Product sulfur specs will determine future refining configurations

Mandated reductions in refined products' sulfur levels, both gasoline and diesel, are the most significant factors in refiners' spending plans for the next few years.

The changing fuel regulations in the US, Europe, Asia, and Latin America will also force refiners that import gasoline and diesel into those regions to invest additional capital.

Clean fuels regulations will compel many companies to reevaluate their overall operations and could lead to the closure of smaller, less efficient refineries, according to Ken Otto, senior vice-president with Purvin & Gertz Inc., Houston.

Investment costs for ultralow-sulfur gasoline (ULSG) in the US are about $8 billon and costs for ultralow-sulfur diesel (ULSD) could reach $9-15 billion, according to Scott Sayles, principal consultant for KBC Advanced Technologies Inc., Houston. "The average refinery is anticipated to invest $75-200 million with the expenditures made between now and June 2006."

In addition, the new low-sulfur regulations will significantly reduce refiners' operating flexibility because off-spec products will be more difficult to blend.

"In certain situations, an operating problem in one unit can now spill over into adjacent units in the process scheme," according to Calvin Cobb, Invensys Corp. "Alternative operations to inventory feedstocks or products while operating problems are solved are not as readily available under the new regulations. This tends to lower operating rates and production volumes at a time when maximum production is needed."

In addition to satisfying the more stringent fuel specifications, refiners must produce the fuels from lower-quality crudes. Due to higher oil prices in 2004, refiners are more likely to process less expensive crudes, which are heavier and contain more sulfur.

The solutions for reducing diesel-sulfur levels are much more complex than gasoline. The primary process for converting the hard-to-remove sulfur species in diesel fuel is high-pressure hydrotreating. These units, both new and revamped, are expensive.

The additional hydrotreating capacity required will also affect other refinery units. Refiners will have to install additional hydrogen-generation capacity to meet the additional hydrotreating demands.

There are also a few concerns that the additional elemental sulfur generated will be more difficult to dispose of.

The specifications for off-road diesel are still being debated in the US. Refiners there are lobbying rule-makers for rational timetables that would allow them sufficient time after the on-road specifications take effect.

"The impact of sulfur reduction regulations on the refining business are manageable provided regulations are ratified and passed in a timely way to allow investment to achieve the stated goals," according to Sayles.

"Regulatory uncertainty has stymied strategic decision-making in much of the world, especially in the US."

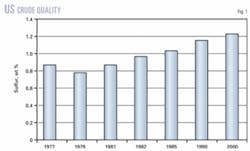

Crude sulfur

The level of sulfur in crudes processed in US refineries has steadily increased in the past 25 years (Fig. 1).

Refiners' use of cheaper, high-sulfur crude is placing additional demands on hydrotreating units, according to Dennis Cima, senior director for Aspen Technology Inc., Houston. Also, "many refiners have expanded resid processing capacities to process the added resid yields resulting from heavier, high-sulfur crudes."

Refiners have several strategic options either to increase operating costs by purchasing lower sulfur crude or invest capital to process higher sulfur, lower-cost crude, according to Sayles.

"This decision has been driven by the sweet-sour price spread; historically, this has remained relatively constant," he said. "As a result, the strategic decision on higher investment vs. higher operating costs is unchanged in many refiners' decision-making processes."

Gasoline

Refiners in the US and Europe have already started producing low-sulfur gasoline; their operational changes are serving as an example for other regions. Refiners outside the US, however, will not have to produce the sheer number of clean gasoline blends that exist in the US.

"The US 'boutique' gasoline blends that have evolved due to local regulations make ULSG implementation confusing," Sayles said. "Without a national mandate, the number of different ULSG blends has an impact on regional supply and price because of production and delivery constraints."

Diesel

While still dealing with final implementation stages of ULSG, US refiners are also developing strategies and building process units to deliver ULSD to the US market.

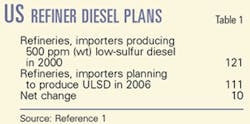

Starting in 2003, US refiners are required to provide annual updates on ULSD production plants to the US Environmental Protection Agency.1 The EPA survey reports the number of refineries planning to make ULSD and a brief indication of refinery capital investment plans for producing different ULSD options. EPA updated the report in September.

Table 1 shows the number of refineries that responded in 2003 to the precompliance requirement.

US refiners' ULSD production planning also depends on the off-road final rules and strategies surrounding new equipment construction, according to Sayles.

"A contingency plan for refiners is the usage of credits," he said. "This is a feasible plan, as long as the requirements are met for sulfur credit generation."

In addition to the challenges of producing ULSD, refiners are concerned with product transportation and measurement accuracy.

"The ULSD transportation and cross contamination potential presents another regulatory uncertainty on how sulfur product level compliance is achieved," according to Sayles.

Measuring 15-ppm sulfur levels commercially with the required ASTM-6248 test concerns many refiners. Recent round robin testing using this method in terms of the ASTM reproducibility at the 15 ppm (wt) sulfur level was 13.15 ±5.56 ppm (wt).2

A 95% confidence level requires refiners to target 10 ppm (wt) or less and leaves no room for cross contamination, according to Sayles.

A final low-sulfur rule for diesel-powered boats and trains in the US is not expected until 2005.

In comments filed with EPA, the National Petrochemical & Refiners Association said it generally supports EPA's draft plan dramatically to lower nonroad diesel sulfur levels. But the group said its members are worried that the multitude of regulatory programs the industry is facing might increase the chance of a supply disruption (OGJ, Sept. 13, 2004, p. 25).

Specifications

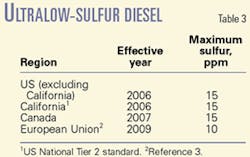

Refiners worldwide are faced with a two-pronged implementation schedule, ULSG then ULSD. For example, Western Europe, Japan, and South Korea have implemented clean fuels and are targeting ultra-lower sulfur levels next year. The US regulatory program mandates the implementation of ULSD by June 2006.

Tables 2 and 3 show the upcoming gasoline and diesel sulfur specifications for North America and Europe.3

European countries are discussing the possibility of zero-sulfur fuels; no decision has been reached, however, according to Sayles.

Europe's regulations provided refiners sufficient lead time; the transition to low-sulfur fuels was smooth and product was delivered without interruption. The next deadline for lower-sulfur products is January 2005, at which time the fuels must be available on a "broad geographical basis within the territory of a Member State."3 Full implementation is scheduled for January 2011.

South America has a strong and growing environmental commitment and has reduced sulfur levels, according to Sayles.

"Brazil, for example, blends ethanol into most of the gasoline marketed in the country and has restrictions on the maximum sulfur contents," he said. "The production of ULSG and ULSG has not started as yet, but regulations are being considered to implement these products in the future."

Japan and South Korea are producing low-sulfur products and are planning to meet ULSD specifications by 2005. Refiners there are producing lower-sulfur and higher-quality products earlier than is mandated.

Other parts of Asia are considering lower sulfur regulations, according to Sayles. These plans, however, have been delayed either due to refining capacity complexity limits or the after-effects of the economic slump.

Other regions of the world have a mixed fuels quality picture. For example, Russia desires lower-sulfur products and is investing to produce them without a regulatory driver (OGJ, Aug. 2, 2004, p. 40).

Other than South Africa, which is mandating 500-ppm sulfur diesel by Jan. 1, 2006, no countries in Africa are regulating fuel-sulfur levels.

Most refiners outside the US and Europe can wait longer to initiate projects or invest because their clean-fuels regulations go into effect at a later date.

Feedstock quality

Several refiners are modifying their refinery planning models to include different sulfur species because more of the hard-to-convert species must be hydrotreated to meet low-sulfur fuels requirements.

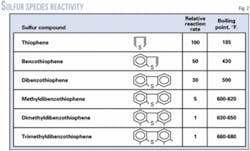

The most difficult species to convert are the benzothiophenes, dibenzothiophenes, methyl dibenzothiophenes, and trimethyl dibenzothiophenes.

Fig. 2 shows recently published relative reaction rates for these species. Relative hydroprocessing reaction rates ranged from 2 to 100 times slower (i.e., more difficult) than easy-to-hydrotreat species.4

Refiners operating hydrotreaters are concerned with variations in both coker light-cycle-oil feedstock quality and rundown temperatures, according to Cima.

"It is not unusual to see significant variations in coker light cycle oil cut point and steam temperature during drum switches," Cima said. "Coker light cycle oil product temperature variations of more than 100° F. have been observed during coker drum, steam strip cycle in a span of 20-30 min."

To run reliably, plant operations need a constant feed-sulfur content and, in particular, the sulfur species in the feed should be constant.

"Just using a brute-force control approach of operators chasing the product sulfur using once a day samples is going to create a situation with wild fluctuations in product sulfur content, and accelerated catalyst deactivation with the associated high costs of excessive down times and catalyst replacement," Cima said.

In addition, the types and volumes of streams feeding the diesel pool can change seasonally due to varying product demand and upstream unit constraints.5

Diesel feedstocks also contain nitrogen compounds that sometimes prevent sulfur compounds from reacting at a catalyst's active sites.

Technical solutions

The technology that each refiner chooses depends on the facility complexity and configuration. Most projects to meet new sulfur regulations worldwide are hydrogen-based; most use hydrotreaters and few use hydrocrackers.

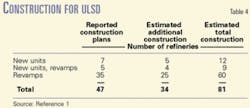

According to the EPA survey, 34 US refineries have not developed plans or are executing other options to produce ULSD.1 KBC estimated the total number of refinery modifications assuming the same distribution as those refiners that reported plans and the total number of units requiring new construction or modifications.

Table 4 shows the estimates of required refinery construction. The estimates are that a total of 21 new units will be required. Nine of these refineries will revamp existing units in addition to adding a new unit. The remaining 60 refineries are planning revamps.

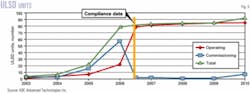

In the US, an aggressive engineering and construction schedule is needed to meet the mandated deadlines for ULSD. The construction requirements to build new or revamped units will increase steadily and peak in 2005 (Fig. 3).

In the US, once a refiner chooses a technology, the construction timing is difficult to determine due to regulatory uncertainties.

"Timing on permitting new refinery sulfur reduction facilities due to current new source review and consent decree issuesUmakes construction timing difficult to understand," Sayles said. "Combining these obstacles [creates] just some of the risks surrounding the regulatory uncertainties in the US, which make investment decisions difficult."

Hydrotreating

Most refiners plan to use hydrotreating for sulfur removal with many refiners planning to revamp their existing hydrotreaters to produce ULSD.

Revamping existing medium-pressure and low-pressure units, however, usually requires additional catalyst volume. In addition, increased hydrogen purity and circulation rates will require significant equipment modifications.

Roughly 80% of US refiners and 70% of European refiners are implementing or developing projects to make ULSD by the mandated deadlines.6

Of these projects, 40% are major revamps of low-pressure units, 35% are minor revamps of high-pressure units, and the rest are grassroots, high-pressure hydrotreaters.6 The first option is an expensive one due to the additional volume of catalyst required.

Typically, revamps consist of installing additional reactor volume and recycle-gas scrubbing to remove hydrogen sulfide, according to Ed Palmer, manager of process design with Mustang Engineers & Constructors LP.

Other modifications include hydraulic debottlenecking in the reactor loop to increase hydrogen circulation and additional makeup gas compression to handle the increased chemical hydrogen consumption associated with ULSD production.

Depending on the feedstock, replacement of low-pressure units, rather than a revamp, may be the choice of many refiners. The capital costs for a revamp are $15-30 million for a 30,000 b/d hydrotreater.6

A new 30,000-b/d hydrotreater typically costs $35-45 million for a US Gulf Coast refinery, and the medium-pressure revamp typically costs $10-25 million.6

Many US refiners have either installed or modified existing hydrotreating capacity to severely hydrotreat cracked naphtha such as heavy FCC naphtha and coker naphtha, according to Cima.

"Some refiners have converted resid hydrocrackers and middle-distillate hydrotreaters to USLD and naphtha hydrotreating service, respectively, to take advantage of more severe hydrotreating capabilities these units offer," he said. "This has been referred to as 'brute force' hydrotreating to meet USLD specifications."

Now, some refiners have moved away from resid hydrotreating and towards FCC feed or vacuum-gas-oil hydrotreating units, according to Cima.

"There are significant cost differences in terms of operating capital investment, maintenance costs, and in routine operations costs between resid hydrotreating and gas oil hydrotreating, all favorable towards gas oil processing," he said. "Also, operations of a gas oil hydrotreater are less complex.

"But the big issue is overall plant processing and resulting plant profitability," he said. "The impact of FCC feed hydrotreating is significant on the total plant operation. FCC feed hydrotreating has a significant improvement in FCC product yields, product selectivity, and leads to an improvement in overall volume gain for the refinery."

Refiners have conducted unit test runs to evaluate a unit's potential for processing ULSD. Test runs on ULSD units also allow refiners to gather steady-state data for the calibration of kinetic hydrotreating models. Once calibrated, these models can help predict required operating changes necessary for different feedstocks, as well as ULSD properties, such as cetane, aromatics, and gravity.

Kinetic models indicate that refiners are likely to encounter cetane and aromatics constraints at end-of-run conditions, according to Cima. Reduced catalyst activity and higher operating temperatures at end-of-run lowers aromatics saturation, which results in a higher product aromatics content, lower API gravity, and a lower product cetane index.

Refiners should try to adjust the feedstock mix to ensure that they can meet cetane and aromatics specifications without using cetane improvers or further product blending.

Many units in USLD operation attempt to maintain a stable feed composition to minimize sulfur product excursions due to feed rate and feed quality variations, according to Cima. The relative importance of feed composition stability in ULSD operations depends on whether the hydroprocessing unit can adjust operations to maintain stable hydrotreating reactor conditions.

Tight control of hydrogen partial pressure, weighted average bed temperature, feed gas:feed ratio, and heater outlet dewpoint margin is crucial to ensure that desired desulfurization levels are achieved, according to Cima.

"Units equipped with advanced process multivariable controls are ideally suited to stabilize ULSD operations providing effective disturbance rejection for feed composition changes," he said. "Disturbances in makeup hydrogen purity and pressure, feedstock temperature will also have an impact on ULSD operations."

A few refiners have added new FCC feed hydrotreaters that also process FCC light cycle oil, according to Palmer.

"This approach lowers the cat gasoline sulfur level to the extent that the refinery pool meets EPA requirements for low-sulfur gasoline," he said. "Removing the light cycle oil from the existing diesel hydrotreater minimizes the revamp scope for ULSD. A light distillate cut from the cat feed hydrotreater fractionator can be blended directly into the ULSD pool."

Many refiners have installed FCC heavy naphtha hydrotreaters in the downstream gas plant. New hydrotreating processes using catalytic distillation have been successful in many applications.

One other issue associated with ULSD hydrotreating is the increased production of ammonia, according to Palmer.

"The nitrogen level in ULSD is as low as sulfur, which means that more NH3 ends up in the diesel hydrotreater effluent wash water," he said. "This [negatively] impacts the capacity of refinery sour water stripping and the recovered ammonia adversely affects the sulfur plant capacity."

Catalyst changes

Catalyst manufacturers are developing more active, second-generation catalysts. Because the new catalysts have not been used as much, they present a potential risk during scale-up and commercialization, according to Sayles.

"Low-pressure hydrotreater units revamped using high activity catalysts are at greater technology risk for producing less than 10 ppm (wt) sulfur diesel," he said.

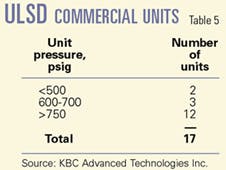

Table 5 shows the number of hydrotreaters that have produced 10-ppm (wt) ULSD at various pressure levels and deactivation rates of 2-3° F./ month.7

Catalyst demand is predicted to increase at least 3%/year in 2003-07. A potential risk factor is that cobalt, molybdenum, nickel, and palladium price increases and potential short-term metal availability problems may occur. These potential cost increases will raise ULSD production costs.

Hydrogen

Hydrogen is the highest operating cost in ULSD production. Sulfur removal for ULSD, however, accounts for only a small fraction of the total hydrogen demand. The higher severities in hydrotreaters also remove nitrogen, saturates, and some aromatics.

Refiners that install additional hydrotreating capacity must, therefore, expand existing hydrogen capacity or build grassroots capacity to meet the additional demand. This further increases the capital they must spend to meet clean-fuels regulations.

Due to the high prices for natural gas, any new hydrogen capacity often has a low return on investment. Some refiners may choose to purchase hydrogen from third parties to mitigate the risk of building a new unit.

"Evaluation of the economics of purchase vs. generation at the capital planning stage is significant," according to Cima. "The marginal cost for hydrogen supply to be used in evaluating purification projects against incremental hydrogen supply would include a similar capital element, whatever the ultimate supply selection.

"Once the hydrogen plant has been built, it is important to realize that the marginal operating cost of hydrogen supply (relative to value as fuel gas) could be only 25% of the design-phase cost, as the capital element is no longer included," Cima said. "The lower operating costs open up the scope for boosting purge rates and improving hydrogen partial pressure in reactors, and optimizing rather than minimizing hydrogen supply."

Sulfur

Although the regulations will reduce sulfur significantly in the fuels, the incremental bulk elemental sulfur production from producing ULSG and ULSD is small, less than 2% of the total sulfur produced in a refinery.

"Basically, the dynamics for elemental sulfur remain the same for the foreseeable future—low price and low demand," Sayles said.

References

1. "Summary and Analysis of the Highway Diesel Fuel 2003 Pre-Compliance Reports," US Environmental Protection Agency, October 2003, Washington, DC.

2. Brtko, K., and Schaefer, R.J., "Sulfur Content in Ultra Low Sulfur Diesel Fuels—Regulatory and Measurement Issues," presented at the 2003 NPRA Annual Meeting, Mar. 23-25, 2003, San Antonio.

3. Commission of European Communities, Directive of the European Parliament and Council on the quality of petrol and diesel fuels and amending Directive 98/70/EC, 2001.

4. Sapre, A., "Advanced Hydroprocessing Technology," presented to the 4th European Fuels Conference, Mar. 17-19, 2003, Rome.

5. Torrisi, S.P., and Gunter, P.M., "Key Fundamentals of Ultra-Low Sulfur Diesel Production: The Four C's," presented to the 2004 NPRA Annual Meeting, Mar. 21-23, 2004, San Antonio.

6. Gosling, C., Gatan, R., Cavana, A., and Molinari, D., "The Role of Oxidative Desulfurization in an Effective ULSD Strategy," presented to the 2004 NPRA Annual Meeting, Mar. 21-23, 2004, San Antonio.

7. Patel, R.H., Low, G.G., and Knudsen, K.G., "How are Refiners Meeting the Ultra Low Sulfur Diesel Challenge?," presented to the 2003 NPRA Annual Meeting, Mar. 23-25, 2003, San Antonio.