OGJ Newsletter

Market Movement

Supply concerns drive record oil prices

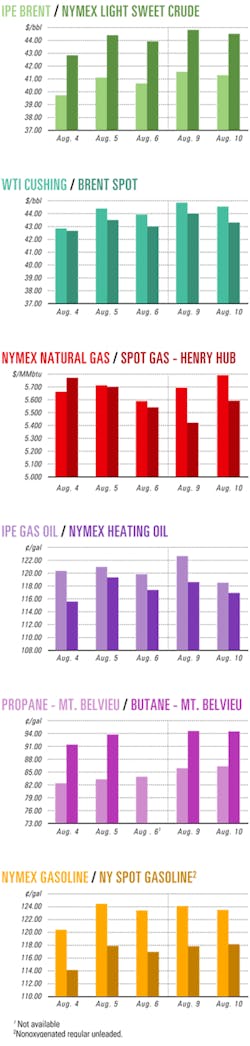

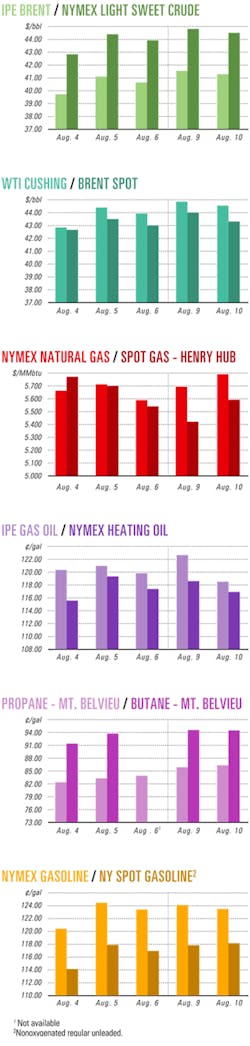

Crude oil prices reached new highs Aug. 9, with the Organization of Petroleum Exporting Countries' basket of seven benchmark crudes hitting $40.04/ bbl, the highest level in 20 years, following reports that crude production in southern Iraq was halted because of sabotage threats.

The September contract for benchmark US sweet, light crudes, meanwhile closed at a record high of $44.84/bbl after earlier hitting an all-time record of $44.98/bbl Aug. 9 on the New York Mercantile Exchange.

However, subsequent reports said Iraqi crude exports were only reduced to 1.1 million b/d from 1.9 million b/d. Crude prices eased during Aug. 10 trading, despite the approach of Tropical Storm Bonnie that forced evacuation of 108 platforms and 37 drilling rigs in the Gulf of Mexico. Through Aug. 10-11, 419,000 b/d of oil and 2 bcfd of natural gas production were shut in, equivalent to about 25% and 17% of the daily oil and gas production, respectively, from the gulf.

Energy prices rebounded Aug. 11, with the OPEC basket price climbing to $40.08/bbl and the NYMEX near-month crude contract at $44.80/bbl. The all-time record price for OPEC's basket of crudes, set on Nov. 20, 1980, was $41.80/bbl. OPEC's basket price has remained above its target $22-28/bbl price band since Dec. 2, 2003. This year, that price has averaged $33.28/bbl through Aug. 6, up from an average $28.10/bbl for all of 2003.

Insulation lacking

What's driving the escalation of crude prices is a "lack of insulation from shocks due to the dramatic reduction in global spare capacity," said Paul Horsnell, analyst with Barclays Capital Inc., London.

He noted that the International Energy Agency said in its latest report that global spare production capacity fell below 600,000 b/d in July, "excepting spare capacity that exists but that cannot immediately be tapped in Iraq and Nigeria." By comparison, he said, "Spare capacity was running well above 6 million b/d 2 years ago."

Horsnell said, "When spare capacity becomes thin, oil prices have a tendency to rise quickly in any event. When you get a supply shock on top of stretched capacity, then prices can rise even more sharply." Limited spare capacity magnifies "every actual and potential" negative impact on crude supplies "or positive demand event," he said. "Put such factors as the start of the US gulf hurricane season, some saber-rattling over Iran, and a continuing deterioration in Iraq into the mix, and you have the recipe for even stronger prices."

Of most concern to world crude markets is Iraq "where the prospect of further severe political and economic setbacks appear to be increasing," Horsnell said.

Saudi Arabia maintains it has both the production capacity and the commitment to keep prices under control.

"It is very possible not to doubt Saudi Arabia's capacity figures, not to doubt the security of [the kingdom's production] installations, and not to doubt the sincerity and firm commitment of producers to keep prices under control, and yet still believe that matters have now reached a stage where $40-plus/bbl is justified and where higher prices are possible," Horsnell said.

US stocks plunge

The US Energy Information Administration reported Aug. 11 that US crude inventories plunged by 4.3 million bbl to 294.3 million bbl during the week ended Aug. 6, while gasoline stocks fell by 1.8 million bbl to 208.3 million bbl. US distillate inventories increased by 1.3 million bbl to 122.5 million bbl during the same period.

That latest data "confirm that the rumors of the demise of US gasoline demand have been greatly exaggerated," Horsnell said. "The weekly demand number for gasoline is the strongest of the year, and US distillate demand continues to grow at a 6%-plus rate."

He said, "To be running ahead of last year's record despite a 22.9% [year-to-year] increase in retail prices implies a remarkable robustness and indeed rude health in the basic components of gasoline demand. Crude oil inventories have continued their expected fall, helped on by imports falling back to 9.52 million b/d, some 1.8 million b/d lower than the peak hit 2 weeks ago. The heating oil data [are] also fairly bullish, with the rate of seasonal build showing some signs of becoming a bit too anemic."

Horsnell noted US gasoline production fell by 95,000 b/d in the latest week, while distillate production was down by 146,000 b/d. "It is always hard to read too much into 1 week's production data, although there is perhaps a hint that light, sweet crude oil is increasingly getting hard to find relative to heavy grades," he said.

Industry Scoreboard

null

null

null

Industry Trends

COULD A SPIKE IN COAL PRICES be the latest factor to help buoy natural gas prices in the US?

Spot prices for eastern US coal have rocketed by 30-45% in recent months, and some analysts speculate that rising coal prices will put upward pressure on gas prices as electric utilities switch to more economically attractive gas.

But in fact it is always coal prices that follow gas prices on the way up—especially in the US East, notes the Henwood Strategic Fuels Group unit of Boulder, Colo.-based Global Energy Decisions consultancy. And while coal supplies in the US East are in fact tight, more-than-ample supplies of coal in the Powder River basin of Wyoming have kept coal prices from rising in the West.

"These high delivered prices have much to do with some incremental increase in demand, and a lot to do with a lack of available coal supply," Henwood said in a recent online research report. "But it is important to remember that these are spot prices and reflect small volumes. (At least, on the average, 70-80% of the coal being sold today is being sold on contract—and these contracts were written months to years ago at lower prices.)"

Edinburgh-based Wood Mackenzie thinks the CAPP rally won't lead to a "meaningful" increase in demand or price for gas markets. WoodMac's North American Power Insight service contends that the number of coal-fired power plants at risk is too small to impact the market for gas.

US REFINING MARGINS are falling despite rising West Texas Intermediate crude oil prices. That is because changing inventory levels drive the relationship between the two, noted Jacques Rousseau, senior analyst with Friedman, Billings, Ramsey & Co. Inc., Arlington, Va.

A quarterly historical correlation between WTI crude oil prices and Gulf Coast refining margins shows the strongest relationship in the first and fourth quarters. The correlation between the two weakens during the summer.

"We believe that inventory changes drive this correlation pattern, and in periods of falling inventory levels (typically 1Q and 4Q), changes in crude oil prices are reflected in refining margins quickly, while in periods of rising inventory levels (historically 2Q and 3Q), there may be ample supply to prevent a pass-through of prices."

During July, total refined product inventory levels increased by 12.3 million bbl, or 3.1%, he said, adding that the average US refining margin declined 21% for the same period and another 10% as of Aug. 4. That compared with a 19% rise in crude oil prices. "Using this theory, if inventories continue to rise, which we expect during the seasonally weak month of September (when production remains strong while gasoline demand slows at the end of the summer driving season), refining margins could decline further, even if crude oil prices do not," Rousseau said.

Fears of a summer gasoline shortage have continued subsiding in August, he noted. FBR's average US refining margin estimate has declined 31% for the third quarter to date and could decrease more, Rousseau said. The firm said the average US refining margin was $7.69/bbl on Aug. 4.

Government Developments

THE US DOWNSTREAM Industry needs to take a second look at what its operational fuel inventory levels should be, US Sec. of Energy Spencer Abraham told the National Petroleum Council.

"The American people need to be confident that the challenges related to petroleum refining and product supply in the US are being addressed," Abraham wrote in a letter last month.

While speaking at a June 22 NPC meeting, Abraham called on industry leaders to examine various economic and regulatory issues associated with the US downstream sector (OGJ Online, June 22, 2004). He urged that a study be completed by Sept. 30.

But now, that timeline may have slipped slightly, according to industry and government sources.

In his latest correspondence to NPC, the secretary amended his request, saying he wanted the study completed "as timely as practicable."

In 1988, NPC studied petroleum inventories. Although the study's conclusions did not specifically call for mandatory levels, NPC did say that lower levels could impact price volatility under certain market conditions.

Now, the US Department of Energy formally has asked NPC to consider a new analysis including current and future demand for refined products, domestic capacity to meet this demand, potential barriers to efficient markets, and the influence of petroleum product supply on price.

Meanwhile, NPC said the group is consulting with its industry members regarding its next course of action. DOE officials said they expect the study to be finished sometime this fall.

Abraham noted that industry has used a Lower Operational Inventory (LOI) level of 270 million bbl for years.

He said, "But is that a number that accurately reflects the realities of the marketplace in 2004, and should it be updated? At the end of the day, our goal is to provide a figure that best serves, and provides stability for, the global petroleum market. Does the 270 [million bbl] LOI do that?"

Abraham said he would "appreciate the council's insights on how refining capacity, inventories, and demand patterns outside the US may impact meeting the consumer demand for refined petroleum domestically."

A BRAZILIAN STATE has asked that nation's Supreme Court to halt the National Petroleum Agency's (ANP) sixth oil and natural gas licensing round, slated for Aug. 17-19.

Santa Catarina Gov. Roberto Requião filed a lawsuit on Aug. 9, arguing that the round is unconstitutional. ANP declined to comment.

Requião said the round makes the last petroleum provinces in Brazil available to multinational oil companies that could export all petroleum discovered—leaving nothing in Brazil but tax revenues from the operations.

"The requirements of the international oil market will lead the oil companies to give priority to foreign markets at the expense of Brazilian consumers," Requião said.

"In 2006, Brazil will become oil self-sufficient through Petróleo Brasileiro SA, Brazil's state-owned company, and private companies should not be allowed to export oil," argued Requião.

He requested that the court revoke ANP's right to authorize oil exports, saying: "The constitution recognizes oil as a strategic asset of the nation."

Quick Takes

Privately held Irving Oil Ltd., St. John, NB, has received approval to develop a $750 million (Can.) LNG receiving terminal at the company's existing Irving Canaport, an ice-free deepwater marine terminal near St. John (OGJ Online, Mar. 31, 2004). The LNG terminal, scheduled to be operational in 2007, will have a throughput capacity of 1 bcfd of natural gas. In 2003, Irving increased both the capacity and cost of this project, which was $500 million in 2001 when the project was first announced. Current plans call for construction of three 160,000 cu m LNG storage tanks, regasification facilities, and a 350 m offloading jetty with mooring facilities for 200,000 cu m capacity LNG carriers. Enagas SA, a Spanish natural gas supplier, awarded Foster Wheeler Ltd. subsidiary Foster Wheeler Iberia SA a contract for an LNG terminal expansion in Cartagena, Spain. Terms of the contract were not disclosed. Following Foster Wheeler's expansion design, the company will manage the engineering and construction, slated for completion by yearend 2006. The Cartagena terminal capacity will increase to 1.2 million cu m/hr of gas from 900,000 cu m/hr, and the expansion project includes the installation of new vaporization lines, sendout pumps, a water system, and a measuring station. Algerian state oil and gas company Sonatrach has taken delivery of a new LNG tanker from Daewoo Shipyard in South Korea. According to Sonatrach, the 140,000 cu m vessel will be followed at the end of October by a second tanker of the same capacity, currently under construction at Kawasaki Heavy Industries Ltd.'s shipyard. The two tankers, to cost a total of about $400 million, will transport LNG to the US and the UK.

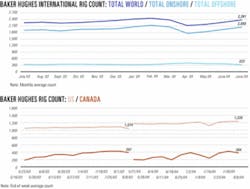

GlobalSantaFe Corp. reported that its GSF Adriatic IV jack up drilling rig sank in the Mediterranean Sea 25 miles off Port Said, Egypt, following a fire Aug. 10. All 79 persons onboard the rig escaped injury and were evacuated. At the time of the incident the rig had been working for 58 days alongside the 5,700 ton Temsah gas production platform, owned and operated by Belayim Petroleum Co., a joint venture of Egypt General Petroleum Co. and ENI SPA. Gains made the week ended July 30 in the number of rotary rigs drilling in Canada were lost the week ended Aug. 6 as 39 rigs idled there for a total of 384 working in Canada, reported Baker Hughes Inc. The US had a total 6-rig gain to 1,235 active, and Gulf of Mexico numbers remained constant with 93 rigs working. Rigs in the US were drilling 1,064 gas wells, 170 oil wells, and 1 unspecified. Of these, 775 were vertical, 318 were directionally drilled, and 142 were horizontal wells. The North American total surpasses by 148 rigs the number working the same time last year.

ConocoPhillips Alaska and BP Exploration (Alaska) Inc. are planning a $500 million project to increase oil production from West Sak oil field—a large, shallow, heavy oil accumulation that overlies much of Conoco- Phillips-operated Kuparuk field on Alaska's North Slope—to 45,000 b/d by 2007 from its current average production of 10,000 b/d. The development program will include two drill sites within the Kuparuk River Unit: existing Drill Site1E and Drill Site 1J, which will be the first stand-alone West Sak drill site. Plans call for the drilling of 13 West Sak wells at Drill Site 1E and 31 wells at Drill Site 1J. Drill Site 1E expansion is expected to add about 10,000 b/d of oil, with first production anticipated to start this summer. Development of Drill Site 1J will add about 30,000 b/d of oil, with first production expected in late 2005 and peak production in 2007. Subsidiaries of Unocal Corp. and ENI have a number of development activities under way off Indonesia: Operator Unocal Ganal Ltd. and 20% partner Eni-Ganal Ltd. will submit a development concept to the Indonesian government later this year for Phase 1 development of Gendalo field in the Ganal production-sharing contract area. The first phase, targeted for start-up in 2007, will be designed to produce 250-300 MMscfd of natural gas. Engineering also is proceeding on the Rapak PSC, and new 3D seismic acquisition is under way across Gehem and Ranggas deepwater fields, which may be developed jointly using a common host facility.

Saudi Aramco has awarded contracts to two J. Ray McDermott SA units for the fabrication, transportation, and installation of offshore production facilities for Aramco's fields off Saudi Arabia's east coast. The work, part of Aramco's 2004 Maintain Potential program, will comprise the construction of two new jackets, four production decks, four rigid and three flexible pipelines, and three submarine cables and anode sleds. Offshore activities will include transportation and installation of the jackets and decks along with seven pipelines, each about 15 miles in length. McDermott's Jebel Ali facility will construct the steel jackets and decks, which will weigh about 440 tons each; work on the structures is slated to begin later in the year and be completed in 18 months.

ConocoPhillips (Grissik) Ltd., operator of Suban gas field on Corridor Block in South Sumatra, concluded a gas sales agreement with PT Perusahaan Gas Negara (Persero) Tbk (PGN) leading to Phase II expansion of the field's production and processing facilities as well as new delivery pipelines. Suban will be connected to existing processing facilities at Grissik. ConocoPhillips plans to supply 2.3 tcf of gas over 17 years to PGN for industrial markets in West Java and Jakarta. The gas will be delivered through a new pipeline PGN will construct from Grissik through South Sumatra to Cilegon in West Java and a 606 km pipeline connecting Grissik to Muara Tawar east of Jakarta. Gas deliveries will begin in first quarter 2007. ConocoPhillips holds a 54% interest in the block. Partners are Talisman Energy Inc. subsidiary Talisman (Corridor) Ltd. 36% and Indonesia's national oil company Pertamina 10%.

TRANSWESTERN PIPELINE CO., Houston, received US Federal Energy Regulatory Commission approval to expand its San Juan lateral. The $138.4 million expansion will add 375 MMcfd of firm natural gas transportation capacity on Transwestern's New Mexico system. Transwestern expects to begin construction in October. The company will modify existing compressor stations and construct 72.6 miles of pipeline from the Blanco Hub in San Juan County, NM, to the point of interconnection with Transwestern's mainline near Gallup, NM. Transwestern expects the facilities to be in service in mid-2005.

Mangalore Refinery & Petrochemicals Ltd., a newly acquired subsidiary of India's Oil & Natural Gas Commission, has basic engineering under way for the addition of a Penex-Plus unit with a deisohexanizer column to the naphtha complex at its refinery at Mangalore, Karnataka, India. The 13,200 b/d isomerate project is designed to produce high-octane isomerate for ultraclean gasoline that will meet the emission standards set by India's national auto fuel policy. UOP LLC, Des Plaines, Ill., which designed the refinery, began basic engineering in February on the new unit. The refinery, with a design capacity of about 9.7 million tonnes/year, currently is operating at an annualized capacity of 11.15 million tonnes. BOC Group, Windlesham, UK, plans to construct a hydrogen production and utilities complex to supply more than 110 MMscfd of hydrogen to industrial customers, including BP PLC's refinery in Toledo, Ohio. A supply agreement between BOC and BP is expected to be finalized soon, and construction is to begin by September. BOC's partner LindeBOC Process Plants, Tulsa, will perform engineering and construction of the plant. The hydrogen will enable BP to meet its production capacities for cleaner-burning, ultralow-sulfur gasoline and diesel fuels that meet or exceed US Environmental Protection Agency Tier 2 clean fuels standards.

ChevronTexaco Corp. plans to build a multibillion dollar facility to upgrade extra-heavy crude from Venezuela's eastern Orinoco belt, according to an online report by Business News Americas (BNA). According to the Latin American news service, Ali Moshiri, president of ChevronTexaco's Latin American operations, said in a company release that the company has proposed a new major project in the Orinoco belt comprising an upstream development, a pipeline, and an upgrader complex capable of producing 200,000-400,000 b/d of high-quality synthetic crude and products. Reuters news service reported that the project carries a $6 billion price tag. However, BNA said a ChevronTexaco spokesperson "could not confirm that figure."

Shell Exploration & Production Co. said it would shut down the Mars tension leg platform Nov. 4 to replace flexjoints on oil and natural gas export lines. Repairs are expected to take 2 weeks. The Mars TLP is on Mississippi Canyon Block 807 in the Gulf of Mexico. Production from the TLP was shut in May 22 when Shell reported damage to its oil export pipeline's flexjoint following a small oil leak (OGJ Online, June 8, 2004). Subsequent inspections of the gas line showed deterioration on its flexjoint, so both lines were repaired temporarily while the flexjoints were refurbished. Production resumed June 28 from the TLP. ExxonMobil Corp. subsidiary Esso Exploration Angola (Block 15) Ltd. began field production Aug. 7 from the $3.4 billion Kizomba A project on Block 15 off Angola. Estimated recoverable resources from Kizomba A total 1 billion bbl of oil. Kizomba A, 370 km northwest of Luanda, will develop the Hungo and Chocalho discoveries in 1,000-1,280 m of water. Esso expects to achieve a production rate of 250,000 b/d, producing from a TLP tied to a floating production, storage, and offloading system having a 2.2 million bbl storage capacity. Kizomba A is the first of three developments on Block 15 that are expected to cost a total of $10 billion (OGJ Online, Dec. 9, 2003). Kizomba B will come on stream in early 2006. Planning and design for the Kizomba C project also are under way.

Unocal Rapak Ltd. has completed drilling operations on the Gehem-3 and Ranggas-7 appraisal wells off Indonesia. Its 20% partner is Eni-Rapak Ltd. Unocal drilled Gehem-3 to 16,424 ft TD in 5,744 ft of water. The well found 232 ft of net gas pay and 8 ft of net oil pay. Well results indicate consistent reservoir pressure across the entire primary reservoir pool in this field and a potential single hydrocarbon pool with high-quality reservoir rock, Unocal said. Ranggas-7 was drilled to 14,402 ft TD in 5,394 ft of water. A total of 167 ft of net pay was encountered, including 52 ft of oil. Ranggas-7 was drilled to delineate the downdip and eastern limits of the primary Ranggas development area and to penetrate the deeper primary reservoir unit of the field. The well did not encounter hydrocarbons in the deeper zone, but in the shallower zone, hydrocarbons were penetrated as far as 400 ft downdip of Ranggas-1.

Calvalley Petroleum Inc., operator of Block 9 in Yemen, found oil with its Al Roidhat 4 appraisal well in the Upper Qishn sand formation reservoir. Initial wireline log evaluation indicates a 6.5-8.5 m oil pay in a 22 m gross oil column. Drilling has resumed to investigate the hydrocarbon potential in the Saar, Shuqra, Kohlan, and basement formations. After this well is completed, the rig will drill an exploration well in the recently identified South Roidhat prospect 5 km southwest of the Al Roidhat 1 discovery well (OGJ Online, July 28, 2004). Calvalley also reported that a production test of the Auqban 1 well in the Shuqra formation reservoir by third party engineering firm Chapman Engineering Ltd. indicated that, in a 59 hr test using a downhole submersible pump, the well flowed a maximum 283 b/d of oil and 41.3 Mcfd of gas from a 9.1 m net oil pay zone. The reservoir had an average pressure of 1,360 psi.

CNOOC Ltd. has made an oil discovery with the JZ 21-1S-1 exploration well, which was drilled on the JZ21-1 south structure in Liaozhong Sag in Bohai Bay. The well, drilled to 2,400 m TD in 20m of water, flowed 700 boe/d and 500 boe/d through 7.94-mm and 7.14-mm chokes, respectively, during two drillstem tests. CNOOC is operator and owns 100% interest in the discovery.

Petróleo Brasileiro SA (Petrobras), Brazil's state-owned oil company, inked an initial $35 million oil exploration contract with state-owned National Iranian Oil Co. of Iran, a Petrobras spokesperson told OGJ. Petrobras International Director Nestor Cervero signed a service contract in Iran to start exploration operations on Tosan Block in the Persian Gulf. The block covers an area of about 3,200 sq miles. Investments, which will be made over 3-4 years, will include seismic work and the drilling of two wells. With this contract, Petrobras returns to the Middle East, where it operated in Egypt and Iraq during the 1970s. In Iraq, Petrobras invested $180 million and discovered Majnoon and Nahr Umr fields, which together had total reserves of 8 billion boe. When Saddam Hussein took power in Iraq in 1978, Petrobras was forced to leave that country.

The joint wind power project of Suncor Energy Inc., EHN Wind Power Canada Inc., and Enbridge Inc. in southern Alberta is now operating and generating electric power. Full production of 30 Mw is expected by September, following wind turbine commissioning. Twenty 1.5 Mw turbines make up the $48 million (Can.) facility 6 km west of Magrath, Alta. Suncor, a unit of Suncor Energy Products Inc., and Enbridge are based in Calgary. EHN is the North American subsidiary of Spanish firm Corp. Energia Hidroeléctrica de Navarra SA (EHN)—a consortium of Acciona 50%, Sodena 39.58%, and Corp. Caja Navarra 10.42%—which focuses on renewable energy projects worldwide.