Alberta's coalbed methane activity expands rapidly

The last 2 years have seen a rapid expansion of coalbed methane (CBM) development in Alberta.

MGV Energy Inc, with its former joint venture partner EnCana Corp., established the first commercial coalbed methane project in January 2003. MGV Energy is the Canadian subsidiary of Quicksilver Resources Inc., Fort Worth.

At yearend 2003, Alberta had about 1,000 CBM wells and the area will have another 1,500 wells drilled by yearend 2004, at which time CBM production should total about 100-150 MMscfd.

MGV along with Apache Canada Ltd. and EnCana account for more than two-thirds of the new gas well drilling in the region.

MGV will drill about 350 gross operated wells in 2004, including more than 330 CBM wells. Its yearend net production will exceed 35 MMcfd up from 17 MMcfd in the previous year.

null

At midyear 2004, MGV had proved reserves of 215 bcf, predominately from CBM.

Commercial projects

The current commercial CBM production in Alberta is from the shallow, 200-800 m Horseshoe Canyon and Belly River coals, which account for about 66 tcf of the Alberta CBM resource.

These coals underlie a large area in central Alberta along the Calgary to Edmonton corridor and have an estimated 60 by 150 mile extent. MGV, as part of its joint venture with EnCana, was the first to recognize the dry characteristic of these coals, which are underpressured and, unlike many CBM reservoirs, do not produce water in any significant quantity.

MGV integrated technologies from the Appalachian Basin Devonian shales with Canadian shallow-gas practices to develop completion and stimulation procedures for these coals, which led to commercial production.

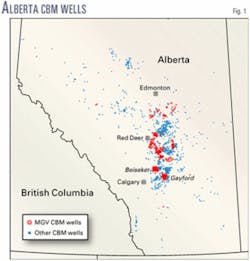

MGV's early production tests in the Palliser block east of Calgary, at Gayford and Beiseker, established average project well producing rates of 90-140 Mcfd, with individual wells producing 250 Mcfd or more.

As the play has expanded and more test wells were drilled, the productive area has grown and some new project areas have established producing rates higher than those first observed in Palliser. Several areas have observed producing rates of more than 400 Mcfd/well and some projects have average rates close to 200 Mcfd/well.

null

MGV has about 350,000 net acres throughout the Horseshoe Canyon play area and has several projects ongoing in these new areas (Fig. 1).

Working with the Alberta regulatory agency, the Energy and Utilities Board (EUB), MGV and other producers have established that production from these Horseshoe Canyon coals often can be commingled with production from interbedded sands and silts. By increasing well producing rates and reserves, commingling provides a more efficient way for recovering Alberta's shallow gas resources.

MGV estimates that optimal well spacing in this area is four to eight wells/section, and individual wells will recover 250-500 MMcf of gas. Figs. 2 and 3 show CBM coiled-tubing work and two compressor installations.

Future potential

The Alberta Geological Survey estimates that Alberta's coals contain more than 550 tcf of gas. About 60% of this resource lies in the Mannville coals that have normal pressure and produce brine along with gas.

Companies are targeting these coals in central Alberta at depths of about 1,000 m. Currently under evaluation are more than 300 exploration and pilot wells. No company has established commercial production to date, but Nexen Inc. has announced intentions of going commercial in late 2004 or 2005.

MGV is involved in a number of Mannville projects and has participated in 30 Mannville wells, with several exploration and pilot wells undergoing evaluation and production testing.

The Ardley and other coals in Alberta have additional activity, but these coals represent a relatively small part of the resource, less than 15%, and have no established commercial projects.

MGV is evaluating the Ardley in a few wells. Most current activity is near the Pembina Cardium oil field near Drayton Valley.

The Canadian National Energy Board (NEB) estimates total Canadian CBM production will exceed 2 bcfd by 2014 and 3 bcfd by 2024 with an ultimate recovery of 75 tcf, which would exceed Canada's current conventional proved reserves.

MGV has about 500,000 net acres of land, with most prospective for CBM. All of MGV's development activity has been in the dry Horseshoe Canyon coals, which still has more than 3,000 future development locations to be drilled.

MGV has a large ongoing CBM joint venture with Conoco Phillips Canada (CPC) and others with EnCana, Enerplus Resources Fund, Petrofund Energy Trust, PenGrowth Energy Trust, and Dominion Exploration Canada Ltd. as well as 100% MGV lands.

MGV expects to drill more wells in 2005 than 2004, many in the new project areas north of Palliser.

With well costs of $230,000-300,000 (Can.) inclusive of gathering and facilities costs, these projects could yield returns ranging from 50 to 100% at current gas prices.

The outlook for CBM in Canada is bright and as the Horseshoe Canyon play expands, the potential of the Mannville, Ardley, and other complementary plays will likely be unlocked and will add further to this growth.

The author

J. Michael Gatens III is chairman and CEO of MGV Energy Inc. He previously worked for S.A. Holditch & Associates Inc. Gatens holds a BS and an MS in petroleum engineering from Texas A&M University. He is Chairman of the Canadian Society for Unconventional Gas and is on the Canadian Association of Petroleum Producers Board of Governors. Gatens is also a registered professional engineer in Texas and a member of Association of Professional Engineers, Geologists, and Geophysicists of Alberta, and SPE.