OGJ Newsletter

Market Movement

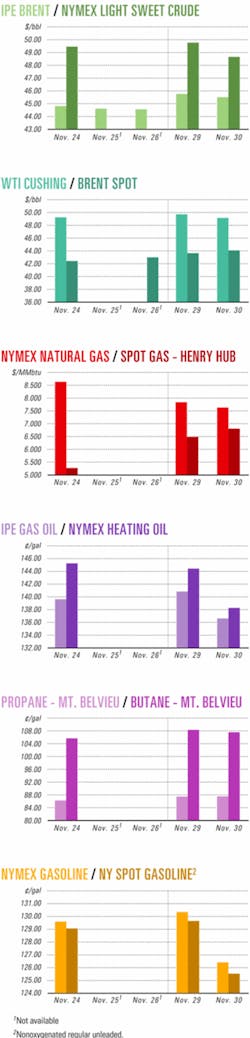

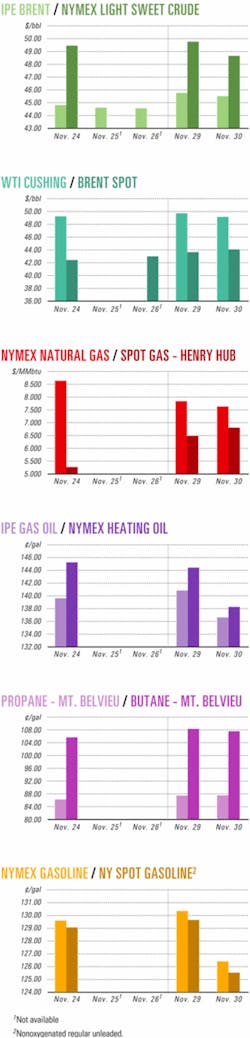

Large drop in crude futures price

Dec. 1 marked a significant day on the New York Mercantile Exchange as the January contract for benchmark US light sweet crudes plummeted by $3.64 to $45.49/bbl—the largest single-day decline in more than 3 years—after the Energy Information Administration reported a jump in US heating oil stocks and a nominal increase in crude inventories.

EIA reported US distillate fuel inventories rose by 2.3 million bbl to 117.9 million bbl during the week ended Nov. 26, with increases in both heating oil and diesel fuel. That followed a gain of 1 million bbl the previous week, after 9 consecutive weeks of declines as demand exceeded supply. Heating oil for January delivery on NYMEX subsequently lost 8.9¢ to $1.32/gal in Dec. 1 trading.

Yet despite recent gains, US distillate fuel stocks still remained below the lower end of the average range for this time of year, said EIA officials. Moreover, Paul Horsnell, Barclays Capital Inc., London, warned in his Dec. 1 report, "We would not make too much of the rise in total distillate inventories and in its two components. As has been noted before, the season has not started yet, and rises at this point are neither unusual nor trend-breaking." The real test will come in January as a function of weather, he said.

Commercial US inventories of crude increased by 900,000 bbl to 293.3 million bbl in the week ended Nov. 26, while gasoline stocks gained 3 million bbl to 205.7 million bbl during the same period. However, US imports of crude declined by 133,000 b/d to nearly 10.1 million b/d during the week. "There clearly is not any huge surplus of crude reaching the US from the global market, with imports remaining fairly restrained," Horsnell said.

Input of crude to US refineries averaged 15.6 million b/d in the week ended Nov. 26, up 75,000 b/d from the previous week, with refineries operating at 94% of capacity. Heating oil production declined slightly from the previous week, while diesel production increased and gasoline production remained relatively flat, EIA reported. Based on that data, Horsnell sees "dislocations" in the US refining system that render it "all but impossible to optimize." He said, "There is no demand-side weakness evident, with implied gasoline demand at 9.204 million b/d in the latest data and running 2.3% higher (203,000 b/d) for the November data released so far.

"Distillate demand is still pounding away at 8.5% [year-over-year] growth, although the latest implied demand is at 4.092 million b/d, just a little weaker than the two previous readings above 4.2 million b/d."

Anniversary of higher oil prices

Dec. 1 also marked the first anniversary of the last time that the Organization of Petroleum Exporting Countries' basket of crude oils was inside that group's official target range of $22-28/bbl. "On Dec. 1, 2003, the value of the [OPEC] basket was $27.92/bbl, but since then it has stayed above $28[/bbl]," Horsnell reported.

"However, this dollar-value pattern disguises the presence of some powerful exchange-rate effects," said Horsnell in a Nov. 24 report. "At the start of 2003, the dollar and euro values of the OPEC basket were very similar, with the dollar at near parity with the euro." As of Nov. 23, he said, the value of the basket was $38.69/bbl, but due to the weakness of the dollar, it was just 29.56 euros/bbl. In recent times, the value fell below 28 euros/bbl, representing a fall in price relative to the start of 2003, he noted.

"One of the key issues for next year will be how the dynamics of the dollar impact on policy-making within the oil industry," Horsnell said. "Should dollar-bears be correct, then exchange rate issues are likely to play a major part in determining target dollar values."

The OPEC basket price was $38.03/bbl Dec. 1.

Natural gas price fluctuates

Just before the long US Thanksgiving holiday weekend, the expiring December natural gas contract shot up by $1.18 to $7.98/MMbtu Nov. 24 on NYMEX after EIA reported an unexpectedly large withdrawal of gas from US storage during the week ended Nov.19.

But when NYMEX reopened after the holiday with no signs yet of extended cold winter weather to boost the market, the January natural gas contract lost a total $1.226 in the next three sessions to close at $7.41/MMbtu on Dec. 1.

"Private forecasters said the weather did a complete about-face...with the East Coast going from below normal to above [in temperatures] and will not likely see much below-normal cold weather until the middle of December," said analysts at Enerfax Daily.

Industry Scoreboard

null

null

null

Industry Trends

MANY US AND CANADIAN oil and gas companies plan to increase upstream capital spending next year despite expectations that oil and natural gas prices will be lower than they have been in 2004.

Merrill Lynch recently increased its 2005 growth estimate for upstream capital spending to 10-12% from its original 2005 forecast of 8-10%. Preliminary spending reports from seven companies that Merrill Lynch covers indicate that exploration and production spending will be up 16% from 2004.

"We still expect most of the increase to be directed at international opportunities, although announcements to date have shown solid increases in planned North American expenditures," Merrill Lynch analyst Mark S. Urness said in a Nov. 23 research note.

"However, about half of the spending increase will likely be absorbed by cost inflation, including higher steel prices, energy prices, and oil field service costs."

Urness said that oil and gas companies' early reports of increased capital budget announcements indicate higher future profits for oil service companies.

Independents and majors alike have indicated plans for higher E&P spending next year.

Although it has yet to release a final 2005 budget, Conoco- Phillips said during a November briefing with analysts in New York that it expects $4.5 billion in E&P spending this year, $5.1 billion in 2005, and $5.2 billion in 2006.

ConocoPhillips Chairman and CEO Jim Mulva said the company is making progress toward its plan to increase E&P to 65-70% of capital employed.

Anadarko Petroleum Corp., Houston, has approved a 2005 budget of $3.1 billion, compared with $2.9 billion in 2004.

Kerr-McGee Corp., Oklahoma City, said it would raise spending on oil and gas operations to $1.7 billion in 2005 from $1.42 billion in 2004.

Williams Cos. Inc., Tulsa, plans to raise E&P capital expenditures to $500-575 million in 2005 from $400-450 million in 2004.

THE US MARKET for gasoline and other fuel additives is expected to increase 2.3%/year for 5 years—to $8.4 billion in 2008 from $7.5 billion in 2003—said Freedonia Group Inc., Cleveland, Ohio.

Federal and state legislation continues to shape the long-term outlook for fuel additives, Freedonia said in a recently released report, "Gasoline & Other Fuel Additives." Also driving the fuel additives market are the fuel performance needs of increasingly complex combustion engines, the market researcher said.

Fuel-grade ethanol consumption is forecast to reach 4.1 billion gal in 2008. Methyl tertiary butyl ether increasingly is being replaced by ethanol, which is blended into gasoline at lower concentrations than MTBE, the report noted.

The ethanol market value is forecast to grow at 9.7%/year to $5.7 billion in 2008. The MTBE market will decline at 15.5%/year to $1.28 billion in 2008. The MTBE market value in 2003 was $2.98 billion.

Biodiesel, benefiting from the renewable fuels standard, is expected to become the fastest growing fuel additive, Freedonia said.

Government Developments

RUSSIA has opened bidding for a Dec. 19 auction of an OAO Yukos subsidiary in the company's prolonged, highly publicized battle over alleged delinquent taxes.

The auction of 76.79% of Yuganskneftegaz is open to international companies, and a $1.7 billion deposit is required in order to bid. Bidding opened Nov. 19 with a minimum price of $8.6 billion. Yukos claims the subsidiary's value is $20 billion.

The stake will be sold in one lot, government officials have said.

St. Petersburg, Fla.-based Raymond James & Associates Inc. said that an independent appraisal for the Russian government by a German investment banker listed the minimum value at $10.4 billion and the fair value at $14-17 billion.

"The state-owned natural gas producer [OAO] Gazprom is widely seen as the front-runner for acquiring the assets," said RJA analyst John Tysseland of Houston.

Yukos CEO Steven Theede called the expropriation "a mockery of the protection of private property."

"The sale is clearly illegal under Russian law, which states that noncore assets are to be disposed of first in tax settlement cases," Theede said. "Yuganskneftegas is the heart of Yukos, and its sale will lead to the destruction of the most efficient Russian oil company, and the one that has attracted the most western investment."

For months, the Russian government has not allowed Yukos access to its bank accounts and has collected money from the company's monthly revenues, Theede said.

Yukos continues to dispute the amount and basis for the tax charges, penalties, and interest. Meanwhile, the Russian government has said the company's tax debts could be as much as $24.5 billion.

VENEZUELAN STATE OIL COMPANY Petroleos de Venezuela SA (PDVSA) has a new president.

Venezuelan Energy and Mines Minister Rafael Ramirez was named PDVSA president in addition to his existing duties. Venezuelan President Hugo Chávez reshuffled his cabinet, announcing the changes on Nov. 20.

Chavez appointed PDVSA Pres. Alí Rodríguez Araque as Venezuelan foreign minister. Rodríguez Araque is a former energy minister and secretary general of the Organization of Petroleum Exporting Countries.

This is the first time that one person has served simultaneously as Venezuela energy minister and PDVSA president.

US REGULATORS have outlined the timing for rules on Alaska's proposed natural gas pipeline.

The US Federal Energy Regulatory Commission plans to issue a final rule in 3 months that would govern open seasons for anticipated capacity on that pipeline—providing that it is built.

FERC intends to implement an open season rule by Feb. 10, 2005. Public comment is being solicited on standards for providing access to the pipeline.

In October, the US Congress passed legislation to provide financial incentives for building a gas pipeline from Alaska's North Slope to the Lower 48.

Quick Takes

The US MINERALS MANAGEMENT SERVICE has accepted high bids totaling $169,928,999 on 346 tracts in the western Gulf of Mexico offered during Lease Sale 192. The Aug. 18 sale results indicate a continuing strong interest in the gulf by both major and independent oil and gas companies, with shallow-water areas continuing to draw bids, MMS officials said. Houston Exploration Co. bid the highest single bid accepted—$6.78 million—for High Island, East Addition, South Extension A-270. Remington Oil & Gas Corp. submitted the second highest bid, $4.9 million, for Garden Banks 506, and Kerr-McGee Oil & Gas Corp. won its $4.2 million bid for East Breaks 424. Both are in 800-1,599 m of water. Amerada Hess Corp., winning 56 leases for a total of $13 million, led the five companies with the highest number of accepted high bids. BP Exploration & Production snapped up 47 leases for a total of $28 million. Petrobras America Inc. took 36 parcels for $10.5 million; a subsidiary of Devon Energy Corp. won 26 blocks for $11.5 million; and Kerr-McGee landed 24 leases for $14 million total. BP Egypt awarded a contract to Petroleum Geo-Services ASA (PGS), Oslo, to conduct a multiazimuth 3D seismic acquisition survey over the recent Raven-1 discovery off Egypt (OGJ Online, Mar. 26, 2004). The area is in the North Alexandria concession 40 km northwest of Rosetta. Using the MV Ramform Viking seismic vessel, PGS plans to acquire 3,150 sq km of 3D data in five directions, employing its proprietary multiazimuth 3D process. BP operates the North Alexandria concession with 60% interest, and Germany's RWE DEA AG holds 40%.

WOODSIDE PETROLEUM LTD. signed a 2-year contract with Iraq's Oil Ministry, giving the Perth-based company the right to investigate oil and natural gas development potential in the Kurdistan region of northern Iraq. Woodside particularly is interested in two discoveries in the Zagros basin near the town of Sulaymeniyah. One is the undeveloped TaqTaq oil accumulation found in 1978. The other is the undeveloped Chemchemal gas discovery dating back to 1950. Woodside describes the program as an initial step toward working with the Iraqi government to learn about the potential risks and rewards of investing in the country's oil and gas sector.

ATP Oil & Gas Corp., Houston, accelerating the development of its 99%-owned Gomez field, reported that the Noble Therald Martin semisubmersible has been moved to the development area on Mississippi Canyon Block 711 in the Gulf of Mexico. The rig is scheduled to reenter, test, and complete the MC 711 No. 4 ST1 well in 3,000 ft of water. The Gomez discovery well, drilled in 1997, was confirmed in 2000 by MC 711 No. 4 ST1, which found 125 ft of oil and natural gas pay in Lower Pliocene sands. irst production is scheduled for fourth quarter 2005. ATP also plans to reenter and complete a second Gomez well in 2005.

OAO Lukoil and Petroleos de Venezuela SA (PDVSA) signed a memorandum of understanding for Lukoil to consider participation in Venezuelan oil projects. Ventures for possible joint participation include oil exploration, development, and production in the Lake Maracaibo area in northwestern Venezuela as well as rehabilitation of depleted fields, enhanced oil recovery, and productivity increases. Proposals also include long-term and spot purchases of crude oil and products by Lukoil and its possible cooperation in refining. The companies intend to share information and exchange personnel for training.

Kimberley Oil NL, Perth, has been granted two coalbed methane permits in France and expects a third French permit to be awarded soon. The new awards include a 739 sq km permit north of Marseilles in the L'Arc basin and a 243 sq km permit west of Lyon in the Loire basin. Awaiting action is Kimberley's application for an 821 sq km permit north of Strasbourg in the Lorraine basin. All are areas where coal mining has taken place in the past and where methane levels are known to be high. The Sardinia permit, in the Sulcis basin, is estimated to contain 1 billion tonnes of coal in the drilling area.

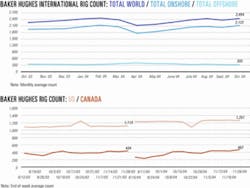

PETRÓLEO BRASILEIRO SA (Petrobras) next year will begin a $15 million drilling program in the Urucu southeast basin, 650 km from Manaus in Amazon state, Brazil. Production from the onshore Urucu basin has peaked at 59,000 b/d of 49° gravity oil and 10 million cu m/day of natural gas. The oil output represents 4% of Brazilian production, most of which comes from offshore. Surveys in the Urucu basin began in 1988. US drilling activity rebounded the week ended Nov. 19, up by 9 rotary rigs to 1,268 working, compared with 1,107 during the same period a year ago, Baker Hughes Inc. reported. Offshore operations accounted for the bulk of that gain, up by 6 rigs to 99 in the Gulf of Mexico and a total gain of 7 to 105 in US waters as a whole. Land drilling increased by 2 rigs to 1,141, while inland waters were unchanged with 22 rotary rigs working. Canada's rig count dipped by 4 to 444 that week, compared with 414 rigs working a year ago.

WORK WAS PROCEEDING WELL Dec. 1 to secure a leaking natural gas well at the Snorre A tension leg platform in the Norwegian North Sea, said field operator Statoil ASA. The leak, detected Nov. 28 during a workover of the well, has left 130,000 b/d of oil production shut in from Snorre A and 75,000 b/d of oil from Vigdis field, a satellite that uses the Snorre A facilities for processing. At presstime last week, Statoil still was uncertain as to when production would resume. "The well has now been brought under control, and no gas is reaching the tension leg platform, but the position remains unclear," Statoil said. "Gas is flowing up from the seabed to the sea surface." About 180 of Snorre A's 216 crew members were evacuated to nearby installations.

Equipment failure was the root cause of a discharge of oily water from the Terra Nova floating production, storage, and offloading vessel Nov. 21, along with "a combination of factors," said operator Petro-Canada (OGJ Online, Nov. 24, 2004). As much as 150,000 b/d of oil production remained shut in Nov. 29 from the field, pending final investigation of the incident by the Canada-Newfoundland Offshore Petroleum Board. Terra Nova lies 350 km east-southeast of St. John's, Newf., in the Jeanne d'arc basin. Petro-Canada, which has been cleaning up the oil, searching for affected wildlife, and tracking the slick, said it is taking "immediate corrective measures, including equipment upgrades and process improvements," to improve its systems and procedures.

Petro-Canada emergency crews responded to a second incident within 8 days off Newfoundland, this one 2 km northeast of the Terra FPSO. About 400 l. of oil was ejected from the Henry Goodrich semisubmersible drilling rig during the flow testing of a well. The rig crew halted the test and secured the well. Initial reports indicate a 1 m by 400 m sheen. The Atlantic Eagle support vessel, standing by at the Henry Goodrich at the time, responded to the spill. The incident is unrelated to the Terra Nova FPSO discharge of oily water Nov. 21. Burlington Resources Inc., Houston, has begun deliveries of 145 MMcfd of natural gas from a shallow-water production platform in Calder field in the East Irish Sea. Deliveries are through a 30-mile pipeline to a new gas treatment plant at Barrow-in-Furness onshore. Calder is the first of five fields in the Rivers fields development project named for rivers. Calder volumes are expected to peak at 90 MMcfd. Burlington holds eight licenses covering 239,000 acres in the East Irish Sea and holds 100% interest in seven gas fields. Darwen and Crossans fields will be tied in during 2007. The other fields are Hodder and Asland. Centrica PLC, London, will operate the Calder platform and the Barrow-in-Furness terminal on behalf of Burlington. Petroleum Geo-Services ASA subsidiary Pertra AS, operator of Varg field on Block 15/12 (Production License 038) in the Norwegian North Sea, plans to continue operating the field at the lower rate of 15,000 b/d until the main production riser can be replaced in March 2005. Revenues for PGS's Petrojarl Varg FPSO, which is used to produce Varg field, also will be reduced because of the lower production. Pertra holds a 70% interest in the license, while Norway's Petoro AS holds 30%.

ENCANA MIDSTREAM & MARKETING, Calgary, and Premcor Refining Group Inc., Old Greenwich, Conn., have agreed to study a project that would expand Premcor's 170,000 b/d refinery in Lima, Ohio, and configure it to process heavy Canadian crude supplied by EnCana. The 6-9 month study could lead to formation of a 50:50 venture to own and operate the refinery, the capacity of which would rise to 200,000 b/d. EnCana would supply the oil under a proposed long-term sales contract and expand its in situ production of heavy oil from oil sands, now about 35,000 b/d. Most of the production comes from EnCana's steam-assisted, gravity drainage project at Foster Creek in the Cold Lake area of northeastern Alberta. Premcor would contribute the refinery and related assets to the joint venture, estimated to be worth more than $1 billion. EnCana would make an equivalent investment in the upgrade project. If deemed feasible, the project would be completed by 2008. Major capital expenditures would not be required before 2006, EnCana said. Converting the refinery to process heavy oil would cost about half as much as building a stand-alone upgrader in Alberta, EnCana said. Products would be clean transportation fuels rather than synthetic crude requiring further processing. BP PLC said it will include its Lavéra refinery in southeastern France in an olefins and derivatives (O&D) company it plans to spin off in the second half of 2005. The company's Grangemouth, Scotland, refinery also will be included. Both refineries are closely integrated with neighboring chemical plants. The two refineries have a combined capacity of 425,000 b/d and chemical feedstock output of 2.2 million tonnes/year. "As integrated refining and petrochemicals sites, they will have a single site-wide management and will provide the new O&D company with secure and competitive feedstock and product optimization flexibility," said BP.

TNK-BP SUBSIDIARY Tyumenneftegaz (TNG) has begun construction of a 76.5-km crude oil pipeline to connect Kalchinskoye field in the Uvat region of Russia's Tyumen Oblast with the Demyanskaya system, according to Interfax news agency. The 720-mm pipeline will have a throughput capacity of 10-12 million tonnes/year of oil. The 1 billion ruble pipeline is part of TNK-BP's development of the Uvat group of fields. ZAO Strymontazh (Yugorsk) is the general contractor. The pipeline designer is OAO Giprotyumenneftegaz (Tyumen). Work is scheduled for completion in July 2005. El Paso Corp., Houston, is seeking a US Federal Energy Regulatory Commission certificate by July 31, 2005, to construct and operate the 41-mile US portion of its proposed 128-mile, 26-in. Seafarer natural gas pipeline (OGJ Online, Mar. 26, 2002). The system would extend from the proposed High Rock LNG regasification terminal on Grand Bahama Island to a connection with the existing Florida Gas Transmission pipeline system in Palm Beach County, Fla. The 87-mile international segment would extend from the terminal to the US-Bahamas Exclusive Economic Zone boundary in the Atlantic Ocean. Construction is scheduled to begin in 2006, with the pipeline slated to be in service by 2008.

Williams Cos. Inc., Tulsa, has placed into service a 9-mile natural gas pipeline lateral near Everett, Wash. Called the Everett Delta project, the 16-in. lateral extends from Northwest Pipeline Co.'s mainline near Lake Stevens, Wash., to two interconnections with Puget Sound Energy—one near the Port of Everett and the other west of Lake Stevens.

THE US EXPORT-IMPORT BANK (Ex-Im Bank) approved a loan guarantee of as much as $930 million to support the export of US goods and services to Qatar Liquefied Gas Co. Ltd. II (Qatargas II) for construction of a $7 billion LNG complex and related offshore and onshore facilities in Qatar. Repayment will be based on project revenues. Qatargas II is owned 70% by Qatar Petroleum and 30% by ExxonMobil Corp. Ex-Im Bank's support covers a portion of the 15.6 million tonne/year LNG project. The project involves production of natural gas from North field off Qatar and construction of two gas liquefaction units, offtake infrastructure at Ras Laffan Industrial City, LNG ships, and an LNG regasification terminal at Milford Haven, UK.

A 10-MILE STRETCH of the Delaware River remained closed to commercial traffic Nov. 29 as cleanup efforts continued following the spill the previous Friday of about 714 bbl of heavy crude oil that caused a 20-mile oil slick. The Cyprus-flagged tanker Athos I, owned by Tsakos Shipping & Trading SA, Athens, was transporting 325,000 bbl of oil from Venezuela to a refinery at Paulsboro, NJ, operated by Citgo Petroleum Corp. subsidiary Citgo Asphalt Refining Co. Investigators found a 6-ft gash in the single-hull tanker. Holes were found in an underwater cargo tank and in an outside ballast tank. The crew transferred oil from the damaged tank to another tank but the ship currently is listing 8° to port. Citgo is working with the US Coast Guard and Tsakos to implement "a salvage plan that will have minimal environmental impact, recover the vessel's cargo, and allow the Delaware River to be reopened to traffic." Tsakos will bear the cost of mitigation and cleanup efforts that are expected to take 2-3 months. Residual work may last as long as 6 months.