OGJ Newsletter

Market Movement

Crude prices fluctuate ahead of OPEC meeting

After plummeting more than $7/bbl through the previous week, crude futures prices went into a seesaw mode Dec. 6-8, up one day and down the next as markets reacted to changing factors.

On the New York Mercantile Exchange, benchmark US crude prices bumped up Dec. 6 amid indications that members of the Organization of Petroleum Exporting Countries might take action to curb that fall at their Dec. 10 meeting in Cairo. However, crude futures prices fell again Dec. 7 as hundreds of protestors ended their 3-day siege of three oil pumping-station platforms in Nigeria, only to rebound Dec. 8 when the US Energy Information Administration reported a lower-than-expected rise in US crude inventories during the week ended Dec. 3.

The Nigerian incident temporarily shut in oil production totaling 120,000 b/d.

Commercial US crude inventories increased by 600,000 bbl to 293.9 million bbl during the week ended Dec. 3, in the middle of the average range for that time of year.

US distillate stocks rose by 1.4 million bbl to 119.3 million bbl during the same period, with almost all of that gain in diesel fuel. However, distillate fuels remained just below the lower average range for the time of year. US gasoline stocks increased by 2.4 million bbl to 208.1 million bbl during the week.

Expectations grow

Still, there were growing expectations among analysts that OPEC members would at least agree at their meeting to curb overproduction or perhaps even roll back their official production quota of 27 million b/d, depending on how strong a message the group wanted to send to oil markets.

Total production from the 10 OPEC members subject to quota restrictions is currently estimated at 28.1 million b/d. With Iraq included, total OPEC production is 29.5 million b/d (OGJ Online, Nov. 30, 2004.)

Days before the OPEC meeting, Venezuela called for production cuts, while Libya's oil minister endorsed both a quota reduction and a decrease in actual production. Iran, Kuwait, and Qatar expressed concern over a massive 17% decline in crude prices in little more than a week. Even Saudi Arabia said all options would be considered at the meeting.

"We think instead of cutting quotas, OPEC should ask members to produce oil according to their respective quotas," said Iin Arifin Takhyan, Indonesia's director general of oil and gas.

Target price band under scrutiny

In the interim, OPEC Conference Pres. Purnomo Yusgiantoro said ministers would discuss raising the target price band of $22-28/bbl that the group instituted in March 2000. Crude has been selling at prices above that band for more than a year.

"Our position on the price band is to adjust it with the inflation that occurred since 2001 until now and the depreciation of the dollar," Purnomo told a recent press conference in Jakarta. In an earlier statement, he said OPEC is actually defending a basket price of $28-32/bbl, which analysts said implies a market price of $31-36/bbl for West Texas Intermediate.

"Remember," said Jeffery L. Mobley, an analyst in the Houston office of Raymond James & Associates Inc., "as oil went to $55[/bbl], OPEC [members] kept saying that prices were too high. They helped lower prices in two ways: by making public statements guaranteeing secure supply—what we call 'moral suasion'—and by actually raising production far in excess of official quotas."

In recent weeks, however, he said, "OPEC has reverted to a 'neutral' stance. They are not saying prices are too low, but they have certainly stopped saying they are too high. If prices move much lower, OPEC will probably do one or both of the following: use their 'moral suasion' to get the market to bid oil higher, perhaps by threatening a cut in quotas; and actually lowering production, perhaps quite substantially. Saudi Arabia will likely be the first to do this."

When OPEC adopted its target price band nearly 4 years ago, the exchange rate between the US dollar and the euro was roughly equal. "Since then, the dollar has weakened by over 30% vs. the euro, [recently] setting an all-time low," Mobley said. "Because the vast majority of OPEC's imports (90.5% for Saudi Arabia, for example) come from nondollar countries, [OPEC members] must effectively defend a higher price band just to secure their purchasing power vis-à-vis their European and Asian trading partners."

He said, "We would argue that OPEC will step in even before oil falls to the mid-$30s. We believe they will act near the $40[/bbl] level."

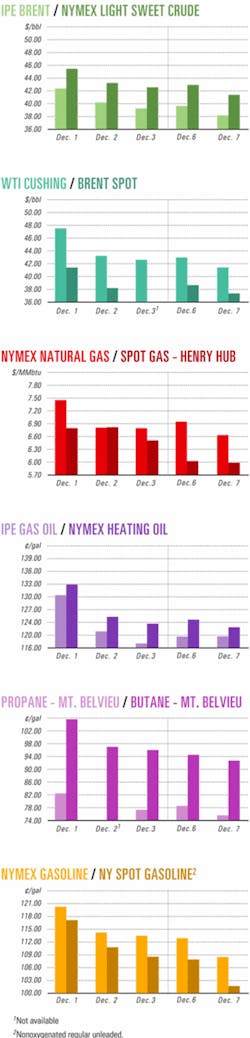

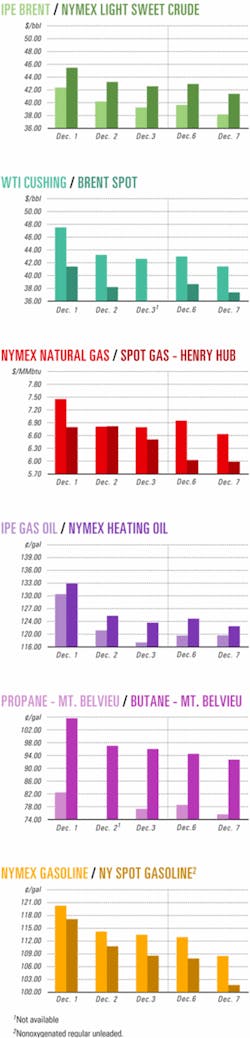

Industry Scoreboard

null

null

null

Industry Trends

THE OFFSHORE OIL AND GAS INDUSTRY is expected to spend $1.4 trillion worldwide during the next decade, and offshore production is forecast to grow to 55 million boe/d by 2015 from 39 million boe/d in 2004.

Analysts at Douglas-Westwood Ltd., Canterbury, UK, reported the results in a recent study of long-term offshore oil and gas prospects.

Offshore oil is forecast to provide 39% of global oil production by 2015, compared with 34% in 2004. Offshore gas production is expected to provide 34% of global gas production in 2015, compared with 28% in 2004.

Study author Michael R. Smith said, "In recent years, offshore oil and gas production growth has been constant and rapid. Offshore output is expected to be some 27 million b/d of oil and 750 billion cu m (bcm) of gas in 2004. It is forecast to grow to 33 million b/d and nearly 1,300 bcm/year by 2015."

Expenditures are being diverted from mature to immature countries. Smith said the shift "will have a massive effect on where and what type of equipment and services will be required."

The role of deep water is growing. The study forecast that nearly 25% of offshore oil will come from deep water in 2015 compared with 10% in 2004. After 2010, all global offshore oil production growth will be from deep water, compensating for declining output from shallow water.

Referring to regional shifts, Smith said, "True offshore oil production began in North America in 1938, and since then, all regions have seen some expansion but most rapidly from Western Europe—mainly the North Sea. In 2004, Western Europe was providing 21% of all offshore oil but is forecast to be providing just 11% by 2015.

"The Middle East, due to its large reserves, and Africa and Latin America, due to their deep waters, are forecast to be contributing the largest shares by 2015, with 21%, 19%, and 18%, respectively."

Offshore gas production is forecast to continue to rise from both shallow and deep water. In terms of oil equivalent, by 2015 gas is expected to provide 40% of offshore volumes, the study said. In addition, 12% of offshore gas is expected to come from deep water in 2015, compared with 7% in 2004.

"The growth in importance of gas, and offshore gas in particular, will drive an unprecedented increase in expenditure on gas infrastructure, including pipelines, LNG plants, gas-to-liquid processing plants, tanker transport, and loading and unloading terminals," Smith said.

The expenditures forecast in the report are in 2004 dollars and are based on the assumption that inflation will remain low.

The study also assumes that upward cost pressures and a higher oil-price environment will be counterbalanced by downward cost pressures through improved technology and cost-cutting strategies.

John Westwood, report series editor, said, "Over the longer term, a sustained increase in oil prices is likely as a global energy supply gap develops and real cost increases materialize, which could lead to additional expenditure growth."

Government Developments

THE FRENCH FINANCE MINISTRY said the government has changed the corporate status of Gaz de France from a state-owned company into a limited liability company in its move toward privatization.

Initially, the government continues to hold 70% of GDF stock and voting rights, but officials are preparing to sell GDF stakes to private investors.

Prime Minister Jean-Pierre Raffarin has said that he hopes to see GDF opened to new shareholders before yearend 2005.

GDF Pres. Jean-François Cirelli called the corporate legal change "a major step." Under its new statute, GDF is freed from the "specialty principle," which restricted its business to natural gas.

Now, GDF is authorized to market other energy commodities and associated services in France and abroad.

THE US ARMY CORPS OF ENGINEERS has issued a draft environmental impact statement (DEIS) saying the first offshore wind farm proposed in the US would do little long-term environmental damage.

Cape Wind Associates LLC of Boston, an independent power producer, wants to build a 420-Mw, 130-turbine wind farm in Nantucket Sound. The project cost is estimated at more than $700 million. The wind farm tentatively is slated for completion in 2005 to supply electricity to Cape Cod, Mass.

Massachusetts Gov. Mitt Romney opposes the proposal, saying he wants to preserve the visual landscape of Nantucket Sound. Romney has asked a US White House representative to consider a moratorium on wind farms off the US until a process can be drafted to regulate them.

Christopher Namovicz, a wind specialist with the US Energy Information Administration, said there is no authoritative, comprehensive US law or regulation covering offshore wind development (OGJ Online, Aug. 31, 2004).

The Corps has federal permitting authority. Following a 60-day public comment period, the Corps will prepare a final environmental impact statement. Released last month, the 3,800-page DEIS took 3 years to complete and involved 17 federal and state agencies.

THE US SENATE has reconfirmed Suedeen G. Kelly to the US Federal Energy Regulatory Commission for a term expiring June 30, 2009.

An attorney, Kelly had been filling an unexpired term slated to end this year. The Natural Gas Supply Association applauded her reconfirmation.

"She has demonstrated a willingness to be engaged in developing constructive solutions to the nation's energy challenges," said NGSA Pres. Skip Horvath.

Kelly previously was a law professor at the University of New Mexico. Before joining the faculty, Kelly was chair of the New Mexico Public Service Commission. Previously, she worked at an Albuquerque law firm. In 1999, she worked as a legislative aide to US Sen. Jeff Bingaman (D-NM).

THE NEWFOUNDLAND OCEAN INDUSTRIES ASSOCIATION (NOIA) reported an "encouraging" outcome of this year's call for bids for exploration rights off Newfoundland and Labrador. Operators bid on all five of the parcels offered. Bidders committed more than $71.1 million. NOIA Pres. and CEO Leslie Galway said the results show renewed interest in the Jeanne d'Arc basin. The bids, conditionally accepted, included Parcel 1, north of White Rose oil field, $28 million; Parcel 2, north of White Rose, $18 million; Parcel 3, northeast of White Rose, about $1 million; Parcel 4, north of Hibernia oil field, $16 million; and Parcel 5, south of Hibernia, about $8.1 million. The bids represent expenditures that the bidders commit to make in exploring the parcels during the initial 5-year period of a 9-year exploration license, NOIA said. Husky Oil Operations Ltd. was one of the most active bidders, with 50% of Parcel 1 and 100% of Parcels 2 and 3.

State-owned Petróleo Brasileiro SA (Petrobras) has discovered light oil in its 1-FRO-3-AL wildcat well on Block BT-SEAL-2 in the Sergipe-Alagoas basin, Brazil. It encountered the reservoir at 965 m. The well verified oil pay indicated in seismic data. It is 37 km southeast of Maceió, in Alagoas state. The discovery is part of a trend toward light oil and natural gas in Petrobras's exploration. From August 1998 through August 2003 the company spent nearly $3.1 billion, drilled 386 exploration wells, and shot 330,000 km of 2D seismic and 60,000 sq km of 3D seismic data, leading to discovery of 1.96 billion bbl of crude oil and 14.8 tcf of natural gas, mainly in the Campos, Espirito Santo, Sergipe-Alagoas, and Santos basins.

Saudi Aramco reported that its Midrikah-1 well found natural gas in what it called Midrikah field in Saudi Arabia's Eastern Province, 30 km south of Ghawar oil field. The Midrikah-1 well on test produced an average 38 MMcfd of natural gas with 1,650 b/d of condensate on Nov. 22, the company said. The permanent production capacity of the well is expected to exceed the current test level of production. Midrikah field is 300 km southwest of Dhahran and 270 km southeast of Riyadh.

Origin Energy Ltd., Sydney, has made a gas discovery with its Trefoil-1 wildcat on Bass basin Permit T/18P off Tasmania. Wireline logs, formation testing, and sampling confirmed 50 m of net gas pay over eight zones in the well in the Eastern View Coal Measures formation, productive in Origin's nearby Yolla field. Analysis indicates high-quality gas with a carbon dioxide content of about 3%, which is less than one sixth of the CO2 level at Yolla. Liquids content is 50-100 bbl/MMcf of gas. Initial estimates suggest an in situ resource of 100-300 bcf of gas and 7-21 million bbl of associated liquids. Origin will test production over two intervals: 3,040-47 m and 3,141-50 m. The company says these are across lower-quality reservoir sands. In addition to Yolla field, which is nearing completion as part of the BassGas project to pipe gas to onshore facilities in Victoria, Origin has a smaller gas find in the White Ibis vicinity. Good results from Trefoil could see it developed along with White Ibis, with both fields' production funneled through Yolla and the BassGas system. Holding interests in Trefoil-White Ibis-Yolla are Origin 41.4%, Sydney-based Australian Worldwide Exploration Ltd. 22.6%, the UK's CalEnergy Gas (Aust) Ltd. 23.5%, and Mitsui subsidiary Wandoo Petroleum Pty. Ltd. 12.5%.

Apache Energy Ltd., Perth, made a significant gas find in Bass Strait with the Longtom-2 appraisal well on Gippsland basin Permit Vic/P54 to the north of the Esso-BHP Billiton main producing area. Longtom-2 flowed on test at 18-19 MMcfd of gas from intervals 2,184-2,192.5 m deep and 2,212.5-2,243.5 m. The gas flowed through a 1-in. choke for 11 hr. This is the first significant gas flow from the Tertiary Emperor formation in the Gippsland basin, confirming the potential of this zone. The Longtom-2 well appraises an old Esso-BHP Petroleum Pty. Ltd. discovery from the 1980s that was then considered noncommercial.The well is being prepared for a production test of a separate zone in the reservoir section.

Apache holds a 62.5% interest, and Nexus Energy Ltd., Melbourne, 37.5%. Apache Northwest Pty. Ltd., Perth, has spudded the Fiddich-1 exploration well on Permit WA-226-P off Western Australia on behalf of a group headed by license operator Origin Energy. Apache is the well operator. The Sedco 703 semisubmersible rig is drilling the well to test a Permian sandstone prospect thought to have potential to hold as much as 240 million bbl OOIP. WA-226-P participants are Origin Energy 28.75%; Apache 28.75%; Dana Petroleum PLC, Aberdeen, 20 %; Voyager Energy Ltd., Perth, 10%; Roc Oil Ltd., Sydney, 7.5%; and Wandoo Petroleum 5%.

Oil Search Ltd., Sydney, is preparing in the third week of December to spud the Al Akhaf-1 wildcat on Block 35 in the Hadraumat region of eastern Yemen.

Voyager Energy Ltd., which has farmed into the block with a 15% interest, is paying $1.2 million (Aus.) toward the cost of the wildcat. The Al Akhaf structure is the largest of several fault-controlled structures in the permit fringing a deep trough of Jurassic sediments similar to kitchen areas sourcing oil elsewhere in the country. The prospect has the potential to hold 106 million bbl of recoverable oil. Block 35 is near the Nexen Inc.-operated Masilah Block, which is producing 230,000 b/d of oil and holds an estimated 1.2 billion bbl of recoverable oil. Block 35 also is adjacent to Block 43, where Oil Search currently is appraising the recent Nabrajah oil discovery (OGJ Online, Nov. 16, 2004).

Petrobras has signed a memorandum of understanding with Sevan Marine do Brasil Ltda., a unit of Norway's Sevan Marine, for the long-term use of Sevan's SSP300 floating production, storage, and offloading vessel in Piranema field off Brazil. Piranema field lies off Sergipe state, 37 km from Aracaju. The FPSO will be available and ready for operation in mid-2006. The field, in 1,000-1,600 m of water, will produce 40º gravity oil. The FPSO has production capacity of 15,000 b/d. India's Oil & Natural Gas Corp. (ONGC) awarded a $215 million contract to Clough Ltd., Perth, to serve as lead contractor for development of G1-GS15 oil field in the Krishna-Godavari basin 28 km off eastern India. The field, in 135-500 m of water, is expected to produce 1 million tonnes of low-sulfur crude and 6 billion cu m of gas over 15 years. ONGC plans to drill five production wells. Production will move via dual subsea pipelines to processing facilities onshore. Development of GS 15, a shallow-water field 5 km offshore, will be integrated with the deepwater project. Clough's contract covers design, procurement, and installation of the onshore gas plant, a shallow-water wellhead platform, and the subsea completions, pipelines, and control system.

NEXEN Calgary, has started up production of 4,000 b/d of oil from Bashir al Khair-A field (BAK-A) off Yemen on Block 51 where it holds 87.5% working interest. Early production from several development wells flows through temporary production facilities and a new 22 km oil pipeline that connects to the existing Masila export pipeline. Full production of about 25,000 b/d is expected late in second quarter 2005 after completion of permanent processing facilities. A smaller field, BAK-B, is expected to start up in late 2005, helping to sustain Block 51 production through 2007. The BAK-I exploration well in the northern area of Block 51 has encountered oil shows. A production test is planned early in 2005. Drilling of a fourth exploration well on the block is under way, and a fifth well, testing a different structure, is to be spudded before yearend. Statoil, operator of Sleipner West oil field in the Norwegian North Sea, plans work to boost estimated recoverable volumes by 350 million boe and maintain gas production at its 775 MMscfd plateau level, reported partner ExxonMobil Exploration & Production Norway AS. Key program components are Sleipner West's Alpha North satellite development, which began production Oct. 11 (OGJ Online, Oct. 13, 2004). Modification of the Sleipner T platform to accommodate compression saved $380 million against the cost of a new platform. Licensees are Statoil 49.5%, ExxonMobil 32.34%, Total SA 9.41%, and Norsk Hydro AS 8.85%.

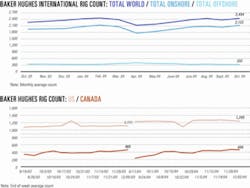

US DRILLING ACTIVITY dipped slightly the week ended Dec. 3—down by 6 rotary rigs to 1,245 working compared with 1,111 a year ago, said Baker Hughes Inc. Land operations accounted for that loss, down by 9 units to 1,121 rotary rigs active. Inland waters activity was unchanged at 19 rigs. Offshore drilling increased by 3 rigs to 105 in US waters as a whole, including a gain of 2 to 98 in the Gulf of Mexico. Canada's rig count dipped by 3 to 459 that week, down from 465 a year ago.

SHELL OIL PRODUCTS US has reached an agreement with the US Environmental Protection Agency and the Department of Justice that modifies a consent decree and keeps the Shell Bakersfield refinery in operation through Mar. 31, 2005. The agreement calls for Shell to reduce the refinery's nitrogen oxide emissions by 62 tonnes/year by Mar. 31, 2005, rather than Dec. 31, 2008, and allows the company to reduce its NOx emission-reduction target for this year by 7 tonnes as a result of not closing the refinery on Oct. 1 as planned. The agreement, which must also have court approval, will next be presented for public comment. Shell is continuing discussions with bidders on the potential sale of the refinery (OGJ Online, Sept. 29, 2004). Extending operations will help with transition should a new owner emerge. If no sale agreement is reached, Shell plans to close the refinery by Mar. 31, 2005. Mangalore Refinery & Petrochemicals Ltd. (MRPL), a subsidiary of Indian government-owned Oil & Natural Gas Corp. (ONGC), unveiled plans to hike capacity of MRPL's refinery in Mangalore, India, to 225,000 b/cd from 180,000 b/cd by 2007. The expansion, estimated to cost $455 million, will raise maximum output of products to 15 million tonnes/year from 12 million tonnes/year. In addition, ONGC has applied on behalf of MRPL for permission to market liquefied petroleum gas and kerosene.

AUTHORITIES IN IRAQ have extinguished a fire that broke out in an oil pipeline supplying the Al-Musayyib power plant, south of Baghdad, as a result of sabotage. Power plant oil supply manager Mu'ayyad al-Shammari said unidentified persons on Nov. 30 blew up the 3 km supply pipeline from Karbala. Al-Shammari was unable to evaluate the damage to the power plant, one of the biggest in Iraq. Iraqi Oil Minister Thamir al-Ghadban assessed the losses resulting from sabotage of the oil installations at $7 billion from August 2003 through October 2004. In a news release, he said sabotage operations have increased and have become particularly dangerous with the targeting of oil wells. Six oil wells in Khabbaz oil field, west of Kirkuk, continued burning in early December as a result of sabotage, and the process of extinguishing the fires was expected to take several weeks, experts said. Florida Gas Transmission Co. (FGT), Houston, has called an open season, requesting interest from shippers in securing capacity on the Phase VII capacity expansion of its Florida pipeline system. The expansion would serve new markets by mid-2007. FGT already has signed a precedent agreement to provide firm transportation service to Progress Energy Florida's Hines generating facilities near Tampa. FGT said it also would consider offers from existing shippers to permanently release firm capacity, reducing the need for construction of incremental facilities. The open season is effective until Dec. 31.

TRANSPETRO, the transportation subsidiary of Petrobras, published a bid notice for a $1.9 billion international tender to build 42 vessels to transport crude oil, products, and LPG. Twenty-two vessels will be built for an estimated $1.1 billion, according to Transpetro Pres. Sergio Machado. Transpetero will hold a prequalification period open until Jan. 31, 2005, and invite qualified companies to submit bids by May. Winning bidders will be announced in June. To qualify, companies must have net assets of at least $296 million. That and other requirements drew criticism from Wagner Victer, Rio de Janeiro state shipbuilding, energy, and petroleum secretary. "In many instances," he told OGJ, "Brazilian shipyards do not have the financial and operational capacity to abide by some of the Transpetro requirements."

CHEVRONTEXACO PRODUCTS CO. has begun marketing gasoline under the Texaco retail brand in eight western US states where it intends to supply more than 300 locations by yearend 2005. The company will market the brand in Washington, Oregon, California, Idaho, Nevada, Utah, Arizona, and New Mexico. The move follows the roll-out of the Texaco brand at more than 1,000 locations in 13 southern and eastern states in July. As part of its merger in 2001 with Chevron Corp., Texaco Inc. agreed to license the Texaco retail brand exclusively to Shell Oil Products Inc. for the marketing and sale of gasoline in the US until July 1 of this year. Currently, both ChevronTexaco and Shell have rights to use the Texaco brand in the US until July 1, 2006, when ChevronTexaco will assume exclusive rights to the brand. In addition to fostering both Chevron and Texaco brands in the US, ChevronTexaco will continue selling gasoline under the Texaco brand in Europe, Latin America, and West Africa and will continue to promote its Caltex brand in the Asia Pacific region and in eastern, central, and southern Africa.