Is oil shale America's answer to peak-oil challenge?

HUBBERT REVISITED—5

Recent discussions regarding the advent of a peak in global crude oil production generally fail to address the potential of America's rich, massive oil shale resources to augment petroleum supplies.

While hope is often expressed for continued reserves growth and a smooth transition to future sources of energy, a realistic assessment of the full range of alternatives will reveal that only unconventional hydrocarbon resources, i.e., oil shale, tar sand, extra-heavy oil, and possibly coal liquids, are large enough to supplement petroleum supply with meaningful quantities of liquid fuels in the long term.

Interestingly, most of the world's known unconventional hydrocarbon resources are found in the Western Hemisphere—in the US, Canada, and Latin America—which geopolitically is relatively secure. Increased production from unconventional Western Hemisphere hydrocarbon resources could substantially shift the center of gravity of America's petroleum supply. Canada and Latin America already supply at least half of current US oil imports. About one quarter, or 2.5 million b/d, is imported from Persian Gulf countries, with the remainder from numerous other sources.

While achieving total US energy independence is an unrealistic objective, it is conceivable that large-scale production of domestic oil shale, combined with continuing growth in tar sand and extra-heavy oil production, could make the US effectively independent of Persian Gulf oil supply sources. Achieving such a goal would have enormous economic, strategic, and national security benefits for the US.

Tar sand resources are now successfully competing for investment capital with conventional petroleum exploration and production. Tar sand resources are well-characterized and readily accessible. They feature high recovery efficiencies and dependable production rates and produce uniform, high-quality products.

Suncor Energy Inc. CEO and Pres. Rick George says of Alberta's tar sand development: "A large part of the rest of this [petroleum] industry is chasing the world for reservesU. We have reserves... We have no exploration risk and also have no decline curve, so we have a completely different business model from the conventional crude oil producer."1

Moreover, the commercial success of these ventures has resulted in the recent addition of 174 billion bbl of tar sand to Canada's proved oil reserves.2

US oil shale resources possess the same characteristics of accessibility, richness, production assurance, and high product quality as Alberta tar sand resources. Perhaps the surest way for America to add large quantities of proved US reserves is to demonstrate the commercial viability of oil shale.

A recent report by the US Department of Energy's Office of Naval Petroleum and Oil Shale Reserves (NPOSR) details the strategic significance of America's oil shale for military and domestic needs.34 The report suggests that the richness and magnitude of America's oil shale resources warrants management as a long-term strategic resource, complementing the shorter-term response capability offered by the Strategic Petroleum Reserve.

Development of US oil shale resources could take a decade or more after start-up to mature fully. As with the Canadian tar sand, it may need to weather start-up technology performance issues and occasional, lower petroleum-price cycles. With the advent of a peak in oil production, crude oil prices almost certainly will remain elevated, however, reducing the historic investment risk of low oil prices.

The payoff for sticking to an oil shale industry development plan that overcomes the first-generation economic issues may be substantial if dependence on crude oil remains anywhere close to estimated levels and the risks of a substantial supply shortfall are as high as many analysts predict. As NPOSR Director Anton Dammer stated: "Developing oil shale in the face of today's geopolitical risk and world production uncertainty is a practical and relatively inexpensive insurance policy—a policy that may provide high dividends at a future time when a new policy would be prohibitively expensive to purchase."5 He sees an immediate need for a government-industry program to advance development of America's oil shale. We agree.

Oil shale resources: rich, huge

Worldwide, the oil shale resource base is conservatively estimated to be 2.6 trillion bbl and is located in about 26 countries.6 About 2 trillion bbl, including both eastern and western deposits, is located within the US.7

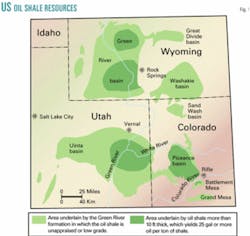

Fig. 1 depicts the most economically attractive US deposits—containing an estimated 1.5 trillion bbl of oil shale resources (>10 gal/ton)—which are found in the Green River formation of Colorado (Piceance Creek basin), Utah (Uinta basin), and Wyoming (Green River and Washakie basins).

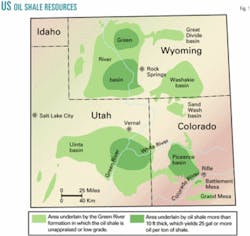

Richness of resource will be a prime economic driver. Fig. 2 represents the relationship between richness and in-place resources.89 The effective comparable richness for commercially produced Athabasca tar sand in Alberta is shown by the tick mark at 22 gal/ton. More than 700 billion bbl of US oil shale resource occurs in concentrations richer than currently produced Alberta tar sand. As commercial viability is demonstrated, a subset, almost certainly in a range near 100 billion bbl, would become a prospect for reclassification to proved reserves.

It is reasonable to assume that first commercial production of oil from oil shale will yield at least 30 gal/ton. (Zones richer than about 40 gal/ton are generally too thin to be selectively recovered at a practical scale.) Beds of commercial thickness that average 30 gal/ton can be found throughout the Colorado and Utah resources. In prior activity, Unocal Corp. reported yields averaging 38 gal/ton, at least in the early stages,10 and is believed to have averaged about 34 gal/ton over the life of the project.

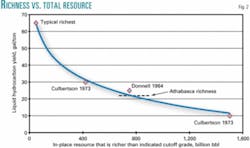

A little-recognized characteristic of oil shale is its high areal density, which can exceed 1 million bbl/acre at its thickest. The high areal density translates into technical and economic benefits and minimizes environmental impact. Although the data shown in Fig. 3 compare in-place resources with proven reserves, the high recovery efficiency expected for oil shale makes the comparison fair.

Given the richness and accessibility of the resource, it is reasonable to conclude that past failures of an oil shale industry were not the fault of the resource. A detailed comparison of the oil shale experience with the commercial experience of Alberta tar sand supports this conclusion.

Comparing US oil shale, Alberta tar sand

Oil was first produced at a commercial scale from Alberta tar sand more than 35 years ago. Today, production is about 1 million b/d, including both mining-based and thermal production. With planned and approved expansions, output is expected to exceed 2 million b/d within the next 6-10 years. The attractive profitability of these ventures is driving these expansions.

A key lesson from the Alberta experience is that the first-generation facility is the hardest, both technically and economically. If not for the commitment of the first venture, Great Canadian Oil Sands, in the 1960s and 1970s—which persevered in the face of unexpected difficulties—the tar sand industry of Alberta would look very different from what it does today. Start-up of a US oil shale industry almost certainly will experience unexpected setbacks as well, and contingencies for these events will need to be factored into policy and economic decisions.

As the Alberta tar sand industry has matured, technology performance and product quality have improved, higher efficiencies have been achieved, and the per-barrel energy and operating costs have steadily declined. Most importantly, once started, investment capital for capacity expansion can be amortized over a larger production base. A similar technology maturation and economic track can be expected for oil shale.

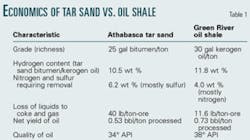

But tar sand and oil shale are different resources, which requires care when making comparisons. A comparison of richness and product quality reveals that oil shale may actually offer certain economic advantages over tar sand (Table 1). First, and most importantly, a 30 gal/ton oil shale feedstock (expected for the first plant) contains about 40% more organic material than does 25 gal/ton tar sand (current production grade). The customary methods for reporting richness are somewhat deceptive because kerogen oil yield is measured after the retort, while the bitumen yield is measured before the coker. The net result is a substantially higher yield (0.73 bbl/ton vs. 0.53 bbl/ton) for oil shale. Second, kerogen is richer in hydrogen than is bitumen, resulting in a more valuable (higher API gravity) product. The term "kerogen oil," or oil derived from the pyrolysis of kerogen, is used in this article in place of the more conventionally used "raw shale oil" to reflect more accurately the geochemical origins of the oil.

Analogous process steps for the two resources are illustrated in Fig. 4. Recovery from each resource involves mining, although the mining technologies may differ. Bitumen extraction, cleanup, and coking/hydrocracking perform the same functions as ore prep and retorting do with oil shale. Both products require upgrading to remove heteroatoms and stabilize the pyrolysis distillate. The removal of nitrogen from kerogen oil by hydrodenitrogenation (HDN) is just as difficult—if not more so—as removing sulfur from coker distillate by hydrodesulfurization, although the mass yield loss is not as great.

An overall mass balance on the two processes shows a dramatic difference between the oil shale and tar sand cases (Table 2). For an equivalent output of sweet refinery feedstock, a room-and-pillar mine that selectively mines only the pay zone requires less than 50% of the mine capacity required for tar sand. The retort handles 30% less tonnage than do the bitumen extraction and cleanup units (although the oil shale ore prep and retort are more capital-intensive). There is no need for a coker or hydrocracker with oil shale. The column labeled "loss minus swell" shows a net volumetric gain for kerogen oil during upgrading, not unlike that for a conventional petroleum refinery.

High thermal efficiency is important if oil shale is to successfully compete as an alternative source of oil. As conventional oil becomes more difficult to find and produce, the energy cost of producing a unit of energy increases. The ability to increase the energy efficiency (lower energy costs) for unconventional resources through technology maturity suggests that both tar sand and oil shale resources will become increasingly competitive with conventional-petroleum over time—a desirable trendline from an investment perspective.

For the oil shale case, an aboveground retort obtains its thermal energy from the combustion of coke remaining on the ore after pyrolysis. External energy in the form of electricity is needed for motor drives in the ore preparation and retort units (estimated at 25-30 kw-hr/ton). These external energy requirements are believed to be no greater than the external energy needed for extraction, cleanup, and coking of bitumen from Alberta tar sand (300,000 btu/bbl of oil shale syncrude vs. 350,000 btu/bbl of tar sand syncrude).4

The energy savings provided by the reduced mine capacity for oil shale may be partially offset by higher per-unit demands of smaller equipment units used in room-and-pillar mining. External energy requirements for the hydrotreating steps are probably similar for the two cases. As a result, the overall energy efficiency for the oil shale case should be very similar to that for Alberta tar sand. A mature oil shale industry should realize economics, energy efficiency, and product acceptance comparable with commercially successful Alberta tar sand.

Factors affecting oil shale development

But what about past failures to commercialize oil shale? What has changed that would make oil shale viable today?

The simple answer is twofold: firm oil prices that are assured by the eventual peak in petroleum production and the competitiveness with other sources offered by its richness.

There are other factors that also will affect the pace of development.

Recovery technology

Technology has been an issue in the past, and poor operability of retort design is arguably a principal cause of the most recent (Unocal) failure.

The front end of the process, i.e., mining by surface, vertical shaft, horizontal adit, etc., and the tail end of the process, i.e., product upgrading, offer relatively mature technologies because these technologies are being used in other, well-established industries.

Surface retorting technologies are less mature, but these technologies have continued to advance over the past 20 years. The Paraho vertical retort has shown good operability for US oil shale, as has the Petrosix version of this technology in Brazil. In Estonia the Galoter retort, a rotary kiln with hot ash recycle, has been operating for more than 20 years. Kiviter retorts have been in operation much longer.

Circular grate technologies show advantages in reducing fines production when retorting the friable Green River oil shale. The surface retorting technology garnering the most favorable attention today is the Alberta Taciuk Process, which is currently being proven in Australia.

Technical challenges for surface retorting include more-efficient and operable solids material handling, improved process energy efficiency, spent catalyst recycling, and elimination of fines from kerogen oil products, among others.

In Colorado, Shell Oil Co. is currently testing a proprietary in situ conversion process (ICP), that uses subsurface heaters to slowly convert kerogen to high yields of high-quality oil and hydrocarbon gases. The ICP process significantly reduces (and in some cases eliminates) the environmental impacts resulting from previous shale oil recovery methods. The process involves no open-pit or subsurface mining, creates no leftover piles of tailings, avoids potential groundwater contaminants associated with combustion, and minimizes unwanted byproducts and water use. Shell believes its technology could be profitable at $25/bbl, once steady-state production is reached.

There may be requirements for other in situ technologies, depending on the resource characteristics. In situ challenges are improved heating technology performance and reliability and, depending on the technology, improved groundwater protection processes.

Oil upgrading, processing

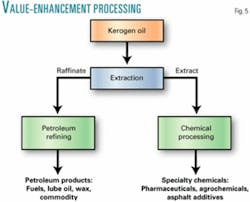

Kerogen oil can be upgraded for use as refinery feedstock and for extraction of high-value chemicals and asphalt additives that extend pavement life.

As with syncrude from Alberta tar sand, refinery feed derived from oil shale is bottomless and possesses low heteroatoms content. The higher hydrogen content of the final product from oil shale results in slightly higher API gravity (38° vs. 34°). The refinery feed also exhibits high concentrations of middle distillate, a desirable component.4 A shale oil-derived refinery feedstock is expected to have a premium value relative to New York Mercantile Exchange-quoted crude oil.

The two most significant characteristics of Green River kerogen oil (the pyrolysis product from the solid kerogen contained in oil shale rock) are its high hydrogen content, derived primarily from high concentrations of paraffins (waxes), and its high nitrogen content, derived from high concentrations of pyridines and pyrroles. The waxes give value to the fuel products for use as diesel and jet fuels but can require special processing to improve the freeze-point properties. The nitrogen compounds are potentially valuable for manufacturing specialty chemicals such as pyridine and picolines or high-performance asphalt additives.

If the nitrogen compounds are extracted for their unique product values, both sides of the extraction process are upgraded, and HDN costs for the resulting raffinate are greatly reduced.11 A schematic of this value-enhancement approach is shown in Fig. 5. A variation of this value-enhancement process is the Shale Oil Modified Asphalt process of New Paraho Corp. (now Shale Technologies Inc.) that has been successfully field-tested in five states.12 Understandably, there may be long-term market limitations to this approach, but not for the all-important first-generation stage.

Project infrastructure

Regional oil and gas developments have created a network of roads and pipelines that could be upgraded to serve oil shale developments. The southern Piceance Creek basin is near US Interstate 70. A pipeline corridor runs from the Uinta basin over Baxter Pass to the I-70 region in Colorado.

The ready availability of natural gas could help meet requirements for production of hydrogen that is used to upgrade kerogen oil to refined products.

Regional power generation facilities are adequate to meet process needs that are not supplied by cogeneration facilities, at least in the early stages of development.

Water resource availability

New oil shale technologies have dramatically reduced process-water requirements, but significant volumes of water still will be required.

Water resources will be required for plant operations, land reclamation, support infrastructure, and for associated population growth.

Many private owners of oil shale lands already have secured senior water rights to supply their projects. Oil shale leases on federal lands, however, will not come with water rights. Water-use priorities and availability will be governed by established legal forum and market forces.

A recent (October 2003) agreement between California and the Upper Basin states returns about 0.8 million acre-ft/ year to the Upper Basin states.13 This amount of water is more than enough to support a 2.5 million b/d oil shale industry, should the water become available for this use.

This agreement also established a reference market price of $258/acre-ft, which is equivalent to $0.033/bbl of water.

Environmental, regulatory compliance

Evolutionary changes in the environmental and regulatory landscape for oil shale projects over the past 2 decades are largely positive.

- Federal and state standards for air quality, surface and groundwater quality, land reclamation and restoration, and ecological and health effects have matured and stabilized since earlier efforts to develop oil shale.

- Regulations and standards are codified; most have been tested in real-world projects as well as in legal proceedings.

- Several states have sought to streamline environmental permitting processes.

- State regulators and federal agencies increasingly collaborate to achieve consistent standards, regulations, and permitting requirements.

- Technology advances have significantly reduced the environmental impacts of many oil shale processes:

- In situ technologies achieve a smaller area of disturbance, or "footprint," than mining-intensive surface retorting approaches.

- Environmental technologies (water and solids treatment) and emissions controls developed for other energy industries can be applied to oil shale mining, retorting, upgrading, and in situ conversion processes.

- Restoration and reclamation techniques that were tested in the 1980s are now proven to be effective.

- Alternative uses for spent shale, (i.e., roadbed and construction materials) can reduce disposal volumes.

- However, in some respects regulatory change has resulted in stricter standards or new challenges:

- Stringent National Ambient Air Quality Standards for Class 1 attainment areas.

- Fugitive-dust standards to reduce regional haze.

- Potential future requirements to limit carbon emissions, metals, or other hazardous materials.

Federal oil shale development activity will likely constitute a "major action" under the National Environmental Protection Act and require a programmatic environmental impact statement.

Socioeconomic, community infrastructure

Development of a commercial-scale oil shale industry in Colorado, Utah, and Wyoming could yield significant long-term local and national socioeconomic benefits, including sustainable economic growth and employment, reduced imports, and improved balance of payments.

Expanded housing, schools, health care, transportation, water resources, utilities, and waste management facilities will be needed and must be carefully planned and properly funded.

Lessons from prior oil shale developments show that local communities cannot be expected to bear the risks of community infrastructure development costs. These risks must be borne by the project developers and larger government entities.

Planning for development will require communication and cooperation with local, regional, and state officials and other stakeholders. The inclusive approach taken by Alberta may serve as a model to gain a community's "permission to practice."14

Other institutional factors

Nearly 80% of the Green River oil shale resource lies on federal land.

While privately held land may support some oil shale development, to achieve major sustained production from oil shale, executive and legislative action will be required to enable the government to manage the leasing and development of oil shale on federal lands in logical units.

Developing an oil shale industry will require both vision and commitment from industry, government, and the public. The recent corporate commitment of Shell to reenter US oil shale, at least at the field experimental level, is noteworthy.

Corporate commitment was an absolute necessity to see Alberta tar sand through its early years and also will be required with oil shale.

Government policies, including economic support for the industry's difficult first-steps, must be clearly articulated and then implemented in accordance with an overall Program Plan. Such a plan is currently being contemplated by NPOSR.

Summary

The world and the US could face a crude oil supply shortfall in the foreseeable future.

The size and richness of US oil shale resources, combined with the evidence of commercial viability analogous to Alberta tar sand, warrants a collaborative government-industry-public effort to commercialize this resource to augment US petroleum supplies.

The amount of oil shale resource that could eventually be classified as proved reserves will depend on the demonstrated success of commercial operations and site-specific economics, but the end result could be hundreds of billions of barrels of oil that America would not need to import.

The impending need for petroleum supplies and the ultimate potential for oil shale to deliver "available, affordable, and environmentally sound" fuels called for by the National Energy Policy is too great to ignore.

Building a consensus to initiate an oil shale industry should now be a priority.

Acknowledgments

This article relies, in part, on the DOE report entitled "Strategic Significance of America's Oil Shale Resources," prepared under contract with Intek Inc. The authors specifically acknowledge Anton Dammer and Hugh Guthrie of DOE, as well as the many professionals who served on the peer review team referred to in that document, for their contributions, comments, and suggestions for this article.

The authors

James W. Bunger (kerogenoil@ jwba.com) is a principal investigator for value-enhancement processing of US and Estonian kerogen oils. He is one of three principal authors of "Strategic Potential of America's Oil Shale Resources." Bunger has developed the Z-BaSIC technology for evaluating petroleum by its molecular composition (www.jwba.com). He holds a BS in chemistry, a PhD in fuels engineering, and has authored 40 technical papers and 11 patents.

Peter M. Crawford ([email protected]) consults in energy technology, policy, and strategic communications in Washington, DC. As a senior manager for Intek Inc., he is one of three principal authors of "Strategic Potential of America's Oil Shale Resources." Crawford has crafted numerous studies, plans, and articles related to energy technology, policy, economics, and technology transfer for public and private clients. He holds a BS from Georgetown University.

Harry R. Johnson (hjohnson@ inteki.com) is a principal petroleum engineer with Intek Inc. He is one of three principal authors of "Strategic Potential of America's Oil Shale Resources." Johnson was a key member of the Department of Interior's Prototype Oil Shale Leasing Program and is the former director of the US Department of Energy's Bartlesville Energy Technology Center at Bartlesville, Okla. He is a petroleum engineer from the University of Pittsburgh, is a member of the Society of Petroleum Engineers, and has authored over 40 technical papers.

References

1. Moritis, Guntis, "Suncor's George: Oil sands a long-life, low-risk resource," Oil & Gas Journal, Mar. 15, 2004, pp. 37-38.

2. Radler, Marilyn, "Worldwide Reserves Increase as Production Holds Steady," Oil & Gas Journal, Dec. 23, 2002, p. 113.

3. Johnson, H.R., Crawford, P.M., and Bunger, J. W., principal authors, "Strategic Significance of America's Oil Shale Resource," DOE Office of Naval Petroleum and Oil Shale Reserves, Anton Dammer, Director, Vol. I—"Assessment of Strategic Issues," March 2004 (http://www.fossil.energy.gov/programs/reserves/keypublications/npr_strategic_significancev1.pdf)

4. Ibid., Vol. II—"Oil Shale Resources, Technology, and Economics." (http://www.fossil.energy.gov/programs/reserves/keypublications/npr_strategic_significancev2.pdf)

5. Dammer, A., personal communication, July 20, 2004.

6. Dyni, John R., "Oil Shale," US Geological Survey, rev. Feb. 27, 2003, cf (http://emd.aapg.org/technical_areas/oil_shale.htm, Sept. 12, 2003).

7. Duncan, D.C., and Swanson, V.E., "Organic-Rich Shales of the US and World Land Areas," USGS Circular 423, 1965.

8. Culbertson, W.J., and Pitman, J.K., "Oil Shale" in "US Mineral Resources," USGS Professional Paper 820, Probst and Pratt, eds. pp. 497-503, 1973.

9. Donnell, J.R., "Geology and Oil-Shale Resources of the Green River Formation," Proceedings, First Symposium on Oil Shale, Colorado School of Mines, pp. 153-163, 1964.

10. Reeg, et al., Proceedings, 23rd Oil Shale Symposium, Colorado School of Mines, 1990.

11. Bunger, J.W., Cogswell, D.E., and Russell, C.P., "Value Enhancement Extraction of Heteroatom-Containing Compounds from Kerogen Oil," pre- prints, Division of Fuel Chemistry, American Chemical Society, 2001, 46 (2), p. 573.

12. Lukens, L., personal communication, Feb 18, 2004.

13. Cf., Salt Lake Tribune, Oct. 17, 2003, Page A-1.

14. "Oil Sands Technology Road- map—Unlocking the Potential," Alberta Chamber of Resources, Art Meyer, president, Jan. 30, 2004 (http:// www.acr-alberta.com/Projects/ Oil_Sands_Technology_Roadmap/OSTR_report.pdf).

This is the fifth in a series of six articles revisiting the topic of peak oil production.