OGJ Newsletter

Market Movement

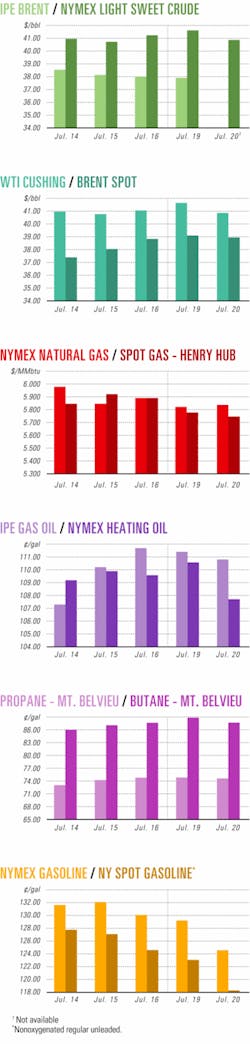

Crude futures fluctuate above $40/bbl

The expiring August contract for benchmark US light, sweet crudes hit a near-month high of $42.30/bbl in early trading July 20 on the New York Mercantile Exchange before closing at $40.86/bbl, down by 78¢ for the day.

The earlier price run-up was primarily the result of purchases by refiners needing supplies of crude. But that was followed by a major profit-taking spree among speculators that pushed crude futures back down, analysts said.

The September contract inched up by 14¢ to $40.58/bbl in the next session after the US Energy Information Administration reported July 21 that commercial US crude inventories had plunged by 3.6 million bbl to 299.3 million bbl during the week ended July 16. However, gasoline stocks jumped by 2.5 million bbl, mostly in finished gasoline, to 208.4 million bbl during the same period, while distillate fuel stocks increased by 1.7 million bbl, mostly in heating oil, to 118.4 million bbl.

Gasoline stocks near average

"Gasoline inventories are now 0.3% above last year and near the 10-year average," said Robert S. Morris, Banc of America Securities LLC, New York, in a July 21 report. "Interestingly, US gasoline demand was down 0.1% year-over-year for the past 4 weeks, with total US product demand up only 1.2%"

US crude imports averaged 9.9 million b/d in the week ended July 16, down by 153,000 b/d from the previous week. "It appears that Saudi Arabia was the top sourceUfor the second week in a row, while crude oil imports from Nigeria were substantially lower," EIA reported.

Crude inputs to US refineries averaged more than 15.7 million b/d during that week, down 86,000 b/d from the previous week, with refineries operating at 94.5% of capacity. Gasoline production increased slightly in that period, averaging nearly 8.9 million b/d.

With the large falloff in the latest reporting period, US crude stocks "are starting to make up for the absence of the decline in inventories that was anticipated in June," said Paul Horsnell, head of energy research, Barclays Capital Inc., London. "Gasoline inventory numbers are very weak, although we would caution against using [the latest] numbers in isolation. We still expect a strong seasonal inventory decline to commence in coming weeks."

Possible trends

In a July 21 report, Horsnell cited two distinct trends in US inventories of crude and petroleum products that should become evident in the next couple of months.

"First, crude oil inventories are likely to be flat or falling in spite of the ramp-up in [the Organization of Petroleum Exporting Countries'] production. The surprise was that crude oil inventories did not fall in June when some of the component numbers implied that they should," he said. The decline in US crude stocks in the week ended July 16 was "certainly in the right direction, albeit larger than would normally be expected," he said. "The level of US crude oil imports has nudged down for the fifth successive week. While there is still a potentially bearish psychological impact attached to imports being above 10 million b/d, we would consider that 10 million b/d is too low for any sort of equilibrium in the US market. So far, extra crude production is being mopped up easily within the global system. Indeed, it has been absorbed so easily that the US crude oil inventory deficit relative to the 5-year average has started to widen again over the past 2 weeks," said Horsnell.

Gasoline outlook

"The second main overall trend is that gasoline inventories should now be starting their period of greatest seasonal decline as demand ramps up towards its August peak. Given that, this [latest] rise in [gasoline] inventories strikes a distinctly discordant note," Horsnell said.

"The implied demand number for the week [through July 16] is 500,000 b/d lower than in the past 2 weeks and is the lowest since March. That is not plausible. In all, we would treat the gasoline data as bearish, but not enough yet to believe that the seasonal inventory decline will be negated this year. However, another build [in the week through July 23] would have to be considered extremely bearish."

Meanwhile, said Horsnell, "The system is cranking out distillate at a phenomenal rate," with production in the latest reported period up by 345,000 b/d—150,000 b/d diesel, 195,000 b/d heating oil—over a year ago. "As Guy Caruso (the head of EIA) noted last week, it is too early to get into any sort of panic about winter heating oil supplies," he said.

Industry Scoreboard

null

null

null

Industry Trends

INTERSTATE NATURAL GAS ASSOCIATION OF AMERICA says $61 billion must be invested in US gas infrastructure by 2020, or consumers will see much higher natural gas bills.

INGAA's nonprofit foundation commissioned the study by Energy & Environmental Analysis Inc. It predicts that a 2-year delay in infrastructure construction will cost US gas consumers over $200 billion (in 2003 dollars) during the next 15 years.

To satisfy an expected 30 tcf market by 2010, gas suppliers will have to develop frontier supplies in North America and dramatically expand LNG imports, it said.

INGAA called on state and federal regulators to work together on policies to attract capital to pipeline and storage projects. States also should coordinate LNG permit issues with federal regulators to move the process forward and to better inform stakeholders, the association said.

UK ENERGY MINISTER Stephen Timms warns of a long-term investment challenge for the North Sea oil and natural gas industry.

Rising North Sea production costs and "stagnating exploration" could make it difficult for the UK government and operators to sustain their joint targeted North Sea capital investment of £3 billion/year in the next 6 years, Timms said in a recent annual report of PILOT, a joint government-industry initiative designed to bolster UK offshore output.

"While the current level of capital investment in the UK Continental Shelf is expected to remain strong, forecasts suggest that meeting PILOT's 2010 production target of 3 million b/d of oil is becoming more challenging," Timms said.

Timms said that a concentrated joint effort by government and industry would be needed to find "innovative solutions" to help recover the UK's postulated remaining 31 billion boe.

PILOT plans this year to complete the principles and framework of "fair third-party access" to infrastructure and seek ways to maximize economic recovery of remaining reserves.

UK OPERATORS, meantime, report an acceleration in oil and gas project approvals, better-than-expected exploration activity, and continuing strong investment this year.

Since Jan. 12, the Department of Trade and Industry has approved 12 new UKCS oil and gas projects, vs. 14 last year, UK Offshore Operators Association said.

UKOOA noted 22 new exploration and appraisal wells have spudded since Jan. 1, vs. 32 total in 2003. UKOOA also says the UK will remain self-sufficient in gas until 2005-06 and in oil until 2007-08. However, indigenous production still should meet 60% of UK gas demand and 80% of oil demand in 2010.

"It is encouraging to see signs of activity picking up, 2 years after the severe setback to investors' confidence caused by the introduction of the supplementary corporation tax rate on UK oil and gas production," said Malcolm Webb, UKOOA chief executive.

Government Developments

BOLIVIAN CITIZENS favor natural gas exports.

That was the result of early voting returns from a July 18 referendum. Government officials plan to release a final count of an estimated 4.5 million ballots on Aug. 4.

Bolivian President Carlos Mesa declared a victory in the referendum to increase state involvement regarding the nation's gas reserves. Bolivians approved all five measures on the ballot.

The referendum could lay the groundwork for renationalization of industry assets following privatization of state-owned Yacimientos Petroliferos Fiscales Bolivianos in the 1990s.

Mesa will use the referendum results as part of the framework for devising a new hydrocarbon law to be submitted to the Bolivian congress later this summer.

Meanwhile, Mesa faces challenges in a congress dominated by opposition parties, and he must deal with oil industry concerns that energy policy reforms possibly could mean some form of expropriation of private assets. In October 2003, thousands of people protested the government's energy policy, forcing then-President Gonzalo Sanchez de Lozada to resign. The revolt was triggered by his plan to build a pipeline to Chile's Pacific Coast to export gas as LNG to North America.

PETROLEOS DE VENEZUELA SA July 21 said its commercial dispute with Science Applications International Corp. should be put before an independent international arbitrator, rather than be subject to White House political pressures. The dispute has raised industry concerns about expropriation of assets in Venezuela as a sign of creeping renationalization.

PDVSA's remarks follow a July 14 decision by the US Overseas Private Investment Corp. to pay a $6 million insurance claim to SAIC. The San Diego, Calif-based company says its assets from an information technology joint venture with PDVSA, called INTESA, were seized illegally by President Hugo Chávez's government in 2002. OPIC is a US agency that offers financing and political risk insurance to US companies that invest in developing countries.

PDVSA said SAIC did not follow contract obligations drafted before Chávez came to power. SAIC, for example, refused to provide a certified financial audit of the JV's books, PDVSA said.

"This is particularly important because the outside auditors of INTESA have refused to certify the validity of INTESA's financial statements for 2002. PDVSA for its part cannot pay SAIC or any entity based solely on guesswork and unaudited financial data," said Rodolfo Porro, PDVSA general counsel.

Thomas Wilner, outside counsel for PDVSA with the law firm Shearman & Sterling, said OPIC's move was a political decision to satisfy a company with powerful connections to President George W. Bush's administration rather than being based on fact or legal precedent.

"How could OPIC have paid this claim when there has never been a financial audit?" he said. Wilner said it was unlikely the dispute would be resolved through international arbitration. Instead, a final decision may come if US officials agree to hold bilateral talks directly with Venezuela.

Bush administration officials said it is unlikely the agency would extend new loans to US companies investing in Venezuela because of the SAIC dispute.

But Bernardo Alvarez, Venezeula's ambassador to the US, said US companies have signaled to PDVSA that OPIC's action will not deter what he suggested are imminent expansion plans by several oil companies.

Alvarez called the SAIC case "an isolated experience" that has no relationship to the actual investment climate in Venezuela.

Quick Takes

TOTAL CANADIAN OIL PRODUCTION, led by output from Alberta's oil sands, is projected to increase to 3.6 million b/d by 2015 from the current 2.6 million b/d, the Canadian Association of Petroleum Producers (CAPP) estimates in its 2004 Canadian crude oil production and supply forecast. The 1 million b/d increase, representing a 40% increase over 2003 figures, will require additional pipeline capacity, CAPP added. Oil sands production, which alone exceeded 1 million b/d in late 2003, is forecast to more than double to 2.6 million b/d by 2015, offsetting a gradual decline in conventional oil production, which currently accounts for more than half of the country's production. Investment spending for oil sands development is projected to surpass $30 billion (Can.) during the decade.

Kerr-McGee Corp. and 50:50 partner Devon Energy Corp., both based in Oklahoma City, reported that the first of two subsea wells is on stream in deepwater Red Hawk natural gas-condensate field in the Gulf of Mexico 180 miles south of Intracoastal City, La. Red Hawk, discovered in 2001, is on Garden Banks Block 877 in 5,300 ft of water. Field production is ex- pected to peak at 120 MMcfd of gas next month when both wells are producing via the world's first cell spar (OGJ, Nov. 17, 2003, p. 54). The cell spar, a floating production facility named Kerr-McGee Global Producer IX, is a third- generation spar system, and field operator Kerr-McGee said the technology has reduced the reserves threshold necessary for the economical development of deepwater fields. The Marco Polo tension leg platform (TLP), operated by Anadarko Petroleum Corp. and owned jointly by GulfTerra Energy Partners LP and Cal Dive International Inc., has begun processing first oil and natural gas production from Anadarko's Marco Polo field on Green Canyon Block 608 in the Gulf of Mexico. Anadarko has tied back six production risers to the TLP and completed three of the six predrilled development wells. The field is expected to reach peak production of 50,000 boe/d when all six are online. The TLP, in 4,300 ft of water, will serve as a hub capable of processing as much as 120,000 b/d of oil and 300 MMcfd of gas. Denver-based independent Forest Oil Corp. has started production from its deep shelf discovery on West Cameron Block 112 in the Gulf of Mexico. The WC 112 No. 1 well was drilled to 15,350 ft TD. It is producing about 33 MMcfed of natural gas and condensate with 9,625 psi flowing tubing pressure. Forest, as operator, has a 55% working interest in the discovery and Dominion Exploration & Production Inc. holds 45%. Forest reported test results for the well during the first quarter (OGJ Online, Mar. 19, 2004). F

null

US MINERALS MANAGEMENT SERVICE issued a final notice and revisions for Lease Sale 192, slated for Aug. 18 in New Orleans. The oil and gas lease sale encompasses 3,907 blocks on federal land in the western Gulf of Mexico (OGJ Online, Mar. 30, 2004). Among revisions were new deepwater royalty suspension price thresholds of $39/bbl for oil and $6.50/MMbtu for gas. MMS also increased to $37.50/acre the minimum bonus bid amount for tracts in water 400-799 m deep, and it made Mustang Island blocks 793, 799, and 816 available for leasing, with restrictions.

Vintage Petroleum Inc., Tulsa, said electric log analysis of its An Nagyah No. 8 appraisal well on the S-1 Damis block in Yemen indicates a gross oil-bearing interval of 43 ft of 43° gravity oil. Vintage drilled the well to 3,966 ft TD. A 34 ft interval in the Upper Lam formation was perforated at 3,345-79 ft and tested at a flow rate of 607 bbl of water-free oil at a pressure of 63 psi. Initial production is targeted for later this month, as is the spudding of the An Nagyah No. 9 infill well. Vintage also drilled the Harmel No. 2 appraisal well to 2,808 ft and obtained cores to assess development potential of the suprasalt heavy oil reservoirs. Completion and testing are targeted for early fourth quarter (OGJ Online, June 4, 2004). Vaalco Energy Inc., Houston, reported that the Eavom-1 Avouma prospect exploration well, on the Etame permit 10.5 miles from Etame field off Gabon, flowed on test at a stabilized rate of 6,600 b/d of oil of 37-38° gravity crude (OGJ Online, July 12, 2004). Flow was through a 40/64-in. choke at 746 psi from 20 ft of perforations in the Gamba sandstone section. Vaalco next will complete the Etame 5H development well in Etame field, drilling a 2,000 ft, horizontal gravel-packed lateral in the Gamba sandstone. The well now has flowlines tying it back to the Etame floating production, storage, and offloading system. Etame 5H production will begin later this month, increasing total production from Etame field to more than 20,000 b/d of oil from the current 15,000 b/d. The partners also plan to drill the Etame-6H development well and said they would submit a development plan for Etame, Avouma, and Ebouri fields to the Gabon government by yearend (OGJ Online, Jan. 22, 2004).

EXXONMOBIL CORP., operator of the Blackbeard West prospect on Newfield Exploration Co.'s Treasure Island play, has awarded Houston-based Rowan Cos. Inc. a $28-35 million contract to drill an ultradeep well on the shallow-water prospect that lies on the Gulf of Mexico's Outer Continental Shelf (OGJ Online, Apr. 22, 2004). Rowan's new Scooter Yeargain Tarzan class rig—capable of drilling to the required depth exceeding 30,000 ft—will drill the well if available. The 1 year assignment is slated to commence in December or in January 2005. US drilling activity continued to climb, by 4 rotary rigs to 1,211 working the week ended July 16, compared with 1,089 in the same period last year, Baker Hughes Inc. reported. Gains were reported in all rig categories, with land operations up by 2 units to 1,094 and offshore drilling by 1 rig to 92 in the Gulf of Mexico and 97 for the US as a whole. However, Canada's rig count plummeted 72 rotary rigs to 241. F

POLAND's Grupa Lotos SA, formerly Rafineria Gdañska SA, signed an agreement with a group to develop a $600 million residue upgrading plant at Poland's second largest refinery, enabling it to produce diesel fuel to future European Union quality standards. Grupa Lotos will license and use a Shell Global Solutions International BV-developed gasification process to convert high-sulfur residual oils into syngas, which will be used to produce hydrogen, steam, and power. The gasification and hydrocracking processes are scheduled to be in service in 2008. The consortium implementing the project at the Gdansk refinery includes Shell Global Solutions, MW Kellogg-Kellogg Brown & Root, DSD Industrieanlagen GMBH, and Uhde GMBH. Yanchang Oil Administration Bureau of Yanchuan, Shannxi Province, China, has licensed CCR Platforming technology from UOP LLC, Des Plaines, Ill., for use at the Yongping refinery. The process produces a high-octane gasoline-blending product (OGJ, June 19, 2000, p. 48). UOP said that basic engineering work for a 20,000 b/d reforming unit at the plant began this year. Yanchang Oil Administration Bureau, a major oil producer in China, operates the Yongping refinery.

STATOIL ASA received government approval for the 3.6 billion kroner development and operation of its two Norne satellites Svale and Stær, in the Norwegian Sea. Transocean Inc. will drill eight wells (OGJ Online, Mar. 12, 2004). Three subsea templates will tie the fields back to the Norne production ship, which will be modified. Initial oil production will begin in autumn 2005, with eventual output expected to be 70,000 b/d. Stolt Offshore SA will deliver and install flexible risers and water injection lines, install umbilicals and manifolds, and connect the subsea systems. Technip Offshore Contractors Inc. will lay pipelines for production and gas lift, and Nexans Norway SA will supply direct heating cable and riser. F

OMAN, Oman Oil Co. SAOC (OOC), and Dow Chemical Co. have formed a joint venture to design, build, and operate a petrochemical complex in the emirate's Sohar industrial port area. The complex will include feedstock production facilities, a natural gas cracker, and "three world-scale polyethylene production units" based on state-of-the-art catalyst and process technology, Dow said. Construction is expected to begin in 2005. The JV also will facilitate the development of downstream industries in Oman that will convert polyethylene to end products. The JV's interests will be Dow 50% and Oman and OOC 25% each. F

GULFSTREAM NATURAL GAS SYSTEM LLC, a JV of operator Williams Cos. Inc., Tulsa, and energy marketer Duke Energy Corp., Charlotte, NC, has begun mainline construction on its 110 mile pipeline extension from central Florida to the state's east coast. The extension will double Gulfstream's service area, enabling the delivery of more than 1 bcfd of natural gas to expanding markets across the state. Florida's power generation needs are expected to more than double in the next decade, according to the Florida Public Service Commission. The extension, through five counties, is scheduled for completion in December. The US Federal Energy Regulatory Commission has approved

ANR Pipeline Co.'s proposed $18.7 million EastLeg expansion in Wisconsin. The El Paso Corp. subsidiary will replace 4.7 miles of an existing 14-in. pipeline with 30-in. pipe in Washington County, add 3.5 miles of 8-in. loop on the Denmark lateral in Brown County, and modify its existing Mountain compressor station in Oconto County, all of which will add about 143.4 MMcfd of firm gas capacity to its lateral system. The expansion will allow ANR to provide additional gas transportation services to new power plants in the area.

Kinder Morgan Energy Partners LP (KMP), Houston, will invest $650 million this year on pipeline system expansion projects that include 70 miles of 20-in. new pipe replacing a 14-in. Concord-Sacramento, Calif., pipeline. The $88 million project will be in service by yearend. KMP is investing $18 million this year on its $200 million multi-year East Line expansion project to increase capacity on products pipelines in Texas and Arizona. The expansion is slated for completion by early 2006. More than $300 million is being invested in carbon dioxide injection for enhanced oil recovery at Sacroc and Yates fields in West Texas. KMP will add 600,000 bbl of storage capacity at the Carteret terminal in New York Harbor—a $19 million project. In addition, affiliate Kinder Morgan Inc. will complete in August its $33 million project to expand TransColorado pipeline firm transportation capacity to 425 MMcfd.

EQUATORIAL GUINEA LNG HOLDINGS LTD. (EG LNG) has signed a contract to license and use ConocoPhillips's proprietary natural gas liquefaction technology—the Phillips Optimized Cascade LNG Process—in the first train of EG LNG's proposed liquefaction plant on Bioko Island, near Malabo, Equatorial Guinea. The contract includes options to license two additional trains. Train 1 is designed to produce 3.4 million tonnes/year of LNG, with first production slated for late 2007. Participants in the first train are wholly owned subsidiaries of Marathon Oil Corp. and GEPetrol, the state oil firm of Equatorial Guinea. F

TANZANIA signaled start-up of its $260 million Songas natural gas-fired power project with the first commercial operation of the 110 Mw Ubungo power station in Dar es Salaam. Gas is transported to Tanzania's capital through a 140 mile pipeline to industrial and commercial customers from Songo Songo gas-condensate field onshore and in shallow water adjacent Songo Songo Island. The wells and a treatment plant are providing gas for 75 Mw of electric power generation. Conversion of the remaining 35 Mw from liquid fuel to gas will be completed within the next 3 months, said international power operator Globeleq. The plant provides power to Dar es Salaam and the national grid. At the request of Tanzania Electric Supply Co., Songas plans to expand its capacity by 65 Mw later this year.