Large independents find opportunities in Southeast Asia deep water

Large independent companies are at the forefront in exploring and developing the deepwater potential in Southeast Asia, which may see an increase in deepwater expenditures during 2005-08.

The nations of Southeast Asia have had falling oil production rates for several years but only recently begun addressing this decline by allowing exploration in deep water.

During the last 10 years, the nations of West Africa, particularly Angola and Nigeria, have turned to the major oil companies to finance deepwater exploration and development to preserve and promote their market shares.

In Southeast Asia, particularly Indonesia and Malaysia, the situation is somewhat different. Apart from the Royal Dutch/Shell Group in Malaysian waters, large independents such as Unocal Corp. and Murphy Oil Corp. are having success in deep water.

Southeast Asia has had good finds, but only Unocal's deepwater West Seno development is producing.

Deepwater potential

The period 2004-08 will be an exciting period for the deepwater players and for many a defining period in their corporate history.

The difficulty faced by both operators and contractors is that even in this growing market the number of projects forecast is small, fewer than 200 developments worldwide 2004-08 and less than 10 in Southeast Asia. This low number of prospects may lead to a polarization of winners and losers.

With the exception of the ultradeepwater frontier (water deeper than 1,500 m), there are few other areas where operators can expect or hope to find the reserves and production potential that deepwater offers. For many operators and potential operators, this next 5-year period may be crucial in determining their longer term strategies, whether or not to be in the deepwater club.

After 5 years of significant consolidation and re-organization, the contractor community is now clearly divided between global and regional players with the former eyeing deepwater as a key market. Within this time, contractors have made considerable investments in capability and equipment. While the industry now has a breed of "super-contractor," questions remain as to their mode of operations because collectively they have had marginal profitability.

The past 5 years has seen worldwide deepwater (water depth between 500-1,500 m) activity evolve from that of a frontier exploration zone to an intrinsic and strategically important element of most global offshore operators' asset portfolios. Even a cursory glance at the websites and annual reports of these operators shows the prominence that deepwater now commands and underpins the increase in value a company can accrue from success in this arena.

Outside of the Middle East, the deepwater market offers the main opportunity to western companies to invest for a greater rate of return to please investors and to arrest their reserves depletion.

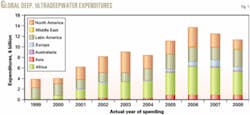

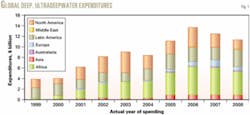

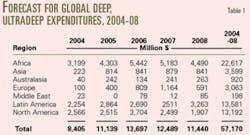

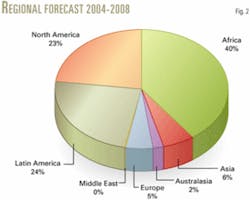

Fig. 1 and Table 1 show the dominance of West Africa, Brazil, and the US Gulf of Mexico. The large finds of the Atlantic Basin are world-class fields. Yet they are only open to the companies that can afford to invest heavily and bear the risk of drilling a $30 million wildcat well. The majors clearly are willing to do this because the potential gains are great.

During the past 5 years these three areas have evenly split the bulk of deepwater expenditure (Fig. 2). The period 2005-08, however, sees a very positive increase in expenditure in Southeast Asia.

Looking at the relative growth rates of the deepwater market reveals the potential importance of the Asian market. Asia looks set to grow rapidly in the next 5-year forecast window with major action taking place in Malaysia and Indonesia.

This article focuses on Southeast Asia and therefore excludes both China and India, the emerging economic giants of the 21st Century, whose impact on the area is sure to grow rapidly in the coming decade.

For the entire world, deepwater expenditure will continue the growth trend of the past 5 years, resulting in an increase in total expenditure of more than $57 billion, an 83% increase from the preceding 5-year period.

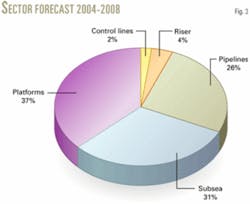

This expenditure relates to platforms, subsea, control lines, pipelines, and risers (Fig. 3).

On a direct 5-year comparison, the forecast shows all five sectors experiencing growth 2004-08, although to varying degrees and with different patterns.

The subsea and pipeline sectors will experience the greatest change from their current position with respective cumulative growth of 128% and 62% when compared with 1999-2003. In many ways, this is not a surprise because much of this activity closely ties in to the many deepwater platforms currently being installed, although there is an increasing use of subsea tiebacks to other infrastructure (and to shore) as well as a number of major pipeline projects within the period.

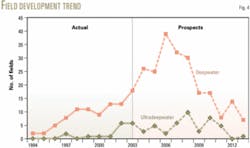

Fig. 4 illustrates the longer term picture of deepwater developments and clearly shows not only the relative youthfulness of the sector but also the scale of the opportunity still to be realized.

Fig. 4 identifies the prospective fields with commercially viable development. After 2006, the number of prospects drops off into the so called "data-droop." This does not indicate the lack of opportunities but simply indicates that many prospects have yet to be classed as commercial or discovered.

While the figure clearly shows the growth in deepwater, the picture for ultradeepwater is less clear. This is a reflection of the embryonic state of what is, technically and commercially, a challenging new frontier.

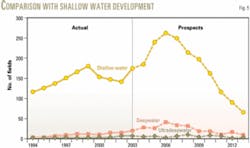

A brief analysis of the context of deep and ultradeepwater shows that during the past 5 years (1999-2003), a steady growth profile has been maintained and was, to a degree, insulated from the slowdown in activity in 2000 and 2001 that followed the lower oil prices in 1998-99 (Fig. 5).

It is important to remember that while the actual number of developments during this period was small, already the industry showed a greater resilience to price movements in this sector.

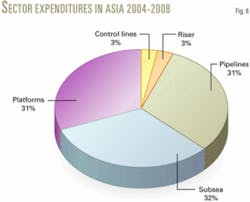

While no one can deny the investment and returns from deepwater fields of the Atlantic Basin, it is areas outside of this such as Southeast Asia that hold future potentially lucrative plays (Fig. 6). Although somewhat smaller and therefore less appealing to some of the larger major operating companies, these plays offer an opportunity for large independents to pursue deepwater plays.

With the smaller scale of fields, investment appears less insulated from geopolitical risk. There has been a push for exploration in alternative regions, however, as the mature basins of the shallow US Gulf of Mexico and North Sea begin to offer only small-scale finds with much higher development costs.

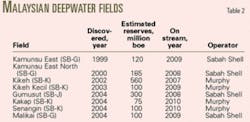

In fact, the large independents such as Murphy and Unocal have become important players in the region (Table 2).

Malaysian

In terms of overall oil and gas production rates, Malaysia produces at about one-third of the rate of the UK. In contrast to the malaise felt in the manufacturing sector in the North Sea, however, Malaysia's manufacturing base supports a steady stream of development orders.

To date these have all been for the shallow waters off the Malaysian peninsula where ExxonMobil Corp. and Malaysia's state oil firm Petronas dominate, or for the slightly deeper waters off Sarawak where Royal Dutch/Shell joins the national oil company as major partner. While oil finds are important off peninsular Malaya, it is as a gas province, feeding the Bintulu complex of LNG plants, that Sarawak is best known.

Offshore Sabah has always been the poor relation, but it is this province that offers most ready access to deeper waters and greatest potential for medium-term growth. The area has three large licence blocks running diagonally northeast-southwest parallel to the shore. Blocks J and G are the province of Sabah Shell and Block K, the largest and furthest out, is the stamping ground of Murphy.

Sabah Shell was first into the action with two discoveries in Block G in the Kamunsu East area. Then Murphy struck "big time" with the Kikeh discovery in Block K.

Murphy has followed its initial success with three further finds at Kikeh Kecil, Kakap, and Senangin. Not to be outdone, in its own back yard, Sabah Shell has responded this year with discoveries at Gumusut (Block J) and Malikai (Block G) in March and September, respectively.

Production from any of these finds is still some years away, but development of Kikeh is going ahead right now, most probably with a tension leg platform (TLP) and an adjacent floating production, storage, and offloading (FPSO) vessel, although Technip SA reportedly has offered a spar solution. This would be an innovation in Southeast Asia because no spars are currently operating outside of the Gulf of Mexico.

Indonesia

In contrast to Murphy's Malaysian oil finds, the deepwater off Indonesia appears to be much more gas prone. This is a short-term disappointment because Indonesia's oil production has declined recently at such a rate that earlier this year it technically became an importer.

Unocal presides over the most important deepwater acreage, which is adjacent to its long established production in the shallow-water shelf. Its Attaka field came on stream in 1972.

Table 3 lists Unocal's discoveries in the Kalimantan East, Rapak, and Ganal license areas in the last 7 years. West Seno in 953 m of water started producing in August 2003 and has slowly built-up production as more platform wells have come on stream.

Problems with further development have arisen with recent delays in obtaining a suitable price formula to build a second TLP for the field. This has led Unocal to cancel the contract for the Smedvig West Alliance semisubmersible drilling rig because TLP-B will not be ready in time for development drilling to continue seamlessly.

All bidders for the project have reported price increases that apparently have resulted from the high demand for steel in China's burgeoning economy. How this delay will affect other projects in the immediate area, such as Merah Besar, has yet to be seen. Certainly delays seem inevitable.

All the fields in this area are undergoing a process of appraisal and delineation, and therefore their reserve figures are being constantly adjusted and must, at this stage, be only taken as a rough guide to ultimate recovery.

To provide feedstock to the large onshore eight-train Badak/Bontang LNG complex, however, Unocal is pushing ahead with the development of Gendalo, Gehem-Ranggas, and Sadewa fields. The latter may be developed with very long extended reach wells from a fixed platform in shallower waters, but the Gendalo and Gehem-Ranggas fields certainly will be developed with long subsea tie-backs to shore similar to the Ormen Lange and Snøhvit fields off Norway. Later liquids production may require a FPSO on the Gendalo field.

Immediately to the south in the Makassar Strait between Kalimantan and Sulawesi, Amerada Hess Corp. has made two recent discoveries at Halimun and Papandayan in the Tanjung Ara licence area. Details of possible production plans are unavailable at present. If these fields produce more gas, the Bontang LNG complex may require a ninth train, or alternatively an upgrading of the pipeline system could include a regional wide network of gas distribution trunklines coming to fruition with a major new line being laid from Kalimantan across the Java Sea to gas-hungry Java Island, Indonesia's most populous island.

To the north of the Unocal acreage, some blocks are in dispute between Indonesia and Malaysia. The East Ambalat block, currently on offer from BPMigas, Indonesia's executive agency for upstream oil and gas business, apparently transgresses the border of one of two blocks ND6 and ND7 that Malaysia's Petronas plans to licence soon.

On the west coast of Borneo island is another dispute over drilling rights between Malaysia and Brunei.

Brunei

Brunei aims to keep oil production at a steady level by infill drilling, improving efficiency by dealing with higher water cuts and updating platform facilities on existing structures while trying to expand the reserve base which is about 1.3 billion bbl of proved reserves, barely enough for another 20 years at current production rates. The latest data for June 2004 show that Brunei produces 174,000 bo/d of which about 145,000 bo/d come from offshore. Gas production is about 1.2 bcfd.

Outside of the giant Southwest Ampa and Champion fields, Brunei has added very little incremental production during the past few years. The most recent was the first phase of the Egret field that came on stream in September 2003. A second phase will follow in 2-3 years.

Other projects are on the horizon, but only the deeper waters of what were to be Blocks K (Shell) and J (Total SA) offer a promise for major new discoveries such as the 400-700 million bbl Kikeh field in Sabah Block K just across the border. Boundary disputes with the Malaysian provinces of Sarawak and Sabah have now stymied exploration. In the short term, these disputes will almost certainly mean that no drilling will take place until a new licence area agreement can be put into effect.

Philippines

Off the Philippines, Unocal has had two disappointing recent deepwater wells in license SC41 in the Sulu Sea near the maritime boundary with Malaysia. The two wells failed to find oil or gas in the highly prospective Rhino and Zebra prospects near the 1998 Hippo find. They have gone back to the drawing board to find a play model that will work.

The Philippines does have the Malampaya gas development on stream, but Shell has again postponed development of the thin oil rim. If Shell pulls out, this could be a good opportunity for an independent to step in. The cost and technical difficulties for developing this thin oil rim apparently are not as solvable as those faced by Norsk Hydro AS on Troll field in the Norwegian sector of the North Sea where 100 plus subsea wells put into service since 1995 successfully exploit a similar oil rim.

The authors

Roger Knight ([email protected]) is responsible for the collection, validation, and evaluation of global offshore oil and gas data held on the Infield Systems database. He previously was a university lecturer in petrology and structural geology in Iran. Knight holds a PhD in geology and is a member of the Institute of Petroleum.

Howard Wright ([email protected]) works for Infield Systems on strategic and market analysis in key sectors within the offshore industry, such as installation, decommissioning, supply and demand, and new product development for global contractors and major operators. Wright holds a BSc in economics from Warwick University.