Smaller field developments off UK, Norway dominate activity off Northwest Europe

Upsides are evident even as Western Europe's offshore basins mature.

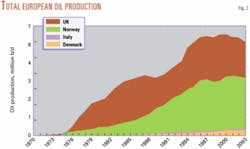

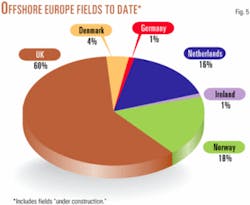

Western Europe is currently the world's seventh largest oil producer, and the majority comes from offshore. Although a number of European countries—Denmark, Germany, Ireland, and The Netherlands—produce from offshore, the region tends to be dominated by the activity of Norway and the UK, which possessed almost 80% of Western Europe's total original offshore oil reserves.

After years of intense exploration and field development activity, total oil production peaked in 1999. To date nearly 500 offshore fields have been developed or are under construction off Western Europe, of which some 45 have been depleted.

Although considerable volumes of oil and gas remain, new discoveries and field developments are smaller. As a direct result the oil majors are exiting the region to chase the billion barrel prospects of the new deepwater areas of the world.

One upside is that the new, smaller players that are entering the patch bring with them management methods better suited to developing small fields and the depleting old fields, and host governments are adapting their offerings to make them more attractive to this new breed.

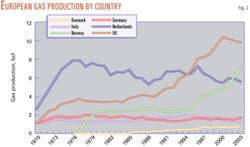

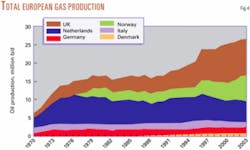

Norway, Netherlands, and the UK hold 80% of remaining gas reserves and resources, mainly in the North Sea. Netherlands also has a substantial onshore element. The region has now produced a 10% share of global cumulative gas but has only a 3% share in remaining reserves and resources. Despite this, it is currently third in global output, producing 11% of global gas supplies (Figs. 1-4).

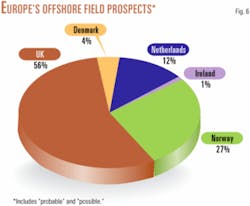

Norway and the UK together account for 78% of all fields developed to date or presently under construction off Western Europe and 83% of prospective offshore field developments (Figs. 5 and 6).

During recent years this organization has contributed a series of overview articles on the prospects for Europe's upstream oil and gas industry to coincide with the major European oil and gas conferences, which alternate between the two oil capitals of Aberdeen, Scotland, and Stavanger, Norway. These two countries form the focus of the article that follows.

The previous articles have shown the strong decline in the size of new offshore fields (OGJ, Aug. 19, 2002, p. 22; Aug. 27, 2001, p. 58; Aug. 14, 2000, p. 84). Therefore we do not repeat that analysis.

UK: mature but attractive

UK southern North Sea natural gas production ramped up rapidly in the late 1960s-early 1970s, reaching a plateau of some 3.5 bcf in 1974.

This held for nearly a decade before a new surge of production from more northern waters drove output to a peak of 10.5 bcf in 2000.

Natural gas production is now in decline, having averaged 9.9 bcf in 2003. After exporting natural gas for some years, it is widely forecast that the UK will become a net importer in 2005-06.

UK offshore oil production rapidly climbed from the mid-1970s. In 1985-86 production peaked at 2.7 million b/d, then fell dramatically to some 1.9 million b/d following the repercussions of the Piper Alpha tragedy. It took until 1994 for production to regain its former levels, and the peak of 2.9 million b/d occurred in 1999. In 2003 production had fallen to 2.3 million b/d—the begging of the inevitable long-term decline, clearly defining the UK as a mature sector, and the country is expected to become a net importer of oil in 2007-08.

Existing fields are now producing an average of 15,000 boe/d, half the average rate of a decade ago. In the same period, the total number of oil and-or gas fields in operation has doubled to more than 250.

There remain over 250 undeveloped discoveries on the UKCS, of which some 150 are within 10 km of existing infrastructure and few are more than 50 km away. Of these potential new plays technological uncertainties need to be addressed (including flow assurance issues), but such numbers support the suggestion that at least as much oil and gas are left to produce as have already been produced.

The UK's 21st licensing round saw 88 licenses awarded to 62 companies, signaling that the industry still believes there to be untapped potential and that it is increasingly the independent operators who seem to hold the key to the prospects of the UK sector.

More than 550 million bbl of reserves changed ownership in 2003, increasing the diversity of players in the basin.

Most significantly, in the 2003 Robertson Research international survey of oil and gas company opinion on the attractiveness of 147 countries, the UK took top place as most favored for new ventures.

The UK Offshore Operators Association stated that UK indigenous crude oil and natural gas production was valued at £23 billion ($42 billion) in 2003 or some 2.5% of gross value added of the total economy.

Norway: gas growth

Norway's remaining gas reserves and resources are the largest in Western Europe, representing about 42% of the total, and its production is now the seventh highest in the world.

Consuming only 5% of its own production, Norway is the third largest oil exporter in the world. Norway contributes to 2% of the world's gas production and will, by 2005, be one of the five largest gas producing nations.

Development of the Norwegian sector has been characterized by a much slower and "managed" approach to development of its reserves. The fundamental difference is that in the early 1970s the UK with a population of some 55 million was an economic basket case and desperately needed the oil revenues. Norway with a population of 4 million could afford to take a long-term view.

Norwegian oil production probably peaked in 2000 at 3.4 million b/d and has since declined slightly to 3.3 million b/d.

Natural gas, however, continues its growth. After Norway produced at 2.2-2.4 bcf from 1980, in 1996 new pipelines allowed exports to mainland Europe and production ramped up to its present level of 6.3 bcf. The UK now also offers a major long-term market for Norwegian gas with a deal signed between both countries. Statoil's Snøhvit development will create Europe's first LNG export facility.

Overall, Norway's combined oil and gas production is relatively stable.

Exploration was low in 2003, with only 22 exploration wells drilled. Of these, 14 were wildcats and 8 appraisals. Eleven new discoveries were nevertheless made. Preliminary calculations from the Norwegian Petroleum Directorate indicate that discoveries replaced about 40% of production in 2003.

Norway also set a record for announcing and awarding new exploration acreage in 2003. In all, 30 production licenses were awarded in the North and Norwegian Seas.

In June 2004, it was announced that in connection with the 18th Licensing Round, 16 companies will be offered participating interests in 16 new production licences in a total of 46 blocks or partial blocks. The NPD stated that it was very satisfied with the round so far, that interest had been high, and that there were more applications than expected.

One of the most interesting situations is how the two main players Statoil and Hydro will develop in future years.

Statoil is Norway's biggest operator, producing at about 920,000 boe/d in 2003. As the Norwegian sector reaches maturity, the future will undoubtedly lie in Statoil becoming a much more international player.

Hydro is operating 15 oil and gas installations, and its production in 2003 averaged 530,000 boe/d, placing it among the world's largest offshore oil and gas companies.

In common with the UK, Norway is attracting new players. In 2003, nine companies were prequalified as licensees or operators: Paladin (UK), Maersk (Denmark), OER (Norway), Talisman (Canada), Anadarko (US), Rhurgas (Germany), BG (UK) and Gaz de France (France).

Oil and gas have a massive impact on Norway's economy. The industry contributed 20% of Norway's gross domestic product in 2002, 23% of its investment, and 43% of its total exports while employing some 1.7% of its population. As a result, the country enjoys a large trade surplus.

While the UK had to use its oil and gas revenues to effect a 20-year economic turnaround, Norway has been able expand its extensive social welfare system.

The Norwegian Government Petroleum Fund, formally established in 1990, has the dual purpose of smoothing out spending of oil revenues and to finance future expenditures associated with the aging of the population. It also serves as a fiscal management tool to ensure transparency in the use of petroleum revenues.

The fund is invested in financial instruments abroad, where 60% of the portfolio is allocated to fixed income instruments and 40% equities. Norges Bank is responsible for management on behalf of the Ministry of Finance. The fund reached $110 billion in 2003.

Opex to dominate spending

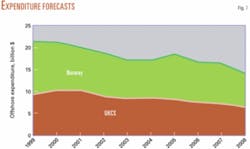

We estimate that in 2003 the UK and Norway each spent about $8.5 billion offshore (Fig. 7). One of the major features in the increasing levels of this is operational expenditure (opex) as offshore Europe becomes a mature domain.

We anticipate total UK sector spending will gradually decline, falling to an anticipated $6.6 billion in 2008. Opex accounted for some $4.3 billion in 2003, about 51% of total spending. We expect this proportion to grow to reach 58% by 2008, although the total is also forecast to decline over the period.

Exploration expenditure is expected to fall by 35%, while field abandonment expenditure remains insignificant as the bulk of the activity is not expected to arrive in this decade.

We anticipate that Norway's opex will also account for an increasing share of the annual total, growing from 41% in 1999 to 66% in 2008. A number of large offshore projects will result in a growth in capex to about $4.5 billion in 2005 before reducing again through 2008.

Again, decommissioning activity is not expected to begin in earnest until after 2008. The total offshore expenditure of the two countries is expected to decline from some $20 billion in the early years of this decade to $14 billion in 2008.

Some Norwegian projects

Alvheim. Operator Marathon is now looking at a stand-alone development for Alvheim and the nearby Klegg find and an FPSO or fixed platform now form the most likely solutions for this 80,000 b/d project. Marathon plans to drill 12-15 development wells including two for water injection in 2005 and has set a deadline for first oil in 2006.

Brage. Production was scheduled to cease in 2005. However, operator Norsk Hydro is hoping that improved recovery schemes and debottlenecking measures could push the cessation date beyond 2010.

Ekofisk. ConocoPhillips is to drill four new wells. A new platform is to be installed, and the steel jacket will be remotely powered and operated from the 2/4J platform and equipped with 30 well slots. The "Ekofisk Growth" project also includes a number of modifications on Ekofisk 2/4K, Eldfisk 2/7A, Aldfisk 2/7 FTP, and Eldfisk 2/7B.

Fram West. This field came on stream in September 2003, producing in 360 m of water with two subsea well templates tied back to the Troll C platform. The rest of the Fram structure (F+C) may be developed later, and other potential discoveries in the Sogn area may also be tied in.

Frigg. The field is due to stop producing in 2004, and facilities will be dismantled and removed. The $487 million decommissioning project will be biggest removal operation ever on the Norwegian continental shelf and is expected to take years, with all the steel topsides and jackets to be removed.

Klegg. Norsk Hydro plans rapid development of Klegg field, discovered in 2003. Norsk Hydro hopes to submit the Plan for Development and Operation (PDO) for Klegg (PL036) by the end of 2004, aiming for first oil in 2006. The field, estimated to contain 120 million bbl of oil, is likely to be developed via a subsea installation linked to the nearby Heimdal platform or to other fields in the area. Reports suggest a total development cost will be in the order of $650 million.

Kristin. Due on stream in the summer of 2005, Kristin will produce from 12 subsea wells via a floating production unit. Samsung Heavy Industries is contracted to provide the hull, with Aker Stord fabricating the topsides with process plant and utilities. Kværner Oilfield Products is to provide subsea production systems. Allseas will install a 30-km gas export loop to and from the Åsgard Transport gas trunkline, and Coflexip Stena Offshore will place 39 km of flow lines to tie the four subsea templates back to the Kristin floater. An oil export line roughly 23 km long will also be laid to connect with Statoil's Åsgard C storage vessel.

Ormen Lange. This giant field lies in 800-1,100 m of water in the Norwegian Sea, some 140 km northwest of Kristiansund. It extends over four contiguous blocks (6305/4-5 and 6305/7-8). Discovered in 1997, it is Norway's deepest water development to date and the second largest gas discovery ever made in the nation's waters, surpassed only by the massive Troll field in the shallower waters of the North Sea. The field's reservoir lies around 1,900 m below the seabed in an area covering 350 sq km.

No surface installations are to be visible. Instead, two 120-km, 30-in. pipelines will transport the unprocessed well stream from Ormen Lange field to the Nyhamna Terminal in mid-Norway. From here gas will be exported via a 1,200-km, 42-in. export pipeline to Easington, UK. Production is currently planned for October 2007. The planned gas export volume to England is about 20% of Norway's gas exports and 20% of UK gas demand.

Oseberg South. Technip-Coflexip has been awarded a subsea tieback contract worth $25.7 million on Norsk Hydro's Oseberg South field. The EPCI contract is for flow lines and umbilicals that will run from the J structure of the North Sea field to the Oseberg South platform. A subsea template will accommodate four wells (two production and two water injection) and is expected to be installed in the summer of 2004. The structure is expected to come on stream late in 2004.

Snøhvit. Gas from Snøhvit, Albatross, and Askeladd fields in the Barents Sea will be fed via a 160-km pipeline to a gas liquefaction plant installed at Melkøya Island, near Hammerfest, Norway. Around 70 shipments (5.67 billion cu m) of LNG are expected each year to markets in Europe and the US. In addition to the LNG exports, 747,000 tonnes of condensate and 247,000 tonnes of LPG will also be produced.

Statoil's recent review of the progress and economics indicated that the original NOK 39.5 billion costs cited in the PDO could rise by NOK 4-6 billion to reach NOK 49-51 billion ($7.2-7.5 billion). There is a risk that regular gas deliveries could be delayed 6-12 months, and in this event Statoil will ensure that the buyers of the gas receive their deliveries from other sources. The Snøhvit project's profitability continues to meet Statoil's requirements, but its robustness has been weakened.

Troll A. A scheme to power compressors on Troll A with electricity generated on land is moving forward after the Troll licensees awarded a contract to ABB to supply and install the submarine power cables and build the electrical compressor drives. The new compressors are required to offset declining reservoir pressure in Troll as gas production proceeds and to help drive output through the pipelines to land.

Tune. This field is being developed via a four-well subsea template tied back to the main Oseberg field center. Tune gas will be used for injection to boost oil production on Oseberg. The injected gas will later be recovered along with Oseberg gas and exported.

Varg. On the main reservoir, operator Pertra is looking at drilling two additional wells to boost oil production. A development solution for the Varg South structure has not yet been finalized, but subsea wells tied back to the Varg FPSO or another suitable vessel is the obvious development option.

Visund. This field has been on line since 1999, producing 50,000 b/d of oil via a semisubmersible floating platform. Statoil plans to produce gas from the field from 2005 onwards and has awarded a contract to Allseas worth about NOK 85 million ($12.3 million) to lay a gas pipeline from the Visund platform to the Kvitebjorn gas pipeline. Gas from Visund is due to be piped on through the Kvitebjorn transport system to the Kollsnes gas processing plant near Bergen.

Some UK projects

Alba. The phased development of Alba Extreme South, which came on stream last year, continues with an additional six wells planned for 2004-05. These will each require subsea pipeline and umbilical links to the Alba Extreme South Manifold B, which will in turn require a 500-m link to Manifold A.

Balmoral. Oilexco, Calgary, plans to drill two wells on Block 15/25b in the outer Moray Firth. The first of the two wells will evaluate a large untested structure adjacent to and northwest of the undeveloped 15/25b-3 discovery. This undeveloped find will be the focus of the second well, which will be designed as a producer for suspension after drilling and testing. Oilexco's aim is to tie this well back to Agip's Balmoral floating production facility 8 km away on Block 16/21. Installation could begin as soon as 2005.

Blake Flank. The structure lies 64 miles from Aberdeen in the Outer Moray Firth, in the northern North Sea immediately adjacent to the main Blake Channel structure. It will be developed by two production wells and a single water injector tied into the existing Blake production manifold.

Blane. A floating production system is thought to be one possible development solution for the Blane field, but the alternative, a tieback to the nearby Pierce FPSO, seems more likely at present. The latter would require 30 km of pipelines and control lines to be installed. A potential stumbling block exists in that the field lies on the UK-Norway median.

Broom. Heather Alpha platform will be the host facility for Broom, which in turn will export the processed oil to Ninian through an existing 16-in. oil export pipeline. Subsea 7 has been awarded a £30 million ($50 million) order from DNO to provide subsea hardware.

Buzzard. This is the largest field to be discovered in the North Sea in the past decade. The development consists of three bridge-linked steel platforms and two subsea water injection manifolds 2 km from the platforms. The crude will be exported via a tie-in to the nearby Forties pipeline. The natural gas will flow to market via the Frigg pipeline system. First oil is planned for late 2006, and Buzzard is expected to produce at about 80,000 b/d.

CLAW. This development involves a five-well subsea drill center tied back to the Schiehallion FPSO. Subsea 7 has been awarded a contract that is reportedly worth more than $15 million to install pipelines and an umbilical.

Duncan/Innes. These tiebacks to Ardmore field (ex-Argyll—the UK's first offshore oil producer) are expected to come back on stream in 2004-05, over 10 years since the fields were originally shut-in. Some 18 km of pipelines and umbilicals will be needed for this development.

Melville. This oil discovery is expected to be developed via a subsea tieback to Hudson. It will involve installation of 5 km of pipelines and control lines from the Melville manifold to the Hudson manifold.

Perth. Amerada Hess has proposed to develop Perth by means of five subsea wells tied back to the Scott platform 11 km to the southeast. The Perth wells will be controlled from Scott via an umbilical and gas lift line. In addition water injection will be provided through an 8-in. line from Scott.

Pierce. Shell hopes to double output and substantially extend the production life of this field by installing water injection facilities. Bluewater was awarded a £50 million ($80 million) contract to install the necessary facilities on the FPSO.

Juno gas project. Apollo, Artemis, Minerva, Wollaston, and Whittle, the Juno project, involve development of five gas fields in the Easington Catchment Area (ECA) of the southern North Sea. The partners in the development are BG, Amerada Hess, and BP. Technip has secured a £30 million ($44 million) EPIC contract, which includes the project management, engineering, and installation of all production control umbilicals and associated equipment as well as the project management, transportation, and installation of two subsea manifolds.

Minerva. This project involves a minimum facility, normally unattended platform, incorporating two local wellheads as well as subsea tie-ins from Apollo and Artemis fields. Fluids from these fields will be commingled on Minerva, and the gas and liquid production will be exported by pipeline to the ECA Riser Tower platform.

Rhum. A subsea tieback to Bruce is said to be BP's preferred development solution for this gas-condensate project, adopting a two-phase development strategy that should see it flowing by late 2005. The first phase is expected to involve three subsea wells, a production, a control manifold, and up to 8 km of flow lines as well as the 44-km export line.

Information sources

The 53rd BP Statistical Review of World Energy 2004 (www.bp.com).

OGPOD – Oil & Gas Projects Database (www.ogpod.com).

"The World Oil Supply Report."

"The World Gas Supply Report."

"The World" series of reports are published by Douglas-Westwood (www.dw-1.com).

The authors

John Westwood ([email protected]) heads the independent energy analysts Douglas-Westwood and over the past 19 years has been responsible for many business and strategic studies of the oil and gas industries. As a consultant he has worked for investment banks, corporations, and agencies of governments. He previously spent 12 years in the offshore contracting industry. Published work includes over 80 papers and joint authorship of a number of the "The World" series of reports.

Georgina MacFarlan ([email protected]) is an analyst with Douglas-Westwood. She has carried out extensive research on worldwide offshore field developments and pipelines and contributed to a number of the firm's studies for oil majors and government departments. She also manages the firm's World Floating Production Database. Published work includes coauthoring of The World Floating Production Report and papers published in Scandinavia.