Russian oil product exports will increase in the next few years, but will face major roadblocks from more-stringent European specifications.

The changes will affect all the international markets.

High-sulfur fuel oil and feedstocks dominate Russian trade, and volumes are already moving into Asian markets. The recent relative strength in the Asian fuel oil market has created an arbitrage opportunity for these long-haul cargoes.

When refinery runs in Asia pick up in the next few years and the fuel oil market weakens, Russian high-sulfur fuel oil still has to trade into Asia. The price the Russians can achieve will fall, and the fuel oil price in Asia will weaken.

Russian exporters must now make important strategic decisions if they want to avoid threats to refinery margins from these poor prospects in the fuel oil market.

Russia exports

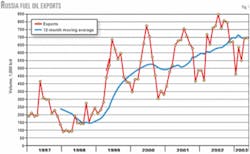

Total Russian product exports have increased sharply over the past 3-4 years; in 2002 exports were 0.5 million b/d higher than in 1999.

This has been achieved through an increase in Russian refinery throughput, rather than any marked downturn in domestic demand allowing for increased exports.

In 2002, fuel oil exports averaged 0.7 million b/d and accounted for almost half of all Russian product exports. The major gain in Russia export volumes has been in fuel oil, with exports up by 250,000 b/d in 1999-2002.

Table 1 details Russian product exports since 1999 and shows the importance of the fuel oil market in absolute volume and growth trade.

There is much seasonality in fuel oil exports, which peak during April to October and dip in November through March.

This is due to high winter demand in Russia for district heating and power generation.

Government intervention, to some extent, also forces a seasonal cutback in fuel oil exports. The government imposes temporary increases in export levies to ensure sufficient local supplies of the seasonal product.

Peak Russian fuel oil exports in the summer have been fairly consistent in each of the past 3 years, at 775,000-850,000 b/d.

The underlying increase in Russian fuel oil exports is mainly because the seasonal, winter decline in trade has not been as sharp.

In 2000, fuel oil exports dipped to a low of 300,000 b/d; in 2002 the lowest export volume was 475,000 b/d. Trade in Russian fuel oil has therefore become more of an all-year occurrence, and this trend will continue.

Russian fuel oil exporters now face a major challenge due to three key issues in the marketplace:

1. Russia exports large-scale volumes of high-sulfur fuel oil.

2. The European inland market for high-sulfur fuel oil has diminished due to the specification change to less than 1% sulfur (from January 2003).

3. There has been a general stagnation, or even decline, in worldwide fuel oil demand.

Russian fuel oil sellers have already felt pressure from European market developments and had to look to longer haul markets in Asia.

In 2003, Russian fuel oil sales in Europe fell by around 0.1 million b/d, but total fuel oil exports from Russia have been sustained at around 0.7 million b/d.

Russian exporters have sold more fuel oil outside the "local" European market; many tankers have transported 80,000-tonne cargoes from the Baltic to Singapore.

Table 2 shows the decline in European fuel oil imports and the growth of Russian fuel oil exports into markets outside of Europe.

Developments in Europe are forcing this longer haul trade. The recent switch of European standards to a 1% maximum sulfur for the inland market means that the only end-use demand for high-sulfur fuel oil is in the bunker market.

This market is limited and does not offer any additional sales opportunities for Russian exporters.

There is a strong possibility that the European Union will impose even stricter controls on bunker specifications towards 2008-09; vessels operating within the EU could be forced to switch to a 1.5% sulfur maximum on fuel oil.

The problem for Russian exporters is that even if they could supply low-sulfur fuel oil, the market demand in Europe is falling so fast that there will be insufficient opportunities to sell current volumes.

For the next few years, there are substantial upgrading investment plans under way in the Russian refining sector; these will decrease fuel oil output.

On the demand side, fuel oil requirements in Russia will remain close to current levels or decline, with continued competition from other fuels (coal, nuclear, natural gas, and electricity) and further efficiency gains.

Volumes of fuel oil available for export will stabilize after the sustained growth during the past 5 years.

With the decreased demand for Russian fuel oil in Europe, however, long-haul Russian fuel oil trade will still have to increase and find its way to Asia.

The problems will occur when Asian refinery runs increase and more local high-sulfur fuel oil becomes available to Asian buyers.

If Russian exporters want to maintain fuel oil exports, they will have little alternative but to continue selling to Asia and to compete more aggressively on price.

Asian fuel oil prices have been strong in 2003; however, if Russian exporters continue to push high-sulfur fuel oil to Asia, prices will weaken and reduce refinery margins for Russian exporters.

The author

Steve Christy ([email protected]) is a senior consultant for KBC Process Technology Ltd., London. He has more than 20 years' experience in oil supply, and market developments and opportunities. Christy holds a degree in math and economics from the University of Bradford, UK.