Clarkson: World's LPG fleet healthy, prospects good for 2004 and later

Events of 2003 did not bear out earlier forecasts for substantial growth in worldwide LPG trade, according to the most recent Shipping Review & Outlook from Clarkson Research Studies, London.

This mainly derived from project start-up delays and production problems and from lower-than-expected demand growth in such key import areas as Asia and has pushed the anticipated growth into this year and beyond.

Nevertheless, the top three size classifications for LPG tankers fared well in the 6 months before Mar. 1, 2004, according to the Clarkson report, benefiting from firming day rates in response to increased demand for longer haul trades and from aggressive removal of older vessels.

The semiannual report reviews worldwide shipping, especially oil and gas tanker activity and fleets, as of Sept. 1 and Mar. 1 of each year.

null

Supply growth

Clarkson's analysis said that most of the early LPG supply growth set to come on stream is concentrated in the Atlantic Basin. "Not all the growth in volume, however, will translate directly into equivalent tonne-mile demand," said the report, as the decline in exports from the Middle East over the last few years appears to be reversing, "as local supply expands and the growth in domestic demand slows."

The anticipated result of this trend, it said, is that the LPG market becomes more polarized, with eastern supply satisfying eastern LPG demand and western supply covering western demand. The background to this is that, over the last few years, strong demand in the East, combined with rising LPG volumes from western suppliers has stimulated longer haul movements West to East. Pricing differentials between western suppliers and Middle Eastern producers have driven this trade, said the report.

Supporting future LPG supply growth, it said, are increased volumes associated with natural gas production that will accompany growth in LNG supply, as well as independent LPG supply growth resulting from less flaring.

Growth of LPG supply will typically be restricted to a few key areas: West Africa (especially Nigeria), Algeria, Latin America, and the Caribbean. Some growth is also likely later from Oceania and Asia. This growth will most likely occur closer to markets and have little effect on tonne-mile demand.

The Clarkson report also noted that North Sea LPG production from Norway will expand slightly over the next 2 years.

The report divided its look at the world's LPG shipping fleet among five size categories:

- Very large gas carriers, 60,000 cu m and larger.

- Large gas carriers, 40-60,000 cu m.

- Mid-sized gas carriers, 20-40,000 cu m.

- Semirefrigerated tonnage, 8-20,000 cu m.

- Small tonnage, less than 8,000 cu m.

Of the 14,365 vessels Clarkson figures show operating as of Mar. 1, 2004, those larger than 20,000 cu m number 11,257 vessels, or 78.4% of the total fleet. And it is with these larger vessel categories that the following discussion deals.

VLGCS

Reviewing charter rates for the months leading up to the study's end date, the report noted that even with growth in the number of VLGCs, the market improved overall in late 2003 but this was from the lows in late 2001 and 2002.

Over the summer 2003, highs of $38/tonne for the benchmark Ras Tanura-Chiba, Japan, voyage retreated in October to about $25/tonne, "as the arbitrage window narrowed between East and West."

In September and October of last year, vessel inventories in Japan and South Korea increased, as did the volume of open tonnage. In November, said the report, tonnage rates rebounded to $30/tonne, "as sentiment strengthened ahead of the peak winter demand period."

As vessel availability tightened in Algeria and Europe and the supply of immediate tonnage receded, 2004 started with a flurry of activity prompted by higher US LPG prices. Demand in the East remained fairly muted, however.

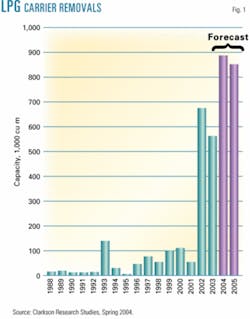

Recent newbuilding and demolition have improved the age profile of the fleet over the last 2 years, said the report, although "a significant segment of tonnage [still] falls in the 25+ years category." Fig. 1 suggests a period of accelerated removals for the entire LPG is imminent.

In March, two more vessels were sold for scrap at more than double 2003 prices, and further candidates will go for scrap before yearend, said Clarkson.

The 6 months leading up to Mar. 1 saw more newbuilding contracts "in anticipation of replacement demand stimulated by the expected growth in LPG trade."

In the first 2 months of 2004, the orderbook increased to 18 vessels, an annualized rate of 29.2%.

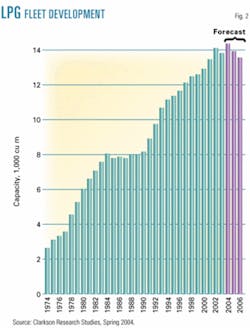

The Clarkson report said that, with the relatively limited deliveries of newbuildings expected before yearend 2006 and the projected expansion of LPG trade, "an improvement is expected in the VLGC sector's fortunes in the near term." Fig. 2 suggests overall growth of the world's LPG fleet has peaked.

Large gas carriers

Supported by growth in longer-haul trades, strong US imports, and a general increase in both ammonia and LPG trade volumes, the 40-60,000-cu-m sector was "buoyant" over the 6 months prior to Mar. 1, 2004.

Furthermore, despite delivery of five newbuildings (four in 2003 and one more in 2004 before Mar. 1), a "more than compensatory" removal of older vessels since 2002 has led to a net contraction of the fleet.

"Idle time fell significantly towards the end of last year as weather-related delays and restrictions" on tankers longer than 200 m allowed to pass through the Bosporus daily "significantly tightened availability of tonnage," delaying voyage times for up to 1 month.

The year 2004 brought this vessel category "a healthier start Uwith a couple of cargoes fixed trans-Atlantic," helping to support owner returns.

LPG chartering activity started to decrease somewhat into February, and some of the pressure from the earlier delays in the Bosporus "began to ease which has seen sentiment soften slightly from the start of the year."

The report said that, as with spot rates, time charter rates for 12 months had also risen through Mar. 1 and were around $790,000/month for a 57,000-cu-m vessel at the end of February and into early March, compared with $710,000/ month at the beginning of October 2003, representing the highest level assessed since summer 2001.

Removal of several vessels older than 25 years and the contracting of new tonnage set to join the fleet before yearend 2005 has improved the overall age profile of the fleet since the start of 2003.

In 2004, one 60,000-cu-m ship for Norsk Hydro is scheduled for November delivery, and a 59,200-cu-m ship from Kawasaki Shipbuilding Ltd. is set for Sonatrach. An additional three vessels will follow in 2005, one of 60,000 cu m for Hydro scheduled for first-quarter 2005 delivery and two for Sonatrach.

Mid-sizes

The 20-40,000-cu m sector saw continued improvement in fortunes over the 6 months before Mar. 1, said the Clarkson report.

Tonnage availability tightened significantly through fourth-quarter 2003, supported by US ammonia and LPG as well as Indian imports.

The report also said that activity in this size category was indirectly affected by Bosporus closing, as delays of 50,000-cu m vessels and "limited availability of prompt tonnage led charterers to tie-up [28-38,000- cu m tonnage] for trans-Atlantic ammonia cargoes." Availability of tonnage in the Persian Gulf also tightened after the late 2003 Muslim Eid holidays and freight rates between the Persian Gulf and Mumbai, state of Maharastra, India, reached $30/tonne through November and December, compared with the low $20/tonne in December 2002.

In the 6 months before Mar. 1, time charter rates for 35,000-cu m vessels increased to $680,000/month in March, from $650,000/month in October 2003.

The Clarkson report said that, given the few newbuildings set for delivery before yearend 2005, market sentiment would "remain relatively buoyant in the near term."

At the end of first-quarter 2004, only three vessels were on the orderbook for delivery before yearend 2005, two for Qatar Shipping in May and October and the first of five 38,000-cu m vessels for members of the midsize pool from Daewoo in fourth-quarter 2005.

The remaining pool of vessels are due for delivery over 2006.

The overall impact of these net additions and removals on the balance of the fleet indicates a slight increase in fleet size in 2005, after a contraction in 2002 and 2003, "before reducing again in 2005 ahead of the next tranche of newbuilding deliveries in 2006," said the report.