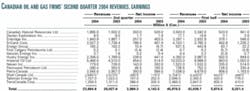

Weakened US dollar dampens Canadian earnings

As the US dollar weakened in relation to the Canadian dollar, many firms based in Canada reported lower first half and second quarter earnings than in comparable periods a year earlier. Some companies, however, overcame currency losses with increased production volumes and stronger refining margins.

Collectively, the 16 Canadian producers, transporters, and service and supply companies reported here earned 30% less during the second quarter on 18% stronger revenues compared with the same period a year ago.

All results are reported in Canadian dollars.

Shell Canada Ltd., Calgary, announced second quarter earnings of $285 million, up 63% from the same quarter of 2003. Gains from the Athabasca Oil Sands Project and strong refining margins more than offset increased exploration costs.

Shell Canada's oil sands segment earned $96 million in the second quarter. The operation lost $68 million in the same period last year, when the Athabasca Oil Sands Project began integrated operations. The project is a joint venture of Shell Canada, Chevron Canada Ltd., and Western Oil Sands LP.

Shell's share of production in the second quarter averaged 85,200 b/d of bitumen, more than double that of the same period in 2003. Total bitumen production in the second quarter was 141,900 b/d—92% of the design rate.

Imperial Oil Ltd., Toronto, citing currency losses, reported a second quarter earnings decline to $454 million from $514 million a year earlier.

Tim Hearn, chairman, president, and chief executive officer, said Imperial's operating performance remained strong through the second quarter.

"Excluding nonrecurring items, Imperial's second quarter and 6-month earnings were higher this year than in 2003, reflecting favorable market conditions and solid operating performance," he said. "Earnings would have been even higher without the effects of the Canadian dollar."

Nexen Inc., Calgary, reported a quarter of strong earnings driven by high commodity prices and attractive margins offset by a stronger Canadian dollar and lower production in Yemen, the US Gulf of Mexico, and Canada.

Nexen's operating costs increased 14% to $6.06/boe from those of the second quarter of 2003 due to higher water-handling and disposal costs and increased maintenance and workover activity in Yemen, as well as lower production and unplanned maintenance off Australia.

TransCanada Corp., Calgary, which focuses on natural gas transmission and power services, announced net income of $388 million, compared with $202 million for the 2003 second quarter. The increase reflected an after-tax gain of $15 million from sale of the ManChief and Curtis Palmer power plants to TransCanada Power LP.

TransCanada also recognized gains of $172 million from the removal of its obligation to fund the redemption of TransCanada Power LP units in 2017, as well as a reduction in ownership interest in TransCanada Power. The year-over-year increase in net income for the 6 months ended June 30, was also attributable to these gains.