US Natural Gas STAR program success points to global opportunities to cut methane emissions cost-effectively

The production, processing, transmission, and distribution of natural gas worldwide releases as much as 88 billion cu m (bcm) of methane to the atmosphere annually.1

Because methane is both the primary constituent of natural gas and a potent greenhouse gas (GHG) when released to the atmosphere, reducing vented and fugitive emissions along the supply chain from wellhead to burner tip can yield substantial economic and environmental benefits.

To the extent that cost-effective emissions reduction opportunities are available, it is in the best interest of industry to avoid product losses by instituting technologies and practices that can both reduce methane emissions and increase corporate revenue.

The experiences of US industry working in collaboration with the US Environmental Protection Agency Natural Gas STAR Program have positively affected not only public image but also GHG emissions levels and corporate profits. The Natural Gas STAR Program is a voluntary partnership between EPA and the oil and gas industry to identify and implement cost-effective technologies and methods to reduce methane emissions. Since 1990, the US oil and gas industry has achieved more than 10 bcm of methane emissions reductions. These reductions have been made primarily as a result of communicating available technologies and efficiency improvements, the integration of which has been facilitated by Natural Gas STAR's efforts to increase understanding of these opportunities among its partners.

Outside the US, data show that significant opportunities exist in the industry for cost-effective methane leak mitigation projects. This article seeks to encourage development of international methane mitigation projects by using the experience of the US Natural Gas STAR Program to estimate opportunities in other countries with large or growing gas industries.

In addition, we examine the emerging emissions-reduction markets that can offer an additional revenue stream beyond increased gas sales and we cite some actual examples of international projects that will achieve methane emission reductions.

Mitigation options

Methane emissions from gas systems in the US account for 2% of US GHG emissions, or 124 million tonnes of carbon dioxide equivalent (MMTCO2E)/ year (124 MMTCO2E is roughly equal to 8.7 bcm of methane).2 Because the reduction of system losses through leaking, venting, or flaring directly leads to increased profits and environmental benefits, many US gas companies have been working voluntarily with Natural Gas STAR to identify and implement practices that have led to significant reductions in methane emissions.

In 2000, the experiences of three Natural Gas STAR Partner companies—Enron Gas Pipeline Group, Unocal Corp.'s Spirit Energy 76 unit, and BP Amoco PLC—were published in Oil & Gas Journal, citing their successes in improving leak detection and repair and reducing or eliminating emissions from pneumatic devices.3 Today, Natural Gas STAR Partners represent almost 65% of the US gas industry and since 1990 have cut methane emissions more than 140 MMTCO2E (10 bcm), valued at over $1 billion.4

The successful methane emissions reduction progress of US companies is evident through the decline in methane emissions, as shown in Table 1. The table presents the contributions of the four major gas and oil sectors to US methane emissions. In each sector, emissions have dropped since 1995 as a result of continued improvements to management practices and technologies.

Many cost-effective emissions-reduction practices have been shown to return initial investment costs within 1 year, further supporting the case that such investments are worth making. In fact, the options identified in this article represent only a subset of those options that are technically feasible and cost-effective within each industry sector. These options have been chosen here because of their comparatively high emissions-reduction efficiencies and low costs. For example, Unocal installed an air compression system in its Fresh Water Bayou facility in southern Vermilion Parish, La., in place of gas-powered pneumatic controls. The cost of this system was $60,000, but it cut methane emissions by more than 69 MMcf/year, saving $200,000/year.

Table 2 presents several technologies and practices that US gas companies in have implemented to reduce methane emissions and save money. Many of these reductions have been achieved through the Natural Gas STAR Program, working with industry to identify technologies and practices, developing technical documents, and conducting workshops to increase understanding of the opportunities available.

As shown, many of these practices quickly result in significant benefits. Most noticeably, early rod packing replacement in the transmission sector and composite-wrap pipeline repairs—applicable to all sectors—incur minimal costs and provide for net savings almost immediately. A complete description of all of these technologies and practices can be found on the Natural Gas STAR web site (www.epa.gov/gasstar).

Global opportunities

The success of US companies suggests that there are significant opportunities globally to reduce methane emissions cost-effectively.

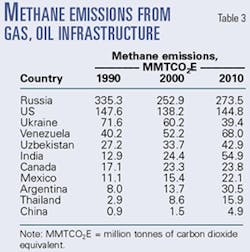

A recent EPA study examined many of the most economic means of reducing emissions of methane associated with the gas industry in several countries.6 The study identified best practices and technologies for fugitive methane leak reduction in order to help achieve international greenhouse gas emissions reductions at the lowest possible cost.The countries selected either have large methane emissions or rapidly growing gas industries, and are listed in Table 3.2, 7

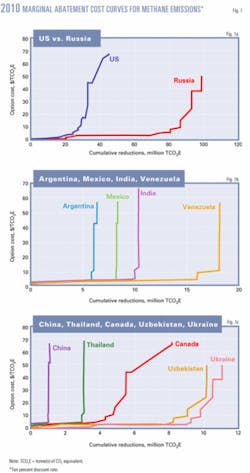

Country-specific marginal abatement cost (MAC) curves, developed to analyze the quantity of emissions reductions obtained by implementating specific abatement options, show that a significant fraction of emissions reductions are achievable at values under $10/TCO2E for all countries analyzed.

These cost-effective methane reduction opportunities are illustrated by Figs. 1a-1c, which show MAC curves for the countries listed in Table 3 implementing various mitigation technologies. The curves are based on a 5 year, discounted cash flow analysis using a 10% discount rate, excluding tax considerations. The estimated size, sectors, and characteristics of each country's gas industry were derived from the data shown in Table 3 together with applicable mitigation options and specific emissions-reduction potentials. Examples of actual mitigation projects in Russia are presented later.

In order to put forth the most conservative breakeven price estimate, revenue from the sale of gas not released to the atmosphere was not included in the calculations. This assumption was made because no reliable wholesale gas sales price data were available for many of the countries analyzed. It should be noted, then, that the methane emissions-reduction value, expressed in US dollars/TCO2E, at which options are presented does not include additional earnings that may be realized through recovered-gas sales.

In countries with developing natural gas markets—where infrastructure such as transmission pipelines and distribution networks are limited—a larger proportion of gas produced in association with crude oil production is vented. Consequently, retrofitting or installing high-efficiency flares offers such countries the greatest potential for cost-effective methane emissions reductions (i.e., less than $10/TCO2E). In the cases of India and Argentina, for example, flare-related reductions are estimated to account for more than 85% and 77%, respectively, of total achievable carbon-equivalent emission reductions.

Certain cost-effective abatement options, such as directed inspection and maintenance (DI&M), are applicable in several industry sectors; however, their potential impact is dependent upon the relative size of the developing country's infrastructure. This situation is illustrated in the case of India, which has a relatively limited gas transmission system (i.e., less than 1,700 km) but larger gas processing capacity. DI&M may provide a greater benefit in the processing sector than in the transmission sector in India. Although the potential reduction associated with DI&M within the processing, transmission, and distribution sectors of emerging gas industries can be small, this option generally provides a very cost-effective opportunity because it is labor-driven.6

Emerging markets

Across Europe, in the US, and in Asia, emissions reduction markets are emerging.

In many cases, these markets represent opportunities to increase profits. By taking advantage of them, positive revenue streams achieved through increased gas sales can be further enhanced by monetizing (selling) GHG emissions reductions. For those projects that can successfully achieve and document emissions reductions that meet certain criteria, a host of potential project development finance sources exist.

Of particular interest are project-based "flexibility mechanisms," under which project developers in one country are able to generate carbon emissions reductions recognized as valid and that have monetary value in another country. These reductions can be sold to generate an extra revenue stream to complement a project's cash flow or banked under the expectation that the emissions reduction unit price will be greater in the future.

Market framework

The emerging carbon emissions-reduction market represents a source of revenue in addition to the sale of saved or recovered natural gas.

Its framework consists of market drivers, market buyers, and market enhancers or facilitators. Together, these three constitute an institutional framework that can offer project developers opportunities for enhancing project investments or revenues.

Market drivers are entities or organizations that have helped establish the framework for acceptable carbon emissions-reduction projects and in the process have created a financial market within which emission reductions can be bought and sold. Also, initiatives derived from the United Nations Framework Convention on Climate Change have evolved into what are termed project-based "flexibility mechanisms," such as domestic and international emissions-trading markets and the international schemes Joint Implementation and Clean Development Mechanism. These market drivers and mechanisms provide platforms upon which companies producing saleable GHG emissions reductions can sell and—if needed to meet corporate or regulatory requirements—buy generated emissions-reduction credits.

- The European Union overall, where a market is set to begin trading carbon emissions reductions in 2005 and is expected to become the world's largest GHG emissions trading market.

- The UK, where a project-based emissions-reduction pilot has been implemented under the voluntary UK Emissions Trading Scheme launched in April 2002.

- Denmark, where a CO2 trading program covering electricity generators was initiated in 2001.

- The US, where the Chicago Climate Exchange was established as a pilot cap-and-trade program.

- In other countries, most notably Norway, Japan, Switzerland, and Canada, that have either indicated interest or begun planning to introduce emissions trading in the future.1

- Two recent projects, one between Germany's Ruhrgas AG and Russia's OAO Gazprom, and another between Gazprom and Japan's Nippon Steel Corp. and Sumitomo Corp., illustrate the potential for cooperation under the mechanisms discussed above.

Notable examples include:

Market buyers are organizations established specifically to purchase GHG emissions reductions. These include:

- The Prototype Carbon Fund, which provides financial support for projects that produce high-quality GHG emissions reductions that meet specific criteria in exchange for the title to those reductions.

- The Netherlands-based Certified Emission Reduction Unit Procurement Tender and the IFC-Netherlands Carbon Facility, which purchase GHG emissions reductions created by projects in developing countries.

- The Natsource GHG Credit Buyers Pool, which is intended to allow its members to obtain carbon credits from a diverse portfolio of project-based emissions reductions, including those originating internationally.

Market enhancers and facilitators are sources of finance for projects that seek reductions consistent with their goals and that meet certain criteria. They include:

- The Asian Development Bank, a multilateral development finance institution dedicated to reducing poverty in Asia and the Pacific region and committed to promoting environmentally sound development.

- The European Bank for Reconstruction and Development, which offers an investment vehicle to fund projects in Central and Eastern Europe that will utilize clean, renewable energy and energy-efficient technologies to improve industrial processes and mitigate climate change,

- The Global Environment Facility, which provides cost-sharing grants and concessional funding to help developing countries fund projects and programs that protect the environment.

In addition to the institutions listed here, there has been an emergence of commercial entities that serve as brokers of emission reductions. Functioning essentially in the same manner as stockbrokers, these brokers bring carbon emissions-reduction sellers and buyers together globally in a structured environment to facilitate and ensure transparency in the transactions needed to monetize carbon emission reduction.

Methane-mitigation projects in the natural gas sector have significant potential for cost-effective, verifiable emissions reductions that qualify for most sources of financing. Natural gas emissions-reduction project developers will have to develop credible emissions estimates and document that project-related emission reductions are actually achieved. In light of increasing gas prices and unit prices reflected in recent carbon emissions-reduction transactions, projects that reduce methane emissions from gas systems often may yield sufficiently high returns to be attractive to sources of necessary finance.

Current efforts

The emerging markets described here can—and do—offer short-term investment opportunities for the natural gas industry to capitalize on low-cost emissions reductions. In fact, several international firms already have taken the initial step of partnering to pursue projects that will reduce emissions.

Nippon Steel and Sumitomo announced early this year that they would partner with Gazprom to repair an aging Siberian gas pipeline. This is expected to result in emissions cuts of 5 MMTCO2E among the partners. Japanese daily Nihon Keizai Shimbun reported that potential credits gained under the agreement are expected to result in a 12.5 billion yen ($116 million) profit over 5 years (assuming a market value of 500 yen/TCO2E reduction).8

Gazprom and Ruhrgas have signed a memorandum of understanding aimed at optimizing a section of the Russian gas system. The project is expected to abate 447,000 TCO2E/year.9 According to Klaus-Robert Kabelitz, head of the economic research, energy industry, and environment department at Ruhrgas, the installation of state-of-the-art energy infrastructure will provide significant benefits for Russia and Gazprom, including lower energy costs and reductions in GHG emissions, as well as improvements in energy efficiency that consequently will have a positive employment and economic growth effect. The expected benefits for Ruhrgas and Germany will be a more cost-effective achievement of EU emissions reduction commitments. Also, the increased presence in Russia may present opportunities for market access.10

Overview

Methane leaks and other fugitive emissions along the natural gas industry's supply chain represent product losses that can be avoided using readily available, cost-effective practices and technologies. With payback periods that are often less than 1 year, significant savings can result. The success of the US oil and gas industry, working in partnership with EPA's Natural Gas STAR Program, demonstrates that the implementation of emissions-mitigation options can yield significant methane emissions reductions, cost savings, and increased profits. Internationally, the US experience suggests that there are significant cost-effective methane emissions reduction opportunities in the oil and natural gas sectors. Companies can take advantage of flexible emissions-trading mechanisms to develop projects internationally, allowing firms in developed countries to seek partners in developed or developing countries to reap mutual financial, social, and GHG emissions reduction benefits.

In addition to the financial benefits discussed here, pursuing natural gas emissions reductions also makes good environmental sense. With a global warming potential 23 times that of CO2, methane releases from natural gas systems contribute substantially to global GHG loadings to the atmosphere, and their mitigation has the potential to account for significant improvements in GHG emissions levels.11

References

1. Fernandez, Roger L., Matthew Mendis, and Lee Schultz, 2003. "Project Finance Opportunities for Natural Gas Emission Mitigation," Proceedings of the 3rd International Methane & Nitrous Oxide Mitigation Conference, Nov. 17-21, 2003.

2. US Environmental Protection Agency, "Inventory of US Greenhouse Gas Emissions and Sinks: 1990-2002," EPA 430-R-04-003, Apr. 15, 2004.

3. Frederick, James, et. al, "STAR partners cutting methane emissions via cost-effective management," Oil & Gas Journal, Aug. 28, 2000, p. 75.

4. http://www.epa.gov/gasstar/.

5. Tingley, Kevin A., and Fernandez, Roger, "Methods for Reducing Methane Emissions from Natural Gas Systems," Proceedings of the 3rd International Methane & Nitrous Oxide Mitigation Conference, Nov. 17-21, 2003.

6. Robinson, D.R., Fernandez, Roger, and Kantamaneni, Ravi, "Methane Emissions Mitigation Options in the Global Oil and Natural Gas Industries," Proceedings of the 3rd International Methane & Nitrous Oxide Mitigation Conference, Nov. 17-21, 2003.

7. US Energy Information Administration, "International Energy Outlook 2002," (http://www.eia.doe.gov/ oiaf/archive/ieo02/index.html).

8. "Nippon Steel, Sumitomo to fix Russia's Gazprom Pipeline for CO2 rights," AFX.com, Jan. 29, 2004.

9. http://ruhrgas.de/englisch/index2.htm.

10. http://www.europarl.eu.int/ workshop/kyoto/kabelitz_en.doc.

11. Intergovernmental Panel on Climate Change, Climate Change 2001: The Scientific Basis, Cambridge University Press, 2001.

The authors

Roger Fernandez is a program manager with the US Environmental Protection Agency's Natural Gas STAR Program. He joined the program in September 2002. Prior to that, he worked at the Japanese Ministry of Environment and the Japanese Ministry of Economy, Trade, and Industry during 2000-02. During 1996-2000, Fernandez worked with the coal industry to harness methane from active coal mines on the EPA's Coalbed Methane Outreach Program. During 1994-96, he reviewed air regulations in the US EPA Office of Policy, Planning, and Evaluation. He has a degree from Michigan State University.

Daniel Lieberman is an associate at ICF Consulting with 5 years of experience using quantitative economic analysis and theory to analyze global climate change issues. He has contributed to several publications covering inventories, projections, and opportunities for reductions of greenhouse gases for US EPA, UK Department for Environment, Food, and Rural Affairs, Ireland's Department of the Environment, Atomic Energy of Canada Ltd., and the International Energy Agency. Lieberman has developed methods to estimate and model marginal abatement cost curves covering all greenhouse gases both in and outside the US and has created a number of publicly available electronic tools to facilitate analysis of emissions abatement technologies and costs associated with reductions at the facility level. He holds a BA in economics from Brandeis University.

Don Robinson is a senior manager at ICF Consulting. He worked in the petroleum industry for 27 years with Chevron Corp., Arabian American Oil Co., and Mobil Oil Corp. He joined ICF in 1997 and has contributed to the US EPA Natural Gas STAR Program for 7 years, including 12 technology studies, 18 technology-transfer workshops, 50 technology briefs, presentations at the Second International Methane Mitigation Conference in Novosibirsk, Russia, and at the Third International Methane & Nitrous Oxide Mitigation conference in Beijing. In the private sector, Robinson worked with BP PLC on its GHG emissions auditing program, and development of ICF's proprietary Greenhouse Gas Emissions Management System. He also contributed to studies of crude oil disruption scenarios for the US Strategic Petroleum Reserve and numerous other fuels and environmental issues. Robinson received BS and MS degrees in chemical engineering from the University of Southern California.