Recommendations in the National Petroleum Council's report on refining issues aim at avoiding hindrance to capacity expansion, encouraging investment, and allowing the supply system to operate efficiently.

An immediate concern is implementation of the Environmental Protection Agency's requirement that highway diesel fuel contain no more than 15 ppm sulfur, which begins to take effect in mid-2006. During the meeting at which NPC approved its refining report, industry officials raised concerns about possibly inaccurate testing procedures and product degradation in delivery systems, which might create supply problems during the transition period (OGJ, Dec. 13, 2004, p. 24).

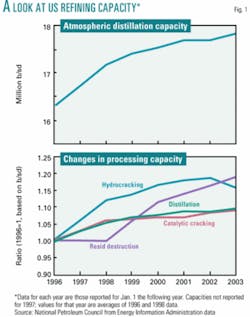

As background to its recommendations, the NPC report points out that US refining capacity has increased since the mid-1990s in the absence of any grassroots construction and despite the closure of small, inefficient plants. Upgrading and conversion capacities have expanded variably, with fluid catalytic cracking changing in step with distillation and hydrocracking and coking increasing relatively faster (Fig. 1).

The processing changes occurred as refiners, with overall demand growing, adapted to a lightening demand barrel and increasingly heavy crude slate. With total product demand outrunning refining capacity, US reliance on imports has increased for most products, especially gasoline (Fig. 2).

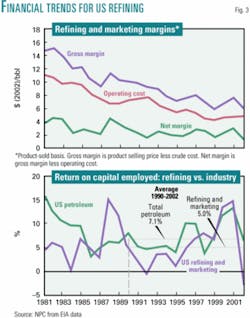

The study notes that grassroots construction remains economically less attractive than acquisitions or expansions of existing refineries. Refinery construction of any kind faces unique economic challenges, including refining's subpar returns on capital and the continuous need to sustain sales margins by cutting costs as gross margins decline due to competition (Fig. 3).

With demand for light products likely to keep growing and grassroots construction unlikely, incremental supply must come from whatever capacity expansions US refiners undertake and increased imports.

Gasoline outlook

NPC expects that in the next few years, supply of gasoline will be adequate but that questions loom for ultralow-sulfur diesel (ULSD).

During the first 6 months of 2004, refiners produced gasoline meeting new sulfur-content requirements—no more than 300 ppm with a corporate average of 120 ppm—at record rates for any type of gasoline. In 2000, NPC estimates the average US gasoline sulfur concentration at 340 ppm.

The new study examines patterns of use this year of allotments refiners earn by reducing gasoline sulfur to below 120 ppm. The patterns, NPC says, indicate that "current domestic production in combination with imports is capable of achieving market demand volumes while meeting specifications and that some capacity exists to reduce sulfur below 2004 levels."

Furthermore, imports of gasoline meeting US specifications will remain available from refineries in Canada, Western Europe, parts of Latin America, and the Virgin Islands. Refineries in Eastern Europe and other parts of Latin America might not upgrade to produce gasoline with lower sulfur content. On balance, however, NPC expects US production and imports to meet gasoline demand at projected levels as sulfur reductions continue through 2006.

Diesel troubles

ULSD supply in 2006 is less certain. EPA has indicated that capacity to meet expected demand for ULSD will be in place as the new specifications take effect if two conditions are met, both of which NPC considers doubtful.

One condition is that a 4-year phase-in provision of the ULSD regulation works. During the phase-in period, 20% of highway diesel sold in the US can exceed the new sulfur standard up to 500 ppm sulfur if the higher-sulfur product is kept separate from ULSD.

The NPC study says there have been no public reports of work to prepare distribution and retail systems to handle the segregated, off-specification product. The phase-in period may be too short to allow recovery of the needed investments, it said.

The other condition is minimal downgrade of ULSD in the distribution system. Because EPA will enforce its sulfur specifications at retail locations rather than refineries, contamination is possible during distribution. Many of the pipelines, vessels, terminals, and trucks through which ULSD will move also will carry higher-sulfur jet fuel, nonroad diesel, and heating oil.

"Significant losses and downgrades during delivery from refineries to the final consumer could result in apparently adequate supplies at refineries being unable to meet demand at retail," the study says. "Trial pipeline shipments of ULSD suggest the potential for significant volume loss of on-specification ULSD, potentially in excess of 10% in each transportation segment, during distribution, even allowing for a significant sulfur increase."

A related problem is EPA's testing tolerance of 2 ppm variability, which requires more precision than is available in the best sulfur testing methods. The inconsistency might lead to the disqualification of large amounts of ULSD at retail locations.

Also, the potential for contamination and testing inconsistency might lead pipeline and other distribution companies to specify diesel sulfur at the refinery gate as low as 5-7 ppm, which might be below refinery desulfurization designs plans.

"If this is the case and desulfurization projects are forced to operate at lower sulfur levels than design, then actual ULSD production could be substantially below design rates," the study says.

Imports of ULSD aren't likely to compensate for a shortfall in domestic production. Unlike with gasoline, supplemental supply isn't like to be available form sources other than the traditional suppliers of low-sulfur highway diesel to the US, Canada, and the Virgin Islands.

NPC's recommendations

NPC's new recommendations to the secretary of energy on refining issues include:

- Reform new source review (NSR). Implement changes, including those under judicial review, proposed by the administration of US President George W. Bush late in 2002 to the Clean Air Act program governing plant modifications with potential to increase emissions of air pollution. The changes attempt to clarify NSR regulation, which discourages refinery investments because of uncertainty and a history of reinterpretation.

- Revise national ambient air quality standards (NAAQS). Adjust deadlines for compliance with new programs to take full advantage of emission reductions from current programs. Current deadlines can require emission offsets that wouldn't be needed if extended until benefits of existing efforts took full effect. The extra burden discourages investment in refinery expansion, reduces refinery profitability, and aggravates the problem of "boutique fuels," the proliferation of fuel specifications.

- Monitor ULSD implementation. EPA, the Department of Energy, and industry should use information about ULSD movement through the distribution system to adapt the program to system realities and still achieve regulatory goals. EPA should adjust its ULSD testing tolerance to accommodate limits on testing precision.

- Pass national energy legislation. NPC considers the conference report on this year's comprehensive energy bill to be "the vehicle with the highest probability of obtaining prompt action on the [reformulated gasoline] oxygenate, oxygenate liability, and boutique fuel issues."

- Make Executive Order 13211 law. The 2001 order requires agencies to prepare a statement about the effects of regulatory actions on energy supply, distribution, and use. NPC cites ULSD and NAAQS regulations as examples of regulations adopted without thorough consideration of energy-supply effects.

- Streamline permitting. Provide for prompt overall review of refinery-project permit requests, with clear processes, well-defined roles and responsibilities for permitting agencies, and specific deadlines for decisions. EPA should define clear procedures for dealing with environmental-justice challenges.

- Adjust the depreciation schedule for all refining equipment to 5 years from 10 years. The move, which would be consistent with treatment of process equipment in other manufacturing industries, would improve the economics of refinery expansions.

- Limit exemptions, exceptions, and waivers to circumstances threatening serious supply disruption. Because repeated requests for variation from regulations create market uncertainty, NPC says, "EPA should issue a definitive variance procedure for allowing noncomplying fuel to be sold in the marketplace."

- Limit mandates or subsidies for alternative fuels. They increase uncertainty and reduce the incentive to invest in refining capacity.

- Continue to resist automakers' calls for a reduction in the driveability index (a measure of fuel factors contributing to vehicle performance) or change in the distillation index (driveability index plus an ethanol adjustment). Either change, which EPA has resisted, would reduce the rates at which US refiners can produce gasoline.

- Keep site security an industry responsibility. Coordinate risk assessment through the Department of Homeland Security. "Refiners have expended substantial resources to enhance security and expect to continue to do so," the study says.

- Make national the "one-call" system for avoiding third-party pipeline digging incidents. And broaden the system to include government entities.

- Provide funding to increase or maintain depths in waterways serving oil import facilities. Streamline dredging-permit processing for terminal sites, and provide adequate disposal sites for dredging materials. Clarify the process for obtaining waivers of the Jones Act, which requires US tankers for shipments between US ports, when market conditions necessitate increased shipping of oil.