ReedHycalog: North American rig fleets grow; US fleet's net rise highest in 22 years

The annual ReedHycalog rig census shows that US and Canadian rig fleets are growing and worldwide rig utilization is strong.

John Deane, president of ReedHycalog, a unit of Houston-based Grant Prideco Inc., presented results of ReedHycalog's 2004 US rig census, Sept. 24, at the annual meeting of the International Association of Drilling Contractors in New Orleans.

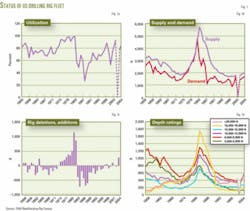

According to the latest census, US fleet utilization rose to 84% from 78% in 2003. The 2004 utilization rate is 11% higher than the 50-year mean of 73% but falls short of 1981's historical peak of 98% utilization (Fig. 1a).

Land rig utilization mirrored that of the entire US fleet, rising to 86 % from 78% in 2003. US offshore rig utilization remained the same—71%—in 2004 as in 2003; offshore utilization historically lags land rig utilization.

The 51st ReedHycalog rig census is based on rig ownership and activity ("turning to the right") during a 45-day period (May 5-June 18, 2004). For the first time, this year's census includes data for mobile offshore rigs and Canadian rigs.

US rig fleet

The supply of US-based rigs increased 10% in 2004, to 1,893 rigs, up from 1,719 rigs in 2003 (Fig. 1b). In 1982, a glut of 5,644 rigs resulted in the highest historical US rig count since the rig census began in 1955. Deane said that the rig supply bottomed out in the late 1990s, and we have finally worked off the surplus inventory.

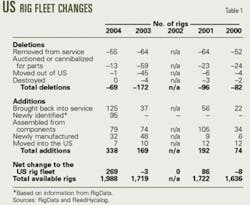

With the help of RigData, a rig location and permit report service, ReedHycalog was able to identify 95 rigs that had never been counted, bringing the total available supply to 1,988. The net addition to the rig count is 269 rigs, the highest annual rise recorded since 1982 (Fig. 1c).

Among the changes to the fleet: 55 rigs were removed from service, but 125 were brought back into service; 13 rigs were auctioned or cannibalized for parts, while 79 were assembled from components; 1 moved out of the US, while 7 moved in; and 32 were newly manufactured (Table 1).

Land rigs (1,736) account for 87.3% of the US rig fleet, and offshore rigs (252) account for 12.7% of the fleet.

Rigs capable of drilling to 10,000-12,999 ft comprise the largest percentage of the US fleet (24%, 473 rigs), followed by rigs able to drill to 6,000-9,999 ft (22%, 435 rigs), and rigs able to drill deeper than 20,000 ft (21%, 424 rigs).

After a sharp drop to 303 rigs in 1993, from 1,717 rigs in 1982, capable of drilling below 20,000 ft, the supply of deep drilling rigs has slowly increased to 424 in 2004, relative to all other depth ranges (Fig. 1d).

Among the remaining third of the fleet, 295 rigs are capable of drilling to 13,000-15,999 ft (15%), 230 rigs can drill to 16,000-19,999 ft (12%), and 131 rigs can drill to a total depth of 3,000-5,999 ft (7%).

In the past year, operator ownership of rigs has increased in the northern Rocky Mountains (10 rigs, up from 5); southern Rocky Mountains (15, up from 11); Permian basin (30, up from 25); Gulf Coast (11, up from 0); and in Arkansas-Louisiana-Texas (3, up from 0). Operator ownership has remained the same in California (9 rigs), the Southeast (1), and Midcontinent (8); and decreased in Alaska (3, down from 7) and the Northeast (2, down from 5). However, contractors still own 95% of all drilling rigs, down from 96% in 2003.

Rig utilization trends vary regionally. Based on data from the 2004 survey, rig utilization is highest in the northern Rockies (96%), followed by the southern Rockies (93%), Midcontinent (90%), Arkansas-Louisiana-Texas (90%), Gulf Coast (83%), Permian basin (83%), Northeast (79%), Southeast (74%), California (70%), and Alaska (61%).

Contractor concerns

Deane pointed out that the number of US rig contractors has been steadily declining to 179 in 2003 from 497 in 1990, due to industry consolidation. The 2004 data show a slight up tick, to 213 contractors, because of better data collection and the addition of several small companies (Fig. 2a).

Most rig contractors (60%) have fleets with more than 20 rigs. This is about average for the past 5 years, but double the percentage of 8 years ago (Fig. 2b). Within the other 40% of owners, 11% control 11-20 rigs, 12% control 6-10 rigs, 14% control 2-5 rigs, and 3% have only one rig.

The contractors surveyed reported that their rig activity had increased an average of 29% from 2003, and land rig rates averaged $9,103/day.

US contractors' top three concerns in 2004 were the same as 2003:

- Rig rates.

- Crew availability.

- Insurance costs.

Maintaining a skilled work force is a perennial concern. Insurance first appeared as a top concern in 2003 and includes medical and liability premiums. Other contractor concerns include the cost of tubulars having increased 12%; contractors expect to spend an additional 25% on tubulars in the coming year. Labor costs have increased 9% and maintenance costs are expected to increase another 16%.

Offshore rig fleets

For the first time, ReedHycalog worked with ODS-Petrodata to summarize information for the global, offshore mobile fleet (not including fixed drilling platforms and inland drilling barges). The size of the fleet decreased 1%, to 673 rigs from 678 in 2003, but utilization increased to 72%, from 71% in 2003. Eleven offshore rigs were added in 2004, 15 were retired, and 1 was destroyed.

Jack ups comprise 57% of the global fleet (385 rigs) and have the highest utilization rate, 78%. Semisubmersibles comprise 24% of the fleet (162 rigs) and have the second highest utilization rate, 73%.

Drill barges comprise 8% of the fleet (52 rigs) and have a 31% utilization rate, while drillships comprise 6% of the fleet (40 rigs) but have a 65% utilization rate.

Drilling tenders comprise 4% of the fleet (27 rigs), with 67% utilization, and the 7 submersible rigs represent about 1% of the fleet, with 71% utilization.

The US employs 24.5% of the mobile offshore fleet; South America 13.7%; Middle East 10.7%; Northwest Europe 10.2%; Southeast Asia 8.3%; and West Africa 7.9%.

The remaining 24.7% of the rigs are working in Mexico (6.7%), Indian Ocean (5.2%), Far East (3.4%), Mediterranean and Black Seas (3.3%), Caspian (1.9%), Central America (1.5%), Australia and New Zealand (1%). Regions employing less than 1% of the offshore fleet include Canada (0.9%), the Russian Arctic (0.3%), and the Baltic (0.1%).

Canadian rigs

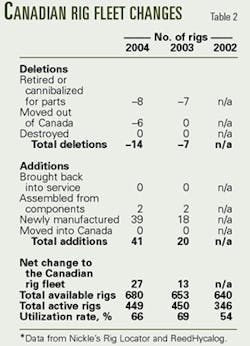

ReedHycalog's first Canadian rig survey was based on responses from 12% of rig contractors and shows that the total number of available rigs has increased by 4% to 680, up from 653 in 2003 (Table 2). The fleet includes 646 land rigs, 28 coiled-tubing rigs, and 6 offshore rigs (2 jack ups, 2 fixed platforms, 2 semisubmersibles).

The quality of the fleet is being upgraded by the addition of newly manufactured rigs (39 in 2004, 18 in 2003) and new rigs assembled from components (2 each in 2004 and 2003). Older rigs were retired or cannibalized for parts (8 in 2004, 7 in 2003), and others were moved out of Canada (6 in 2004).

Canadian rig fleet data for 2002-04 were provided by Nickle's Rig Locator and show that utilization rates are highest (90%+) for shallow rigs with depth capacity from 3,000-5,999 ft (total of 170 rigs) and for the very deepest rigs, capable of drilling below 20,000 ft (total of 15 rigs). The lowest utilization (58%) was for rigs drilling 6,000-9,999 ft (total of 350 rigs) and those drilling 10,000-12,999 ft (total of 78 rigs; 46% utilization).

Overall utilization of the Canadian fleet was 66%, but the reporting period for the survey (May-June) is generally a low drilling activity period in Canada.

Canadian contractors' top concerns in 2004 were:

- Crew availability.

- Rig rates.

- Drill pipe replacement (tie).

- Government regulations (tie).

Labor rates in Canada had increased 4% and rig rates had increased 6%. The cost of tubulars was expected to rise 11%.

Outlook

The outlook for driller contractors in North America and worldwide offshore is positive, Deane said, and the fleets are in better shape than they have been for many years.

US rig fleet utilization is likely to rise to 88% in 2005, reflecting steady growth in drilling activity. Deane sees the US land fleet increasing 10% to 2,187 rigs in 2005, from 1,988 rigs this year, and the number of active rigs increasing 15% to 1,925 in 2005, from 1,674 in 2004.

RIG CENSUS DATA from 1955-2004 can be downloaded from the Grant Prideco web site, at http://www.grantprideco. com/pressrelease_docs/Census%20history%202004.xls.