Market Movement

Conflicting inventory reports undermine energy futures prices

Despite severe winter storms across much of the US, energy futures prices continued to fall through Jan. 28, largely because of conflicting government and industry reports on US inventories of crude and petroleum products.

The March contract for benchmark US light, sweet crudes lost 35¢ to $34.12/bbl Jan. 27 on the New York Mercantile Exchange, as traders' expectations of a bearish build in US inventories of crude and petroleum products from historic lows outweighed forecasts of a major snow storm in the Northeast. Instead, the US Energy Information Administration reported Jan. 28 that commercial US oil inventories fell by 1.5 million bbl to a 28-year low of 263.7 million bbl during the week ended Jan. 23. That was 35.8 million bbl below the 5-year average for that time of year.

US distillate fuel stocks plunged by 4.5 million bbl, with decreases in both diesel fuel and heating oil, said EIA officials. Gasoline stocks fell by 3.5 million bbl to 206 million bbl during the same period.

However, the American Petroleum Institute subsequently reported a jump of 3.6 million bbl to 268.2 million bbl of US oil stocks during the week ended Jan. 23. Distillates fell by 2.6 million bbl to 133.6 million bbl during the same period, and gasoline stocks lost 7.2 million bbl to 201.6 million bbl, API said.

Traders were expecting a build of 1-2 million bbl in US crude stocks, along with an increase in distillate inventories. With conflicting reports on oil inventories, the March NYMEX oil contract fell to $33.62/bbl on Jan. 28.

"Over the past week, trading appears to have concentrated even more than usual on the very short term," noted Paul Horsnell, head of energy research, Barclays Capital Inc., London, in a report issued that same day.

The latest EIA data "can be described as screamingly bullish," he said. For those "looking to get into the downturn in prices early, the appearance of these numbers may not subtract from the bearish eagerness to get the timing of the turn right, but it does remove any fundamental basis for the turn to happen now," said Horsnell.

Moreover, he said, "The [latest] draw in heating oil inventories confirms the start of a period of significant draws. The path of inventories has been shifted below the 5-year average again and has moved closer to last year's extremely bullish trajectory. The implied distillate demand figures also have started to make more senseUin sharp contrast to those suspiciously low readings earlier in the month."

Horsnell said, "The most surprising numbers are those for gasoline. For nearly 3 months, gasoline inventories have been tracking the usual sharp seasonal rise almost perfectly." In the latest weekly data, however, he said, "The pattern has departed from the script fairly dramatically. The period left for building gasoline inventories is running out, and they should not be drawing at this point. Some sharp builds are required over the next month, or there will be a strong prospect of yet another gasoline season showing strong price dislocations."

Crude imports fall

Analysts earlier said US refiners had responded to recent cold weather by increasing imports to meet surging demand for heating oil. US distillate fuel imports averaged 512,000 b/d during the week ended Jan. 23, "the highest weekly average since the week ended Mar. 7, 2003," EIA confirmed.

However, US oil imports averaged 8.6 million b/d in the week ended Jan. 23, "down nearly 1.2 million b/d from the previous week and the lowest level since the week ended Mar. 7. Half of the decrease was on the Gulf Coast, which dropped to its lowest level in 3 weeks," officials said. US gasoline imports, including both finished product and blending components, were down by nearly 200,000 b/d to an average 490,000 b/d in the latest period.

API said US oil imports dropped by 1.3 million b/d to 8.4 million b/d during the same period.

Crude inputs into US refineries averaged just over 14.7 million b/d last week, down by 163,000 b/d from the previous week and by 677,000 b/d over the last 3 weeks. "The vast majority of the decline last week was on the West Coast, while crude oil inputs on the Gulf Coast averaged about 7 million b/d, down 116,000 b/d from last week's level," EIA reported.

Meanwhile, EIA on Jan. 29 reported the withdrawal of 195 bcf of natural gas from US underground storage in the week ended Jan. 23. That compares with draws of 156 bcf the previous week and 247 bcf during the same period last year.

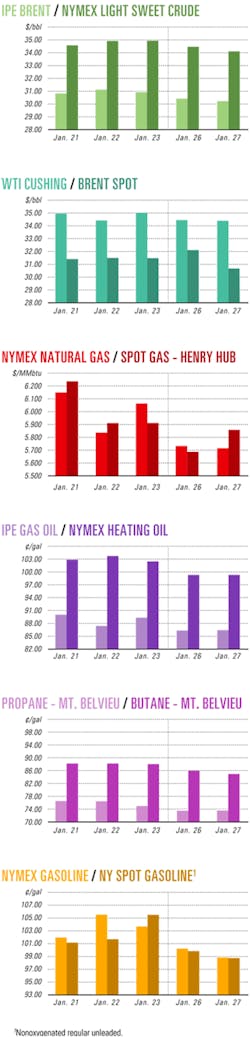

Industry Scoreboard

null

null

null

Industry Trends

RUSSIA'S OIL PRODUCTION is expected to grow for the foreseeable future, but the average 9%/year growth rates observed during 2000-03 are unsustainable, an analyst said.

"We are not expecting Russia to continue to provide the panacea for the world's oil thirst, and we don't think prudent investors should either," said Wayne Andrews, a Houston-based analyst for Raymond James & Associates Inc., St. Petersburg, Fla.

"Even the Russian government itself admits that depletion of existing reservoirs is a major long-term challenge for the industry," Andrews said in a Jan. 26 research note. "In fact, the energy ministry's own production growth forecast for 2004 is a mere 2.5%, an even more conservative projection than our 6.1% estimate."

Russian production grew 10% in 2003, and some analysts have predicted an increase of 7-8% for 2004.

"We believe that last year's 740,000 b/d increase in Russian oil production will not be repeated again—probably ever," Andrews said.

RJA expects a substantial deceleration in output growth rate. For 2004, the firm forecast an additional production increment of 510,000 b/d, or 6.1% growth. For 2005, RJA's forecast is 400,000 b/d, or 4.5%.

A combination of political and economic factors is beginning to severely constrain the growth rate of oil production across the entire former Soviet Union, Andrews said. He contends that low investment is leading to reserve depletion. Russia's infrastructure was neglected for decades, and all of the recent investment barely restored oil production to pre-1991 levels, he said.

Political fears and higher taxes also are making investment less attractive, he added. Those fears include the October arrest of OAO Yukos CEO Mikhail Khodorkovsky by Russian police (OGJ Online, Oct. 28, 2003).

Another factor constraining production growth is pipeline bottlenecks, which are limiting exports.

US LNG COMPANIES are busy reassuring investors and neighbors of the safety of both existing and proposed LNG terminals in the aftermath of the Jan. 20 explosion at the Skikda LNG complex in Algeria (OGJ, Jan. 26, 2003, p. 30).

The Skikda incident involved a steam boiler in a plant associated with the LNG complex but not directly linked with the LNG itself.

The equipment responsible for the accident is not used in any existing or proposed US LNG projects, industry spokesmen told participants attending a Jan. 26-27 LNG conference in Houston sponsored by Strategic Research Institute.

John Hattenberger, senior vice-president of Marathon International Petroleum Ltd., said it is incumbent upon oil and gas companies to educate the American public so that citizens become more comfortable with LNG imports.

He said that industry must demonstrate that it respects and can manage all safety risks.

Michelle Michot Foss, executive director and assistant research professor of the Institute for Energy, Law & Enterprise at the University of Houston, said that the Algerian accident "wasn't helpful" for US LNG projects.

The incident probably will generate "misinformed perceptions of the likelihood of that happening," in the US, which could negatively influence the reactions of politicians, she told the conference.

Government Developments

THE US GOVERNMENT is unlikely to take any action regarding an Austrian oil and gas company's prospective investment in Iran.

OMV AG of Austria signed a memorandum of understanding with Iran's National Iranian Gas Export Co. that OMV said strengthens the two countries' interest in developing future exploration and development projects together.

OMV officials told OGJ that the nonbinding declaration, signed Jan. 27, complies with all European Union and Austrian laws. They declined to speculate on whether the action would trigger a reaction from the US government.

US Department of State officials could not be reached for comment. But other US government sources familiar with the OMV plan said it is unlikely any action would be taken because the mou is not a binding contract. Even if OMV had announced a binding arrangement, the White House would avoid trying to block the deal, US officials suggested.

A US law called the Iran Libya Sanctions Act (ILSA) encourages the White House to use economic sanctions as a way to discourage non-US-based oil companies from investing more than $20 million in either country. Neither US President George W. Bush or former President Bill Clinton used the bill to its full potential to impose sanctions; however, the threat of such action did deter some large investments from being made when the law passed in 1996, according to some analysts.

Yet over the years, the bill's effectiveness has waned, given that there has been a general understanding between the US and the European Union since the late 1990s that the law would not be strictly enforced.

Now, any real challenge from OMV's announcement will come from the US Congress, not the White House.

Some House Republicans say ILSA, due to expire in 2006, should be strengthened to give the White House less discretion. But other lawmakers say the law is outdated and should be rescinded, given recent international events. They point to Libya's recent efforts to cooperate on antiterrorism measures and more quiet efforts by Iran's reformist president to encourage dialogue with the West.

A White House report on ILSA's effectiveness is due to be given to Congress in March. Meanwhile, industry lobbyists anticipate hearings this year on sanctions policy, especially with regard to Libya.

OMV's announcement came after Austrian President Thomas Klestil made a state visit to Iran. He was accompanied by Helmut Langanger, a member of the executive board of OMV responsible for exploration and production, and Otto Musilek, CEO of OMV Erdgas GMBH. They signed the exploration and production agreement and also pledged to strongly consider investments in the $4 billion Nabucco pipeline from Turkey to Austria, including the possibility of committing Iranian gas supplies to the project. OMV will make a final decision on the pipeline later this year.

In April 2001, OMV signed a 4-year agreement with Iran regarding exploration in the Zagros region. OMV's interest lies in the Mehr block where it is the operator of a consortium. Partners are Repsol-YPF SA and Chile's Sipetrol SA, each with a 33% stake. OMV holds the remaining 34% stake. Drilling is slated to begin in March.

Quick Takes

SAUDI ARABIA has awarded three contracts to international oil companies (IOCs) to explore for nonassociated natural gas in the country's Rub' al-Khali basin.

Each contract recipient will form an exploration and production company jointly with Saudi Arabian Oil Co. (Saudi Aramco), which will hold a 20% share of each.

Contract Area A, consisting of 30,000 sq km, was awarded to Russia's OAO Lukoil, operator.

Contract Area B, a 39,000 sq km section, was awarded to Sinopec International Petroleum Exploration & Production Corp., a unit of China Petrochemical Corp. Sinopec will be operator.

The 52,000 sq km Contract Area C was awarded to a consortium of ENI SPA and Repsol-YPF SA. Operator ENI will hold a 50% stake and Repsol-YPF 30%.

The sections are in a southeastern desert area known as the Empty Quarter. Any commercial quantities of gas found will be used in Saudi Arabian petrochemical plants and for power generation and water desalination.

The upstream packages were developed after a $25 billion natural gas development plan involving three core venture projects—initiated 4 years ago with IOCs led by ExxonMobil Corp. and Royal Dutch/Shell Group—fell through last year from the sheer complexity of deals that included upstream, midstream, and downstream aspects (OGJ Online, June 10, 2003). Afterwards, it was decided that the projects be simplified and rebid separately (OGJ, July 7, 2003, p. 29), with Saudi Aramco taking a larger role in the negotiations.

A group led by Edison International, Milan, is drilling the Sehqanat Deep-1 wildcat on Munir Block on the Zagros fold belt northwest of Shiraz in Iran.

Sehqanat Deep-1, on a large, well-defined four-way dip closure, is projected to 2,887 m to as many as seven target reservoirs, including primarily Sarvak, Dariyan, Fahliyan, and Surmeh.

After rig release, the group will drill the Shakestan prospect.

The 2,690 sq km Munir block, in Khuzestan Province about 75 miles inland from the northern Persian Gulf, lies east and south of supergiant Gach Saran oil field and several other giant fields.

The two wells drilled on the block in the 1960s drew only from surface geologic information and "poor seismic data," Edison said. Shahrenjan-1, TD 1,948 m, recovered 24° gravity oil emulsion from Asmari. The Edison group acquired 534 km of 2D seismic data during August 2002-January 2003 and integrated its interpretation with results of field work and a magnetotelluric survey.

Edison won the block in January 2001 under a 4 year buyback contract with National Iranian Oil Co. The work program consists of an exploration period of 4 years, plus 1 optional year, for seismic acquisition and the drilling of three exploration wells. Minimum gross financial commitment is $40 million in 4 years.

Interests are Edison 40% and Lundin Petroleum AB, Stockholm, and Malaysia's Petronas Carigali 30% each.

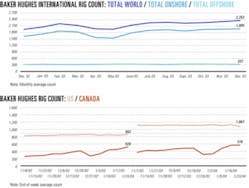

KERR-MCGEE CORP., Oklahoma City, said it will develop its 100%-owned Constitution field in the Gulf of Mexico with a truss spar similar in design to three of its existing spars in order to speed the field's development. Constitution will be Kerr-McGee's sixth deepwater hub.

Constitution's spar design will resemble the Nansen, Boomvang, and Gunnison spars, each of which can process 40,000 b/d of oil and 200 MMcfd of natural gas. Technip-Coflexip Group of France will build the hull at its Pori, Finland, yard, where the other hulls were fabricated.

The field, in 5,000 ft of water on Green Canyon Blocks 679 and 680, has estimated proved and probable reserves of 110 million boe, the company said. Total project cost is expected to be $600 million.

Development facilities will include five dry trees and one subsea tieback. Well bores from previously drilled appraisal wells will be used as part of the final development plan. First production is expected by mid-2006, with peak production expected to reach 40,000 b/d of oil and 75 MMcfd of gas in 2007.

Pemex Exploration & Production, a subsidiary of Mexico's national oil corporation Petroleos Mexicanos, has awarded an engineering services contract to a joint venture of Jacobs Engineering Group Inc. unit Uhde Jacobs and Mexican engineering firm Vigen SA for the Ku-Maloob-Zaap (KMZ) fields project in the Bay of Campeche off Mexico. The contract includes engineering oversight for 18 new offshore platforms that Pemex will build for the KMZ field complex during the next 5 years at a cost of more than $2.5 billion. The project will improve the complex's oil production capability to 800,000 b/d from Ku's output of 242,000 b/d in 2003 and the fields' gas production capability by 600 MMscfd.

Derek Oil & Gas and Ivanhoe Energy Inc., both of Vancouver, BC, have signed agreements for the joint development of LAK Ranch field, a horizontal-well, thermal oil recovery project covering 7,500 acres in the Powder River basin in Weston County, Wyo.

LAK Ranch field is estimated to have 100 million bbl of OOIP, and Ivanhoe estimates that 30-70% may be recovered using thermal recovery techniques.

Derek has completed two steam-assisted, gravity-drainage wells to 1,000 ft and 1,800 ft horizontally into the Lower Cretaceous Newcastle Sand. Surface preparations are under way, and steaming operations are expected to begin by early April.

The companies expect to drill five vertical steam-injection wells by summer, providing continuous steam application to the reservoir and increasing production volumes from the initial horizontal production well. Ivanhoe also plans a high-resolution 3D seismic data acquisition program to further identify the limits of the field.

The development program is expected to include additional horizontal production wells, new vertical or horizontal steam-injection wells, and surface facilities expansion. Ivanhoe estimates that the initial development program could grow to more than 20 wells producing more than 4,500 b/d. Optimum production rates could exceed 10,000 b/d of oil the company said.

SAUDI ARAMCO has commissioned a major natural gas and oil processing project at Haradh, Saudi Arabia. The facility consists of a 1.5 bcfd gas processing plant for delivering sales gas to Saudi Arabia's national gas system, a state-of-the-art gas-oil separation plant (GOSP) capable of separating 300,000 b/d of Arabian Light crude, and a 130 MMscfd gas-gathering system.

The Haradh gas plant is designed to deliver 170,000 b/d of condensates to Saudi Aramco's Abqaiq processing facility and 90 tonnes/day of sulfur for export.

Gas from the plant will be allocated to several major petrochemical projects and industrial complexes to be built within the next 5 years for an investment totaling 75 billion riyals, said Saudi Aramco Pres. and CEO Abdallah S. Jum'ah. He said the GOSP, combined with a similar plant Saudi Aramco completed 2 years ago and another that will be completed within the next 2 years, will raise Haradh area production to 900,000 b/d of oil, "a level exceeding the production of several oil producing countries."

ANTRIM ENERGY INC., Calgary, has awarded a drilling management contract to the Peak Group, London, for Antrim's first offshore exploration well on the North West Shelf off Australia (OGJ Online, Dec. 1, 2003). Antrim and Peak plan to finalize well planning and rig contracting immediately.

The well, South Galapagos No. 1, will be drilled later this year in 345 m of water to 3,775 m TD on Permit WA-306-P in the Barcoo subbasin. The prospect is 200 km southwest of Brecknock and Scott Reef fields, which are said to have a combined 20 tcf of gas and 300 million bbl of condensate recoverable.

Antrim, which is financing 100% of well costs, is operator of WA-306-P with an 87.5% ownership interest. Magellan Petroleum (WA) Pty. Ltd. holds 12.5%.

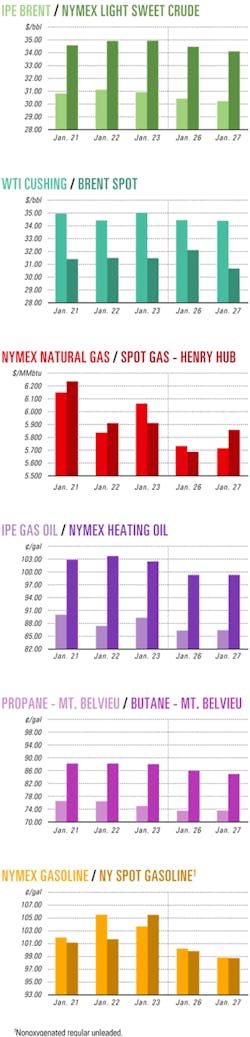

US drilling activity plummeted the week of Jan. 19, down by 40 units from the prior week's 27-month high, with 1,087 rotary rigs still working, officials at Baker Hughes Inc. reported Jan. 23. The reduction impacted all three areas of activity. Land drilling was down by 32 rigs to 971 working. Offshore drilling dipped by 3 units to 98 in the Gulf of Mexico and by 5 rigs to 99 in US waters as a whole. Inland water activity lost 3 rigs to 17. In Canada, there were 576 rotary rigs working last week, 13 more than the prior week. Worldwide, there was a net gain of 4 mobile offshore rigs under contract, to 530.

ALASKA GOV. Frank H. Murkowski has accepted an application from North Slope producers BP Group LLC, ConocoPhillips, and ExxonMobil Corp. to enter into negotiations to build a natural gas pipeline from the slope.

The application has been under review by the Department of Natural Resources and the Department of Revenue since Jan. 13, Murkowski said, and it was accepted after amendments were made to accommodate requests from the applicants.

The announcement came 1 day after Murkowski received an application to build a competing pipeline from a consortium of MidAmerican Energy Holding Co.—a privately held company of which Warren Buffett and his Berkshire Hathaway Corp. are the major owners—Pacific Star Energy, and Cook Inlet Region Inc. Pacific Star Energy is an umbrella group of 12 native corporations.

At that time, Murkowski had said the next step would be to negotiate with the MidAmerican group a draft contract that then would be submitted to the Legislature for approval.

The state now will enter into negotiations with the producer group. Murkowski said he hopes to have concluded negotiations on the terms of a draft contract with the producers in time to submit it to the state legislature for approval.

Stranded gas reserves in the North Slope area are estimated to be more than 100 tcf.

Transcontinental Gas Pipe Line Corp. (Transco), a unit of Tulsa-based Williams Cos..Inc., is holding an open season for interested shippers until Feb. 13 for firm transportation service of as much as 150 MMcfd of natural gas capacity on its pipeline system, following completion of its central New Jersey expansion.

Transco expects new service to be available on the expansion in November 2005.

Anadarko installs world's deepest TLP in Gulf of Mexico

Anadarko Petroleum Corp. has installed the Marco Polo tension leg platform—-the deepest such installation in the world—in 4,300 ft of water in the Gulf of Mexico 160 miles south of New Orleans. The 196-ft TLP hull was built in South Korea and transported 13,000 miles to Marco Polo field on Green Canyon Block 608. There it was attached to its 6,725 ton topsides, which was constructed in Corpus Christi, Tex.

Anadarko, operator of the field and the TLP, is now completing six development wells and preparing to connect oil and gas offtake pipelines to the TLP.

The platform, owned by GulfTerra Energy Partners and Cal Dive International, has a production capacity of 120,000 b/d of oil and 300 MMcfd of gas. Production is expected to begin in July. Illustration from OGJ archives.