Market Movement

Terrorism fears buoy energy prices

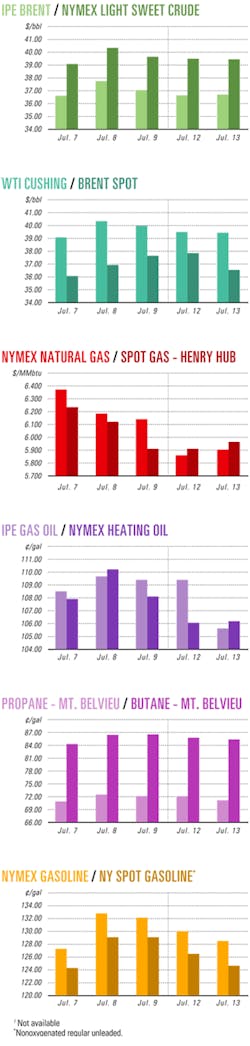

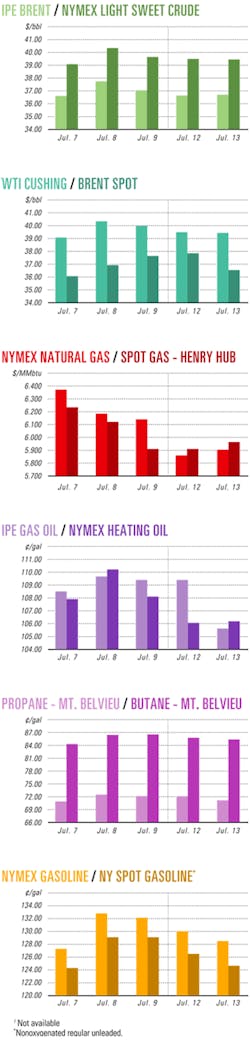

Crude futures prices soared above $40/bbl for the first time in more than a month on the New York Mercantile Exchange when US Sec. of Homeland Security Tom Ridge July 8 warned that terrorists might be planning an attack aimed at disrupting the upcoming US presidential elections.

Energy prices fell in the next three sessions as traders recovered from that initial knee-jerk reaction until a bullish July 13 report on US inventories of crude and petroleum products triggered a strong US futures price rebound to $40.97/bbl July 14.

Meanwhile, energy specialists at East-West Center (EWC) in Honolulu predicted that worldwide terrorism, dramatically increased oil demand, and much more expensive natural gas will prevent oil and gas prices from ever returning to the low levels of past years.

East-West outlook

Fereidun Fesharaki, an EWC senior research fellow and a leading expert on Asia Pacific oil and energy, said prices were expected to drop more after the war in Iraq had ended, but a number of developments have prevented that. Worldwide terrorism has grown, in Iraq and beyond, with oil prices now reflecting a "terrorism premium" of $3-5/bbl, he said.

"Is the handover of Iraqi sovereignty going to reduce terrorism in Iraq?" Fesharaki asked. "God put oil in an unstable place. Geography cannot be changed by politics."

The likely prospect that hedge funds eventually will unload 140 million bbl of open interest in the oil futures market could bring down the price of oil by $6-8/bbl, but overall, "prices will not go down to the levels of before," Fesharaki said.

Other factors that are expected to keep oil and gas prices at lofty levels include:

The price of natural gas, competing with fuel oil for use in the electric power sector, has tripled after remaining stable for 30 years. The US has a shortage of natural gas at a time of increased demand, a situation that Fesharaki said has brought permanent changes.

Environmental standards will keep gas prices high, Fesharaki said.

Revived global economies will mean an increase of more than 100% in the rate of oil demand growth this year vs. 2003, the largest annual growth in a decade. The US and China will make up more than half of that growth.

Kang Wu, a research fellow in EWC's energy group, said China's 10% growth in energy demand paralleled a 10% growth in gross domestic product in 2003. China accounted for 30% of worldwide growth in energy demand last year, and the US-Asia Pacific region totaled more than half.

Japan's growth in demand in 2003 was abnormally high because safety concerns shut down nuclear plants in that country, said Tomoko Hosoe, an EWC professional associate who also specializes in oil and energy issues. With an aging population and a growing services industry that require less energy, Japan's oil demand will start to decline after 2005.

IEA sees slower demand growth

Meanwhile, the International Energy Agency in Paris recently predicted that the growth of global oil demand will slow to a relatively high 1.8 million b/d in 2005 from a record 2.5 million b/d this year. IEA expects that world demand for oil will increase to 83.2 million b/d in 2005 from 81.4 million b/d this year.

Commercial oil inventories among members of the Organization for Economic Cooperation and Development rose by 33 million bbl to 2.5 billion bbl in May, 12 million bbl more than last year. "While crude stocks returned to more comfortable levels in the OECD, product stocks remained tight. Days of forward demand cover in May was depressed at 51.7 days, little changed from that in April and similar to the low cover level of 2003," said IEA in its July report.

Crude production among the Organization of Petroleum Exporting Countries averaged 28.6 million b/d in June, up by 635,000 b/d from May, "despite a 325,000 b/d reduction from Iraq," IEA said.

"Concerns over strong demand and supply disruption issues prevailed over higher OPEC output in June," said IEA. "Strength in transportation fuels reemerged, and concerns remain that refiners' focus on gasoline, diesel, and jet fuel could delay production of heating oil ahead of the winter."

The US Energy Information Administration reported US crude inventories fell by 2.1 million bbl to 302.9 million bbl during the week ended July 9 vs. an expected draw of 500,000 bbl. US gasoline stocks dropped by 200,000 bbl to 205.9 million bbl during the same period, while distillate fuels increased by 2.7 million bbl to 116.7 million bbl, still in the lower half of the average range for this time of year.

Industry Scoreboard

null

null

null

Industry Trends

US LAND DRILLING market fundamentals indicate that day rates will improve later this year and going into next year, said Raymond James & Associates Inc., St. Petersburg, Fla.

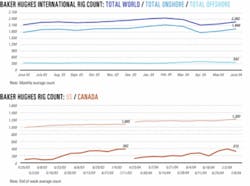

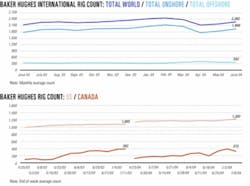

Lubbock, Tex.-based Land Rig Newsletter recently reported 1,323 active US land rigs, 60 more than the peak achieved during industry's last big drilling upswing, in July 2001. A recent rig count tallied by Houston-based Baker Hughes Inc. reported 1,111 US land rigs working, 16% above year-ago levels and 2% shy of the Baker Hughes count of 1,136 land rigs in July 2001.

The US land drilling market is headed for "uncharted territory," RJA analyst Marshall Adkins said in a July 12 research note. "Relative to 2001, we are experiencing several driving factors that should support this upward trend and separate this cycle from previous cycles."

Given a bullish backdrop of sustainable high commodity prices, Adkins contends that the US land rig count is experiencing a much more balanced utilization vs. pricing environment than it has in the past.

"Rig operators have done a remarkable job at balancing supply just enough to meet demand, as compared to previous cycles. Specifically, the industry began the current cycle with 250-300 more rigs than it did the previous cycle, which has to date caused day rates to grow at a much slower pace for the same number of active rigs. However, given the continued consolidation and financially responsible nature of the largest drilling contractors, pricing has started from a much higher base this time around," Adkins noted.

Utilization has shifted upward to near 70% and is approaching the point at which the slope of the day rate improvement curve changed rapidly during the previous cycle, he noted.

RJA forecasts a gradual day rate increase of $250-400/day for each quarter this year. "In other words, it appears that the day rates and margins are on track to increase the quarterly rate of change from the $200-300 range to the $400-500+ range within the next 2 quarters."

US NATURAL GAS prices will fall from recent high levels during the next several years, and sulfur dioxide (SO2) emissions-allowance prices will continue to escalate, according to a study from ICF Consulting Group Inc., Washington, DC.

ICF's US Fuel & Emissions Market Outlook 2004 provides an integrated analysis of electric power, coal, natural gas, and emissions-allowance fundamentals in what the firm calls "rapidly converging markets."

The study concludes that gas prices will fall steadily in the long term because recent drilling and exploration will bring new gas to the market and because LNG imports will be expanded.

"The turning point for gas markets was actually set in motion in 2003, when drilling investment turned upward and companies pushed to permit LNG regasification facilities," said Nate Collamer, an ICF principal.

"Strong economic and power sector demand growth are likely to keep prices high in the very near term, but added production and falling oil prices will push [gas] prices down as early as 2005," Collamer said.

Government Developments

THE AMERICAN PETROLEUM INSTITUTE has offered US lawmakers some suggestions on how government can encourage investment in new refining capacity.

API Pres. Red Cavaney last week testified before the House Subcommittee on Energy and Air Quality. He outlined legislative and administrative policy options.

He suggested updating the current tax structure so that refineries are treated like most other manufacturing assets, which are depreciated every 5-7 years. Refineries are on a 10-year schedule.

Cavaney also called on Congress to address balkanized reformulated-fuel markets by passing a clean-fuels update within comprehensive national energy legislation. A pending plan repeals the oxygen content requirement for reformulated gasoline (RFG) and in its place installs a renewable fuels standard designed to more than double fuel ethanol demand during the decade.

The RFG plan also phases down the fuel oxygenate methyl tertiary butyl ether, but lawmakers continue to argue about whether industry should be shielded from product liability lawsuits.

Outside the RFG conundrum, Cavaney said major disincentives to expanding a refinery or building a new one are the numerous permitting requirements and the time it takes to get permits reviewed and issued.

Congress should enact a "Reasonable Permit Review Act" designed to coordinate and eliminate overlap among the many permitting processes, he said. The legislation could direct federal agencies involved in permit review to enter into a memorandum of understanding that would clearly define the steps involved in the federal permit review and approval process.

Similarly, Congress should enact legislation directing the Environmental Protection Agency and other agencies to lend appropriate technical, legal, and other assistance to states whose resources are inadequate to meet permit-review demands. The law also could earmark federal resources for state refinery permit reviews, API said. In order to take advantage of federal assistance, states would be required to establish a refining infrastructure coordination office to facilitate federal-state cooperation in permit reviews.

Congress also should consider codifying into law EPA's New Source Review reforms, some of which are in the courts (see related article, p. 46). Cavaney said that past NSR guidelines discouraged refineries from expanding capacity and improving efficiency. The reformed rules will provide greater clarity, resulting in more-efficient regulation and less uncertainty, he said.

API also suggested that EPA and other federal, state, and local agencies regulating fuels could avoid "excessive" use of their enforcement discretion. Agencies should adopt policies that clearly outline the processes and requirements suppliers would need to follow during periods of supply disruption, removing the need for—and uncertainty associated with—use of enforcement discretion, it said.

The association also called on the White House to follow advice coming from the National Petroleum Council's updated refinery study, slated for release this fall. Meanwhile, API would like the administration to have agencies do a better job considering the impacts on energy supply, distribution, and use when undertaking certain regulatory actions. President George W. Bush's 2001 executive order has rarely, if ever, been fully implemented, Cavaney said.

Quick Takes

QATAR and ExxonMobil Corp. subsidiary ExxonMobil Qatar GTL Ltd. have agreed that ExxonMobil will build a $7 billion, gas-to-liquids (GTL) project at Ras Laffan Industrial City in Qatar. A 25 year development and production-sharing agreement (DPSA) will go into effect when production starts in 2011. ExxonMobil, which will use its patented AGC-21 GTL technology for the plant, will provide 100% of the projected capital cost and will design, construct, and perform all petroleum operations, including development and production of enough gas and other hydrocarbons to meet the plant's proposed 154,000 b/d capacity. Half of the plant's production will be "sulfur-free" (<10-15 ppm) diesel. ExxonMobil will drill an appraisal well for the project this year, and will supplement the preliminary front-end engineering and design. FEED is expected to begin upon execution of the DPSA.

NORSK HYDRO ASA and partners awarded a $2 billion kroner contract to Aker Kværner ASA for engineering, procurement, and construction of a gas reception and export area at Nyhamna on Norway's western coast as part of the Ormen Lange natural gas-condensate development project. Construction, to begin in spring 2005, will include a slug catcher, flare tower, and emergency shutdown valves for the gas terminal. The $9.5 billion Ormen Lange project is expected to begin producing 2.5 bcfd in October 2007. The field lies on Block 6305/5, more than 100 km northwest of Aukra, Norway, in 3,300 ft of water. Reserves are 14 tcf of gas and 180 million bbl of condensate. ATP Oil & Gas Corp., operator of Ship Shoal Block 358 in the Gulf of Mexico, has expanded development and production with its third well. ATP reached TD on its Ship Shoal 358 A-3 well at 8,599 ft, with gas pay in three Lentic sands. The well was completed in the lowest Lentic sand. Company officials said they plan to produce the upper sands over the life of the well. Ship Shoal 358 produces a total 19.3 MMcfd of natural gas and 1,750 b/d of condensate from all three wells. Tullow Oil PLC unit Energy Africa signed a joint development agreement for development of Kudu field off Namibia as part of a gas-to-power project. Kudu gas would be piped ashore for treatment and delivery to an 800 Mw power station near Oranjemund to be developed and operated by Namibian utility NamPower. Produced electricity would be sold to NamPower and South Africa utility Eskom. The primary objectives of Phase II, which has begun, are to confirm project viability, complete detailed engineering and design work, and procure financing leading to a final investment decision by yearend 2005. Tullow is the operator, and National Petroleum Corp. of Namibia is a 10% partner.

UNOCAL CORP.'s appraisal well to the St. Malo discovery on Walker Ridge Block 678 in the deepwater Gulf of Mexico encountered more than 400 net ft of oil pay at depths greater than were encountered in the discovery well (OGJ Online, Oct. 31, 2003). The appraisal well, 6,000 ft east of the discovery well in 7,036 ft of water, also indicates potential hydrocarbon resources greater than previously suggested by the discovery well, Unocal said. Redrilling on the Dana Point location saved Unocal and its coventurers $25 million vs. the cost of a new well. The appraisal well was drilled to 28,903 ft, about 2,000 ft deeper than the original Dana Point well that was completed as a dry hole in early 2001. Unocal hopes to establish commerciality in 2005. Cairn Energy PLC, London, confirmed the distribution and connectivity of reservoir sands across Mangala oil field, on its onshore Block RJ-ON-90/1 in northern Rajasthan, India. Cairn concluded its appraisal drilling in the field after drilling the Mangala-5 and Mangala-6 appraisal wells. Mangala-5 encountered 125 net m of high-quality oil-bearing Fatehgarh sands and an oil column of 30 m in fractured basement above the field's oil-water contact. On test, Zone 1 flowed at 1,786 b/d through an 80/64-in. choke, and Zone 2 flowed at 2,153 b/d through a 72/64-in. choke. Mangala-6 encountered 69 net m of high quality oil-bearing Fatehgarh sands. A 3D seismic survey over Mangala and NA fields will be completed in the fourth quarter. First production from Mangala is planned for late 2007. Falcon Romania, operator for a joint venture group that includes Romanian state gas company Soc. Nationala Gaze Naturale Romgaz SA, confirmed July 1 that the Bilca-1 exploration well on Brodina block in northern Romania flowed on test 6.3 MMscfd of natural gas from a Miocene sand, reported UK partner Europa Oil & Gas Ltd., Newark-on-Trent, UK. The group made the discovery after analyzing new seismic data. The well is being suspended as a natural gas production well, and Falcon Romania plans to conduct a long-term well test shortly to quantify the field's proven reserves.

US DRILLING ACTIVITY continued to increase the week ended July 9, up by 6 units to 1,207 rotary rigs working, compared with 1,065 a year ago, Baker Hughes Inc. reported. Land operations accounted for the bulk of the increase, up by 7 rigs to 1,092. Activity in inland waters also increased, up by 1 rig to 19. However, offshore operations decreased by 2 rigs to 91 in the Gulf of Mexico and 96 in US waters as a whole. Canada's rig count plunged by 84 units to 313 rigs working, down from 382 during the same period last year.

STATOIL ASA is leading an 8.5 billion kroner project to build cogeneration plants at its Mongstad refinery near Bergen in western Norway and at Tjeldbergodden in central Norway, along with an increase in Tjeldbergodden's methanol capacity. Statoil recently concluded a cooperation agreement with Denmark's largest electricity and heat producer Elsam AS, which would construct the Mongstad cogeneration plant and become a part owner. Statoil also is negotiating with other companies about equity participation in the power station at Tjeldbergodden. License and permit applications and notifications are before the Norwegian Water Resources and Electricity Directorate and the Norwegian Pollution Control Authority. The Statoil board will make a final decision on investing in the two projects after license terms and other conditions have been clarified—probably in the first half of 2006. All new facilities are scheduled to start up in 2008. Meanwhile, Statoil is investigating the cause of a July 12 fire at the crude oil unit at the Mongstad refinery. The blaze, extinguished within 2 hr, slightly injured two people, who were treated and released. "The extent of the damage is less than expectedU," commented Mongstad Vice-Pres. Bjørn Kåre Viken. Although the crude oil section remains shut down, refinery production is continuing at moderately normal levels, he said. Repairs are expected to take "some weeks," Viken said. Meanwhile, the refinery will operate at about 50% capacity. Motiva Enterprises LLC, a Houston-based petroleum refining and marketing company owned by affiliates of Shell Oil Co. and Saudi Refining Inc., said it plans to further expand the base oil plant at its Port Arthur, Tex., refinery. Motiva said it will construct a third lube hydroprocessing unit that will upgrade heavy gas oil into high-quality Group II base oil, using Motiva's patented unit design. Construction will begin in the third quarter and is slated for completion in January 2006.

GAZ DE FRANCE has awarded a lump sum, turnkey contract to a joint venture of Saipem SPA, Milan, and French engineering firm Sofregaz to construct an 8.25 billion cu m/year LNG terminal at Fos Cavaou on the southern French coast near the existing Fos terminal. The 350 million euro project will take some 37 months to complete. The contract includes engineering, procurement, construction, and commissioning of the terminal, three 110,000 cu m LNG storage tanks, marine facilities, and related infrastructure and utilities. The terminal will be capable of receiving carriers transporting as much as 160,000 cu m of LNG. ConocoPhillips and Sound Energy Solutions (SES), a wholly owned subsidiary of Japan's Mitsubishi Corp., have signed a nonbinding memorandum of understanding to work jointly on the development of the proposed SES LNG import terminal proposed for Long Beach, Calif. The terminal would have a sendout capacity of 700 MMcfd with a peak capacity of 1 bcfd. The facility could become operational in 2008 after the project receives permit approval from the US Federal Energy Regulatory Commission and California state agencies. Qatargas II, a joint venture of Qatar Petroleum Co. 70% and ExxonMobil 30%, awarded a contract for engineering, procurement, construction and installation of two wellhead jackets to J. Ray McDermott Middle East Inc., a subsidiary of McDermott International Inc., New Orleans. The 1,500 ton and 1,300 ton jackets are for the WH4 and WH5 platforms in supergiant North field 90 km off Qatar's Ras Laffan Industrial City. The WH4 jacket is slated for installation in the third quarter and the WH5 jacket, in late spring 2005. Qatargas II includes a liquefaction plant, a receiving terminal and a fleet of LNG carriers to supply LNG to the UK (OGJ Online, Mar. 17, 2004).

SHELL EXPLORATION & PRODUCTION CO. began producing natural gas June 23 from its Coulomb development on Mississippi Canyon Blocks 657 and 613 in the deepwater Gulf of Mexico. The block contains the two deepest producing wells in the world in terms of water depth, the company said. The Coulomb wells are tied back to the BP PLC-Shell Na Kika floating development system on MC Block 474. The Coulomb C-2 well is producing about 65 MMcfd of gas. Combined, the C-2 and C-3 wells can produce 100 MMcfd of gas, Shell said. The C-2 well is in 7,565 ft of water, and the C-3 well is in 7,570 ft of water. Ivanhoe Energy (USA) Inc., operator, and partner Derek Oil & Gas Corp., both of Vancouver, BC, have completed a steam injection test at the LAK Ranch enhanced oil recovery project in Wyoming. A second steam cycle will begin in late July. A 3D seismic survey is slated for the fourth quarter, after which Ivanhoe will drill additional delineation wells. Development will include 20 horizontal producing wells, new steam injection facilities, and surface facilities extension. Ivanhoe expects an initial development of more than 20 producing wells, with volumes exceeding 4,500 b/d. Two independent engineering reports confirmed the potential for at least 100 million bbl of OOIP at LAK Ranch, Ivanhoe said.

GULFTERRA ENERGY PARTNERS LP, Houston, plans to construct a 70 mile, 16-in. oil export pipeline and 32 miles of 16-in. natural gas pipeline to deliver production from Kerr-McGee Oil & Gas Corp.'s deepwater Constitution field on Green Canyon Blocks 679 and 680 in the Gulf of Mexico. The 200 MMcfd gas pipeline will extend to a point on GulfTerra's existing Anaconda gathering system, and the oil pipeline, with a minimum capacity of 80,000 b/d, will link Constitution to the Poseidon and Cameron Highway oil pipeline systems at the recently installed Ship Shoal 332B platform. GulfTerra will install the pipelines in summer 2005, with first production scheduled for mid-2006. Lukoil Overseas Holding Ltd. has shipped 134,900 tonnes of light oil from Karachaganak field in northern Kazakhstan to markets via the 635 km Karachaganak-Bolshoy Chagan-Atyrau pipeline system, the Caspian Pipeline Consortium's (CPC) Tengiz-Novorossiysk pipeline system (Map, OGJ, May 10, 2004, p. 52), and the Aegean Lady tanker at South Ozereyka terminal near Novorossiysk. With the Karachaganak connection, within months CPC will transport 2 million tonnes/month, or 500,000 b/d, of oil. CPC's volumes gradually will increase to 6.5 million tonnes/year. With the shipment of Karachaganak crude, Karachaganak Petroleum Operating BV international consortium, with a 15% share of Lukoil, becomes the second largest oil supplier to CPC after Tengizchevroil Co. Kinder Morgan Energy Partners LP (KMP), Houston, has begun service on its $30 million intrastate natural gas pipeline from Katy to Austin, Tex. KMP acquired the 130-mile section of crude oil line in December 2003, converted it to 170 MMcfd natural gas service, and added a 5-mile lateral to serve a municipal power plant. In addition, Kinder Morgan Inc. completed and placed into service a $20 million, 58-mile natural gas pipeline to serve retail customers between Montrose and Ouray, Colo.

UNOCAL CORP. unit Unocal Midstream & Trade has placed a third natural gas storage cavern into service at its Keystone gas storage facility in the Permian basin near Waha Hub in West Texas. Mining operations are continuing for two additional caverns. The Keystone facility connects to pipeline systems owned by El Paso Natural Gas, Transwestern Gas Co., and Northern Natural Gas Co. Unocal has sold out its firm capacity in the first four caverns and is talking with customers about a fifth cavern. Mining of a sixth cavern could begin by yearend. Total capacity at the site could reach 5 bcf by early 2006, Unocal said.

CORRECTION

The US Minerals Management Service erred in a press release announcing eight deepwater discoveries in the Gulf of Mexico in 2004 that OGJ covered June 21, 2004, p. 27. In the last line of the table, the operator of Goldfinger field is actually Dominion Exploration & Production Inc., not Kerr-McGee Corp.; the lease issue date is June 1, 2002, not Dec. 1, 1999; and the ownership partners are Dominion E&P 75% and Pioneer Natural Resources 25%.