Myriad Maverick basin prospects challenge San Antonio independent

With half a basin to explore and exploit, Exploration Co. of San Antonio is probably not too worried about a lack of geologic opportunities.

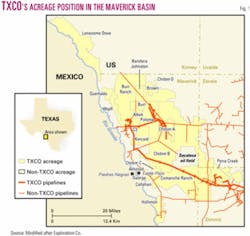

The company, formed in 1989, is unlocking hydrocarbons in the Maverick basin east and north of Eagle Pass in Southwest Texas on more than 500,000 acres, 8.5 times its holding in 1997.

If one multiples that surface area by the number of prospective formations below, the result is a spread of 1.4 million acres.

The company has had better than an 85% drilling success rate the last 5 years. Its working interest averages more than 85%, and it is still acquiring acreage.

Even with the largest capital expenditure programs in its history the past 2 years and six rigs working at mid-September, the company is hard pressed to examine all possibilities. More than 20 zones in Maverick's formations are prospective in adjoining basins.

The multipay operation involves low permeability oil and gas formations with relatively low but mostly profitable initial flow rates and coalbed methane pilot testing. Horizontal drilling is employed in several formations.

The company's net production from the basin was 1,270 b/d of oil and 10.6 MMcfd of gas as of Sept. 10, up 20% since June 30.

null

The company attributes much of its geoscience success to interpretation of 3D seismic data, which now cover practically all of its holdings. It has identified well over 1,000 drilling prospects overall.

Expanding to the northwest, TXCO in July acquired a 75% working interest in seismic options on 62,000 gross acres on the Quemado and Lonesome Dove prospects in Maverick, Kinney, and Val Verde counties with lease purchase options. The parcels are adjacent to the Burr and Wipff leases (Fig. 1).

TXCO acquired the 12,200-acre Hollimon lease, prospective for the same plays, along the Rio Grande south of its main acreage block in March 2004.

Exploration Co. ranked 86 in 2003 on the OGJ 200 list of public US oil and gas companies, although in a number of individual categories it ranked somewhat higher (OGJ, Sept. 13, 2004, p. 28). Its field operations are a mix of 100% operated, shared interests, and carried interests.

Maverick basin

Maverick is a small carbonate basin in proximity to the Gulf Coast basin and geologically associated to the East Texas basin.

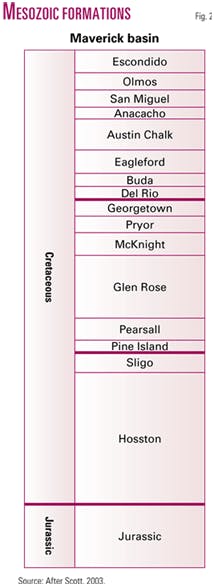

Extending into Mexico, it occupies parts of Maverick, Zavala, and Dimmit counties in Texas. The basin has 20,000 ft or more of sedimentary rock, with at least 5,000 ft of uppermost Jurassic underlying 15,000 ft of Cretaceous (Fig. 2).

The Chittim anticline is a large regional structure in the area under which hydrocarbons have been found in at least 14 horizons since the 1930s. TXCO is pursuing seven plays at the moment.

The largest and most productive Glen Rose reef drilled to date in the Chittim (5600) field dates to 1931. It has produced more than 30 bcf of gas from the 960-acre reef. On the oil side, a nonoperated well on the Comanche Ranch flowed 5,000 bbl of oil to pits in 24 hr in 2002 from the Upper Glen Rose (porosity interval).

The company has been acquiring 3D seismic data in the basin since 1993 and now holds 3D data over more than 95% of its acreage there.

TXCO has also established or acquired production in the Georgetown, San Miguel, and Escondido formations and is evaluating Jurassic formations, the deeper part of the Cretaceous section, and Texas' first coalbed methane, in shallow Olmos sands.

The company booked 2.1 million bbl of oil and 15.6 bcf of gas proved reserves as of yearend 2003. This includes mainly Glen Rose oil and gas, San Miguel oil, Georgetown oil and gas, and Escondido gas. The reserves grew 3.5 times since mid-2001 and are slightly biased toward gas.

Glen Rose porosity

TXCO identified a 3,800-acre prospective area and estimated more than 100 million bbl of oil in place in the Glen Rose porosity interval on an initial 850-acre feature that contains the high-flowing 2002 discovery.

Operated by private Saxet Energy Ltd., Houston, the well's attention-getting flow came after a drilling break at 6,521-53 ft. The discovery opened Comanche Halsell (6500) field and was granted a 2,200 b/d allowable to produce from a highly fractured porosity interval.

The zone produces 40° gravity oil, copious amounts of water, and no gas.

By yearend 2003, Saxet had drilled 27 wells, with 17 on production over a 20 sq mile area, with Comanche-Halsell field averaging 1,317 b/d of oil and 9,195 b/d of water.

Five 2003 horizontal wells drilled 50-150 ft above the porosity interval and only intersecting those faults that extended above the zone did not respond as expected. Production declined additionally because no wells were drilled in the first half of 2004 due to corporate restructuring at Saxet.

A strong water drive is associated with the oil production through a complex fracture system that extends below the Glen Rose porosity zone. Due to the lack of gas in the Glen Rose oil, the water drive is necessary to effectively drive the oil from the porosity zone.

TXCO's engineers reasoned that drilling horizontal wells parallel to the fracture orientation and limiting production rates would maximize oil production and minimize water encroachment. The first well drilled using that technique seemed to validate the idea.

CMR Energy LP, Houston, succeeded Saxet, operating partner since early 2001, in early 2004. The budget called for as many as four new wells and four reentries this year subject to a fall hunting season moratorium, with the first spudded in mid-July.

That well, Comanche 239-H, tested at rates as high as 1,920 b/d of oil, no water, on a 24/64 in. choke with 580 psi flowing tubing pressure. It went on production Aug. 31 at a restricted 394 b/d with 800 psi FTP to minimize potential water inflow.

Petrohawk Energy Corp., Houston, is acting operator under contract to CMR.

Glen Rose porosity wells pay out in as little as 2-3 months.

TXCO in late 2003 redrilled the Comanche 2-2 Glen Rose porosity well so that the horizontal section paralleled, rather than crossed, potentially water-productive faults while staying in the porosity interval. It went on production in early October at 750 b/d of water-free oil.

Seismic coherency processing has helped pinpoint fracture patterns and aided drillers in keeping horizontal well bores in the oil zone and away from underlying water. At least one well was recompleted to Georgetown when Glen Rose didn't pan out.

Still, TXCO said, the primary recovery factor appears low.

Glen Rose shoal/reef

This play has been TXCO's bread and butter since it discovered Prickly Pear (Glen Rose) field on the Paloma lease in 1994.

The company discovered a horizontal Glen Rose shoal play on part of its Chittim A lease. With 47-62% working interest, TXCO drills and completes the wells, and then farmor AROC-Texas Inc. operates them.

Chittim East (Rodessa 5300) field produced a gross 9.7 MMcfd and 58 b/d of oil from 25 wells at the end of 2003, and cumulative production is 4.8 bcf since horizontal drilling started.

A good vertical Glen Rose shoal well makes 100 Mcfd, but each 3,000-4,000 ft horizontal leg can produce 1-2 MMcfd.

TXCO has identified more than 200 prospects in the Glen Rose porosity and shoal/reef plays. The 3D seismic data show hundreds of reefs, but interpreters cannot discern whether a reef contains gas or water. This problem may never be solved, writes Robert J. Scott, chief geologist.

"Carbonates are high-velocity rocks and the contrast in velocity between gas and water-filled porosity is a small percentage of total rock velocity and very difficult to measure," Scott said in a geological article.

In April 2004 TXCO found gas with a horizontal well in a second Glen Rose shoal 180 ft above the Glen Rose C shoal, from which all of its other shoal wells produce.

TXCO spudded six reef wells, including five on the 100% owned Burr/Wipff prospect, in mid-2004.

Net Glen Rose reef production was 1.7 MMcfd and 22 b/d at Aug. 31.

Completed horizontal well costs are $750,000 on the shoal/reef wells on the Paloma and Chittim northern leases and $1 million on the Comanche southern porosity leases. A shoal/reef well targets 2.5 bcfe recoverable and a porosity well targets 100,000-400,000 bbl. Cumulative oil production from all Glen Rose plays exceeds 1.5 million bbl.

The reefs range as large as 640 acres and produce out in 6-7 years.

TXCO acquired working interests in seven Glen Rose and Georgetown producing wells and 1,817 gross acres adjoining its Chittim and Paloma leases in March 2004 from EXCO Resources Inc., Dallas, for $990,000.

Georgetown fault play

The fractured Georgetown formation, containing gas and oil, represents the largest share of the company's 2004 drilling program at 25 wells planned.

TXCO identified an oil producing province in the Georgetown on its northern acreage with completion of five oil wells on the Briscoe-Saner lease.

The formation produces gas with minor condensate to the south on the Comanche Ranch/Pena Creek leases, and the formation is believed to underlie the company's entire Maverick acreage position.

Gross Georgetown production was 9.1 MMcfed at yearend 2003 from 27 wells. Net Georgetown production was 3.9 MMcfd of gas and 230 b/d as of Aug. 31 even though pipeline limits temporarily affected two wells.

One well drilling at midyear tested at 3.3 MMcfd, and a reentry tested at 456 b/d.

TXCO is using 3D seismic data and advanced coherence processing techniques to identify fractures in the Georgetown, 10-15 ft thick. As of mid-June it began a 32 sq mile 3D survey east of Pena Creek field. Horizontal wells are then drilled to cross multiple faults.

The seismic techniques "changed the Georgetown from a hit-or-miss target to a consistent producer," said TXCO president and CEO James E. Sigmon.

The Georgetown wells target 50,000-100,000 bbl of oil or 2 bcf of gas at an estimated $630,000-785,000/well. The company has identified several hundred drillable locations.

Reserves are more difficult to predict in fractured formations than in sandstones, but outside engineers assigned 1.3 bcfe/well of proved reserves to the first three TXCO-operated Georgetown gas wells. The company believes initial reserves will increase as production history accrues.

San Miguel oil

TXCO acquired Pena Creek oil field in Dimmit County effective Apr. 1, 2002.

The field, with 94 producing wells, 94 injection wells, and 28 shut-in wells, was producing 265 b/d of oil from San Miguel formation at the end of that year. Estimated proved reserves were 674,000 bbl net to TXCO.

A 3D seismic survey acquired in late 2002 showed numerous drillable Glen Rose locations and considerable infill potential in San Miguel.

The company expects further oil recovery by reconfiguring the injection wells, for which $500,000 was included in the 2004 budget, and was testing the economic potential of two overlying San Miguel sands.

Yearend 2003 production averaged 463 b/d of oil and 1,404 b/d of water and 400 b/d in September.

Severe weather and flooding interrupted operations several times in the first half of 2004 at Pena Creek. Since then six new wells were drilled, more wells were being returned to production, and a water injection optimization program continued.

TXCO's working interest is 100% at Pena Creek, where a completed well costs $250,000 to about 1,800 ft.

ConocoPhillips Co.'s Sacatosa field just northwest of Pena Creek field has produced more than 40 million bbl of oil on 10-acre spacing. Pena Creek has produced less than 9 million bbl on 40-acre spacing.

Jurassic-deep Cretaceous

This is the only play TXCO considers to be high risk, and it holds Jurassic rights on more than 300,000 acres.

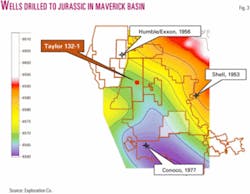

Blue Star Oil & Gas Ltd., private Dallas concern and partner since 1999, spudded the Taylor 132-1 on TXCO's Paloma lease on Mar. 27, 2003, and drilled to TD 22,400 ft at a reported cost that exceeded $14 million.

The location was identified from a 426 sq mile 3D seismic survey designed by Blue Star. The survey area covered 37,000 acres of TXCO leases and Blue Star's 190,000-acre Chittim lease. Blue Star carried the costs of TXCO's 62.5% interest in the Taylor well to earn a 25% interest in deep rights below the Sligo in 50,000 acres on the Paloma and Kincaid leases.

The well cut more than 5,300 ft of Jurassic rocks and is believed to be the first to have penetrated Jurassic in the basin. Blue Star tested numerous horizons below 18,000 ft and only one above 18,000 ft.

Jurassic formations below 16,800 ft flowed noncommercial volumes of rich, high-btu gas, and TXCO assumed operation of the well in February 2004, perforating Upper Jurassic at 14,942-15,140 ft and 15,292-400 ft. The lower zone had gas shows but very low permeability. The upper zone produced salt water with better porosity and permeability.

The Taylor 132-1, where TXCO's interest is 62.5%, produced at rates as high as 900 Mcfd from Sligo through temporary production facilities, but company engineers determined that stimulation would not enhance production.

The company plans to perforate and test the overlying Pearsall formation. Sligo and Pearsall lie at 7,000-8,000 ft.

Blue Star also permitted to 20,200 ft the McKinney 106-1 on the Paloma lease. It retains the right to carry TXCO's interest to earn a further 25% interest in the deep rights.

Three earlier deep wells drilled by majors TDd short of a rift system which on today's 3D seismic data appears to contain half grabens filled with sediments (Fig. 3). They are:

- Shell 1 Plumly, in Zavala County just east of the Chittim B lease, 1953, TD 14,500 ft in clastics;

- Humble 1 Bandera County School Lands, in Maverick County on the present-day Bandera Johnston lease, 1956, TD 13,870 ft, with metamorphics topped at 13,450 ft; and

- Conoco 1 Halsell Foundation, in Maverick County on the western Comanche Ranch, 1971, TD 15,250 ft.

Olmos CBM pilot

TXCO established the first CBM production in Texas in April 2001 at the Farias 5-110 well, designated as Sacatosa (CBM Olmos) field.

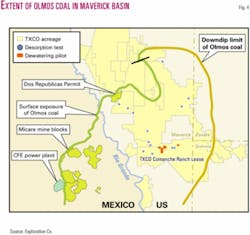

The coals are present on more than 250,000 acres on TXCO's Comanche and Chittim leases (Fig. 4).

The US Geological Survey determined coal rank as high-volatile C bituminous, and the coals were found to contain as much as 350 cf/ton of gas.

Vertical wells have produced gas at low rates even when drilled with air, and TXCO plans to reenter two wells this year to attempt horizontal recompletions using multiple short-radius lateral technology.

A completed well costs $150,000 to about 1,500 ft.

TXCO places gross unrisked potential at 1 tcf and has 36 wells dewatering. The wells averaged a combined 208 Mcfd of gas and 1,837 b/d of water at the end of 2003 compared with 144 Mcfd and 1,975 b/d at the end of 2002.

Water produced from the coals is used to waterflood the San Miguel oil formation in an undeveloped south extension area of Sacatosa field contiguous with TXCO's coalbed pilots.

TXCO began to pursue the play after an engineer with Petroleos Mexicanos SA told of having to drill wells to degasify coal mines on the Mexican side of the basin. Most Texas coals are lignites unsuited to desorb gas at commercial rates.

Escondido gas

Gas in shallow Escondido at 1,200-1,900 ft is a low risk play for TXCO along with the San Miguel oil and Glen Rose shoal plays.

Escondido development will likely accelerate as pipeline infrastructure grows to serve gas produced from the Georgetown. Escondido wells that would have been economically marginal by themselves will become profitable because of the Georgetown pipeline infrastructure, the company reckons.

TXCO drilled five Escondido wells in 2003 on the east side of the Comanche Ranch. The three successful wells totaled 132 Mcfd at Dec. 31, 2003.

At the end of 2003, Escondido production totaled 397 Mcfd, compared with 98 Mcfd at the end of 2002.

The company holds 100% interest in the Escondido play but budgeted no drilling to Escondido in 2004.

Transportation

Most of the oil is trucked, and TXCO has three connections that allow it great flexibility in gas sales.

It can sell gas northwest into West Texas or east into South Texas, and since late 2003 it has been delivering gas to Piedras Negras, Mexico, via a connection on the Comanche Ranch to the Tidelands/Reef International LLC system.

Reef's pipeline transits the Rio Grande River east of Eagle Pass, Tex.

The company controls 80 miles of pipeline in the Maverick basin, gathering its own and its partners' gas. Deliveries are 22-23 MMcfd, including about 10 MMcfd net to TXCO. Capacity of 35 MMcfd can be expanded to 100 MMcfd.