OGJ Newsletter

Market Movement

Lower crude prices follow EIA report

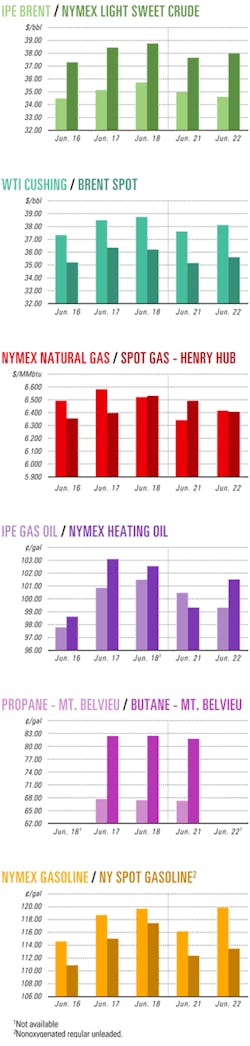

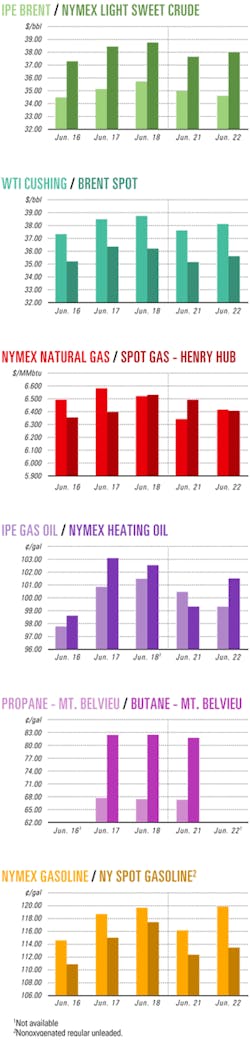

Energy prices seesawed daily early last week, with the new near-month August contract for US light, sweet crudes falling 68¢ to $37.57/bbl June 23 on the New York Mercantile Exchange and the US spot market price for West Texas Intermediate slipping 45¢ to $37.68/bbl after the US Energy Information Administration reported US crude inventories jumped by 2.5 million bbl to 305.4 million bbl in the week ended June 18—the highest level since the week ended Aug. 2, 2002.

NYMEX gasoline futures inched up above $1.20/gal June 23 on NYMEX, although EIA said gasoline stocks fell by 800,000 bbl to 205.1 million bbl in the same period. That put US gasoline inventories 9 million bbl below the 5-year average, while crude remained 4.5 million bbl below its 5-year average.

Some attributed the rise in US crude inventories to runaway imports during the week. But EIA said US crude imports were down by 83,000 b/d to 10.2 million b/d in the week ended June 18. And despite talk of increased production from the Organization of Petroleum Exporting Countries, EIA noted, "It appears that the two largest sources of crude oil imports were Mexico and Canada."

"While product availability continues to tighten, crude availability continues to improve," said Paul Horsnell, head of energy research, Barclays Capital Inc., London. That means "the impact of a buildup in crude inventories is negated by the tightness in gasoline, particularly on the East Coast," he said. "Gasoline output is continuing to head downwards." With US refineries operating at 95.6% of capacity, EIA said, gasoline production fell slightly, averaging nearly 8.7 million b/d in the week ended June 18.

"US oil demand continues to surprise on the upside. The overall demand gain for June to date is 705,000 b/d, with increased demand seen in every product category," Horsnell said. "Distillate demand remains very strong indeed, with year-to-year growth for June to date running at 4%."

He said, "With spare capacity so limited, with Iraq such a source of longer-term uncertainty and short-term shocks, with global demand strong, supply weak, and with a host of potential short-term disruptions..., we believe that the speculative bears are now pushing too hard. Expect to see further immediate price weakness with short-term insulation from bullish news and further overreaction to bearish morsels. Then expect to see a rush to cover shorts [uncovered sales contracts] and a correction back up."

Meanwhile, a 17-year consensus among investment bankers of $18-21/bbl as the general long-term price for crude "has well and truly been broken," Horsnell said. Moreover, he said, "We still think that the figure has further to rise."

In a June 23 report, Horsnell cited "two sets of oil price forecast surveysUpublished over the past week." In one survey by the UK Treasury, UK banks forecast the price for North Sea Brent crude at $21.50-35/bbl for 2005, with an average price of $27.90/bbl.

In a second survey by Reuters news service, said Horsnell, "The average 2005 Brent forecastUwas $28[/bbl], almost exactly the same as for the banks in the [treasury] survey, with the West Texas Intermediate forecast put at $30.10[/bbl]. This places the Barclays Capital 2005 WTI forecast at $5.50[/bbl] above consensus."

Bulletin

Strike actions from two offshore unions in Norway forced the Norwegian Oil Industry Association June 24 to impose a lockout starting June 28, which would pose the potential for a significant disruption in oil supplies from that country.

Should the action go ahead, reported Edinburgh, UK-based Wood Mackenzie Ltd., it "could ultimately result in an almost complete shutdown of oil and gas production on the Norwegian Continental Shelf, where output is currently running at 3.3 million b/d of oil and 7.3 bcfd of gas."

Strike actions already have resulted in about 400,000 b/d of oil production taken offline, WoodMac said.

If a complete shutdown ensued, WoodMac estimated Norway's net revenue losses to be more than $130 million/day, adding that in the past, similar situations have been resolved by the Norwegian government stepping in to force a settlement without suffering significant supply disruptions.

Industry Scoreboard

null

null

null

Industry Trends

RECENT MERGER AND ACQUISITON activity in the US could prove very bullish for drilling activity, particularly in the Rocky Mountains and the Permian basin.

Large independent exploration and production companies actively bought smaller firms and also assets from integrated majors during the last 3 months.

"In the Permian basin of West Texas and southeastern New Mexico, the top 10 transactions in [year-to-date] 2004 totaled over $2.2 billion. They were predominantly property deals rather than corporate deals, with integrated majors generally being the sellers," said Wayne Andrews, a Houston-based analyst for St. Petersburg, Fla.-based Raymond James & Associates Inc.

"This trend represents a clear opportunity to capitalize on a meaningful increase in domestic drilling activity. In short, it is the best of both worlds for E&P and oil service investors," Andrews said.

The US offers very few areas with "truly outstanding potential for long-term growth," he said. The Rockies represent one such area, particularly coalbed methane production in Colorado and Wyoming.

"While the Permian basin is a more mature area, new well completion technology is revitalizing gas production, and high oil prices are making workovers and exploitation projects more attractive. The basin has a massive inventory of drilling prospects that growth-hungry E&Ps can turn into a highly profitable production stream," Andrews said.

Recent M&A activity represents a continuation of the majors' divestiture of maturing US and Canadian assets. Meanwhile, high commodity prices are generating free cash flow for large independents that is above and beyond their capital spending plans.

"While debt repayment and stock buyback are sensible options, most E&P balance sheets are already in good shape, and the core competency of these companies is reinvesting in future growth through the drillbit.

"The major challenge many [large capitalization] E&Ps face is a dearth of drilling prospects, particularly in areas with long-term growth potential. As a result, acquiring mid and small-cap peers, or assets from the majors, is becoming an increasingly popular means for large-caps to enhance their growth outlook for the next 5-10 years," Andrews said.

"Whether in the Rockies or the Permian, a critical factor in making an acquisition succeed is for the acquirer to immediately boost drilling activity on the new properties," he noted.

Apache Corp., Houston, paid $385 million for part of ExxonMobil Corp.'s stake in mature producing oil and gas fields in the US and Canada. In addition, the two companies agreed to jointly explore for deep natural gas on more than 800,000 acres of Apache properties (OGJ Online, May 24, 2004).

"The deal represents a new paradigm of collaboration between majors and independents," Andrews said.

Independents consistently reinvest 70% or more of cash flows in US properties, so capital spending is expected to be up in 2004 vs. 2003, RJA contends.

"Higher [capital expenditure] budgets stimulate growing demand for rigs, which provides service firms with an opportunity to push through moderate price hikes without jeopardizing the level of drilling activity," Andrews said.

Government Developments

THE US DEPARTMENT OF ENERGY announced a $5.2 million research and development program to help commercialize "microhole" technology using portable drilling rigs.

Officials said portable rigs could offer environmental and economic advantages because the development "footprint" is smaller. The use of microhole technology also could mean that producers can drill for oil faster and safer than by using today's traditional methods. Researchers will look for ways to drill wells with a diameter smaller less than 3 in.

DOE will contribute a total of $3.7 million toward six new projects, and oil service companies will pay the remaining $1.4 million in cost.

DOE's National Energy Technology Laboratory will manage the projects. The six new projects involve the following companies:

Gas Production Specialties, Lafayette, La. DOE said this 8-month project is developing technology to overcome the problems of mature, low-pressure reservoirs that have high amounts of remaining gas by using an artificial lift system to get to the trapped gas. The technology will allow operators, particularly those in the Gulf of Mexico, to reactivate wells that can no longer flow by natural lift. US officials predict that the technology will allow operators to extract more reserves from reservoirs where previous production has depleted the natural pressure. DOE plans to contribute $210,000 toward the company's research.

Stolar Research Corp., Raton, NM. During an 18-month period, researchers will use radar to pinpoint drillbit location and to bring measurement data to the surface through radio data transmission. DOE will contribute $921,875.

Baker Hughes Inc., Houston. DOE will spend $986,000 during 18 months for engineers to design and fabricate a drillbit steering device and a tool that measures the electrical resistivity of the rock. The instruments will be 23/8-in. diameter and will be able to fit into coiled tubing. Development of these tools will provide a modular and effective coiled tubing drilling system that enables higher, more-effective production from existing oil fields.

Schlumberger Ltd., Sugar Land, Tex. Researchers will develop and build a microhole coiled tubing drilling rig tailored for shallow oil and gas reservoirs often found in the Lower 48. The rig will be designed to improve the environmental and economic performance of shallow well drilling by using small and purpose-built equipment that is easy to move and fast to mobilize, yet versatile in its application. DOE will spend $1.8 million during 18 months.

Western Well Tool Inc., Anaheim, Calif. DOE will spend $645,000 over 14 months on a downhole tractor tool to help transport a drillbit and measurement tools into long (3,000 ft or more) sections of horizontal wells. The tractor is expected to cost 25-50% less than conventional drilling methods and allow faster drilling of small-diameter horizontal sections of microboreholes.

Bandera Petroleum Exploration Inc., Tulsa. During a 30-month period, DOE will spend $592,000 for researchers to develop a highly abrasive slurry jetting technique to drill through rock.

Quick Takes

EQUATORIAL GUINEA, Marathon Oil Corp., and Equatorial Guinea's national oil company GEPetrol have finalized agreements for their Equatorial Guinea LNG project, including the formation of Equatorial Guinea LNG Holdings Ltd. (EGLNG). Marathon is funding 75% of the project and GEPetrol 25%. BG Gas Marketing Ltd. will purchase 3.4 million tonnes/year of LNG for 17 years beginning in 2007. EGLNG is developing the $1.4 billion plant at Punta Europa on Bioko Island. Primary engineering and construction contractor Bechtel Corp. is now under way with plant construction. Feedstock gas will come primarily from Marathon-operated offshore Alba field, which has estimated reserves of 4.4 tcf of gas (OGJ Online, June 22, 2004). The US will be the principal market for the LNG. The US Federal Energy Regulatory Commission has authorized Freeport LNG Development LP to construct and operate a 1.5 bcfd LNG receiving terminal at Quintana, southeast of Freeport in Brazoria County, Tex. Freeport LNG applied in March 2003 for the authorization. Facilities will include a 9.6 mile, 36-in. pipeline (OGJ Online, June 20, 2003). Freeport LNG Investments LLC holds a 60% limited partnership interest; Cheniere Energy Inc. subsidiary Cheniere LNG Inc., Houston, 30%; and Contango Oil & Gas Co., Houston, 10%. Dow Chemical Co. and ConocoPhillips have agreements for all of the facility's LNG capacity (OGJ Online, Mar. 9, 2004).

PIONEER NATURAL RESOURCES CO., Dallas, has begun natural gas production from its Tomahawk and Raptor fields in the western deepwater Gulf of Mexico. The two discovery wells are tied back to Falcon field facilities. Pioneer owns and operates all four fields in the Falcon Corridor, which currently produces 350 MMcfd of gas and 1,000 b/d of condensate. Tomahawk, on East Breaks Block 623, and Raptor, on East Breaks Block 668, lie 1.4 miles and 5.5 miles, respectively, from the Falcon subsea manifold in 3,600-3,700 ft of water. The wells produce into a dual flowline system connecting the Falcon manifold to the Falcon Nest processing platform, 32 miles to the north.

BURULLUS GAS CO.'s subsea development contractor on the West Delta Deep Marine concession (WDDM) in the Mediterranean Sea off Egypt—Technip Offshore UK Ltd.—awarded a contract to a joint venture of Weatherford International Ltd.'s Pipeline & Specialty Services (P&SS) and Norson Services Ltd. for pipeline precommissioning services. The work includes pipeline flooding, cleaning and gauging, hydrotesting, and dewatering of a 26-in. export pipeline, a 20-in. interfield pipeline, a glycol pipeline, and flowlines for the deepwater Simian, Sienna, and Sapphire fields development project (OGJ, Oct. 20, 2003, p. 9). First hydrocarbons from Simian-Sienna wells are planned for October 2005. Sapphire is scheduled to tie in to WDDM in 2006. Vaalco Energy Inc., Houston, has cased the vertical portion of the Etame 5H development oil well off Gabon and will drill the horizontal portion following installation of flowlines and umbilicals to tie in the well and the next development well, Etame 6H, to the floating production, storage, and offloading facility moored in the field. Etame 6H will be drilled early in 2005. First production, to begin in August, is expected to increase Etame field production to more than 20,000 b/d of oil. The company, meanwhile, is drilling a new exploration well, Avouma 1 offshore 17 km south of the main Etame field. Paramount Resources Ltd., Calgary, plans to drill three development wells and two exploration wells at Cameron Hills field in the Northwest Territories this year. Oil and gas are found in structural and stratigraphic traps in the Middle Devonian age Slave Point, Sulphur Point, and Keg River formations, the company said. Paramount holds rights to almost 80,800 acres. Gas production began Mar. 29, 2002, from six wells. Paramount began light oil production in April 2003 from five wells. Target rate of 1,500 b/d of oil was reached in November 2003, but first quarter 2004 net production averaged only 15 MMcfd of gas and 547 b/d of oil.

TALISMAN ENERGY INC., Calgary, has started construction of a $21 million(Can.) natural gas-fired cogeneration plant at its Edson sour gas processing facility in Alberta. The 10 Mw plant will replace older equipment with more-efficient technology, reducing the amount of gas needed to operate the plant by 12%, or 700 Mcfd, Talisman said. The plant will produce 2 Mw of electricity more than is required to operate the gas plant. Talisman expects construction to be finished by yearend. The Edson facility processes about 200 Mcfd. Talisman plans $249 million in capital spending for the Edson area this year, including the drilling of 103 wells.

INTEROIL CORP., a Toronto-based company with operations in Papua New Guinea, reported that the first shipment of oil for its refinery arrived at the company's marine terminal across the harbor from Port Moresby, and commissioning of the refinery can now begin. The refinery, which has a nameplate capacity of 32,500 b/d, will process low-sulfur, sweet crude into products to satisfy domestic requirements and provide exports to the surrounding region. BP Singapore is the exclusive agent for oil supplied to the refinery, and Shell Overseas Holdings Ltd. holds contracts for most products from the refinery. Italian firm ERG SPA awarded a contract to a unit of Foster Wheeler Ltd. for a new ultradesulfurization unit at ERG's 225,000 b/cd refinery at Priolo, Sicily. ERG also awarded Foster Wheeler a contract to expand a power station. Both contracts call for Foster Wheeler to provide engineering, procurement, and construction supervision services. Total investment cost of the two projects is more than $160 million. Contract terms were not disclosed. The ultradesulfurization unit will produce gasoline with a sulfur content of less than 10 ppm in order to meet new European fuel specifications. Both plants are slated for completion by yearend 2005.

THE US MINERALS MANAGEMENT SERVICE has accepted high bids totaling more than $364 million on 542 Gulf of Mexico tracts in its oil and gas lease Sale 190 Mar. 17, indicating continuing interest in the gulf. About 61% of tracts bid were in 200 m or less of water. Amerada Hess Corp. made the highest accepted bid of $35.3 million for Green Canyon Block 468 in 800-1,599 m of water. A consortium led by Unocal Corp. bid $31 million for Green Canyon Block 512, and EnCana Gulf of Mexico LLC bid $8 million for deepwater Walker Ridge Block 969. New Zealand, which has natural gas reserves insufficient to meet projected domestic gas-fired electric power demand past 2015, is encouraging gas exploration with proposed incentives to its royalty and tax regimes: The government will reduce to 1% from 5% the ad valorem royalty on gas from discoveries made from June 30 through yearend 2009. The AVR on oil remains at 5%. Another change would reduce to 15% from 20% the accounting profit royalty (APR) on gas and oil from discoveries made during the same period. The incentive is limited to the first $750 million (NZ) offshore, the first $250 million onshore, and 20% for production beyond that. Joint Oil, owned by Libya National Oil Corp. and Tunisia's ETAP, is seeking investors and an operator to explore new plays and prospects on the 7th of November block in Pelagian basin on the Libyan-Tunisian continental shelf 100-160 km off North Africa. The block, which covers 741,000 acres in 80-120 m of water, is surrounded by oil and gas finds on other blocks. Seismic includes 6,500 km of 2D data and 670 sq km of 3D data. Data rooms will be set up through July 15 at Beicip Franlab, Paris, and July 1-31 at Joint Oil, Djerba, Tunisia. Marathon EG Production Ltd. reported a gas and condensate discovery on Sub Area A on its operated Alba Block, 1,000 ft below the currently producing Alba field pay sands. The Deep Luba discovery well was drilled to 5,497 ft TMD, encountering 270 ft of net gas-condensate pay in the LowerIsongo section and some gas-condensate pay in the more-shallow Isongo sands. One pay zone flowed on test 18.1 MMcfd of gas and 1,000 b/d of condensate through a 32/64-in. choke. Marathon will test two thicker, untested pay zones this year. Partners are Noble Energy Inc. and GEPetrol.

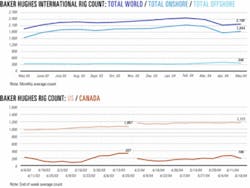

US DRILLING ACTIVITY continued to fluctuate, dropping by 16 rotary rigs to 1,171 working the week ended June 18, but up from 1,067 during the same period a year ago, Baker Hughes Inc. said. Land operations accounted for the bulk of the loss, down by 15 rigs to 1,055 drilling. Offshore drilling activity dipped by 2 units to 93 in the Gulf of Mexico and 96 in US waters as a whole. The only gain was in inland waters, up by 1 rig to 20 rigs working. Canada's rig count plunged by 77 units to 196 working that week, down sharply from 337 during the same time last year.

TAIWAN's state-owned Chinese Petroleum Corp. (CPC) plans to form a domestic and overseas petrochemical network as a part of its plan to establish a global logistics center. The domestic network will coordinate operations of petrochemical production and storage facilities in Chienchen, Taichung Harbor, and Taipei Harbor. CPC recently completed a 15,000 tonne capacity ethylene storage tank at Chienchen and plans to build storage tanks for paraxylene at the new Taipei Harbor. CPC holds a 49% stake in a joint venture with Ocean Plastics Co. Ltd. and several minor partners to build 19 petrochemical products storage tanks at Taipei Harbor. Zagros Petrochemical Co. has contracted the JV of Petrochemical Research & Technology Co. (NPC-RT) of Iran and Haldor Topsøe AS of Denmark to license their proprietary technology, provide engineering, and supply catalyst for a dimethyl ether (DME) plant to be constructed at Bandar Assaluyeh, Iran. The 800 million tonne/year plant will incorporate technology and a catalyst Haldor Topsøe developed for the dehydration of methanol, available in Iran via the JV with NPC-RT. Completion of the plant will result in a 200% increase in DME production worldwide and represents "a breakthrough for the application of DME as a green fuel," the JV said. Saudi Basic Industries Corp. (Sabic) has awarded a program management service contract to Foster Wheeler Energy Ltd. for the engineering, procurement, and construction of a petrochemical complex in Yanbu Industrial City on Saudi Arabia's Red Sea coast. The complex is slated to have a production capacity of 3.8 million tonnes/year of ethylene, ethylene glycol, polyethylene, and polypropylene products. Sabic announced details for the complex late last year (OGJ Online, Dec. 22, 2003). The facility is expected to begin operating by Dec. 31, 2007. The Saudi Arabian government owns 70% of Sabic, and private investors hold 30%.

WILILIAMS COS. INC., Tulsa, has called a 30-day open season to determine shipper interest in a $180 million expansion of its Transcontinental Gas Pipe Line Corp. (Transco) system from Leidy, Pa., to delivery points in New York and New Jersey. Under the proposal, pending FERC approval, Williams would provide an additional 150 MMcfd of new gas capacity by November 2007. The project has two primary paths in Transco's Zone 6, with 100 MMcfd of gas being offered from the Leidy hub to Long Island in Suffolk County, NY, and an additional 50 MMcfd of gas from Leidy to Transco's Station 210 Pooling Point. Alaska has accepted TransCanada Corp.'s Stranded Gas Development Act application to build a natural gas pipeline from Alaska's North Slope. TransCanada subsidiary Alaskan Northwest Natural Gas Transportation Co., Calgary, proposes a 48-in. pipeline to the Alaska-Yukon Territory border, transporting 4.5 bcfd of gas into the Canadian system for distribution across North America (OGJ Online, June 7, 2004). Negotiations will begin within the next few weeks. The state also is negotiating with two other pipeline sponsor groups (OGJ Online, May 7, 2004). Alaska Gov. Frank Murkowski said he hopes to have a contract from one or more of them to present to the legislature in January 2005. Transmeridian Exploration Inc., Houston, signed a transportation agreement for use of the national crude oil pipeline and terminal system for South Alibek field production in Kazakhstan (OGJ Online, Feb. 2, 2004). It's the first step in allowing Transmeridian to complete a pipeline connection to the KazTransOil terminal 1.5 km from South Alibek. Initial plans call for installation of a pipeline transfer and measuring system to handle as much as 30,000 b/d of oil. Transmeridian expects oil deliveries to begin by second quarter 2005. The oil will be shipped by rail until the pipeline connection is established.