INGAA: Delaying US pipeline expansions will cost consumers billions

The US can ill afford persistent opposition to new pipelines and natural gas storage, a new report sponsored by the Interstate Natural Gas Association of America said last month(OGJ, july 26, 2004, p.7).

The study, authored by Arlington, Va.-based consultancy Energy and Environmental Analysis, predicts hefty energy bills for residential and industrial gas customers if construction delays spurred by local opposition or bureaucratic red tape continue plaguing industry efforts.

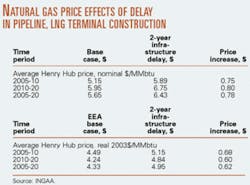

The INGAA report finds that a 2-year delay in natural gas infrastructure construction will cost US gas consumers more than $200 billion (in constant $2003) by 2020. With the Henry Hub price as a measure of the impact on gas prices, a 2-year delay in pipeline and LNG import terminal will increase US natural gas prices by an average of $0.62/MMbtu over 2005-20.

Natural gas supply, demand

INGAA anticipates that annual US natural gas consumption will rise to 30 tcf by the end of the next decade from the current 23 tcf level if gas supplies are developed. Where will the new gas come from?

INGAA says gas produced in such traditional basins as the Midcontinent, onshore Louisiana, and the shallow waters of the Gulf of Mexico will continue to be important sources of supply. But to meet growing demand, gas from frontier regions and LNG imports will be needed.

By 2020, volumes from traditional basins are likely to decline by more than 3 tcf/year to 16.2 tcf/year, representing only 61% of North American production. INGAA lists as "frontier" supplies the Gulf of Mexico deepwater, unconventional gas in the US and Canadian Rockies, Arctic gas, and Eastern Canada gas.

LNG will also play a key role in managing demand. By 2020, US LNG imports could be more than 6,600 bcf/year, nearly a 30-fold increase from 2002. LNG is competitive with North American production at prices ranging from $3.50 to $4.00/Mcf, depending on the distance from the liquefaction plant to the regasification terminal, INGAA says.

To bring gas from new supply regions and from new LNG terminals, pipeline infrastructure will have to be built.

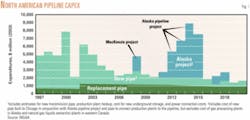

"If the US market is to satisfy demand in an efficient manner by the end of the next decade, significant pipeline and storage infrastructure investment, about $61 billion in constant 2003 dollars, must be made in both the US and Canada," the study says. Of that total, $19 billion of investment will be needed just to maintain existing pipeline capacity. Nearly $42 billion will be needed for new pipeline and storage projects, the INGAA study predicts. Of that $42 billion, $18 billion will be associated with the Alaska and MacKenzie Delta projects to access Arctic gas.

Preventing delays

INGAA offers regulators and industry four specific options to help avoid what could be costly delays to the needed expansion of the US natural gas delivery system.

First, regulators at state and federal levels should consider actions that attract capital to pipeline and storage projects. Specifically, state utility regulators should conduct a review of existing rules and policies that now discourage state-regulated local distribution companies from entering into the long-term capacity contracts for transportation and storage that are necessary to underpin new infrastructure projects.

"State regulation should recognize the public benefit of capacity into a market and create a cost recovery mechanism that promotes the construction of sufficient facilities to allow for incremental supplies of gas to be delivered during peak demand periods," says the INGAA study.

Additionally, federal and state regulators should consider electricity resource planning that reflects the reliability benefits of firm pipeline and storage capacity to gas-fired generation as well as alternative fuel capability.

Second, the gas industry should work with state and local officials to close the information gap on energy infrastructure projects. As part of this, public education and outreach efforts should include information regarding details of the construction process, the ultimate (post-construction) impacts on the environment and safety as well as the ongoing direct and indirect benefits of building new infrastructure.

Third, federal and state regulators should conduct in-depth regional analyses that explicitly consider the impact on consumers and economic development of decisions to prohibit or delay infrastructure. Those economic analyses in turn should be incorporated in federal, state, and local permitting proceedings, according to the study.

Fourth, homeland security and safety concerns, particularly regarding LNG, should be met with a balanced and informed evaluation of risk, study authors say. Risk should be evaluated in terms of the overall cost to citizens and the possible economic failures that could result if no one builds the natural gas infrastructure required to meet growing energy demand.

"There are many elements of modern life that present manageable risk but almost none that can be described as risk-free," the report says.