CGES: Falling oil prices don't signal market collapse

Although crude prices have fallen considerably from record highs in mid-October, the retreat doesn't necessarily signal the start of an extended price slide into 2005, said analysts at the Centre for Global Energy Studies in London.

"The path of oil prices in 2005 will depend on the extent of the slowdown in economic growth and the severity of winter weather," said CGES analysts in their Nov. 22 monthly report. "US heating oil stocks are as low as they have ever been for the time of year over the last decade and well below the levels seen at this point in each of the last 2 years. While they are probably sufficient to meet demand if the winter is mild, they will not do so if it is severe," they said.

Moreover, CGES reported, "High levels of oil imports and lower refinery runs in the US have allowed crude oil stocks to be built up in recent weeks, but crude stock cover is still low, and inventories of key products remain below normal levels, providing support for crude oil prices in the short term."

OPEC

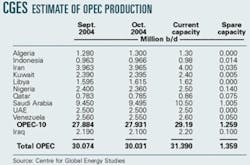

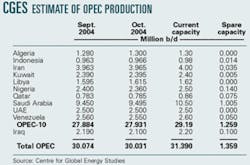

Meanwhile, total production by the Organization of Petroleum Exporting Countries has increased above 30 million b/d, including Iraq, surpassing the group's current official quota of 27 million b/d, excluding Iraq.

Still, OPEC's oil production capacity "is rising only slowly," said CGES. "Hopes of a rapid resurgence in Iraq's oil production have been dashed by the unrest in the country, and any large-scale investment is still years away, while Iran has struggled to boost its output capacity beyond 4 million b/d as onshore oil projects have moved forward at a snail's pace.

"Saudi Arabia, too, has shown little serious intent to raise its output capability significantly, suggesting that the world's spare oil production capacity will remain limited," it said.

The report noted that non-OPEC producers "are struggling to offset output declines in traditional core areas such as the North Sea and North America, limiting expected growth in aggregate non-OPEC oil supplies in 2005 to around 1 million b/d."

CGES analysts said, "As we look ahead, it is difficult to see oil prices falling much below $40/bbl this winter unless temperatures are very mild, and while OPEC may need to cut output next year in order to keep the price of its basket of crudes above $30/bbl, calls from some members for an immediate reduction are premature."

Meanwhile, they said, "The high oil prices of 2004 have finally begun to have a noticeable impact on both economic growth and oil demand. Third-quarter figures have started to show a marked slowdown in economic growth in countries such as Japan, while estimates for both economic growth and incremental oil demand in 2005 are being revised downwards."

Hurricane raised prices

Record high crude prices in October were triggered by a shortage of sweet crudes, particularly in the US where more than 400,000 b/d of production in the Gulf of Mexico was disrupted by the damage caused by Hurricane Ivan to offshore infrastructure in September, CGES noted.

"The rush to replace these missing barrels coincided with heavy buying by Asian refiners, who were stocking up for the fourth quarter," analysts said.

However, they said, "Now the bubble has burst. US production has recovered much more quickly than expected—domestic output is back to pre-Hurricane Ivan levels—and the large volumes of West African and other Atlantic Basin crudes purchased last month have arrived at US refineries."

Freight cost impacts

As a result of increased international crude shipments, said CGES analysts, "Soaring freight rates—reflecting a severe shortage of tanker capacity—are now adding to the downward pressure on crude prices. The volume of oil being shipped around the world is at record levels, reflecting this year's surge in demand growth. Global seaborne liftings during the third quarter were 2 million b/d higher than they were in the same period last year."

At the time of the CGES report, very large crude carrier rates were 3 times their levels at the beginning of October, increasing to more than $6.50/bbl the cost of moving oil from the Middle East to the US and northwest Europe, analysts said.

"With crude prices already at historical highs, the jump in freight costs had an immediate impact on crude demand," CGES reported. "US refiners, benefiting from higher domestic production, saw no reason to pay an extra $5-6/bbl for foreign crudes. Meanwhile, Asian refiners who had already bought most of the crude they need for the rest of this quarter have largely withdrawn from the long-haul market."