seasonal limitations of exports and a seasonally depressed inland demand for [gasoline] at around 600,000 b/d, a resultant excess of lower-priced gasoline will be used to replenish its stocks," PMR reasoned. Production in 2004 is estimated to be 670,000-690,000 b/d.

Diesel fuel production in third quarter 2003 also rose—to 1.1 million b/d, where it was thought to remain in the fourth quarter. Gas oil exports were expected to be limited to 580,000 b/d in the fourth quarter, given the higher export duties, seasonal shipping restraints, and seasonally grown inland demand. Production in 2004 is forecast at a maximum of 1.13 million b/d.

Heavy fuel oil output was deemed likely to rise in line with last year's seasonal growth to 1.07 million b/d. Inland demand is expected to double to about 470,000 b/d, while exports of heavy fuel oil will be limited to less than 580,000 b/d in order to meet domestic demand.