Royal Dutch/Shell lowers proved reserves estimate 20%

Royal Dutch/Shell Group's recent announcement that it overestimated its proved oil and natural gas reserves by 3.9 billion boe, or 20%, caught both investors and analysts by surprise.

Although generally considered an anomaly within the industry, at least one consultant expects that the miscalculation could prompt investors to call for greater transparency in reserves reporting. Spokespeople for other major companies, including Shell's partners in various projects, have said they plan no reserve revisions.

The US Securities and Exchange Commission already was reviewing its reserves definitions and contemplating increased surveillance of oil companies' reserve calculations (OGJ, June 23, 2003, p. 58).

Meanwhile, Canada's stock exchanges last year implemented a requirement for third-party certification of reserve figures for public companies (see related story, p. 30). No such requirement exists in the US.

"[Shell's] revision highlights the challenges regarding reliance on SEC figures to analyze true exploration performance. While there will undoubtedly be calls to tighten the guidelines attached to booking proved reserves, this is only part of the story," said Derek Butter, consultant with Edinburgh-based Wood Mackenzie Ltd.

"To give a clearer picture of a company's exploration performance, investors may call for greater disclosure of 2P [proven and probable] reserves to supplement the current information together with a more detailed breakdown of the reserves booked," he said.

Butter also said there is apt "to be a call for third-party certification of reserves, given the importance of this area as a proxy for a company's exploration performance."

Overestimate

Shell said that more than 90% of the change is "a reduction in the proved undeveloped category; the balance is a reduction in the proved developed category." Numerous countries were affected by the change, with half of the total adjustment involving overestimates in Nigeria and the Gorgon fields development—linked to a proposed LNG export project—off Australia.

The company expects "no material effect on financial statements for any year up to and including 2003" and that the production profile for 2003-05 will be "broadly flat."

Shell said the "recategorization of proved reserves does not materially change the estimated total volume of hydrocarbons in place, nor the volumes that are expected ultimately to be recovered."

Shell expects that most of these reserves will be rebooked in the proved category as field developments mature.

Of the total, 2.7 billion bbl involved crude oil and natural gas liquids, and 1.2 billion boe, or 7.2 tscf, involved natural gas. The revision was made to figures stated on Dec. 31, 2002.

"Reserves affected were mainly booked in the period 1996 to 2002. A significant proportion of the recategorization relates to the current status of project maturity. The recategorization brings the global reserve base up to a common standard of definition, consistent with the globalization of processes within the new exploration and production business model," Shell said.

Gorgon reserves

Shell spokesman Simon Henry told reporters that the company started booking Gorgon reserves in 1997 based upon letters of intent for gas sales and upon development schedules that did not materialize as expected.

Henry said Shell is increasing its internal controls and establishing a group-wide process to verify reserves estimates from the group's various units.

WoodMac said that questions "undoubtedly would have been raised at the time concerning [Shell's] booking of Gorgon reserves, had a more detailed breakdown of reserve bookings been available."

Gorgon operator ChevronTexaco Corp. issued a news release saying Shell's announcement would not affect how ChevronTexaco's worldwide reserves are categorized, including reserves in Nigeria and Australia.

John Gass, president of ChevronTexaco Global Gas, confirmed that the company has not yet recognized any proved reserves for its interest in the Gorgon joint venture.

"Our Gorgon project continues its steady progress toward commercialization, having received in-principle approval in 2003 from the Western Australia state government for the restricted use of Barrow Island for a foundation development in 2003, and strong market support, including a memorandum of understanding with China National Offshore Oil Corp. (CNOOC) to import Gorgon LNG into China," Gass said.

The Western Australian government last year authorized construction of an LNG liquefaction plant on Barrow Island, which lies between the Gorgon gas fields and the Australian mainland (OGJ Online, Sept. 9, 2003).

CNOOC Ltd. agreed to become a partner with the Gorgon joint venture participants. Its parent, CNOOC, was to purchase an undisclosed but "significant" volume of LNG directly from Gorgon for use in China (OGJ Online, Oct. 31, 2003). Before the equity purchase agreement, Chevron Australia Pty. Ltd. held a four-sevenths interest in the Gorgon development, Shell Development (Australia) Pty. Ltd. two sevenths, and ExxonMobil Corp. unit Mobil Australia Resources Co. Pty. Ltd. one seventh. CNOOC Ltd.'s equity interest was not disclosed.

ExxonMobil spokeswoman Sandy Duhe said that ExxonMobil had not booked Gorgon reserves as proved reserves.

"We are very confident in our proved reserves number, and we stand behind it," Duhe said. "We've always taken a very conservative and rigorous, structured approach to booking proved reserves. While we may be in joint projects with Shell and other companies, it doesn't mean that we all book reserves the same way."

SEC regulations

Ryder Scott Co. LP Chairman and CEO D. Ronald Harrell said Shell's revision illustrates growing concerns with SEC reserves reporting regulations, established 26 years ago.

"Since that time, the technology that we use to evaluate reserves has increased dramatically beyond the tools and techniques that we had in 1978. The way oil and gas is marketed today is drastically different than in 1978.U So trying to incorporate the business world and the technology world of today with requirements that were written a long time ago just brings about problems of interpretation," Harrell said.

Annual reserves reports are either prepared by companies themselves or by third-party engineers. Many companies also conduct midyear or quarterly reserves updates, he said.

Project partners frequently have different reserves estimates for the same field. Harrell said this is because reserves reporting depends on the quality and quantity of data, and figures also vary depending upon the individual making the estimate.

"There is no way to take out the effects of professional interpretation on the data that we have," he said. "It is highly interpretative, so that is why we use the term 'estimate.'"

Butter said that the initial impetus of reactions to the Shell announcement could help push tightened definitions of proved reserves for SEC purposes.

"There is no indication that a widespread problem exists among other oil and gas companiesU. We believe the major investor groups will be the ones calling for greater transparency, and that the companies are quite likely to comply to reassure investors that there are no similar problems to the one that has affected Shell," Butter said.

He said he expects that investors will demand more-detailed knowledge of reserves potential.

Harrell said the Sarbanes-Oxley Act, passed by the US Congress in 2002 to deter corporate fraud in financial reporting, already had prompted renewed interest in more third-party intervention in reserves reporting (OGJ, Oct. 13, 2003, p. 22).

"I think Sarbanes itself probably will advance that cause a little more than the Shell event will, but if there is another Shell and another Shell, then all bets are off. I wouldn't anticipate that, but I wouldn't rule out the possibility. If it's happened once, it could happen again, but I have no specific expectation of any one company," Harrell said.

Reserve replacement

Standard & Poor's Rating Services analyst Emmanuel Dubois-Pelerin of Paris said, "Standard & Poor's had already expressed concern over Shell's level of reserve replacement in 2001-02 but took comfort from the company's very strong bookings of proved reserves in previous years and expected stronger bookings in 2003. The announced reclassification, however, regards bookings made during 1996-2002 and also reveals that 2003 bookings will be well below 100%, markedly heightening our concern."

Shell projects a reserves replacement ratio for 2003 of 70-90%, representing a net addition of 1-1.3 billion boe.

Dubois-Pelerin said that, during the past 8 years, Shell's replacement rate of proved reserves of about 80% implied high finding and development costs (estimated by S&P to be around $6.50/boe) and resulted in a significantly shortened proved reserves life of just above 10 years compared with 13.3 years reported at yearend 2002.

"Additionally, the concentration of the reclassification on crude oil and NGLs implies that this indicator, for liquids only, will be even lower: just above 8 years," Dubois-Pelerin said.

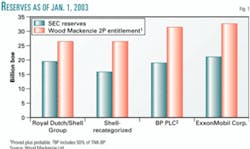

Butter said that, accounting for the reserves downgrade, Shell's reserves replacement performance for 1997-2002 drops to 57% from 105%, compared with ExxonMobil's 116% and BP PLC's 152% (Fig. 1).

Shell's finding and development costs for the same period have risen to $7.90/bbl from $4.27/bbl, in light of the downgrade. That compares with $3.93/bbl for ExxonMobil and $3.73/ bbl for BP, Butter said.

The reserves reclassification itself will not affect Shell's operational performance or future growth prospects, but "the fact that both reserve replacement and finding and development costs are widely used to benchmark the relative performance of oil and gas companies, and the fact that these have now changed so markedly, will cause concern" among investors and analysts, Butter said.

Credit agencies reactions

In response to Shell's reserves downgrade, S&P put its AAA long-term ratings on Royal Dutch/Shell and its fully owned subsidiaries on CreditWatch with negative implications. At the same time, the A-1+ short-term ratings on these entities were affirmed.

New York-based Moody's Investors Service on Jan. 9 placed the Aaa ratings of Royal Dutch/Shell under review for possible downgrade. This involved Shell Finance (UK) PLC and Shell Finance (Netherlands) BV.

On Jan. 12, Moody's also placed several entities linked to Shell under review for possible downgrade credit ratings. The review involves $1.6 billion of debt securities. The entities include Shell Oil Co., Pennzoil-Quaker State, and Shell Frontier Oil & Gas Inc.

Others under review are Coral Energy Holding LP, a trading subsidiary owned 91% by Shell Oil. Motiva Enterprises LLC and Deer Park Refining LP, both joint ventures owned 50% by Shell Oil, also are under review.

Investor reactions

Reserves numbers indicate the assets underlying an oil and gas company's stock price. Shell's stock price dropped $4.15/share on Jan. 9 (the day the announcement was made), while ChevronTexaco shares dropped 93¢, ExxonMobil shares dropped 61¢, and ConocoPhillips dropped 37¢. Meanwhile, BP shares gained 1¢ that day. All the companies' stock are traded on the New York Stock Exchange.

Shell's management credibility is likely to suffer, said analyst Michael Mayer of Prudential Equity Group Inc.

"This is expected to reduce investor confidence and thus the price paid for future earnings and cash flow," he said.

Banc of America Securities LLC analysts said they see no material adverse effect for independent operators.

Ryder Scott Co. LP's Chairman, CEO D. Ronald Harrell

"We believe this writedown is largely a Royal Dutch/Shell-specific event, which they attribute to timing and technical issues," Banc of America analysts Bob Morris, Tyler Dann, and others said in a note on the announcement.

"Importantly, it has always been our perception that many of the majors are more aggressive than the independents in booking proven reserves. In fact, on average over the past 10 years, 37% of worldwide reserve replacement by the majors has been the result of positive revisions to prior estimates vs. 1% for the independents," they said.

Unlike independents, the majors traditionally conduct their own internal reserves calculations without third-party verification, the analysts noted.

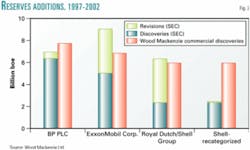

Butter said he believes the vast majority of the unbooked reserves still will prove to be commercial, adding that the issue is the timing of booking those reserves (Fig. 2).

"Shell's announcement has highlighted the problem of relying solely on reported oil and gas metrics in assessing a company's underlying exploration performance. The control of reserve reporting is largely regulated by the companies themselves, and there is little transparency as to which discoveries are being included in the proved category," Butter said.