Multicyclic Hubbert model shows global conventional gas output peaking in 2019

HUBBERT REVISITED—6

A new, multicyclic approach to modeling future global production of natural gas reaffiRMS an outlook for growing dependence of Western nations on the Middle East and Russia for their supply as global conventional gas output peaks in the next decade.

This multicyclic Hubbert model avoids some of the pitfalls seen with earlier Hubbert-style models of future production peak and decline for oil and gas.

However, a lack of country data and questions over the future contribution of unconventional gas resources mean that a completely accurate picture of future global gas supply through even this improved model is not yet available.

Gas demand growth

Natural gas is one of the world's most important energy sources. Its growth has been the fastest of all the fossil fuels in recent years.

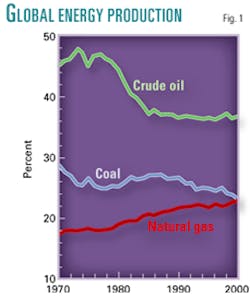

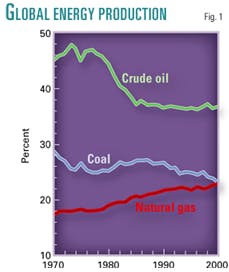

While the share of oil in the world's total energy produced declined to 36.7% in 2000 from 45% in 1970, the gas share went to 22.8% from 17.2% (Fig. 1).

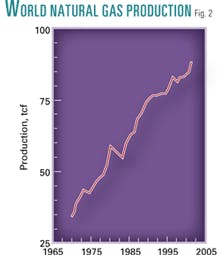

In just 20 years, global production of natural gas has increased about 1.7 times (Fig. 2), and the US Energy Information Administration predicts its use to double by 2020.

There are several reasons for this rapid increase in gas demand, such as availability in abundance, low price, and the fact that it is environmentally much cleaner than coal or crude oil. It is therefore becoming increasingly important to get a better understanding of gas production trends throughout the world and to forecast future production to aid in developing economic strategies regarding gas reserves management.

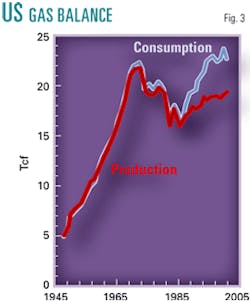

Today the US is the largest consumer of gas in the world. As Fig. 3 shows, US gas consumption has exceeded its production in recent years. As a result, US gas imports have increased to 16% of total consumption. Due to this increasing dependency on imports, it is important for the US to get a better idea of what it can expect in the future and plan accordingly.

The analysis in this article relies on a newly developed technique, known as the Multicyclic Hubbert model developed by Al-Fattah and Startzman1 in 2000, to forecast future gas production trends for all the major gas producing countries.

This multicyclic model is a modified form of the original Hubbert model presented by M.K. Hubbert2 in 1956. Hubbert used one complete production cycle to forecast the crude oil production trend for the US. A Hubbert curve with only one production cycle is somewhat bell-shaped with a maximum production rate flanked by two symmetrical tails. As noted by Al-Jarri and Startzman,7 oil production rates for many of the world's countries seem to closely follow a single Hubbert curve with one production cycle. However, some observers3 have noted that the original Hubbert model may be inappropriate for forecasting natural gas production. Different techniques45 have been suggested over the years to improve the Hubbert model, but they usually require information that is unavailable or difficult to gather. Therefore, Al-Fattah and Startzman developed a technique of incorporating two or more cycles of gas production to get a better match of the actual production data and achieve a better forecast.

Another problem that some critics have with the original Hubbert model is the symmetry of a single bell-shaped curve that represents the entire production cycle. They point out that the decline rate after the production peak may be lower, in absolute teRMS, than the incline rate before it. This could be attributed to advances in technology that aid in production and cause the amount of oil or gas actually produced after the peak to be higher than the value expected from a single-cycle (symmetrical) Hubbert curve.

Although many areas of the world do, indeed, exhibit a symmetrical curve, it would seem reasonable that a Hubbert-type analysis should allow for the possibility that the decline rate will be lower after the peak. The Multicyclic Hubbert model takes care of this problem, as adding a number of Hubbert cycles results in lowering the decline rate after the peak. A multicyclic Hubbert model is an improvement on the original model precisely because it takes this possibility into account.

Natural gas production data from 1970 to 2002 is used in this study to forecast future production trends for 46 major gas-producing countries in the world to 2050.

How it works

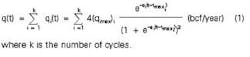

The Multicyclic Hubbert model helps us determine the production rate (qcal), total ultimate recovery (Gpau), cumulative production (Q), and future recoverable gas (Gfr). The multicyclic model uses these equations:

Production rate

Total ultimate recovery

Cumulative production

Future recoverable

First, the historical production data for each country are examined, and then the number of cycles is assigned.

The decision to assign the number of cycles to each country is somewhat arbitrary but subject to the country's historical reserves additions and production trends. Once the number of cycles is decided, the multicyclic model (Eq. 1) then is employed to estimate the production rate. A nonlinear least-squares method is used with initial guesses for ai, qmaxi, and tmaxi. Here qmaxi and tmaxi are the peak production and time, respectively, and 'ai' is a constant. To obtain optimal values for these parameters, the root mean square value (RMS) is minimized.

RMS = root mean square

qobs = observed production rate

qcal = production rate calculated from the model

n = number of observations

Once the optimal values of the parameters ai, qmaxi, and tmaxi have been determined by minimizing the RMS, a future production trend can be forecasted. These parameters also are used to calculate ultimate gas recovery, Gpau. By subtracting the cumulative production, Q, from the ultimate recovery Gpau, future recoverable gas, Gfr, can be obtained.

After forecasting production, models for all the countries are added to determine the global model. It is important to note that Hubbert-type methods examine only production time series. These time series are the result of a combination of exploration and discovery variables, technology, national policies, economics, gas demand, and other considerations. These factors are very difficult to predict and analyze. Thus we are left with raw production data that may or may not demonstrate a clear trend.

We must therefore exercise caution when extrapolating historical trends. A major discovery, for instance, in a currently undeveloped ultradeepwater basin could significantly alter world production trends. It is our view that forecasts of this type need to be updated regularly. We must also clearly differentiate between "estimated future recovery" and the much more strict term "reserves." Estimated future recovery from a Hubbert-type model includes potential future discoveries. Reserves are estimated from known, and therefore previously discovered, reservoirs.

Discussing results

Table 1 presents a summary of the results for all countries. The countries have been divided into six geographic regions. Table 2 presents the results for all regions and the world in total.

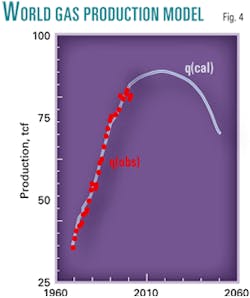

Using the multicyclic method, world production is expected to peak at 88.428 tcf/year in 2019. World cumulative production to date has been slightly less than 2,529 tcf. Ultimate recovery is calculated to be 9,215 tcf, and remaining recoverable gas should be around 6,686 tcf. This means that more than 72% of the world's ultimate recovery of gas remains to be produced.

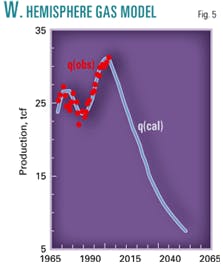

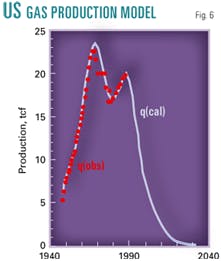

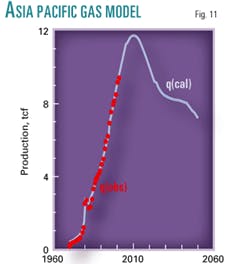

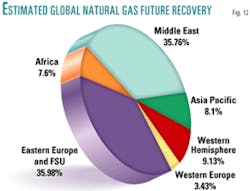

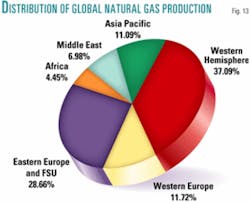

Figs. 4-11 show actual production data and forecast production trends for the world and each of the six regions. Fig. 12 indicates how estimated natural gas recoveries are distributed across the globe, while Fig. 13 shows the percentage of natural gas produced by each region in 2002.

Western Hemisphere

Today the Western Hemisphere has only 9% of the world's estimated future recovery (Fig. 12), and its production in 2002 was 37.1% of the total (Fig. 13), making it the biggest gas-producing region in the world.

The multicyclic model suggests that production in this region had already peaked in 2000. Its ultimate recovery is expected to be 2,240 tcf, and more than half (around 56%) already has been produced.

The US passed its gas production peak in 1973. It seems that a major portion of its ultimate recovery already has been produced, as the US's cumulative production to date is more than 85% of its estimated total recovery.

Other important producers in this region are Canada, Mexico, and Venezuela. Venezuela's future recovery constitutes about 30% of the region's total. However, its production in 2002 amounts to only 2.65%. Peak production for Venezuela is expected in 2044, and future recoverable gas is a huge 90% of the ultimate recovery.

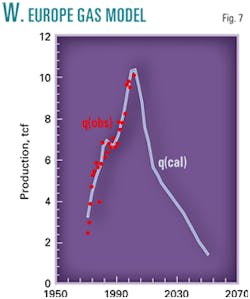

Western Europe

The amount of gas produced in Western Europe in 2002 was about 12% of the world total.

However, Western Europe now possesses less than 3.5% of the world's future gas recovery. A multicyclic model of Western Europe suggests that this region reached a plateau during 1999-2002, with a peak of 10.293 tcf/year in 2000. Ultimate recovery is expected to be around 494 tcf, and 49% of it already has been produced. More than half of the major producers in this region are either past their peak or are about to be.

The UK, the Netherlands, and Norway are some of the region's top producers today. The UK's current production trend suggests that its peak occurred in 2002, and we can expect a decline in its production in the near future.

Today less than 40% of the UK's total recovery remains to be produced. The Netherlands already has produced more than 80% of its ultimate recovery.

Norway has the largest estimated future recovery in the region, and with only 15% of its total recovery produced to date, it is expected to play a key role in the future of Western Europe's gas sector.

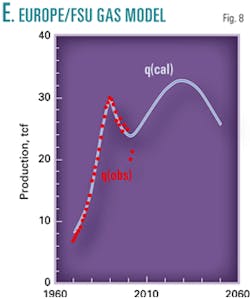

Eastern Europe, FSU

Thirty six percent of the world's estimated future recovery is in this region, making it the region with the largest indicated future gas recovery. It also is the second largest gas-producing region in the world.

Eastern Europe and the former Soviet Union have the highest ultimate recovery of any region. Only about 24% has been produced so far.

Other than Russia, Romania was the only significant producer in the region until recently. However, with the huge decline in production and devaluation of its estimated reserves, Romania's contributions have now become insignificant.

Turkmenistan and Uzbekistan now are emerging as significant natural gas producers in this region, although their industry is still in its formative stages.

Russia, on the other hand, is the No. 1 country in the world today in teRMS of estimated reserves and annual production. Although Russian gas production has seen a steady decline since the fall of the Soviet Union, it is expected that its production will witness another cycle due to the presence of huge natural gas reserves in that country and its improving political environment, which is attracting foreign capital. However, there is also a general skepticism about Russia's reserves reporting,6 which are classified as 'explored reserves,' usually understood to be proved plus some probable reserves, while most countries of the world declare only proved reserves that are economically recoverable with the present technology.

According to the multicyclic model, ultimate recovery and future recoverable gas for Russia are expected to be around 2,925 tcf and 2,236 tcf, respectively. This is the highest ultimate recovery for any country. Nearly 76% of Russia's ultimate recovery is yet to be produced.

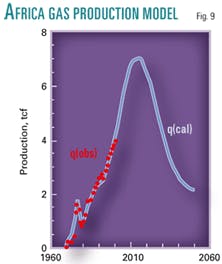

Africa

Natural gas production in Africa has increased over the years. This trend will continue until 2015, when production is expected to peak.

Ultimate recovery should be around 452 tcf, which is the lowest of all regions. However, future recoverable gas is high at 85% of the total.

Algeria, Nigeria, and Egypt are some of the significant reserves holders and producers in this region.

Algeria is the world's fifth largest gas-producing country and secured the seventh position in the 2002 list of top countries with estimated future recovery. With peak production expected in 2015 and nearly 80% of its total recovery yet to be produced, we can expect Algeria to continue to play a role as a major gas producer for a significant time.

Nigeria has the latest production peak, which is expected to occur in 2089. With only 3.7% of its total gas produced so far, it is clear that natural gas will be prominent in Nigeria's future for a long time.

Production in Egypt is expected to peak in 2012. Three quarters of Egypt's total recovery still remains to be produced.

Our analysis show that, while Africa's future recovery is limited in amount, production will continue for a long time.

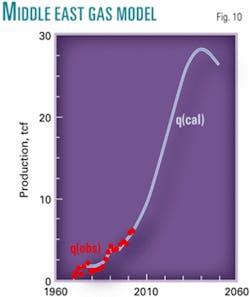

Middle East

Much of the future of natural gas seems to be in the Middle East. This region has the world's second highest estimated future gas recovery, and it has barely tapped into those resources.

Production in Middle East is expected to peak in 2039. Its cumulative production is merely 4% of its ultimate recovery, which means that around 2,219 tcf of gas still remains to be produced.

Iran, Qatar, Saudi Arabia, and the UAE are the major players, as they hold nearly 90% of the estimated future recovery and almost 84% of the total gas produced in this part of the world.

Iran's model shows that production will peak in 2076 and is expected to ultimately produce 1,094 tcf of natural gas. Its future recoverable portion is a massive 97% of its total. In fact nearly half of the future recoverable in the Middle East will come solely from Iran. This amply de- monstrates the importance of this country's production trends to the region and the world.

Gas production in Qatar is expected to peak in 2035. Its cumulative production so far has been close to 2.61% of the total recovery (318 tcf). Qatar has produced the lowest of its ultimate recovery as compared with any other country in the world. This clearly indicates that it is producing far less than its potential.

Saudi Arabia will peak in 2046, and around 96% of its ultimate recovery remains to be produced. With a peak this late and future recoverable gas of more than 420 tcf, Saudi Arabia is expected to continue to be a major gas exporter in the future.

Asia Pacific

Future recovery in the Asia Pacific region is about 8% of the global total, and the production was close to 11% in 2002. The multicyclic model suggests that production will peak in 2010, and ultimate recovery could be close to 742 tcf. With slightly more than 19% of its total recovery produced so far, it still has a considerable amount of gas to be recovered in the future.

However, none of the countries from this region made it up to the top 10 recovery list, and only one (Indonesia) was among the top 10 producers of 2002. Still, contributions of countries such as Indonesia, Australia, Malaysia, and China can be of significance in the future.

Indonesia's production has seen a steady decline in the past few years. This has had an adverse effect on its model, which suggests that Indonesia might have passed its peak in 2000, and its future recoverable might now be less than 25 tcf.

Malaysia's production is expected to peak in 2012, and 83% of its ultimate recovery has yet to be produced. This shows that Malaysia might play a significant role in the future of the gas industry, particularly in the Asia Pacific region.

The latest major gas producing country to peak in this region is China. It will witness its peak production in 2044, and its future recoverable gas will be around 341 tcf, third highest in the world, indicating that China might have an important role to play.

However considering its own size and population, domestic demand of energy is quite high. Therefore, we might not see China as a leading exporter of gas in the near future.

Where we stand

When looking at the results presented here, one thing is quite obvious: Now that the Western countries are nearing the end of their reserves, they will become more dependent on the countries of the East to fulfill their energy needs if no other reliable energy source is developed.

Already Russia alone provides 30% of Europe's natural gas supplies. The US is planning to buy more LNG from the Middle East and Russia. Table 1 shows the percentage of ultimate recovery that already has been produced by all countries.

It is easy to conclude that the countries with a high percentage in this category will become dependent on the countries with a lower one, in order to provide them with their gas requirements in the future.

Also important is the fact that most of the countries with a high percentage are the ones known as "developed countries." They have better infrastructure, political, and economic stability and therefore are more attractive to oil and gas companies. For example, examine the ultimate recoveries of Western Europe and Africa, which are quite similar. However, it is observed that although Western Europe is nearly half depleted, recovery in Africa is even less than 15%. This is related to the operating environment, which generally is quite favorable in Europe as compared with Africa—with notable exceptions north of the Sahara.

Lack of infrastructure and political stability hinders the transfer of technology to these underdeveloped nations of Africa and Asia. However, it is expected that ultimately, as the resources in the West diminish, exploration and production companies will concentrate attention on the East, as that is where the future of gas production seems to lie. More than 66% of the world's future recoverable gas today resides in Eastern Europe/FSU and the Middle East. In fact just two countries, Russia and Iran, control almost 50% of the world's future recoverable gas.

In the present scenario the responsibility of the West is twofold. First, the West should provide necessary help to these underdeveloped nations to build their infrastructure and transfer to them technology required to economically produce their gas resources. Second, the world should now seriously and effectively start exploring and developing alternative sources of energy that are both reliable and economical because fossil fuels are an exhaustible resource and sooner or later, we will run out.

Conclusions

This study shows that the Multicyclic Hubbert model can be used as an effective technique to forecast future production trends. It is an improvement on the original Hubbert model, as the use of two or more production cycles gives a better match to the historical production trends and consequently leads to a better forecast.

Forecasts should be updated regularly, whenever new data become available. Currently, only the countries with steady and significant production were used in this study. Lack of data availability makes it impossible to model production trends of all the countries in the world and then aggregate them to get a completely accurate global picture.

Our forecasting results may not be appropriate for unconventional gas produced from tight gas reservoirs, coalbed methane, gas shales, or hydrates etc. The Hubbert method relies heavily on historical trends. Thus it has a considerable bias in favor of past production statistics. Recent trends, such as those that may emerge from newer sources of natural gas, may take considerable time before they significantly influence a Hubbert analysis. We expect that these unconventional resources will play a role in the addition of reserves in some countries and will affect ultimate recovery. Thus it is possible that these new unconventional resources will form yet another Hubbert cycle when their role in the total natural gas picture becomes clearer.

References

1. Al-Fattah, S.M., Startzman, R.A,"Forecasting World Natural Gas Supply," Journal of Petroleum Technology (May 2000).

2. Hubbert, M.K., "Nuclear Energy and Fossil Fuels," API Drilling & Production Practices (1956) p. 17.

3. Wattenbarger, R.A., and Villegas, M.E., "Trends in US Natural Gas Production," Advances in the Economics of Energy and Resources, J.R. Moroney (ed.), J.A.I. Press, Greenwich, Conn., (1995) pp. 9, 169.

4. Wattenbarger, R.A., "Oil Production Trend in the Former Soviet Union," Advances in the Economics of Energy & Resources, J.R. Moroney (ed.), J.A.I. Press, Greenwich, Conn. (1994), pp. 8, 111.

5. Laherrére, J.H.: "Multi-Hubbert Modeling," www.hubbertpeak.com/Laherrere/multihub.htm, 1997.

6. Grace, J.D., Caldwell, R.H., and Heather, D.I., "Comparative Reserves Definitions: USA, Europe, and the Former Soviet Union," paper SPE 25828 presented at the Society of Petroleum Engineers' Hydrocarbon Economics & Evaluation Symposium in Dallas, Mar. 29-30, 1993.

7. Al-Jarri, A.S., Startzman, R.A., "Worldwide Petroleum-Liquid Supply and Demand," Journal of Petroleum Technology, December 1997, pp. 1329-1338.

This is the last in a series of six articles revisiting the peak-oil debate.

The authors

Asher Imam is an applications engineer with eProduction Solutions Inc. in Houston. He completed his bachelors in mechanical engineering from NED University of Engineering & Technology, Karachi, Pakistan, in 1999. He graduated from Texas A&M University in 2003, with a masters in petroleum engineering. Imam is a member of the Society of Petroleum Engineers and Pakistan Engineering Council.

Richard A. Startzman is holder of the L.F. Peterson Endowed Professorship in the Harold Vance Department of Petroleum Engineering at Texas A&M University. His industry experience consists of 20 years with the former Chevron Corp. in management, research, and operations in Europe, the Middle East, and the US. He consults with majors, independents, and service companies in the areas of economics and reservoir engineering. Startzman has published over 100 technical papers and articles on reservoir engineering, production engineering, artificial intelligence, and petroleum economics. His most recent contributions have been in the areas of petroleum supply forecasting. Startzman's areas of specialization include reservoir engineering, economic evaluation, artificial intelligence, and operations research. He graduated from Marietta College in 1961 with a BS in petroleum engineering and earned an MS and a PhD in petroleum engineering from Texas A&M University, in 1962 and 1969, respectively. Startzman is a member of the Society of Petroleum Engineers and was named a Distinguished Member in 1994. He is a member of Pi Epsilon Tau, Tau Beta Pi, Beta Beta Chi, Kappa Mu Epsilon, Phi Kappa Phi, and Sigma Xi.

Maria A. Barrufet is an associate professor in the Harold Vance Department of Petroleum Engineering at Texas A&M University. She has been the principal or coprincipal investigator on projects sponsored by the US Department of Energy and various oil companies in the area of improved oil recovery using thermal and chemical methods. She has over 30 publications in the areas of thermodynamics, phase behavior and phase equilibria of fluid mixtures, profile modification, neural networks, and polymer flooding. Barrufet earned a BS in 1979 and an MS in 1983 in chemical engineering from the Universidad Nacional de Salta in Argentina and a PhD in chemical engineering in 1987 from Texas A&M University. Her research interests include enhanced oil recovery, equations of state for multiphase equilibria, liquid-liquid-vapor equilibrium in steamflooding processes, reservoir simulation of near-critical fluids, hydrocarbon characterization methods, simplified methods to model gravitational gradients in compositional reservoir simulation, multiphase flow, and rock and fluid properties. Barrufet is a member of American Institute of Chemical Engineers, Society of Petroleum Engineers, and Omega Chi Epsilon. She also is a member of the Journal of Chemical & Engineering Data advisory board.