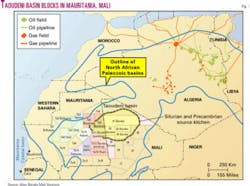

Explorers prepare to evaluate Taoudeni basin in Mali, Mauritania

As Mauritania looks toward becoming an oil producing country for the first time in early 2006, a host of exploration companies has lined up to explore the nonproducing Taoudeni basin in the heart of onshore Northwest Africa.

Mauritania has awarded Taoudeni blocks to Total, Repsol, China National Petroleum Co., Woodside Petroleum Ltd., and several smaller companies.

Five large onshore exploration permits in northern Mali, West Africa, have been awarded to private company Baraka Mali Ventures Ltd., established by Perth-based geologist and entrepreneur Max de Vietri. Baraka has also applied to license two Mauritanian blocks that adjoin its Mali holdings.

De Vietri introduced Hardman Resources NL, Perth, to the virgin acreage off Mauritania in the mid-1990s (now operated by another Perth company, Woodside) in what led to the first commercial oil discoveries there.

He now is applying the same principles in neighboring landlocked Mali, a country that has had only five exploration wells drilled throughout its history. No drilling has taken place since the 1980s.

Meanwhile, Woodside and partners are drilling development wells in Chinguetti oil and gas field in the Mauritania Coastal basin and plan to start production in the first quarter of 2006.

In a recent briefing, Duncan Clegg, director of Woodside's Africa business unit, said, "Mauritania started out as an adventure. It's now a very serious piece of business."

One of Woodside's goals is to be producing 100,000 b/d from Mauritania by the end of 2007. Of that, 75,000 b/d would come from Chinguetti.

Another goal is to have established production from four countries in Africa within 10 years. It already participates in the Ohanet gas-liquids project in Algeria, which has been producing a bit more than a year (OGJ Online, Nov. 5, 2003). Besides Mauritania, Woodside is exploring in Libya, the Canary Islands, Sierra Leone, and Kenya.

Mali permits

Baraka's five permits total 193,200 sq km, one-third the size of Texas, and extend from the Algerian border in the east across to the border with Mauritania in the west.

Blocks 1, 2, 3, 4, and 9 lie in the Taoudeni basin in the Sahara Desert to the north and west of the ancient city of Timbuktu.

The basin, containing Precambrian to Carboniferous sediments, is similar to known petroleum provinces with large oil and gas discoveries in neighboring Algeria and Libya.

Mali introduced a new Petroleum Code into law in August 2004, and Baraka's production-sharing agreements, signed on Oct. 27 in the national capital Bamako, are the first to be issued under the new regime. Details of the PSA terms are confidential, but they are described as globally competitive.

Baraka has undertaken to spend $51 million over the next 4 years across all five permits. It will also spend $1 million training Malians and promoting the country as an exploration destination for the world petroleum industry.

Baraka will spend the first year reprocessing 2D seismic data that the company acquired earlier this year. The company intends to negotiate with other explorers to take farmouts on the rank wildcat acreage.

Baraka is also negotiating with several corporate entities with a view to merger or acquisition and a listing on the Australian Stock Exchange.

Chinguetti and beyond

Woodside operates four of the five Mauritania Coastal discoveries in which it has participated. It hopes to tie the most recent find, Tevet, about 10 km back to Chinguetti.

The Tevet-1 discovery well, on PSC-B Block 4, cut 70 m of gross gas pay overlying 44 m of gross oil pay in October on its way to TD 2,715 m.

Development of Chinguetti, discovered in 2001 in 800 m of water 90 km offshore, is on schedule and budget. It will have six production wells, 5 water injectors, and one gas reinjection well.

An FPSO to serve Chinguetti is under construction in Singapore, and Woodside should be operating four to five FPSOs worldwide—as many as any of the supermajors—by 2007.

Woodside is keen to progress the 2003 Tiof/Tiof West discovery as Mauritania's second producing field. Tiof is 25 km north of Chinguetti.

With success at Tiof, Woodside reclassed Mauritania as a proven petroleum province, said Dr. Agu Kantsler, director exploration. It continues to explore, drilling dry this year at Dorade and Capitaine. The next prospect to be drilled is Merou, a channel draped over a salt dome like Chinguetti and Tevet, and after that the similar Fantar feature in 2005.

Mauritania's government, operating as Groupe Projet Chinguetti, exercised its option to take 12% equity in Chinguetti. This brought participating interests in the field to Woodside 47.384%, Hardman 19.008%, BG PLC 10.234%, Premier PLC 8.123%, and Roc Oil 3.25%.

Besides the oil, Woodside eventually sees exporting LNG to the Atlantic basin. It has found gas at the Banda and Pelican discoveries and associated gas in the Chinguetti, Tiof, and Tevet finds, but the volume is not yet large enough for an LNG project.

Woodside, which has 125 employees in the country, has serious training programs designed to involve Mauritanians in all aspects of the oil and gas business.

Woodside's frontiers

Woodside plans to drill nine exploratory wells in Africa in 2005, up from the eight it was to have drilled in 2004.

Frontier exploration wells are likely off the Canary Islands and Kenya in 2005 and off Sierra Leone in 2006.

The Canary Islands play involves salt-cored structures with Tertiary objectives similar to those off Mauritania. From 3,500 sq km of 3D seismic data, Woodside has matured three prospects, one of which looks exciting, Kantsler said. The acreage has 19 structures.

Woodside is starting a 2,500-line-km 2D seismic survey in the Indian Ocean off Kenya to better define a series of very large structures of Cretaceous age. Risks include charges, reservoirs, and seals. The play has strong regional geology, and each of the four-way dip closures could hold several million barrels of oil, Kantsler said.

The 2006 drilling off Sierra Leone would be to channel sands on the shelf slope in stratigraphic traps similar to those found off Equatorial Guinea's Rio Muni enclave. Woodside acquired 3,500 sq km of 3D seismic data in 2004.

Libyan programs

Meanwhile, Woodside is well advanced in a 6-year exploration program in Libya. Seismic crews are gathering data in the Murzuk basin and to start 3D soon in Sirte. A third crew will begin work in 2005, and drilling should start by the end of 2005.

Woodside is conducting a feasibility study at Libya's undeveloped Atshan field, which contains 50-100 million bbl of oil and 750 bcf to 1 tcf of gas in Carboniferous to Ordovician formations no deeper than 1,200 m. The project could involve a gas pipeline from Atshan to ENI SPA's recently inaugurated Greenstream pipeline from Wafa field in northern Libya to Sicily and Italy (OGJ Online, Oct. 26, 2004).

Atshan, in 1957 Libya's first hydrocarbon discovery, was a continuation of a Paleozoic play from the Edjeleh region of the Illizi basin in Algeria (OGJ, Mar. 6, 1995, p. 41).