OGJ Newsletter

Market Movement

Algerian mishap briefly boosts energy prices

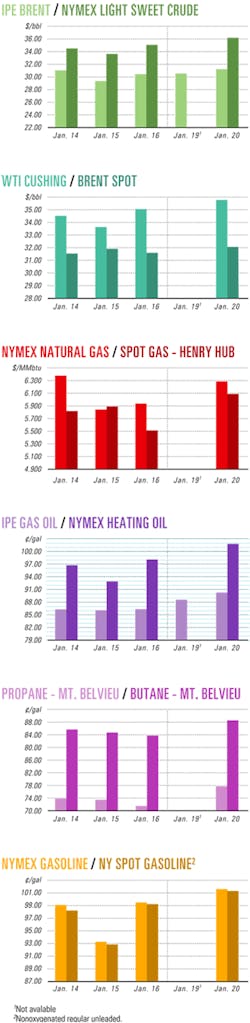

As the New York Mercantile Exchange resumed trade Jan. 20, following observance of the US holiday for civil rights leader Martin Luther King, energy futures prices jumped because of an explosion at the Skikda LNG complex in Algeria, threats of another strike by oil workers in Nigeria, and forecasts for extremely cold weather in the US Northeast and Midwest.

Concerns of possible disruption of world supplies of oil and petroleum products as a result of the threatened strike and shutdown of the adjacent Skikda refinery in the face of increased demand initially pushed oil futures prices to a 10 month high on NYMEX. The expiring February contract for benchmark US light, sweet crudes closed at $36.20/bbl on Jan. 20, up by $1.13 for the day after trading in a range of $34.92-36.37/bbl. The March contract gained 87¢ to $34.87/bbl on NYMEX. On the US spot market, West Texas Intermediate at Cushing, Okla., advanced to $36.23/bbl.

The February natural gas contract shot up by 35.1¢ to $6.29/Mcf on NYMEX, "driven by firmer crude oil futures and stronger physical (spot market) prices as forecasters call for more cold weather in the [US] Northeast and Midwest," reported analysts at Enerfax Daily.

By the next day, however, with inspectors still trying to assess damage from the Skikda disaster, energy prices dropped, with the new near-month March crude contract dipping to $34.58/bbl on NYMEX, WTI retreating to $34.98/bbl on the US spot market, and the New York futures price for natural gas down to $6.15/Mcf on Jan. 21.

Oil futures prices declined after an appellate court in Nigeria ordered the Nigerian Labor Congress to suspend a national strike scheduled Jan. 21 to protest over the government's fuel tax that was implemented Jan. 1. The court also ordered the government to rescind the controversial tax. An additional court hearing is scheduled to begin Jan. 26.

However, analysts denied that the drop in energy futures prices signaled a new downward trend or lack of confidence in the market. Instead, they said prices were expected to rally if ministers of the Organization of Petroleum Exporting Countries vote to retain their current production quotas at the special meeting scheduled in early February. OPEC officials so far have indicated that is their plan.

Natural gas futures prices on NYMEX are expected to rebound with another wave of cold weather in key US markets. "Forecasters are calling for below-normal temperatures for the Northeast and Midwest through January after frigid readings [recently] boosted natural gas and electricity use to record levels from Philadelphia to Quebec," said Enerfax Daily analysts.

Meanwhile, Chakib Khelil, Algeria's minister of energy and mines, said Algeria would honor gas delivery commitments to European customers through increased deliveries of natural gas through two existing pipelines to replace the lost LNG natural gas supplies. He also announced plans to build "according to a new process" two LNG plants on the site of the three destroyed trains that would double the previous LNG capacity.

US oil inventories increase

In a report delayed 1 day by the US holiday, the US Energy Information Administration said Jan. 22 that US commercial crude oil inventories increased by 1.2 million bbl to 265.2 million bbl during the week ended Jan. 16. Oil stocks remained 33.4 million bbl below the 5-year average for this time of year, however.

Distillate fuel inventories fell by 2.8 million bbl to 135.5 million bbl during the same period, with decreases seen in both diesel fuel and heating oil. Gasoline inventories rose by 1.1 million bbl to 209.5 million bbl.

US crude imports averaged 9.8 million b/d during the week ended Jan. 16, up by 589,000 b/d and essentially reversing the previous week's drop in imports. Most of the increase was on the West Coast. Distillate fuel imports averaged 473,000 b/d during that period, the highest weekly average since the week ended Aug. 1, 2003. Total US gasoline imports also increased, averaging 689,000 b/d.

Crude input into US refineries during the observed period averaged less than 14.9 million b/d, down by 184,000 b/d from the previous week and 514,000 b/d over a 2 week period. "The vast majority of the decline was on the East Coast, while crude oil inputs on the Gulf Coast averaged about 7.1 million b/d," said EIA officials.

Total product supplied during a 4 week period ended Jan. 16 averaged nearly 19.7 million b/d, or 1.6% less than in the same period last year. Gasoline demand over the 4 week period averaged nearly 8.6 million b/d, or 1.4% below year-ago levels. Distillate fuel demand was down 9.8% in that period, while kerosene-type jet fuel demand was down 8.1%.

EIA also reported Jan. 22 that 156 bcf of natural gas were withdrawn from US underground storage during the week ended Jan. 16, up from 153 bcf withdrawn during the previous week but down from 219 bcf during the same period in 2003 and below the consensus of 176-182 bcf among Wall Street analysts.

That dropped US gas storage to 2.26 tcf, representing surpluses of 282 bcf compared with the same period in 2003 and 193 bcf over the 5-year average.

OPEC's performance

OPEC enjoyed remarkable success in addressing and handling difficult political and economic situations associated with the world oil market in 2003, boosting its credibility worldwide, according to a new annual study, "Gulf Economic Report for 2003-04."

The study also called for OPEC to "turn up its sleeves" in dealing with new and continued challenges this year.

Authored by Waleed Khadoury, editor of the Middle East Economic Survey, for the UAE daily newspaper Al Khale ej, the study said the world oil market reacted positively to OPEC's performance in addressing political and economic problems from June 2002 to June 2003.

"OPEC has achieved spectacular success in providing the oil market with enough supplies over the period under review, despite the halt of oil exports from Venezuela, due to the political strike, a shortage of supplies from Nigeria, because of the ethnic disputes in the Niger Delta, and the complete removal of Iraqi exports after the war," it said. "Oil prices have gone up beyond OPEC's range of $22-28/bbl for only a short period, despite the troubles faced by the market, thanks to OPEC's sound management of these developments," Khadoury said.

The price for OPEC's basket of seven benchmark crudes averaged $30.74/bbl on Jan. 21 and had remained above the group's target range for more than a month with no official action to reduce that price.

However, Khadoury said he believed the free flow of oil supplies, along with the absence of oil crises or shortages throughout the period provided concrete proof of the group's good intentions, especially among the Arab producers.

"Despite the stormy period, the global economic decline, the low demand for oil, and high supplies from Russia and the Caspian Sea, OPEC took the challenge and managed to keep the average price of a barrel at $25[/bbl during the period]," he claimed.

Industry Scoreboard

null

null

Scoreboard

Due to a holiday in the US, data for this week's Industry Scoreboard are not available.

Industry Trends

VENEZUELA is Latin America's oil and gas investment focus of concern to watch in the first half of 2004.

Otherwise, the Latin American energy sector appears poised for growth with improving capital market conditions, renewed investor interest, and decreased sovereign credit risk, Chicago-based Fitch Ratings Ltd. reports.

"Beyond navigating a period of turbulence that has significantly pressured Latin American energy, sector participants appear for the most part to be facing calmer conditions. Until the second part of 2003, regional sovereign creditworthiness was exhibiting a deteriorating trend," Jason Todd, a Fitch senior director, said during a Jan. 15 conference call.

Regional access to capital was difficult and expensive last year while liquidity pressures and corporate defaults were widespread in Venezuela and Argentina, he said.

"Investors and shareholders witnessed firsthand the volatility that comes with Latin America's energy industry's close link to the respective sovereigns. Recent positive macroeconomic trends include improved financial liquidity and increased capital market access," Todd said.

Conditions now may be sufficient for most Latin American countries to achieve near to midterm energy goals, he said.

But Venezuela's political environment remains highly charged, Todd said. State oil company Petroleos de Venezuela SA (PDVSA) is affected by the political environment and continues to experience ramifications from last year's strike. The company has been hindered in efforts "to extricate itself from the surrounding events and effectively move forward.

"The recall of President Hugo Chávez could occur by May, but delays are still possible. Significant uncertainty and volatility will remain until after the recall election," Todd said. In August 2003, opponents of Chávez submitted petitions calling for a nationwide referendum. PDVSA has increased its 2004 budget, nearly doubling its 2003 capital expenditure program. The company is expected to invest nearly $5 billion during 2004, primarily focused on improving refinery output, he said.

The company's capital investment program also calls for significant third-party investments within 5 years.

"But the near-term appetite from potential sponsors and investors for Venezuelan risk is uncertain in the current environment. This, coupled with increased PDVSA's cost of capital, may result in a scaling down of new projects in the near term," Todd said.

MEXICO WILL help drive the drilling services sector in the Gulf of Mexico in 2004.

National oil company Petróleos Mexicanos has announced plans to spend more than $8 billion this year on exploration and production, said Patrick McGeever, Fitch Ratings director on drilling and services. "It is Pemex's goal to increase crude oil production by more than 20% and natural gas production by more than 50% by the end of 2006," McGeever said.

To reach these goals, Pemex will need to exploit Campeche Sound fields, which are typically in 260 ft of water and ideal for jack ups, McGeever said.

Fitch analyst Jason Todd noted that efforts to open Mexico to opportunities for third-party participation in upstream activities have been hampered by political disputes between President Vicente Fox and the National Action Party, his own party.

Government Developments

JAPAN IS LIKELY to prevail over China in their competition over the route of an Asia-bound oil pipeline from the East Siberian city of Angarsk.

No decision has been announced, but Boston-based Energy Security Analysis Inc. (ESAI) said that a proposed pipeline to the Chinese city of Daqing stands little chance. That pipeline was supposed to help OAO Yukos fulfill its obligations under a 25-year supply agreement signed with China National Petroleum Corp. last year (OGJ Online, May 30, 2003).

ESAI Russian oil analyst Yulia Woodruff said that Yukos faces mounting troubles, particularly a $3.3 billion tax bill. Con- sequently, Yukos has shifted its priorities from expansion to survival. Yukos also has indicated a readiness to supply crude to Nakhodka if that pipeline route is built.

"The likely demise of the Angarsk-Daqing pipeline indicates that, for the Kremlin, near-term increase in export capacity is a lesser priority than strengthening the market position of state-owned and politically close energy companies," she said.

Russia's state-owned oil major OAO Rosneft, a rival of Yukos, supports the line to Nakhodka on the Pacific Coast. Woodruff said the Nakhodka route has geopolitical advantages and would help strengthen competitive positions of the state-favored energy majors, which recently formed an East Siberian consortium.

"It will be a long time before the Nakhodka line will be built, and there will be many obstacles, but it is looking like the more likely option than Daqing," she said.

Last year, the Japanese government denied published reports that it offered Russia a $7 billion financial package as an inducement to persuade Russia to build the Nakhodka line instead of the route into Daqing (OGJ Online, Oct. 15, 2003).

Russian authorities have repeatedly maintained that there is not enough oil available for export in East Siberia to justify both pipelines, and they insist that substantial investment is needed to develop the resources (OGJ Online, May 30, 2003).

Japan seeks Russian oil to reduce its dependence on Middle Eastern crude oil imports. In addition, Japan also is concerned about increased competition with China for oil. China became a net importer of oil in 1993, and analysts say that China could overtake Japan as the world's second-largest importer of oil.

THE PARIS-BASED International Energy Agency is helping India fulfill the Indian Cabinet's Jan. 7 decision to establish a strategic oil reserve of 5 million tonnes, equivalent to 15 days of India's consumption.

IEA called the decision "an important step" in India's efforts to establish 45 days of strategic stocks, as announced by Prime Minister Atal Bihari Vajpayee in February 2003.

"Given India's increasing oil imports, and subsequent influence on the global oil market, the establishment of Indian strategic oil stocks will certainly reinforce global oil security," said US Ambassador William Ramsay, IEA deputy executive director.

Currently the world's seventh largest oil consumer, India is expected to become the fifth largest oil consumer by 2020 after the US, China, Japan, and Germany.

Quick Takes

TWO EXXONMOBIL CORP. UNITS have applied to the Federal Energy Regulatory Commission for authority to build LNG receiving terminals on the Texas Gulf Coast. Vista Del Sol LNG Terminal LP wants to construct a $600 million LNG terminal in San Patricio County, just west of Ingleside. The 1 bcfd terminal would receive imported LNG beginning in 2008-09.

ExxonMobil said the permitting process and engineering, environmental, and other studies would take about 18 months. Golden Pass LNG Terminal LP applied in November to build an LNG terminal at Sabine Pass, in Jefferson County about 10 miles south of Port Arthur. ExxonMobil also holds a purchase option for a potential LNG import site at Mobile Bay, Ala.

Cheniere Energy Inc., Houston, has entered into an agreement with Atlantic Marine Inc. for an option to purchase a site for an LNG receiving terminal in an industrial zone on Pinto Island, also at Mobile Bay. Cheniere currently is evaluating potential support from Mobile residents. Cheniere also is a 30% limited partner in Freeport LNG, which applied to FERC last March for a permit to develop an LNG facility at Freeport, Tex. In addition, Cheniere filed applications on Dec. 22, 2003, for sites at Corpus Christi, Tex., and Sabine Pass, La. (OGJ Online, Dec. 26, 2003). India's first consignment of LNG will be delivered later this month to Petronet LNG's new $547 million, 5 million tonne/year receiving terminal at Dahej on the Gujarat coast, following the recent signing of a supply agreement with Qatar's RasGas Co. Ltd. Petronet will import 5 million tonnes of LNG from Qatar for an aggregate fixed price of $800 million/year until December 2008. The price, about $3.25/MMbtu, is at least 25% cheaper than current Asian LNG prices. Petronet has planned a similar 2.5 million tonne/year LNG terminal at Kochi, in the southern Indian state of Kerala, and is considering doubling the Dahej terminal capacity (OGJ Online, July 28, 2003).

LONDON-BASED INDEPENDENT Premier Oil PLC received a license from the Philippines Department of Energy to explore a 10,800 sq km area in the Ragay Gulf, off Luzon, Philippines. Premier initially will conduct technical studies and a seismic survey to define specific drilling targets for exploration drilling.

Premier will assign a 42.5% ownership interest in the license to Pearl Energy and 15% to Philippines National Oil Co.

Fortuna Energy Inc., a wholly owned subsidiary of Talisman Energy Inc., Calgary, has completed a test of its Andrews Hz No. 1 gas well, which probed a new structure in the Appalachian basin in the Corning, NY, area. The well was drilled to 10,100 ft and then steered horizontally within the upper Black River formation. It flowed on test at more than 18 MMcfd, limited by surface equipment, with a flowing pressure of 1,300 psi. Based on initial flow results, the Andrews well has the unconstrained potential to exceed 30 MMcfd and to be "possibly the most prolific well encountered in the region to date," the company said. Tie-in work is under way, and the well is expected to be on stream in early March at a pipeline-restricted rate of 8-10 MMcfd. Fortuna Energy said additional pipeline capacity should be available by early April. In 2004, Fortuna Energy plans to increase 2003 production by 30% to more than 80 MMcfd. IPR Mediterranean Exploration Ltd. (IPRMEL), a subsidiary of Dallas-based independent IPR Group of Cos., signed a 7 year production-sharing agreement Jan. 15 with Syrian ministry officials for Block XXIV in Syria. The award stems from a bid round that the Ministry of Petroleum & Mineral Resources of Syria sponsored in 2002. As operator, IPRMEL will explore 4,000 sq km in three phases with its partner, India's ONGC Videsh Ltd. In the first phase, IPRMEL will drill two wells, acquire 500 sq km of 2D seismic, and reprocess 200 sq km of 2D. The following two phases will include drilling another two wells and acquiring 500 sq km of 2D or 3D seismic equivalent. The joint venture's exploration obligation will be $15.5 million.

THE PRINCIPAL trading and shipping business of the Royal Dutch/Shell Group, Shell International Trading & Shipping Co. Ltd., has signed a contract of affreightment with General Maritime Corp., New York, to transport Shell oil cargoes in its Aframax and Suezmax fleet in the Western Hemisphere. Liftings already have begun, General Maritime said.

THE KASKA NATION of western Canada and Foothills Pipe Lines Ltd., representing the Alaska Highway pipeline project group (OGJ Online, Feb. 24, 2003), signed an agreement in principle Jan.15 that will provide the framework for a future participation agreement for the Alaska Highway pipeline project. A participation agreement would specify the benefits and opportunities Kaska communities would receive through the advancement of the pipeline. "Key areas covered by the agreement in principle include the establishment of a joint advisory committee, a traditional knowledge protocol, a human resource strategy, and a joint environmental issues management strategy," said Kaska Tribal Council Chief Hammond Dick. The pipeline would extend 1,700 miles from Alaska's North Slope through Alaska to northwestern Alberta, where existing pipelines would carry Alaskan natural gas to Lower 48 and Canadian markets (OGJ Online, Nov. 15, 2001).

The Kaska Nation includes five First Nations whose traditional territory covers about 25% of the Yukon Territory, adjacent areas of Northwest Territories, and about 10% of British Columbia. Kaska land claims are part of the first comprehensive claim accepted by Canada under its 1973 land claims policy.

FIRST GAS IS FLOWING from the Bayu-Undan natural gas and liquids field, reported participant Santos Ltd. The field lies in the Joint Petroleum Development Area in the Timor Sea, jointly shared by Australia and the newly independent East Timor (OGJ Online, Mar. 10, 2003).

Operator ConocoPhillips has put on line two gas wells for production as part of the commissioning and start-up procedures for Wellhead Platform No. 1, Santos said. In addition, 1,000 tonnes each of propane and butane have been loaded onto the Liberdade floating storage and offloading vessel to precool its storage tanks before NGL production start-up from the field, slated for April.

This $1.8 billion first stage involves stripping condensate and NGLs from the field's gas stream and reinjecting the residual gas.

The $1.5 billion second stage—LNG development—involves transporting dry gas to Wickham Point at Darwin in Australia's Northern Territory and liquefying it for export to Japan. A joint venture of Tokyo Electric Power Co. Inc. and Tokyo Gas Co. Ltd., which has assumed a 10.08% ownership interest in the project, has contracted to purchase the project's entire production of 3 million tonnes/year for 17 years. LNG production is scheduled to begin in first half 2006 (OGJ, June. 30, 2003, p. 64).

ConocoPhillips holds a 56.72% interest in the project. Other partners are ENI SPA unit Agip SPA 12.04%, Santos 10.64%, and Inpex Corp. 10.52%. ChevronTexaco Corp. unit Chevron- Texaco Petroleum Co. and Colombia's national oil company Ecopetrol have agreed to extend their Guajira Area A Association contract, continuing natural gas production in Colombia's northeastern coastal region. ChevronTexaco will continue equity participation for the commercial life of the fields with a 43% interest, down from 50%, in exchange for financial and technical benefits to Ecopetrol, which will hold 57% interest. ChevronTexaco operates Chuchupa field offshore and Ballena field onshore in Guajira State, together producing 500 MMcfd of gas, more than 80% of the natural gas consumed in Colombia. Statoil ASA, operator of the Åsgard license in the Norwegian Sea, is planning a 1.8 billion kroner program to increase oil recovery by 26 million bbl from one of Åsgard's three fields. Phase I includes the drilling of two additional wells through a new five-slot Q subsea template on the Smørbukk South deposit. The well stream will be piped through two new flowlines to the Åsgard A floating production, storage, and offloading vessel (see map, OGJ, Aug. 17, 1998, p. 66). Phase II will include a gas injection well drilled through the existing R template on Smørbukk South. FMC Technologies, Houston, will supply subsea production systems, including three subsea trees and associated structure, manifold, and production controls system, and Transocean Offshore Inc.'s Transocean Searcher drilling rig will drill the wells, spudding the first in April. Production is scheduled to begin in early 2005.

Two wells in Åsgard's main 52-well drilling program also have yet to be drilled, with the Stena Don semisubmersible currently spudding the penultimate producer. Statoil said the final well in that program would be drilled through the new Q template.

FRONTIER OIL CORP., Houston, reported a fire Jan. 19 at its 46,000 b/d refinery at Cheyenne, Wyo. The fire, brought under control within 15 min, was confined to the coking unit furnaces, Frontier said, and no other units suffered any damage. The affected coking unit will be out of service for about 30 days until repairs can be made to the furnaces.

There were no injuries other than smoke inhalation, and other units are "operating normally," the company said. Cause of the fire remains under investigation.

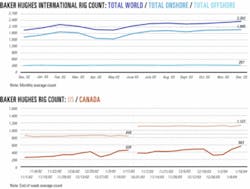

THE US RIG RATE hit a 27-month high this month as US drilling activity jumped by 21 units to 1,127 rotary rigs working in the US and its waters—the highest weekly rig count since early October 2001, Baker Hughes Inc. officials said Jan. 16.

That number is up from 845 rotary rigs working during the same period a year ago. Land operations accounted for the bulk of the increase, up by 20 rigs to 1,003.

Canada's rig count also increased—by 75 units—to 563, up from 520 a year ago.

Worldwide, the number of mobile offshore rigs under contract remained unchanged at 526.

In other drilling news, Norsk Hydro AS has extended for 2 years a drilling contract with Stavanger-based Smedvig ASA for use of the West Venture semisubmersible drilling rig. Equipped with a dual derrick set, the rig has been operating in Troll field for 4 years. The $150 million contract, which contains renewal options and incentives for drilling performance, goes into effect August 2004.

THE US CHEMICAL SAFETY AND HAZARD INVESTIGATION BOARD (CSB) declined to conduct a full investigation of a chemical explosion and fire that occurred Jan. 11 at a 10-year-old petrochemical plant owned by Huntsman Petrochemical Corp. in Port Neches, Tex. (OGJ Online, Jan. 15, 2003). CSB investigators spent 2 days at the plant site last week. The explosion and chemical fire that burned two plant workers and caused minor injuries to six others occurred during a shutdown for scheduled maintenance operations within a 27,000 b/d unit that produces methyl tertiary butyl ether. CSB officials said plant personnel did not know at the time that a pipe contained residual feedstock chemicals, which overheated when workers directed steam through the pipe. Pressure ruptured the pipe, releasing a flammable vapor cloud that ignited, investigators said.

Citgo gasoline hydrotreater on line at St. Charles

Tulsa-based Citgo Petroleum Corp. started up a new 35,000 b/d gasoline hydrotreater Dec. 28, 2003, at its Lake Charles, La., refinery. The unit, which is operating at capacity, is designed to remove sulfur from the gasoline stream while maintaining octane value. New federally mandated Tier II clean fuel regulations affecting gasoline will be phased in over a 3 year period, beginning this month.

A second, identical unit will be installed at the refinery in mid-year and started up as needed to meet the regulations. The cost of the two hydrotreaters is $210 million. Citgo is planning additional investments at the refinery during the next 5 years to meet future environmental regulations. Photo courtesy of Citgo.