OGJ Newsletter

Market Movement

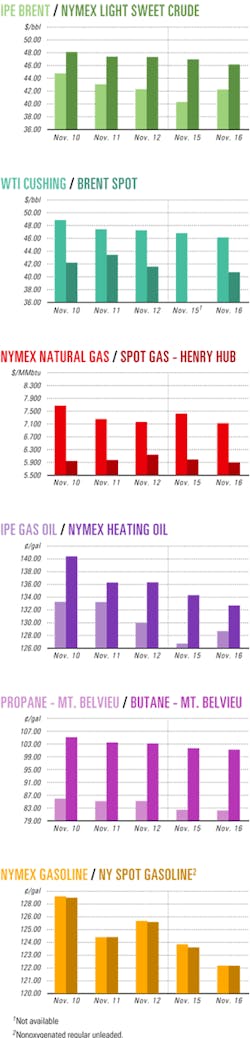

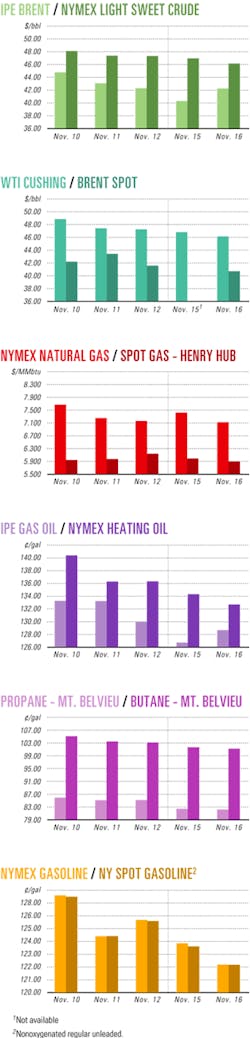

Energy prices fall in expectation of balanced market

Energy prices tumbled Nov. 15-16 in expectation of a build in US crude inventories, as most traders claimed energy markets are "finally coming in line with the demand-supply equation" after earlier being "way overboard."

On Nov. 17, however, the Energy Information Administration reported US commercial inventories of crude increased by a minimal 800,000 bbl to 292.3 million bbl during the week ended Nov. 12.

Moreover, it said distillate stocks continued to fall for 9 consecutive weeks. The latest report was down 1 million bbl to 114.6 million bbl. US gasoline inventories were down by 400,000 bbl to 200.9 million bbl for the same period.

"US demand growth has not stopped, it has not weakened, and indeed so far November has been the strongest month of the year," said Paul Horsnell, Barclays Capital Inc., London. In his weekly report on Nov. 17, Horsnell described the latest EIA data on US demand growth as "strong across the board, taking the [year-over-year] gains for the month-to-date to 8.4% for distillate (the strongest growth this year), 3.2% for gasoline (the strongest since March), 12.8% for residual fuel oil, and 6% for total US oil demand."

Meanwhile, Horsnell said, "Diesel inventories continued their sharp decline, falling for the 11th straight week. Heating oil showed its first inventory gain in 7 weeks in aggregate, while inventories continued to slip in the key mid-Atlantic region."

US imports of crude averaged more than 10.2 million b/d during the week ended Nov. 12, down by 266,000 b/d from the previous week. "It appears that the amount of imports from Iraq were relatively low last week, while imports from Saudi Arabia were higher than in recent weeks," said EIA.

Input into US refineries averaged 15.6 million b/d during the same period, up by 197,000 b/d from the previous week, with refineries operating at 93.5% capacity.

Iran reacts

On Nov. 16, Iran—historically the biggest price hawk in the Organization of Petroleum Exporting Countries—became "the first OPEC member to express concern about the recent decline in oil prices," said analysts in a report for Raymond James & Associates Inc., St. Petersburg, Fla. "An Iranian oil official suggested that OPEC intervene to prop up the market by reducing production back to quota levels, especially in regard to the 'sour' (high sulfur) grades," they reported.

"Unless prices fall much further, it is unlikely that the more moderate Persian Gulf members will support any proposal to actually cut quotas at the [Dec. 10] meeting. However, OPEC has already adopted a 'neutral' stance, essentially thwarting any further increases in quotas," said Raymond James analysts.

"It may seem strange to even hint at [OPEC production] cuts when WTI prices are close to $45/bbl," said Horsnell in his Nov. 17 report. "After all, until August this year, prices had never before reached $45, so current WTI prices are not exactly low, given the broader sweep of history."

However, he said, "There are two reasons why it would not be surprising for [OPEC] ministers to become defensive even at current prices. First, the [Dec. 10] meeting is designed to consider strategy moving into [first and second quarters of 2005], and so the level of the current price is not relevant if ministers were to be concerned that a precipitous fall might emerge in coming months. Second, when the situation is put in terms of the value of OPEC basket, rather than WTI, a very different picture emerges."

The market's concentration on the near-month NYMEX futures price for benchmark US crudes "may make current prices still seem high, while looking at the world through the prism of the [lower priced] OPEC basket makes them seem far more moderate," said Horsnell. "Indeed, throw in currency considerations and the widespread expectation of yet more dollar weakness, given the US deficits, and prices are perhaps already at levels low enough to cause some concern among producing countries."

The average price for OPEC's basket of seven benchmark crudes dipped by 17¢ to $35.94/bbl on Nov. 16. "That's the lowest value for more than 4 months and less than $8 above the current OPEC target band," said Horsnell. "The value of the OPEC basket has now moved very close to what might be considered a reasonable target for OPEC to pursue, particularly given the weakening in the dollar."

He noted, "Since July, the OPEC basket has fallen from a $3[/bbl] discount to WTI to more than $10[/bbl] discount, part of the general decoupling of light from heavy crude oil values brought on by the lack of incremental cracking capacity in refineries."

Industry Scoreboard

null

null

null

Industry Trends

US ETHANOL PRODUCTION is climbing in response to strong demand that is expected to continue, Standard & Poor's Ratings Services said.

But ethanol producers face challenges. S&P credit analyst Elif Acar said, "The industry is a relatively capital-intensive, commodity-based industry with thin margins that are subject to price volatility."

He noted the industry's dependence on uncertain government policy decisions for viability and also its reliance on project finance sponsors that are not rated. S&P has not rated any ethanol projects but issued a research report on the industry's fundamentals.

"To what extent the industry can tap the high-yield market for its large capital needs to finance the 'boom' will depend on investors' risk appetite," Acar said.

The Renewable Fuels Association said the US ethanol industry is expected to produce more than 3.3 billion gal in 2004, up from 2.81 billion gal in 2003.

Currently, 81 ethanol plants have the capacity to produce more than 3.4 billion gal/year. In addition, 14 plants are under construction.

The US ethanol industry set a monthly production record in August of 225,000 b/d, according to data released by the US Energy Information Administration. Production was up 25% from August 2003. F

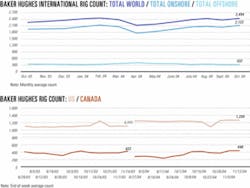

THE WORLD RIG COUNT will average 2,595 in 2005, up 8% from its projected level this year, a Merrill Lynch & Co. analyst forecasts.

"The Eastern Hemisphere markets are expected to post the strongest growth, particularly in the Middle East and Asia," said Mark Urness, Merrill Lynch director of oil services and drilling research in New York.

Drilling activity in the US and Canada is expected to grow more slowly than elsewhere. Fleet utilization already is high in both countries.

Worldwide offshore rig utilization has moved above 85% and is expected to reach 90% by the second half of 2005, Urness said. Day rates for deepwater rigs have increased, and the jack up market appears ready for similar improvement, he said. F

THE RECENT SURGE in oil prices has aggravated the already-difficult economics of the US aviation industry, said Fitch Ratings Ltd.

Jet fuel increased to about $1.65/gal in early November from 86¢/gal at the same time last year.

Jet fuel is the second largest expense of airline companies behind labor costs—driving 15-18% of annual operating costs, a Fitch research note said.

"Absent a significant market correction, crude oil prices persisting well above the historical norms will undermine airline operating results again in 2005," Fitch said. "Higher jet fuel prices in 2004 have driven over $5 billion in lost operating cash flow among US airlines vs. the 2003 baseline."

Government Developments

US SEC. OF ENERGY Spencer Abraham has submitted his resignation to President George W. Bush, effective upon confirmation of a successor.

In his resignation letter, Abraham cited family considerations. A one-term Republican senator from Michigan, Abraham was defeated in a re-election contest in November 2000. At the beginning of his first term, Bush appointed Abraham energy secretary (OGJ, Jan. 8, 2001, p. 30).

American Petroleum Institute Red Cavaney called Abraham's leadership "important in the international energy areas, especially in Russia. Sec. Abraham has been a steadfast leader for the nation in vigorously pursuing a sound national energy plan for our nation's future."

Skip Horvath, president of the Natural Gas Supply Association, said Abraham, "recognized the needs of the marketplace," in particular "by commissioning the October 2003 National Petroleum Council study, which highlighted the necessary natural gas industry and government actions that can eventually lead to a more balanced energy future."

VENEZUELA SIGNED two separate agreements to supply Costa Rica and the Dominican Republic with oil and refined products as part of regional cooperation and integration between Latin America and the Caribbean.

The Costa Rica supply agreement followed renewal of the San Jose Oil Accord, which initially was signed in August 1980. In late October, Venezuelan President Hugo Chavez and Mexican President Vicente Fox agreed that Venezuela and Mexico each would supply 80,000 b/d of oil and products to Costa Rica, OPEC News Agency reported.

Separately, Venezuela signed a supply agreement to provide the Dominican Republic with up to 50,000 b/d of oil and products.

"We have relaunched the Caracas Energy Agreement, and we are committed to begin sending shipments of oil and products as soon as possible," the Venezuelan state news agency, Venpres, quoted Chavez as saying during a Nov. 6 news conference.

The Dominican Republic and Venezuela had suspended their cooperative Caracas Energy Agreement in 2003 because of political differences. Venezuelan Energy and Mines Minister Rafael Ramirez said relations between the two countries have improved. F

NORWAY IS SEEKING block nominations, and companies have until Feb. 23, 2005, to propose acreage.

Minister of Petroleum and Energy Thorhild Widvey has invited oil companies to nominate blocks in the Norwegian Sea and Barents Sea for the 19th licensing round, with licenses to be awarded in first quarter 2006. Blocks are to be put up for offer during the summer.

Nominations may include areas already opened for petroleum activities in the Norwegian Sea and in the Barents Sea except for defined areas close to existing infrastructure and areas that Norwegian authorities consider particularly valuable environmentally, including the Nordland VI sector off the northern Lofoten islands of the Norwegian Sea and parts of the continental shelf close to coastal Troms and Finnmark counties. F

Quick Takes

NIGERIA HAS INVITED Chinese companies to expand and strengthen their investments in Nigeria, reported OPEC News Agency. China National Petroleum Corp. (CNPC) has signed a memorandum of understanding (MOU) with Nigeria to begin oil exploration in the Nigerian side of the Chad basin and has expressed an interest in developing a working relationship with state-run Nigerian National Petroleum Co. (NNPC) in Oil Mining Lease (OML) 65 and OML 111. CNPC also may seek to acquire shares in the Port Harcourt and Kaduna refineries. Edmund Daukoru, Nigeria's presidential adviser on petroleum and energy, started a task force in Abuja Oct. 22 with representatives from NNPC, CNPC, and other entities to determine how to achieve the objectives of the MOU. The task force expects by yearend to develop a plan for implementing the MOU, OPECNA reported.Pan-Ocean Energy Corp. Ltd., St. Helier, Jersey, UK, said a short-term production test of its onshore TST-2 appraisal well in Gabon confirmed the commercial viability of Tsiengui oil field (see map, OGJ, Nov. 8, 2004, p. 38). During a 4-day test, the well flowed 2,450 b/d of 32º gravity oil at 614 psi wellhead flowing pressure through a 36/64-in. choke with a gas-oil ratio of 420 scf/bbl and no water. The oil is similar to that produced at nearby Obangue field. Pan-Ocean said the well is capable of sustained production of 1,000-1,500 b/d of oil. The company has a 100% interest in the well subject to the government's 7.5% back-in.Russia's Lukoil Overseas Holding Ltd. has begun a $6 million drilling program on the North-East Geisum Block in the Gulf of Suez off Egypt. Egyptian Drilling Co. will use its Senusret jack up for the 2-month project. The well will be drilled in 35 m of water to a target depth of 1,820 m. The project is part of a $27.8 million, 4-year exploration program in which Lukoil will drill four wells on the block and adjacent West Geisum Block. The first well on the West Geisum Block will be spudded in February 2005. Lukoil said five oil and gas prospects havebeen identified on the blocks, which have a combined area of 175 sq km.Pakistan has granted an exploration license agreement for Block 2367-4 (Indus Delta-A) to Government Holdings (Pvt.) Ltd. and signed a production-sharing agreement with Oil & Gas Development Co. Ltd. (OGDC) for exploration activities offshore. Block 2367-4, which covers 2,499 sq km, lies in shallow water at the offshore edge of the Thar Platform in the Arabian Sea. The minimum work commitment involves spending estimated at $3.5 million. OGDC currently holds the largest acreage position in Pakistan, operating 16 concessions, of which it holds 100% interest in seven. OGDC also holds nonoperating working interests in seven concessions operated by other companies.BHP Billiton, operator of the deepwater Shenzi discovery on Green Canyon Block 653 in the Gulf of Mexico, reported that its second appraisal well, Shenzi-3, encountered 330 ft of net Miocene oil pay in a 410 ft gross hydrocarbon column. Shenzi field, 9 miles northwest of BHP's Atlantis field, was discovered in 2002 (OGJ Online, Nov. 21, 2002). Global Santa Fe Corp.'s CR Luigs drillship, which BHP operated, drilled Shenzi-3 to 28,000 ft TD in water 4,355 ft deep. An updip sidetrack well confirmed the hydrocarbon column. Drilling on another sidetrack is under way to gain additional reservoir data. BHP holds a 44% interest in the field, and Amerada Hess Corp. and BP PLC each hold 28%. Shenzi-1, drilled in 2002, encountered a gross hydrocarbon column of 465 ft with net pay of 140 ft. Shenzi-2, drilled in 2003, encountered a 1,250 ft gross hydrocarbon column and 500 ft of net oil pay in lower Miocene sandstones.Perth-based independent Baraka Mali Ventures Ltd. has signed production-sharing agreements (PSA) with Mali's Council of Ministers for five exploration permits spanning a total of 193,200 sq km in northwest Mali—one of the largest collective permits awards known to

AMERADA HESS EQUATORIAL GUINEA INC. has awarded a contract to Modec International LLC, Houston, to design, engineer, procure materials, and construct hulls, topsides, mooring, drilling riser, and production riser systems for two tension leg platforms (TLP) for Hess's Northern Block G development off Equatorial Guinea. The platforms will be used to develop the Oveng and Okume-Ebano oil and gas reservoirs 55 km southwest of Bata and 250 km south of Malabo. The TLPs each will support as many as 18 top tensioned risers and will contain similar topsides capabilities. Hydrocarbons will be routed back to the block's central process facility. The TLPs are scheduled for installation in second quarter 2006.Marathon Petroleum Norge AS let a 400 million kroner contract to Advanced Production & Loading AS, Arendal, Norway, to develop the turret mooring system for the Alvheim floating production, storage, and offloading vessel. The vessel will handle production from four oil and gas fields in the Alvheim area, which lies in 125 m of water on the Norwegian continental shelf, west of Haugesund. Norwegian authorities recently approved the Alvheim development and operation plan (OGJ Online, Oct. 13, 2004). Operator Marathon holds a 65% interest in the Alvheim project. License partners ConocoPhillips holds 20%, and Lundin Petroleum AB of Stockholm 15%. Alvheim production is expected to ramp up to more than 50,000 net b/d during 2007. Alvheim reserves are estimated at 200-250 million gross boe. Fields to be developed are Boa, Kneler, Kameleon, and East Kameleon.Brazil's BNDES bank has approved a $387 million loan for construction of a semisubmersible platform that state-owned Petrobras will use in the second phase of development of deepwater Roncador oil and gas field off Brazil. The P-52 semi, to cost $895 million, will be anchored in 1,800 m of water and handle production from 20 wells and injection into 10 wells. Its capacity will be 180,000 b/d of oil. Petrobras let contract in September 2003 to FSTP Pte. Ltd.—a joint venture of Fels Setal SA (75%) and Technip Engenheria SA (25%)—to construct the platform with Petrobras Netherlands BV. They will then lease the P-52 to Petrobras for Campos basin operations.

TRINIDAD AND TOBAGO has agreed to take 40% interest in a Jamaican LNG regasification terminal slated for construction at Port Esquivel in Kingston by 2008. In an agreement signed on Nov. 9, Trinidad and Tobago agreed to provide 1.1 million tonnes/year of LNG for 20 years. Jamaica is seeking to reduce its reliance on oil. Jamaica's Prime Minister Percival James Patterson said the regasification terminal would provide gas for power stations and a Jamaican oil refinery. In addition, the agreement ensures the security of energy supplies at stable and competitive prices, he said.

AFTER EXTENSIVE NEGOTIATIONS, Argentina and Brazil signed a letter of intent Nov. 3 to finance a $200 million expansion of Argentina pipeline company Transportadora de Gas del Sur SA's (TGS) 3,408 km San Martín natural gas pipeline from the Austral basin in southern Argentina, according to Business News Americas. High gas demand has necessitated the 3 million cu m/day capacity expansion. The agreement with Brazil came after Argenina's President Néstor Kirchner signed an accord with Bolivia's President Carlos Mesa in October to import 20 million cu m/d of gas beginning in 2006. Brazil's national development bank, the Brazilian Development and Social Bank, will finance $142 million of the costs, and the TGS pipeline unit of Brazil's state-run Petróleo Brasileiro SA (Petrobras) will execute the pipeline expansion. Construction is slated to begin in January, with start-up scheduled for July 2005.Sonatrach TRC has awarded ABB Group, Zurich, a $90 million contract to expand and improve compressor facilities on Sonatrach's natural gas pipeline system in Algeria. The project is part of Sonatrach's 30-month plan to install seven 25 Mw turbocompressors and upgrade five compressors across Algeria's Sahara region. ABB will perform engineering, procurement, construction, commissioning, and start-up of a new compressor station on the GR1/GR2 gas pipeline at Tin Fouye Tabankort, 300 km south of the Hassi Messaoud refining hub. It will upgrade a station near Rhourde Nouss gas fields. Work is scheduled for completion by September 2006.

POGO PRODUCING CO., Houston, plans to drill more than 100 wells during 2005-06 on West Texas oil and gas producing properties that it is acquiring from a private company. The company has signed a definitive stock purchase agreement valued at $208 million, including $35 million in debt, and expects to close the deal on Dec. 21. Pogo will acquire 90 bcfe of proved reserves and 16.5 MMcfd of gas equivalent production. It will become operator on most of the properties, which cover 15,000 leasehold acres. Pogo Chairman and CEO Paul G. Van Wagenen cited potential for "repeatable, low-risk development drilling," recompletions, and exploratory drilling. "We hope to more than double the current daily production rate from these properties by the end of 2005," he said.

PETROBRAS has begun operation of new plants at two of its refineries. At its largest refinery, Replan in the 350,800 b/cd Paulínia complex at Sao Paulo, it started up a second coking unit with a capacity of 31,000 b/d. Petrobras also started up a 37,500 b/d diesel hydrodesulfurization unit at the 181,000 b/cd Presidente Getúlio Vargas (Repar) refinery at Curitiba in south Paraná state. The unit, with a hydrogen unit able to produce 270,000 cu m/day, reduces the sulfur content of diesel oil to less than 500 ppm.Petrobras awarded a license to KBR, Houston, to add a second catalyst cooler at its residue FCC unit in the 51,270 b/cd Capuava (Recap) refinery in Sao Paulo. FCC catalyst cooling is a technology offered by KBR and ExxonMobil Research & Engineering Co. through an FCC technology, development, marketing, and engineering alliance. Petrobras previously licensed the same technology from KBR for six catalyst coolers at three refineries in Brazil. The installations will provide Petrobras with the flexibility to process lower-cost atmospheric residue feedstocks in its newest FCC units.

DOW CHEMICAL CO. and Petrochemical Industries Co. have signed a memorandum of understanding with Fluor Corp. to provide utility and infrastructure front-end engineering and overall project management consultancy services for a $1 billion project to double the capacity of an olefins complex in Shuaiba, Kuwait. The integrated petrochemical complex project will include construction of an 850,000-tonne/year cracker, a 600,000-tonne/year ethylene glycol unit, a 450,000-tonne/year ethyl benzene-styrene monomer unit, and the addition of 225,000 tonnes/year of polyethylene capacity to debottleneck the existing complex. Construction start is scheduled for early 2005, with completion expected in 2007.Cabot Corp., Boston, and its joint venture partner Shanghai Coking & Chemical Co. plan to build a world class carbon black plant in Tianjin, China. The first production unit, which will have an estimated capacity of 50,000 tonnes/year, is scheduled to begin production in early 2006. Expansion of the plant is planned for later in 2006, Cabot reported.

A TOTAL OF 1,259 RIGS was working in the US the week ended Nov. 12—down 9 from the previous week but up by 148 over the number making hole the same week in 2003, reported Baker Hughes Inc. Offshore activity gained 2 rigs, to 98 working—93 in the Gulf of Mexico. Texas gained 15 rigs that week, while Oklahoma idled 10, Wyoming idled 9, and Louisiana 6. Canada's rig count rose by 16 to 448 units working—an increase of 173 over the same week in 2003. Rig fleet utilization in the Gulf of Mexico is 78.6%, and the worldwide utilization rate is 85.6.