Brazil round draws $220 million from 19 bidders for 154 blocks

Brazil's sixth oil and gas licensing round began under heavy stress for representatives of the 24 qualified companies due to an injunction of a supreme court justice that would have suspended concession holders' rights to the oil they find in exploration blocks.

As the round was starting, the president of the court, Nelson Jobim, suspended the injunction but said that the court's 11 members would meet in a plenary session at an undecided date to discuss the matter. The injunction was granted to Roberto Requião, governor of the southern state of Paraná, who argued that the round was unconstitutional (OGJ Online, Aug. 13, 2004).

"Since contracts will be signed in December of this year, and no one can predict what the court will decide, I feel that the licensing round should have been suspended," Wagner Victer, Rio de Janeiro's state petroleum, energy and shipbuilding secretary, told OGJ.

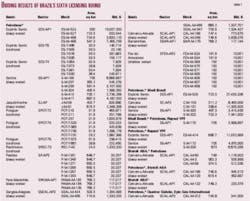

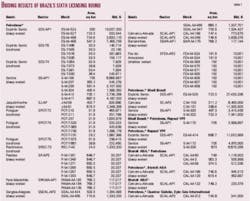

Despite this legal challenge, 19 companies paid a record high bonus totaling $220 million to acquire 154 of the 913 cell-blocks offered during the 2-day round (Table 1).

"This is by far the biggest sum obtained by the National Petroleum Agency (ANP) compared to the five previous rounds," said Sebastião do Rego Bastos, president of Brazil's regulatory agency. ANP calculated that the winning bidders committed to minimum expenditures of around $666 million through 2010.

"Brazilian rounds have rarely put up very impressive percentages in terms of acreage acquired vs. offered (Table 2). So this time, nearly 17%—154 blocks acquired out of 913 offered—is considered very good, and a big improvement over the 10% acquired last year, especially taking into account the number of less desirable blocks onshore and in frontier basins that were included in this year's round," reported the international consultancy Macleod Dixon.

Petrobras dominates

Brazil's state Petroleo Brasileiro SA (Petrobras) disbursed $145.6 million to secure 107 blocks of the total 154 acquired. Petrobras took 55 blocks alone and 52 more in partnerships, committing itself to invest $500 million in the next 2 years.

Francisco Nepomuceno, Petrobras' exploration and production executive-manager said, "Our strategy was to circle blocks acquired in round zero in 1998, the so-called blue blocks, to evaluate the discoveries we announced last year."

"Many companies committed themselves to local content percentages which despite being ideal are unattainable, not only in Brazil, but also abroad," said Elói Fernandez y Fernandez, president of the National Organization of Petroleum Industry (ONIP). One of the main tasks of the organization is to verify and report to ANP whether companies fulfill contracts.

After Petrobras, Petróleos de Portugal SA (Petrogal), Lisbon, won the largest number of concessions and also became the most frequent partner of Petrobras with joint ventures in 20 onshore blocks. The Portuguese company will operate 12. Petrogal's director Ricardo Peixoto said his company will invest $10 million over the next 2 years.

EnCana Corp., Calgary, which purchased 8 blocks, will invest $60 million. Petrobras, Royal Dutch/Shell, and Repsol YPF took 11 of the 21 blocks in the Santos basin. The area is in deep water, considered of high potential, and contains part of the blue blocks near the giant gas discovery on Block BS-500 announced by Petrobras in 2003.

Together and separately, Statoil ASA and Petrobras picked up 7 of the 13 cell-blocks offered in deep water in the Camamu-Almada basin. The bids varied from a high of $1.2 million to a low of $233,379.

Petrobras and Devon Energy Corp., Oklahoma City, mounted the biggest competition for the C-M-61 cell-block in the Campos Basin. Devon, with partners EnCana, Kerr-McGee Corp., and SK Corp., Seoul, won the block with a $9.5 million bonus. Petrobras-Repsol YPF offered more money but lost the bid because of lower points for domestic content.

The highest bonus was $27.4 million by the consortium Petrobras and Shell for the ES-M-525 block in the deepwater Espirito Santo basin, near where Petrobras found light oil last year.

Petrobras and Shell also took the C-M-103 cell-block for $6.4 million and Block C-M-151 for $11.3 million, both in the Campos basin.

The consortium led by Petrobras won areas disputed in the Camamu-Almada basin. Petrobras 60%, Queiroz Galvão Perfurações SA, Rio de Janeiro, 20%, and El Paso Corp. affiliate Epic Gas International 20% outbid EnCana for blocks CAL-M-312 and 372.

Synergy Group, Rio de Janeiro, 65% and PortSea Oil & Gas NL of Australia 35% took all blocks in the SPOT-T-5 sector of the Potiguar basin, outbidding Aurizônia Empreendimentos Ltda. and Arbi Petróleo Ltda., both of Rio de Janeiro, in four areas and Petrobras in two.

Small Brazilian companies took onshore areas in the northeast. This was the case of Aurizônia and Queiroz Galvão, which have already exploited oil in Brazil, plus newcomers such as W. Washington Empreendimentos e Participações Ltda., Sao Paolo, and Arbi Petróleo. Besides Petrobras, seven Brazilian companies won blocks, a record in these six rounds.

Legal hurdles

Besides the lawsuit filed by governor Requião, another two motions of unconstitutionality that will directly affect the oil sector are awaiting a decision of the supreme court. The court will analyze the Noel and Valentim laws, both approved by Rio de Janeiro's state legislature.

The Noel law calls for charging 19% ICMS tax over crude oil prices produced in Rio de Janeiro state. The state's crude oil output represents 80% of Brazil's total production. The Valentim law calls for an 18% tax on imported equipment to be used in the state.

João Carlos de Luca, president of the Brazilian Petroleum and Gas Institute (IBP) and president of Repsol-YPF in Brazil, told OGJ "that these laws [Valentim and Noel] have caused a sharp drop in investments because foreign companies do not know whether these laws are constitutional or not and whether they will be maintained by the supreme court."

Legal experts consulted by OGJ said that the Valentim law clashes directly with the federal law called Repetro that grants a tax exemption on imports of equipment for oil exploration and production and which the government recently extended to 2020 from 2007.