Rising expectations of ultimate oil, gas recovery to have critical impact on energy, environmental policy- Part 1

Rising expectations of ultimate oil, gas recovery to have critical impact on energy, environmental policy—Part 1

Oil & Gas Journal last year rendered an invaluable service to the energy industry in six consecutive issues featuring special reports on future energy supply (OGJ, July 7-Aug. 18, 2003).

These articles effectively, yet in a very balanced fashion, deflated the prophets of the nearly imminent peaking of global production of petroleum liquids and natural gas.

In an earlier OGJ issue, this author published an article that showed that the late American geophysicist M. King Hubbert and his intellectual heirs—notably Colin J. Campbell and, to a lesser degree, Jean Laherrère—were mistaken in attempting to predict peak global or regional oil and gas production by fitting a bell-shaped (logistic) curve to the available annual production data, with the area under this curve defining the ultimate resource recovery (URR).1

The only instance in which this seems to have occurred is in the Lower 48 states, the world's most thoroughly explored and, along with the Russian Caspian Sea, oldest oil province. It also must be noted that Hubbert's projection of peak UK North Sea production of 2.5 million b/d in 1985 has not materialized, and current production is still 2.5 million b/d after peaking at about 2.7 million b/d in 1999.2

Even the apparent success of the Hubbert methodology for the Lower 48 was questioned by another distinguished American petroleum geologist, William L. Fisher, at the Bureau of Economic Geology at the University of Texas. In October 1992, Fisher participated in an authoritative study conducted under the auspices of the US Department of Energy.3 In contrast to yearend 1991 proved reserves of oil of only 24.7 billion bbl,4 total remaining US oil resources—at $27/bbl (1992 dollars) and advanced technology—at yearend 1991 were estimated to be 204 billion bbl; including cumulative production at yearend 1991 of 164 billion bbl (185 billion bbl at yearend 2001), ultimate recovery was estimated at 368 billion bbl, contrary to the wide-spread belief that the US is in imminent danger of "running out of oil."

Similarly, Fisher's estimate of the global natural gas endowment is 25,000 tcf, which especially if it includes cumulative production of 2,200-2,400 tcf at yearend 2001, is a reasonable value and supports this author's current estimate of 20,000 tcf of conventional remaining recoverable world gas resources.5

Projecting magnitude, timing

OGJ's July 7 and July 14, 2003, issues have several articles on the controversial subject of projecting the magnitude and timing of the peak in global and important regional oil production, which deviate widely.6-8

A global production peak of 27 billion bbl/ year as early as 2004 is projected by the perennial pessimists Campbell and Laherrère (without citing a corresponding value for ultimate recovery). However, according to OGJ, in 2002 Laherrère, using a different methodology of more relevance to energy per capita data, projected a peak of about 33 billion bbl/year around 2010 and an ultimate oil resource recovery of 3,000 billion bbl.

The US Geological Survey, as reported by the US Energy Information Administration, projects peak oil production at 48.5-78 billion bbl/year in 2021 at respective probabilities of 95% to 5% and at annual production growth rate of 3%.

At a growth rate of 1%/year, peak production would be 34.8 billion bbl in 2033 and 48.8 billion bbl in 2067 at probabilities of 95% and 5%, respectively.

EIA's range of peak crude oil production corresponds to USGS estimates of ultimate recovery of 2,248-3,896 billion bbl, at a 95% probability for the low value and a 5% probability for the high value. The USGS mean expected value of global URR is 3,003 billion bbl, which would produce a peak of 63 billion bbl in 2030 at a growth rate of 3%/year and a peak of 41 billion bbl in 2050 at a growth rate of 1%/year. And this does not include natural gas liquids, synthetic crudes derived from bitumens and extra-heavy crude oils whose potential substantially outstrips conventional crude oil.

Excluding NGLs, OGJ Executive Editor Bob Williams last year reported estimates of resources of nonconventional heavy hydrocarbons in place at 4,291 billion bbl as of yearend 2000,9 based on data from the International Energy Agency, of which only Canada's Alberta oil sands and Athabasca tar sands and Venezuela's Orinoco heavy oil belt are currently commercial and which produced 964,000 b/d in 2001.

An interesting side issue in the assessment of Alberta oil sands is that the Alberta Energy and Utilities Board put Alberta's "established" remaining reserves at 174 billion bbl at yearend 2002 and that OGJ accepted this value in its invaluable annual yearend assessment of country-by-country oil and natural gas reserves and oil production. This vaulted Canada from a minor holder of about 5 billion bbl out of 1,031.6 billion bbl of global reserves as of Jan. 1, 2002, to No. 2, just behind Saudi Arabia's 259.3 billion bbl, out of 1,212.9 billion bbl of global crude oil reserves as of Jan. 1, 2003.10

Royal Dutch/Shell Group's view (undated) of the world conventional oil endowment, as reported in the July 14, 2003, OGJ, is 3,250 billion bbl, including 860 billion bbl of cumulative production and 1,090 billion bbl of proved reserves (which indicates that this may be an estimate made around 2000 or 2001), plus 610 billion bbl under the category "scope for recovery" and 690 billion bbl yet to find.

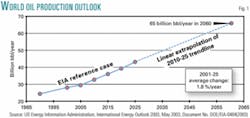

The USGS projection of peak production of 53.2 billion bbl in 2037 at an annual production growth rate of 2% is certainly the lower limit of a credible range. For comparison, EIA, in the reference case of its International Energy Outlook 2003, projects global oil production in 2025 of 43.2 billion bbl at an average annual growth rate during 2001-25 of 1.8%/year.11

This article offers an estimated peak value, using EIA data for oil production in 2060, of 65 billion bbl (Fig. 1); however, the methodology used here of a roughly linear extrapolation of the 2010-25 trendline does not allow a prediction of the timing and magnitude of the peak and merely indicates that most of the previously cited predictions appear to be low. For example, the Association for the Study of Peak Oil arrives at a peak value of only 30 billion bbl of all sources of petroleum liquids, including NGLs and heavy oil, in 2010.7

This wide range of the magnitude and timing of peak oil production and a somewhat narrower range of ultimately recoverable resources based on what one must assume is solid scholarly analysis must be resolved if we are to pursue a rational energy policy and adequate funding for the development of sustainable energy sources.

However, Williams noted that progress in improved oil recovery and economics also is essential in deferring the global oil production peak.12 He further stresses that refiners' future profitability depends on their ability to adapt to the changing feedstock and product specifications resulting from the introduction of growing percentages of very light to very heavy new sources of petroleum liquids.13

In my recent publications I have used a remaining resource recovery value of 3,600 billion bbl of petroleum liquids (i.e., in addition to cumulative production of roughly 900 billion bbl). This value includes NGLs and Alberta oil sands.

The large potential of NGLs seems to be overlooked by many analysts. This can be illustrated by assuming the same ratio of NGLs to dry gas reserves in the US for the world's remaining recoverable dry natural gas resources. On Dec. 31, 2001, the US had 183.5 tcf of dry natural gas reserves and 7.993 billion bbl of NGL reserves, or 0.0436 billion bbl/tcf. Thus, for 20,000 tcf, this would correspond to 872 billion bbl of NGL.

If we consider the prospects for recovery of petroleum liquids that have physical properties, even after blending or upgrading, within the range of the various benchmark crude oils—including the 4,300 billion bbl of heavy hydrocarbons noted previously—total remaining recoverable supplies of petroleum liquids could be as much as 8,000 billion bbl.

That value, more than twice the current estimates excluding these additional sources, does not seem too unreasonable. This does not include global shale oil resources of more than 3,500 billion bbl according to the IEA.

Oil shale

The US has the largest oil shale resources, but there are also massive resources in the former Soviet Union, China, Brazil, and Canada.

However, potential shale oil reserves are put at a mere 160 billion bbl. It is important to note that oil shale is geologically quite different from the heavy hydrocarbons—i.e., tar and oil sands and other bitumens and extra-heavy crudes—being a sedimentary rock containing kerogen, the organic carbon compounds that yield shale oil when retorted.

When western US oil shales are mined, crushed, and then retorted, they produce a relatively light shale oil compatible with the properties of the world's benchmark crudes. The Institute of Gas Technology, under the sponsorship of American Gas Association, DOE, and Phillips Petroleum Co., did quite a lot of research and development on pressure retorting with hydrogen of both eastern and western US shales (hydroretorting) in the 1960s, 1970s, and 1980s, which increased the yield and improved the properties of the resulting shale oil.14 Moreover, under more severe operating conditions, oil shale was a potential source of substitute natural gas.15-18

The US Bureau of Mines also operated an experimental oil shale mining operation in Rifle, Colo. But the interest in oil shale processing diminished as oil prices fell and government support evaporated. Today, tiny Estonia is the world's largest producer of shale oil at about 3,000 b/d. However, in spite of the relatively high costs of shale oil production and the environmental problems arising from the mining of oil shale and disposal of spent shale, it is a more economical source of hydrocarbon liquids than Fischer-Tropsch synthesis using synthesis gas produced by steam-oxygen gasification of coal.

Wilford G. Bair undertook a comprehensive review of IGT's activities during 1941-91 related to the use of high-pressure hydrogen in increasing the yield and enhancing properties of US western and eastern oil shales.14 Hytort, the process for converting oil shale to crude oil under pressure of about 1,000 psig of hydrogen was originally developed by IGT and AGA on a bench scale in the 1960s and 1970s. In the 1980s, federal research funding was added, and the process was further developed by a team headed by Phillips.

In 1972, AGA resumed sponsoring oil shale hydrogasification research with IGT because of rising concern about natural gas supply. The program consisted of a thermobalance study of the optimum conditions for converting both western and eastern US oil shales to substitute natural gas. The eastern US oil shales were not amenable to processing by conventional retorting and had very low yields of oil. However, under the conditions used in hydroretorting, the eastern shales gave a very good conversion to either high-btu gas or shale oil, depending on processing conditions.

According to Bair's review, 95% of the organic carbon content of western shales could be converted to useful products by hydroretorting, whereas conventional retorting could convert only about 70%.

Hydroretorting of eastern shales converted about 90% of the organic carbon, compared to only 35% by conventional retorting. These results were confirmed by continuous-flow tests in a benchscale unit with a throughput of roughly 200 lb/hr of oil shale. A large-scale process development unit (2,000 lb/hr), then was constructed and operated for about 2 years to provide scale-up data for a commercial plant. The moving-bed hydroretorting technology was patented and the new process called Hytort.

Near the end of the decade and into the 1980s, however, as the world supply picture improved, interest in oil shale as a resource for substitute natural gas production waned. Gas Research Institute withdrew from the oil shale conversion program in 1980, and the emphasis of IGT's shale work shifted to liquid products. The large increase in the eastern shales' carbon conversion was of special interest to petroleum companies.

In September 1980, Gas Developments Corp., IGT's commercialization arm, formed a wholly owned subsidiary, Hycrude Corp., to commercialize the Hytort technology for the production of oil from both western and eastern shales. In November 1980, Phillips agreed to jointly develop the Hytort process with Hycrude. For the rest of the decade, Hytort development was sponsored by Phillips and was directed at processing eastern shales.

In 1980, DOE began a major program in oil shale conversion based on the hydroretorting technology developed by IGT. DOE's program sought to build an information base on US shale resources and a database on hydroretorting for a variety of eastern and western shales. Thus, by the end of the fourth decade of IGT's oil shale research, Hytort technology was being actively pursued by Phillips and Hycrude, while DOE's program was further evaluating the eastern US shale resource base.

Natural gas

Given all of the preceding discussion of petroleum liquids resources, it is unlikely that oil supplies will "run out." And while the old adage "the Stone Age didn't end because we ran out of stones" may apply to petroleum liquids, perhaps it won't apply to natural gas.

The latter has a low carbon intensity, low emissions of conventional pollutants, and an inherent ability to be used at high efficiency, such as in natural gas-fired, combined-cycle power plants with a lower heating-value efficiency of 60% and for distributed electric power generation at potentially even higher overall efficiencies.

With the use of fully commercialized and widely practiced technologies, natural gas also could be the logical (and low carbon-emission) interim source of hydrogen—by steam reforming and catalytic water gas shift processing, producing a mixture of 80% hydrogen and 20% carbon dioxide—to serve as the energy supply for proton exchange membrane fuel cells used in electromotive propulsion for surface transport, at triple the efficiency of internal combustion engines in the same mode.

In respect to global natural gas supply, Campbell in OGJ projected a global plateau of about 130 tcf/year during 2015-40, followed by a steep decline on the assumption of a global endowment (including cumulative production) of only 10,000 tcf, which is about half of a reasonable value, considering the limited exploration for natural gas in much of the world and the growing contributions of unconventional sources of natural gas.7 Laherrère projected a slightly higher ultimate recovery of 12,000 tcf, including unconventional sources, and peak production of about 130 tcf in 2030, although his graphic representation shows a peak near 138 tcf in 2030.19

Williams cites a USGS compilation of 1996 Petroconsultants and 1995 NRG Associates data giving a mean value of 15,400 tcf for the global natural gas endowment, including 1,750 tcf of cumulative production for only those parts of the world actually assessed. USGS updated this value to 15,687 tcf in 2000, including a worldwide mean of proved reserves of 5,501 tcf, 4,839 tcf of worldwide undiscovered natural gas, 3,000 tcf of stranded reserves, and 2,347 tcf for reserves growth. Note, however, that the proved reserve value is for Jan. 1, 2003, and that the total of 15,687 tcf apparently excludes cumulative production of about one half of 4,839 tcf of worldwide undiscovered natural gas. This increases the credibility of this author's assessment of 20,000 tcf of remaining technically recoverable resources.

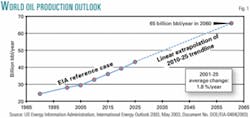

In contrast with the aforementioned relatively low projections of peak global natural gas production within about 30 years, EIA projects a continuing increase in world natural gas consumption, to 175.9 tcf in 2025 from 90.3 tcf in 2001, or a growth rate of 2.8%/ year—in large measure due to an increase in international gas trade, especially LNG, which provides access to large, otherwise stranded reserves. (For example, France's Cedigaz estimated that international trade of LNG rose to 4.9 tcf in 2002.20

My estimate for the future peak in gas supply, based on the previously cited EIA data, is 253 tcf in 2045 (Fig. 2), well above any of the levels of peak production cited earlier. However, as noted in the earlier use of EIA data to project oil production, this methodology of roughly linear extrapolation of the 2010-25 trendline does not allow prediction of the timing and magnitude of the peak but merely indicates that most of the projections by other analysts appear to be low. In any event, these divergent projections of world natural gas resources and peak production require further study.

Similarly, in parallel studies by GRI, published in January 2000, and of the National Petroleum Council, published in December 1999, estimates of the potential (i.e., excluding cumulative production of 882 tcf) US Lower 48 natural gas resource base—as of Jan. 1, 1998, and with 2015 technology—were 1,696 tcf and 1,309 tcf, respectively.21 The Canadian potential resource base with 2015 technology was estimated to be 758 tcf and 603 tcf, respectively, excluding cumulative production of 103 tcf, with the lower estimates in both instances made by the more-conservative NPC.

Again, this bodes well for getting the winter of 2002-03 "natural gas crisis" (as well as several previous such crises leading to counterproductive government intervention) behind us and relying on the market to establish price and supply stability. However, it seems unlikely that we will see the wellhead and Henry Hub prices of $1.50-2.50/MMbtu prevailed prior to the winter of 2000-01 and the California energy crisis, compounded by the record drawdown of US seasonal underground storage during the severe winter of 2002-03. For the foreseeable future, the US price outlook is about $3.00-5.50/MMbtu.

Unconventional natural gas

Originally, unconventional sources of natural gas included gas from tight formations, Devonian shales, ultradeep and geopressured reservoirs, and methane recovered from coal beds.

Today, all of these sources after they have been adequately assessed are included in the proved reserves and ultimate and remaining recoverable resource data.

Scott Reeves in OGJ reported on a multiyear government-industry research and development collaboration launched in October 2000 by DOE and its contractor Advanced Resources International that investigated the potential of replacing coalbed methane (CBM)—the largest current source of US "unconventional" natural gas—with carbon dioxide.22

His article established CO2:CH4 replacement ratios of most major US coal basins and found that these ratios decrease from 10:1 to 1:1 for coals of increasing rank from subbituminous to low-volatility bituminous coal. In total, the potential for CO2 sequestration is about 90 gigatonnes (or 24.5 billion tonnes of carbon) for enhanced CBM recovery.

In 2001, the US emitted 1.56 gigatonnes of carbon in the form of CO2 from fossil fuel use of which 0.506 gigatonnes was emitted by coal-fired electric plants.23 Thus, coalbeds have a CO2 sequestration capacity for emission from coal-fired power plants for nearly 50 years at the 2000 rate. The US has a CBM resource of 170 tcf vs. proved reserves at yearend 2001 of 17.531 tcf.4 The economics of CBM CO2 sequestration at natural gas prices of $3.00-4.50/Mcf are nearly break-even up to about 80 tcf of CO2 at the higher price level and a modest profit up to about 30 tcf, assuming the cost of delivered CO2 to be zero.22

However, the largest US potential unconventional source of natural gas is in the form of ice-like methane hydrates (clathrate compounds) in US coastal waters at depths greater than 500 m and some permafrost deposits in Alaska. The total methane content, according to USGS, ranges from 112,000 tcf to 676,000 tcf at 0.95 and 0.05 probability levels, respectively.24 GRI estimates the mean average methane content in methane hydrates in nine plays in US coastal waters and one onshore permafrost play in Alaska at 320,000 tcf.19

Carbon emissions

Growing pressure to impose limits on carbon emissions out of concern for postulated catastrophic climate change poses a problem.

Even if we phase out the use of coal or develop the technology to convert it to hydrogen and carbon dioxide and sequester the CO2 in suitable geologic reservoirs or the deep ocean, the carbon content of remaining recoverable petroleum liquids and of natural gas produced during 1991-2100 would exceed 1 trillion tonnes. This would take atmospheric CO2 concentrations to levels that some believe will cause increases in the average global surface temperature of as much as 15° C.25 26

CO2 is the most important of the anthropogenic greenhouse gases that some hold responsible for much of the overall rise in average global surface temperatures of 0.6-0.7° C. since CO260 as noted by the Intergovernmental Panel on Climate Change. It is also important to note that the roughly 8 gigatonnes/year of anthropogenic sources of carbon in the form of CO2 is only a small fraction of the natural circulation of 200 gigatonnes/year of carbon between the atmosphere, the ocean, and terrestrial sources and sinks. In any event, CO2 is used as the surrogate for all of the greenhouse gases of human origin. The widely fluctuating actual temperature record for CO260-2000 does not support a direct cause-and-effect relationship between atmospheric CO2 concentrations and surface temperatures, as will be discussed later.27

Nevertheless, a relatively simple global radiation balance indicates that the Earth's effective emission temperature from 5.5 km up in the troposphere would have to rise by 1.2° C. (2.2° F.) to accommodate the radiative forcing of 4.4 w/m2, if preindustrial concentrations of atmospheric CO2 roughly double—i.e., from 280 ppmv to 550 ppmv.27 28

However, the average global surface temperature also is affected by feedback effects of water in various forms (vapor at various concentration profiles in the troposphere and stratosphere, clouds at different heights and reflectivity, etc.), because more than 95% of the "greenhouse effect" is caused by these forms of water not subject to human control.27 28 32

Carbon emissions potential

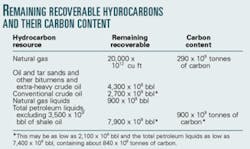

This raises the question of carbon emissions from the proved reserves and the upper bounds of technically recoverable resources of conventional fossil fuels. Even an estimated 20,000 tcf of remaining recoverable natural gas resources (about 31/2 times proved reserves of 5,501 tcf) contains only 290 gigatonnes of carbon.

Similarly, an estimate of 3,600 billion bbl of technically recoverable petroleum liquids (or about 21/2 times proved reserves of 1,453 billion bbl, an amount that breaks out to 1,213 billion bbl of crude oil and Canadian oil sands, plus an estimated 240 billion bbl of NGLs) contains 410 gigatonnes of carbon.

Thus, until the recent series of OGJ articles on future energy supply, it seemed reasonable to assume that the total carbon content of the potentially remaining recoverable hydrocarbon fuels is only 700 gigatonnes. However, if we raise the recoverable petroleum liquids potential by including the estimate of unconventional heavy oil resources to 8,000 billion bbl, this would cause carbon emissions from hydrocarbon fuels to rise to about 1,200 gigatonnes, even excluding shale oil (see table).

This compares with 4,450 gigatonnes of carbon in the upper bound of technically recoverable resources of coal and lignite (about 6 times the proved reserves of 1.089 trillion short tons).

The carbon content of the proved reserves of conventional natural gas and petroleum liquids, plus those for coal and lignite, totals about 1,000 gigatonnes.

Thus, prior to this analysis, the total potential carbon emissions from conventional fossil fuels ranged from about 1,000 gigatonnes for the proved reserves to over 5,000 gigatonnes for the technically recoverable resources. Therefore, it also seems logical that reliance on the conventional hydrocarbon resources and technologies that eliminate carbon emissions from coal would offer a sound basis for energy policy. However, if the total liquid hydrocarbon resources from oil and tar sands and other bitumens, extra-heavy crude oil, etc., even excluding shale oil, could be as high as 8,000 billion bbl, global warming constraints—instead of oil supply constraints—could become the limiting factor.

Policy implications

As noted before, the reason these data of potential carbon emissions from fossil fuels have major implications for energy and environmental policy is that this policy should strive to limit cumulative anthropogenic carbon emissions in the form of CO2 (largely from fossil fuel combustion) from 1991 to 2100 to 1,000 gigatonnes in order to stabilize atmospheric CO2 concentrations at 550 ppmv.25-28

Assuming median climate sensitivities to increases in CO2 concentrations, cumulative anthropogenic carbon emissions of 1,000 gigatonnes from 1991 to 2100 would limit further average global surface temperature increases to 2-2.5° C. (3.6-4.5° F.).25 26 The CO2 concentration in 2000 already had risen to 367 ppmv from the preindustrial level of 280 ppmv.

Roughly doubling of preindustrial CO2 concentrations is projected to cause temperature fluctuations still in the range of those that occurred naturally during the current, 10,000-year-old interglacial period (the Holocene Age).29

Moreover, it now appears that there is a practical solution to capping and then sharply reducing CO2 emissions, while extending the lead time for the complete conversion of the global energy system to sustainable and carbon-emission-free sources of power and hydrogen by more than a century.

This could be accomplished by generating coal-fired power using a modification of the integrated coal gasification-combined cycle (IGCC) process in which the carbon monoxide (CO) in the products formed in the initial steam-oxygen coal gasification step is catalytically converted with steam into more hydrogen and CO2 by the well-known water gas shift reaction (CO + H2O ‡ H2 + CO2).30 31

The CO2 is then separated and sequestered in suitable geologic formations, coal beds, or the deep ocean before the remaining hydrogen, about 90% pure, is used as the fuel for the extremely efficient combined-cycle power generation step. This essentially carbon-emission-free source of hydrogen could also be used for distributed power generation technologies and as a transportation fuel if the economic and technical obstacles to regional hydrogen transmission, distribution, and storage systems (similar to the existing natural gas system) can be overcome.

Thus, our concern with limited remaining recoverable resources and early peaking of production of petroleum liquids and natural gas may become irrelevant.

Acknowledgment

The author gratefully acknowledges the generous financial support of the underlying analytical studies for this article by Gas Technology Institute in Des Plaines, Ill.

References

1. Linden, Henry R., "Flaws seen in resource models behind crisis forecasts for oil supply, price," OGJ, Dec. 28, 1998, p. 33.

2. Williams, Bob, "Debate over peak-oil issue boiling over, with major implications for industry, society," OGJ, July 14, 2003, p. CO2.

3. "An Assessment of the Oil Resource Base of the United States," Oil Resources Panel, commentary by William L. Fisher, Noel Tyler, Carol L Ruthven, Thomas E. Burchfield, and James F. Pautz, Bartlesville Project Office, US Department of Energy, Bartles- ville, Okla., October 1992, Doc. No. DOE/BC-93/1/SP.

4. "US Crude Oil, Natural Gas, and Natural Gas Liquids Reserves," 2001 Annual Report, Energy Information Administration, Office of Oil and Gas, US Department of Energy, November 2002, Doc. No. DOE/EIA-0216(2001).

5. Linden, Henry R., "Energy Independence NOW—Environmentally benign technologies can meet the president's hydrogen plan," Public Utilities Fortnightly, Vol. 141, No. 13, July 1, 2003, pp. 22-26.

6. Lynch, Michael C., "Petroleum resources pessimism debunked in Hubbert model and Hubbert modelers' assessment," OGJ, July 14, 2003, p. 38.

7. Campbell, C.J., "Industry urged to watch for regular oil production peaks, depletion signals," OGJ, July 14, 2003, p. 38.

8. Bakhtiari, A.M. Samsam, "Middle East oil production to peak within next decade," OGJ, July 7, 2003, p. 20.

9. Williams, Bob, "Heavy hydrocarbons playing key role in peak-oil debate, future energy supply," OGJ, July 28, 2003, p. 20.

10. Radler, Marilyn, "Worldwide reserves increase as production holds steady," OGJ, Dec. 23, 2002, p. 113.

11. EIA, "International Energy Outlook 2003," May 2003, Doc. No. DOE/EIA-0484(2003).

12. Williams, Bob, "Progress in IOR technology, economics deemed critical to staving off world's oil production peak," OGJ, Aug. 4, 2003, p. CO2.

13. Williams, Bob, "Refiners' future survival hinges on adapting to changing feedstocks, product specs," OGJ, Aug. 11, 2003, p. 20.

14. Bair, Wilford G., "IGT-The First 50 Years: A History of the Institute of Gas Technology 1941-1991," Chicago, 1991 (now Gas Technology Institute, Des Plaines, Ill.).

15. Linden, H.R., and Shultz Jr., E.B., "From Oil Shale to Production of Pipeline Gas by Hydrogenolysis," Industrial & Engineering Chemistry Research, Vol. 51, pp. 573-76, April 1959.

16. Linden, H.R., and Feldkirchner, H.L., "Pipeline Gas from Oil Shale by Direct Hydrogasification," I&EC Process Design Development, Vol. 3, pp. 2CO2-26, July 1964: American Chemical Society, Division of Fuel Chemistry Preprints, Vol. 7, No. 1, pp. 70-82, January 1963.

17. Linden, H.R.. Tsaros, C.L., Feldkirchner, H.L., and Huebler, J., "Pipe- line Gas from Oil Shale," presented before the United Nations Symposium on the Development and Utilization of Oil Shale Resources, Tallinn, USSR., Aug. 26-Sept. 9, 1968.

18. Linden, H.R., "Process for Production of Pipeline Quality Gas from Oil Shale," US Patent 3,703,052, Nov. 21, 1972.

19. Williams, Bob, "Debate grows over US gas supply crisis as harbinger of global gas production peak," OGJ, July 21, 2003, p. 20.

20. LNG Observer, Gas Technology Institute, Vol. XII, No. 4, July-August 2001.

21. Linden, Henry R., "Let's Be More Positive About Natural Gas!" Public Utilities Fortnightly, Vol. 140, No. 12, June 15, 2002, pp. 28-32.

22. Reeves, Scott R. "Enhanced CBM recovery, coalbed CO2 sequestration assessed," OGJ, July 14, 2003, p. 49.

23. EIA, "Annual Energy Outlook 2003 with Projections to 2025," January 2003, Doc. No. DOE/EIA-0383 (2003).

24. "A Strategy for Methane Hydrates Research & Development," US Department of Energy, Office of Fossil Energy, DOE/FE-0378, August 1998.

25. Houghton, J.T., et al., eds., "Climate Change 1995, The Science of Climate Change," Contribution of Working Group I to the Second Assessment Report of the Intergovernmental Panel on Climate Change (IPCC), 1996, Cambridge University Press.

26. Houghton, J.T., et al., eds., "Climate Change 2001: The Scientific Basis," Contribution of Working Group I to the Third Assessment Report of the IPCC, 2001, Cambridge University Press.

27. Linden, Henry R., "CO2 Does Not Pollute; But Kyoto's Demise Won't End Debate," Public Utilities Fortnightly, Vol. 139, No. 10, May 15, 2001, pp. 22-28.

28. Linden, H.R., "The United States Can No Longer Stay on the Sidelines in Formulating a Rational Global Climate Change Policy," (Guest Editorial), The Electricity Journal, Vol. 14, No. 8, October 2001, pp. 80-84.

29. Hileman, Bette, "Web of Interactions Makes It Difficult to Untangle Global Warming Data," Chemical and Engineering News, Apr. 27, 1992, pp. 7-14, 16, 18-19.

30. "Evaluation of Innovative Fossil Fuel Power Plants with CO2 Removal," Electric Power Research Institute, Palo Alto, Calif., and US Department of Energy, Office of Fossil Energy, Germantown, Md., and National Energy Technology Laboratory, Pittsburgh, Pa., Interim Report, Doc. No. 1000316, December 2000.

31. Linden, H.R., "Bridging the Carbon Gap: Fossil Fuel Use for the 21st Century," Public Utilities Fortnightly, Vol. 140, No. 21, Nov. 15, 2002, pp. 32-41.

32. Linden, Henry R., "Let's Focus on Sustainability, Not Kyoto," The Electricity Journal, Vol. 12, No. 2, March 1999, pp. 56-67.

The second part of this article concludes in the Jan. 26 issue.

The author

Henry R. Linden is Max McGraw Professor of Energy and Power Engineering and Management and director, Energy + Power Center, at the Illinois Institute of Technology, Chicago. He has been a member of the IIT faculty since 1954 and served as IIT's interim president and CEO from 1989 to 1990, as well as interim chairman and CEO of IIT Research Institute. Linden helped to organize the Gas Research Institute (GRI), the US gas industry's cooperative research and development arm that merged with the Institute of Gas Technology (IGT) in 2000 to form Gas Technology Institute (GTI), on whose Strategic Advisory Council he now serves. He served as interim GRI president in 1976-77 and became the organization's first elected president and a director in 1977. Linden retired from the GRI presidency in April 1987 but continued to serve the group as an executive advisor and member of the Advisory Council. From 1947 until GRI went into full operation in 1978, he served IGT in various management capacities, including four years as president and trustee. Linden also served on the boards of five major corporations for extended terms during 1974-98. He worked with Mobil Oil Corp. after receiving a BS in chemical engineering from Georgia Institute of Technology in 1944. He received a master's degree in chemical engineering from the Polytechnic Institute of Brooklyn (now Polytechnic University) in 1947 and a PhD in chemical engineering from IIT in 1952.