Drillers, operators share outlooks at IADC annual meeting

Nina M. Rach

Drilling is on the rise worldwide as the market facilitates implementation of new technologies. The 2004 International Association of Drilling Contractors annual meeting, Sept. 22-24, New Orleans, featured outlook sessions from drillers and operators; discussions of managed pressure drilling, deepwater, and deep gas drilling; and results of the annual ReedHycalog rig census (OGJ, Oct. 25, 2004, p. 49).

The drillers' outlook session included presentations from Nabors Industries Inc. and GlobalSantaFe Corp. According to Dennis Smith, director of corporate development for Nabors, the rig supply is increasing, and the short-term outlook is that rig demand will increase due to rig-intensive worldwide mega projects.

Smith tabulated onset of first production from the projects coming online this decade: 2003 (7 projects), 2004 (11), 2005 (18), 2006 (11), 2007 (3), and 2008 (3), all of which will require additional rig capacity. Saudi Arabian Oil Co. (Aramco), for instance, had 17 rigs running at the end of June and seeks to increase to 40 rigs by yearend.

Smith said customers were focused on higher recovery efficiency and enhanced technology, seeking to increase incremental reserves. In Texas, drilling was centered on clustered pads with 20-acre well spacing, and the company has been able to increase efficiency in rig moving times to 31/2 days from 5-7 days. Smith anticipated rig moving times to drop to 11/2 days for 11 1,000-hp rigs under construction in Canada.

Incremental demand

In August 2000, there were 850 land rigs operating in the US, before Helmerich & Payne Inc. built 48-50 new Flex rigs, contributing to the increased fleet of more than 1,100 land rigs now operating.

Nabors has recently reactivated 12 rigs and is working on 8-10 rigs, with 60 more available, including "big" rigs (2,000 hp). Refurbishing a land rig costs $12-15 million, compared to $25-30 million for a new build. Smith said that rig reactivation is a preferred way to handle incremental demand in a sustainable market environment.

GlobalSantaFe Pres. and CEO Jon A. Marshall presented a macro picture for the drillers' outlook, noting the increased utilization of jack ups and ultra-deepwater drilling vessels. For capital investments made 1987-1996, drilling contractors earned a 16.2% return on investment, compared to the current 8% return. He said that lower commodity prices would benefit drillers; at high prices, operators grow through increased revenues, but as the price falls, operators grow through increased drilling.

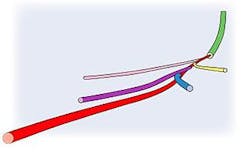

Marshall noted that Russian production has increased to 9 million bo/d from 6 million bo/d due to production efficiencies provided by Halliburton Corp., Schlumberger Ltd., and Baker Hughes Inc., rather than through increased drilling. He also mentioned the emergence of "fishbone" drilling patterns, with opposed multilaterals at multiple levels (Fig. 1).

null

Managed pressure

According to Don Hannegan, director of underbalanced services at Weatherford International Inc., 75% of US land rigs today drill at least one section with a closed and pressurable mud returns system, compared with 10% in 1995. Wells drilled with a closed system have fewer incidents, a positive factor for health, safety, and environmental considerations.

Managed pressure drilling (MPD) is a step-change technology which the IADC defines as "an adaptive drilling process used to precisely control the annular pressure profile throughout the wellbore. The objects are to ascertain the downhole pressure environment limits and manage annular pressure."

Hannegan said that more than 50% of all known hydrocarbon resources, gas hydrates excluded, are economically undrillable with conventional tools and technology, but "MPD increases the range of economic drillability of many offshore prospects."

MPD incorporates a rotating control head with flexible flow lines and a choke manifold with surface blowout preventer (BOP) systems. To accommodate vessel heave on floaters, a RiserCap is added for spills containment.

Two recent applications are Shell Malaysia's drilling with the Stena Clyde moored semisubmersible off Sarawak, using a pressurized mudcap system, and slim-riser drilling with surface BOP in deep water. He also noted Conoco- Phillips's MPD project off Viet Nam, off Denmark, deep shelf wells in the Gulf of Mexico, and MPD from Transocean's Triton rig off Angola. While underbalanced drilling and MPD have been widely utilized onshore, this move to the offshore is a growing phenomenon (OGJ, Dec. 1, 2003, p. 39).

The next jump in technology will be a "virtual riser" system with a subsea rotating control head, allowing riserless dual gradient drilling with zero discharge. The system has been tested for 180 hr at a simulated 7,500-ft water depth. Hannegan said such a system could be used with a top hole drilling package by the International Ocean Drilling Project (OGJ, Sept. 22, 2003, p. 19).

Deep shelf opportunities

Elliot Pew, vice-president of exploration at Houston-based Newfield Exploration Co., said opportunities are apparent from a quick examination of well density in the Gulf of Mexico. There have been 35,947 wells drilled to total vertical depths of less than 14,000 ft, but only 3,903 wells drilled greater than 14,000 ft.

Pew characterized deep shelf prospects as predominantly Miocene-age and geopressured, with subtle or no amplitude anomalies on conventional 3D seismic. Newfield spent $18 million on regional seismic data and uses advanced seismic attribute analysis and imaging to refine their stable of prospects.

So far, the company has drilled 6-8 deep shelf wells/year, totaling 19 wells with 12 successes (63%). The average total depth was 16,096 ft and average dry hole cost was about $8.1 million. Newfield's latest success was a deep shelf discovery at West Cameron 77, announced in late July, with 120-ft net pay in a well drilled to 19,603 ft. The company's 2004 drilling program includes 5-6 deep shelf wells, 15-20 traditional wells, and 3-4 deepwater wells.

Although the Gulf of Mexico provides about 25% of the US gas supply, Pew said production from the deep shelf "will not have a meaningful impact on US reserves."

Technology advances

Pete Miller, chairman, president, and CEO of National-Oilwell Inc., discussed advances in drilling rig technology. He sees a proliferation of automated drilling systems, offline capability, and dual activity rigs, including the addition of secondary racking systems. Pipe-handling systems for land rigs have started being installed and will probably spread, and centrifugal boost pumps for land rigs will be released toward yearend.

Miller anticipates enhanced well servicing rigs up to 700 hp and new valve cartridges for hex mud pumps that can be changed in only 5 min. A new safety brick system involves employees wearing computer chips that interface with equipment to avoid accidents.

Mike Williams, president of drilling equipment at Varco International Inc., discussed the impact of technology on the drilling process. He traced evolution from the "manual" era through the "mechanized" era, in which labor-enhancing machinery reduced exposure rates and technical limits were expanded.

The current "automated" era includes advanced mud systems with better solids control, and racking systems which reduce drilling labor and expenses and improve performance and reliability. New technologies include MPD underbalanced drilling, hex mud pumps, continuous circulation, casing drilling, and drilling with casing, expandables and monobores, integrated control systems, portable simulation tools, built-in remote connectivity, smart pipe, and just-in-time delivery systems.

In the future, Williams said drillers and operators will embrace technologies that reduce the cost of drilling and shave nonproductive time, increase rate of penetration, improve safety, reliability, and simplicity, and enhance delivery of information and crew training.

Juan A. Garcia, drilling manager at ExxonMobil Development Corp., spoke about operator-contractor relationships that promote safe, efficient drilling operations. ExxonMobil uses a "PPP" system involving partnership, proactivity, and participation.

Together, the partners develop a 1-12 page, site-specific operations safety plan. They are proactive in developing and providing safety leadership courses and safety initiatives involving such topics as dropped objects, hand safety, work permits, lock-out and tag-out, and personal protective equipment use. Participation forces the thinking process and uses tools such as job safety analysis sessions, step back 5x5 and stop cards, and allows for reward incentives. Garcia noted that the leadership is ultimately responsible for implementation.

All speakers stressed a commitment to improving the drilling industry by advancing safety and providing enhanced training in addition to developing and implementing new technology. Drilling projects are increasingly becoming partnerships in which all participants contribute their best solutions and technologies.