EU plans expansion of natural gas-import network

Loyola de Palacio, EU's energy and transport commissioner, says the improved network "is a prerequisite to an effective European energy market," while the successful opening of gas and electricity markets "requires a major increase in interconnections between national networks."

The EU Directorate for Energy and Transport recently released its priorities for upgrading both electricity and gas networks for the organization. Called the Trans-European Energy Networks program, the plans include the 10 new central and eastern European countries that joined the EU in May.

The plans, however, have not yet been fully adopted or approved by the European Commission.

The program identifies the missing links and bottlenecks on the electricity and gas networks and the priority items that need upgrading. These include, says de Palacio, the new transit routes needed "to diversify supplies and reduce dependence on individual third countries." The EU depends on outside sources for a large part of its growing natural gas demand.

"It is likely, though," de Palacio said, "that the new infrastructure will take 5-10 years from planning to entry into service."

Financing

The ambitious plans could cost as much as 28 billion euros for both gas and electricity infrastructure during 2007-13. The EU Commission has a relatively small budget for the program, however, and will use it as a catalyst for investment and as an initiator of studies and other preparatory activities, rather than to support the actual construction of projects.

Financing, the EU feels, should be the responsibility of the network operators who are expected to invest their own funds or raise market capital for these projects. EU funds may be used to cover insurance in regions where investments are considered high risk.

Projects

The EU has already agreed upon five natural gas priority projects (Figs. 1-4).

Project NG1 involves installation of a new pipeline to deliver Russian gas to the UK and North Central Europe, including Germany, Denmark, Sweden, the Netherlands, and Belgium.

It would be split into two main sections: The northern European line, which could be operational from 2013, would bring Russian gas across the Baltic Sea or overland along the existing Yamal-Europe pipeline.From this mainline there could be additional branches to the Nordic and Baltic states.

Apart from increasing imports of Russian gas in these countries to 30 bcm/year from the current 20 bcm/year—making Russia's total gas exports to Europe 130 bcm/year—the option of a pipeline across the Baltic Sea diversifies supply routes, simplifies gas transfer, and reduces the number of countries crossed.

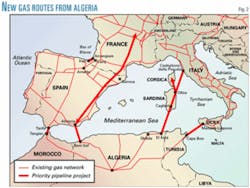

Project NG2 is a new gas pipeline to diversify supply routes from Algeria and increase capacity through Spain, Italy, France, and other EU countries. Four supply routes would increase overall gas capacity from Algeria by 31 bcm/year:

- Algeria-Morocco-Spain-France via Tangier and Gibraltar, with the Spain-France link to be ready in 2005.

- Algeria-Spain-Northern France, with construction in 2005-06.

- Algeria-Sardinia-Corsica-France-Italy, for which studies will be ready this year.

- Algeria-Tunisia-Italy, due on stream in 2006.

Project NG3 improves links in the southeastern EU that would open up new Caspian Sea region imports through Turkey, Bulgaria, Hungary, Romania, and Austria and through Turkey, Greece, and Italy. Gas lines through Turkey would be upgrades.

The new 10 bcm Turkey-Greece interconnect should be on stream in 2006. The new Greece-Italy interconnect will see the first phase—2 bcm/year—of four on stream in 2008. The 30 bcm/year Nabucco pipeline—3,400 km through Turkey, Bulgaria, Romania, and Hungary to Austria in the Eastern Balkans—should be on stream in 2009.

Another route, possibly 10 bcm/year, could extend from Turkey to Austria through Greece, the western Balkans, and Slovenia

Project NG4 is the construction of LNG terminals in France, Spain, Portugal, and Italy and could also include Poland, Greece, and Cyprus.

Besides diversifying LNG supplies, the project would boost the internal gas market and upgrade the transmission grids. If all these facilities are completed to their full planned capacity, output to European distribution networks could be increased by as much as 75 bcm/year.

Project NG5 provides underground storage in Spain, Portugal, Italy, Greece, and the Baltic Sea region and is linked to Europe's reliance on external sources for its gas and the need to be assured of a 60-day supply.

Storage facilities also would improve the internal market by increasing the transfer of gas among member states.

NG6, an additional natural gas priority project, creates an "East Mediterranean gas ring," with a network of pipelines bringing gas from Egypt and Libya to Italy and southern Europe. These Arab gas lines, to be built in six phases, would bring 10 bcm/year of Egyptian gas to Jordan, Syria, Lebanon, Cyprus, and Turkey.

The 8 bcm/year Libya-Italy line is to be on stream next year, with further shares to go to France and other countries north of Italy. Egypt will ship much of the gas as LNG.