OGJ Newsletter

Market Movement

Attacks on Iraqi oil facilities bring on slow, weak market response

Buoyed by an earlier decision by other members of the Organization of Petroleum Exporting Countries to boost their production quotas, energy futures markets were slow and weak in reacting to a series of terrorist attacks June 14-16 that effectively shut down oil exports from Iraq.

Iraq's state oil marketing agency closed that country's Basrah terminal on the Persian Gulf June 15 after terrorists successfully attacked two crude pipelines supplying the southern export terminals in that country on 2 consecutive days.

Yet prices for crude and petroleum products fell in profit-taking June 15 in futures markets in London and New York, as traders shrugged off that escalation of violence. Energy prices also were undermined by expectations of substantial increases in US inventories of both crude and gasoline, following the June 3 decision by other OPEC members to boost crude output quotas to roughly the levels they were already producing.

On June 16, the July contract for benchmark US light, sweet crudes recovered only 13¢ to $37.32/bbl, vs. a 40¢ loss in the previous session, on the New York Mercantile Exchange, as terrorists again sabotaged Iraq's primary southern pipeline. Gunmen also murdered the security chief for state-run Northern Oil Co. Iraqi officials said it could be weeks before oil exports are back to previous levels of 1.6-1.8 million b/d.

Important developments

"What has happened in IraqUis far more important than the initial market response might imply," said Paul Horsnell, head of energy research, Barclays Capital Inc., London. "Oil exports are being very deliberately and so far very successfully, targeted."

"Attacks on pipelines feeding Iraq's Basrah and Khor al-Amaya terminals, with export capacity of 1.6 million b/d and 400,000 b/d, respectively, have halted all exports from [southern Iraq] for now," said Robert S. Morris, an analyst with Banc of America Securities LLC, New York, in a June 16 report.

"In addition, there have been no exports from Kirkuk in the north since a pipeline attack in late May," Morris said. "Overall, total Iraq exports last month, on average, declined 200,000 b/d, or 11%, to 1.6 million b/d compared with April following similar pipeline attacks."

The loss of Iraqi oil exports, "depending on how long the shut-ins last and if there are additional attacks," Morris said, "could offset a significant portion of the projected uptick in OPEC [excluding Iraq] production this month. We estimate OPEC production [excluding Iraq] in June will rise by at least 1 million b/d to 27.5 million b/d."

"The attacks on Iraqi oil export infrastructure are significant, given the lack of additional flexibility in the global upsteam. The Iraqi oil system was already compromised by neglect and misuse, and sabotage is making a bad situation worse," Horsnell said.

"The big-picture story here is that the global upsteam system is now running pretty close to full capacity," he said. "The Saudis in particular have taken the sensible approach that the policy of least regret is to produce now and throttle back later if necessary. That is better than finding further down the line that it is too late to respond adequately to a potentially vicious seasonal swing up to fourth quarter."

Horsnell noted, "Within that context, an increased level of unreliability in Iraqi exports is not of minor importance."

Bullish inventories

Meanwhile, the US Energy Information Administration reported that, in the week ended June 11, US commercial crude inventories increased by 800,000 bbl to 302.9 million bbl—well below the 1.15 million bbl expected by Wall Street analysts.

US gasoline stocks fell by 500,000 bbl to 205.9 million bbl in the week through June 11, vs. an expected gain of 1.25 million bbl. That put gasoline inventories "3.1% below normal as the summer driving season ramps up," said Morris. Distillate stocks increased by 1.5 million bbl to 109.8 million bbl, with heating oil accounting for most of that gain.

The American Petroleum Institute subsequently reported US crude stocks increased by 482,000 bbl to 303.9 million bbl during the week ended June 11, while gasoline stocks were down by 503,000 bbl to 204.97 million bbl. It showed a growth in distillate stocks of 913,000 bbl to 109.6 million bbl during the same period.

"Gasoline demand remains very robust, and total US demand is strong," said Horsnell. "Beyond remarkably robust demand, the other key feature for gasoline is the failure of inventories to build sufficiently. The situation remains very tight, particularly on the East Coast, and we would suggest that in light of the data, the selloff in gasoline did become somewhat overdone."

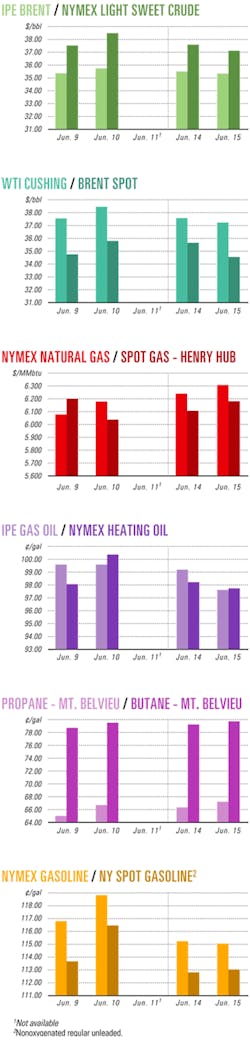

Industry Scoreboard

null

null

null

Industry Trends

THE GULF OF MEXICO jack up rig inventory stands at a 10-year low of 111 rigs, said J. Marshall Adkins, a Houston analyst with St. Petersburg, Fla.-based Raymond James & Associates Inc.

"We expect the market to tighten further in the near future, as drilling contractors still have the incentive to move additional rigs to international markets based on the large day rate discrepancy that exists today" between drilling regions worldwide, Adkins said.

Any slight increase in drilling demand or the departure of any more jack ups from the gulf in coming months would put a severe stain on the market, pushing day rates higher, he said. Premium jack up day rates are expected to lead the gulf's jack up market recovery during the next several months.

"Once operators are forced to wait months and not weeks for jack ups in the GOM, reality will begin to set in, and day rates should shift meaningfully higher," he said.

The gulf fleet utilization was 76% as of June 7, but the market actually is much tighter than that utilization number would seem to suggest, he said.

"After excluding 13 cold-stacked rigs (rigs that require significant capital investments before returning to work), effective utilization of the marketed GOM jack up fleet is 86%. More importantly, the vast majority of idle jack ups are shallow (less than 100 ft) workover-type rigs, while premium and standard jack ups are both enjoying above 90% utilization," Adkins noted.

Historically, rig fleet utilization rates of 85% mark significanly increased day rates, he noted.

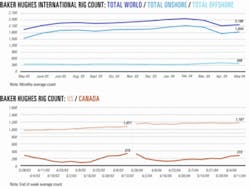

OIL AND GAS COMPANIES' spending and drilling, workover, and seismic survey activities are expected to accelerate in the US and Canada within 60 days, according to the June PatchWork Survey results from New York-based UBS Securities LLC.

"Every activity index hit a record high this month, and all broke out of the very high levels that they have been at over the past few months," said UBS analyst James H. Stone. The survey, started in 2002, polls oil company operating personnel.

The survey uses an index ranging from 2.100 to 100. Positive numbers indicate that an increase in activity or pricing is expected in 60 days. A negative number indicates a decrease in activity or pricing is expected during the same timeframe. A value of zero or close to it indicates that no change is expected in 60 days.

The spending index for June for the US and Canada stands at 54 and is trending upward again, Stone said.

"Commodity prices remain very high, underpinning the ability and propensity to spend. Spot WTI [West Texas Intermediate] averaged over $40/bbl in May, some of which will likely find its way into service company pockets," he said.

Stone also noted that the UBS forecast outlining a US rig count of 1,200 rigs working by yearend "is beginning to look conservative." Smaller operators appear to be accelerating their drilling after 4 months of reduced activity, the survey showed.

Government Developments

TRINIDAD AND TOBAGO government officials no longer will consider proposals for the construction of individual ammonia or methanol plants in the twin-island Caribbean nation.

Prime Minister Patrick Manning said that separate methanol and ammonia plants do not add sufficient value. The government will grant approval only to proposals calling for centralized production of ammonia and methanol.

"If a company wishes to manufacture methanol or manufacture ammonia alone, they are told we are not interestedU. That shift in policy has brought about a significant number of proposals, some of which have been considered recently by the [Trinidad and Tobago] cabinet," Manning said.

The nation's energy policy seeks the right balance of monetization of Trinidad and Tobago's burgeoning natural gas reserves for export vs. expanding an industrial base supported by those reserves. Investments from foreign oil and gas companies are considered key to attaining that balance.

Trinidad and Tobago anticipates production of 5 bscfd of gas and 160,000 b/d of crude oil and condensate by 2020. Production in 2001 reached 124,000 b/d of crude and condensate and 1.4 bscfd of gas (OGJ, Apr. 1, 2002, p. 22).

Already, Trinidad and Tobago is the world's largest exporter of both methanol and ammonia. Prospective international investors have expressed interest in establishing an ethane-based petrochemicals operations.

The $1.2 billion Atlantic LNG Co. of Trinidad & Tobago's Train 4 expansion project ensures the availability of a critical mass of ethane to build an ethylene plant, government officials have indicated (OGJ Online, Sept. 3, 2003).

The government is contemplating proposals calling for manufacturing facilities to produce polyethylene products.

Union Estate in southwestern Trinidad has been identified as a site for gas-based industries, including ammonia, ethylene, and methanol facilities. Both the Standing Committee on Energy and the cabinet are working to help accelerate development of the 750 acre site.

"There is a second one with exactly the same configuration, which also is targeting La Brea, and there is a third one that goes from ammonia to melamine, which is targeting the industrial estate in Point Lisas," Manning said.

He noted there also are two proposals for construction of a plant that would process natural gas into synthesis gas, a mixture of carbon monoxide and hydrogen. The syngas could be used to produce methanol or ammonia.

PAKISTAN is considering lower fuel taxes.

Pakistan's Standing Committee on Petroleum and Natural Resources in the nation's Upper House has recommended that the government implement all means possible to keep fuel oil prices down and stabilize future petroleum prices, including scaling down taxes levied on petroleum products.

The government twice has disallowed oil price increases in the last two fortnightly revisions by the Oil Companies Advisory Committee, which fixes oil prices, committee chairman Sen. Dilawar Abbas said on June 1.

The committee also recommended that the government take immediate steps to purchase gas from Qatar, Iran, and Turkmenistan and to initiate gas development and expansion projects to avoid gas shortages after 2010.

Quick Takes

THE UK'ssuccessful 22nd offshore and 12th onshore licensing round generated continuing international interest as applications were received June 4 for 4 innovative "Frontier" licenses, 42 "Promote" licenses, and 30 traditional licenses (OGJ Online, May 10, 2004). Of the 68 companies that applied for 164 offshore blocks, 20 were newcomers to the North Sea area. Onshore licenses drew 30 applications, nearly four times as many as a year ago. The new frontier licenses apply to newly offered blocks in Areas 1 and 4 north and west of the Shetland Islands. The UK plans to offer license awards in August-September.

BP Exploration (Angola) Ltd. and partners made a fourth deepwater oil discovery, Venus, on Block 31 off Angola, reported partner Marathon Petroleum Angola (Block 31) Ltd. The Venus I well, drilled to 4,506 m, encountered three pay intervals. It lies 175 km off Angola in 2,000 m of water. Block 31 covers 5,349 sq km (OGJ Online, Nov. 24, 2003). Angola's state oil company Sonangol is the concessionaire and BP, the operator. Other partners are Esso Exploration & Production Angola (Block 31) Ltd., Statoil Angola ASA, and Total SA unit EPA (Block 31) Ltd.

Murphy Oil Corp., El Dorado, Ark., reported "significant oil and natural gas pay" in multiple reservoirs from its Kakap No. 1 deepwater exploration well on Block K off Sabah, Malaysia. Kakap No. 1 was drilled in 3,037 ft of water. Operator Murphy subsequently sidetracked the discovery well and recovered full cores in each of the main reservoirs, said Pres. and CEO Claiborne P. Deming. Murphy holds an 80% working interest in Block K, which covers more than 4 million acres. Petronas Carigali Sdn. Bhd., the exploration and production arm of Malaysia's state-owned Petronas, holds the remaining 20%. Brazilian state oil company Petróleo Brasileiro SA (Petrobras) signed a production-sharing agreement (PSA) with Tanzania and Tanzania Petroleum Development Corp. authorizing Petrobras to explore Block 5 in Mafia Bay. The block covers 9,250 sq km in 300-3,000 m of water. The PSA involves an initial exploitation period of 4 years with options to extend the agreement for an additional 4 years and then a 3 year period.

The agreement stems from a 2001 bidding round. Tullow Bangladesh Ltd., a unit of Tullow Oil PLC, Dublin, reported its Lalmai-3 well on Block 9 in Bangladesh flowed on test as much as 8.6 MMscfd of dry natural gas from a zone at 2,420-60 m. The onshore well, drilled to evaluate the potential of a large anticlinal structure, reached 2,800 m TD. Tullow plans to appraise the Lalmai structure when it completes the Bangora well 40 km north of Lalmai, which spudded June 2 on the same trend. Tullow operates Block 9 with coventurers Niko Exploration (Block 9) Ltd. and Bangladesh Petroleum Exploration & Production Ltd.

Lukoil Overseas of Russia and Kazakhstan's Kazmunaigas launched 2D seismic surveys in the northern Caspian Sea off Kazakhstan and expect to begin drilling in 2005. Surveys on the 8,400 sq km Atashsky block and 1,168 sq km Tyub-Karagan block, combined, will cost more than a $4.2 million. The blocks are 250 km southwest of supergiant Kashagan oil and gas field and 125 km northeast of Lukoil's Khvalynskaya oil and gas operations and the Yuri Korchagin oil discovery on the Severny Block in Russian waters. Data acquisition will continue through September. Lukoil speculates that one structure on Tyub-Karagan may hold 3.1 billion boe, 76% oil. If such a discovery is borne out and proves commercial, the structure could begin producing as early as 2012 at 7.2 million tonnes/year of oil from 79 oil and 4 gas wells. Atashsky's postulated resources are 248.8 million tonnes of oil equivalent, 57% oil. ExxonMobil Corp. unit Esso Exploration & Production Norway AS was awarded operatorship and 30% interest in a new license involving an unexplored area on the Norwegian Continental Shelf in the southern North Sea. The license covers Blocks 8/6, 9/2-6, 10/4, 10/7-9, and 11/7 in the Norwegian-Danish basin 100 km southwest of Egersund. Partners are Statoil ASA 30% and RWE DEA AG 10%. The Norwegian state financial interest is 30%. ExxonMobil Canada Ltd. plans soon to begin a seismic survey of eight parcels in the Orphan basin off Newfoundland. It acquired a 25% interest in the licenses in December along with partners Imperial Oil Resources Ltd. (25%) and Chevron Canada Resources Ltd. (50%) (OGJ Online, Dec. 18, 2003). Working in 1,200 m of water, the partners currently are examining supply chain logistics and iceberg management.

DUKE ENERGY GAS TRANSMISSION, Houston, is expanding by 8 bcf the natural gas storage capacity at its Market Hub Partners' (MHP) Egan facility in Acadia Parish, La. Egan has two existing 8 bcf caverns, and MHP expects to leach out a third like-sized cavern by mid-to-late 2006. Cavern leaching was slated to begin this month. Egan has a 12-month injection-withdrawal cycle capability and more than 1.2 bcf of current gas deliverability, Duke Energy said. Egan has been fully subscribed since Duke Energy's acquisition of MHP in 2000. MHP also has received approval to develop a salt dome storage facility in Copiah County, Miss.

THE CAMISEA CONSORTIUM expects to invest as much as $500 million in Block 56 development, following the recent agreement on royalties for natural gas exports, reported state oil agency Perupetro. Block 56, adjacent the Camisea natural gas megacomplex in Peru's Amazon rainforest, holds reserves estimated at 3 tcf of gas from Pagoreni and Mipaya fields discovered by Royal Dutch/Shell Group in the late 1990s. Camisea partners plan to drill five wells on Block 56 by 2006 and to build a liquids separation plant. The consortium, led by operator Pluspetrol SA of Argentina, includes Dallas-based Hunt Oil Co., South Korea's SK Corp., and Tecpetrol del Peru. The consortium expects to sign an exploitation contract with Perupetro by July 15, after which Pluspetrol will begin an environmental impact study, seismic studies, and eventual drilling of additional wells. Field work is expected to begin early next year. Peru LNG, led by Hunt Oil, also is preparing to build a $2.25 billion liquefaction plant south of Lima to export LNG to Mexico and the US by 2008.

PEMEX EXPLORATION & PRODUCTION has awarded Paragon Engineering Services Inc., Houston, an 18 week contract to provide basic and detailed engineering for the 8,000 ton Ayin-A and Ayin-B drilling platforms for drilling in 600 ft of water off Mexico. Paragon will develop engineering deliverables required to solicit engineering, procurement, installation, and commissioning (EPIC) bids for the platforms. Paragon will issue engineering details, assist in development of the technical portions of the bid tender packages, and serve as advisor to Pemex during EPIC work. The platforms will feature a four-leg skirt-pile design using modern building materials and improved installation methods.

BG GROUP PLC has loaded the first shipment of Karachaganak oil for export at the Novorossiysk sea terminal on the Black Sea following its resumption of production May 11 from Karachaganak Phase II facilities in northwest Kazakhstan. BG's total 2004 production from Karachaganak field is projected at 35 million boe. Although first oil production entered the connecting export pipeline to Atyrau on July 15, 2003, the facilities were shut in September because of caustic soda contamination to the oil and further delayed in December (OGJ Online, Dec. 9, 2003). The field's production capacity is 700 MMscfd of sales gas and more than 200,000 b/d of oil. Further development with increased liquids production will follow when markets are established for the accompanying gas volumes.

MARATHON OIL CO. signed agreements with Syntroleum Corp., Tulsa, to license a Syntroleum process for the Marathon-led Qatar gas-to-liquids (GTL) project and to amend the $21.3 million promissory note on a GTL demonstration plant at Port of Catoosa, near Tulsa (OGJ Online, Mar. 22, 2004). The Catoosa agreement extends the note's maturity to 2005, giving Syntroleum the option to repay it sooner. Otherwise, Marathon may convert any remaining balance into license credits or Syntroleum stock at no less than $6/share. Syntroleum plans to pay the Catoosa balance from the Qatar license fees. It would collect $125 million from a definitive license agreement for the Qatar project, contingent upon agreement among Marathon, its partners, and Qatar Petroleum Co. for a 120,000 b/d GTL facility.

STATOIL has finalized a 20-year contract with Richmond, Va.-based Dominion Resources Inc., giving Statoil access to increased processing capacity and storage that Dominion is planning for its Cove Point, Md., LNG receiving terminal. Statoil will more than quadruple its current 2.4 billion cu m/year, which is one third of Cove Point's LNG processing and storage capacity. BP and Royal Dutch/Shell Group each hold one third (OGJ Online, Sept. 3, 2003). During 2006-23, Statoil plans to deliver 2.4 billion cu m/year of LNG from its Snøhvit development in the Barents Sea. Until Snøhvit production begins, Cove Point partners will buy LNG from Algeria and Trinidad and Tobago (OGJ Online, Feb. 12, 2004). Cove Point's processing capacity will be increased to 1.8 bcfd from 1 bcfd and its storage capacity to 14.6 bcf from 7.8 bcf, both by 2008. Construction of new LNG storage tanks is expected to take 3 years, following regulatory approval. The project includes associated pipelines, expected to go into service by late 2008, and natural gas storage projects in Maryland and Pennsylvania. Shipping firm Tsakos Energy Navigation Ltd. (TEN), Athens, has signed a contract for the construction of a 150,000 cu m capacity LNG carrier to be built by Hyundai Heavy Industries Co. Ltd. of South Korea. The vessel is scheduled for delivery in March 2007. The contract represents TEN's first entry into a rapidly growing LNG market. According to the US Energy Information Administration, US LNG imports are expected to increase by 58% during 2007-10 as new regasification projects come on line. TEN also remains in talks with another shipyard regarding the construction of two additional LNG carriers.

QATAR FERTILIZER CO. has completed its fourth major expansion project, Qafco-4, at Messaied Industrial City, making Qafco the world's largest single-site urea producer, the company said. The expansion increased ammonia production by 50% and urea production by 65%, raising annual production capacity to 1.4 million tonnes of ammonia and 1.7 million tonnes of urea. Qafco is owned by state-run Qatar Petroleum Co. 75% and Norsk Hydro AS 25%. The new 2 billion riyal production train was built by Consolidated Contractors International Co. of Lebanon; Hollandsche Beton Groep NV unit Interbeton BV; and Chicago Bridge & Iron, The Woodlands, Tex.

EXCELSIOR ENERGY INC., Wayzata, Minn., and ConocoPhillips signed a development and technology licensing agreement for an integrated gasification combined cycle facility to be built on the Iron Range in northeastern Minnesota. The first unit of Excelsior's Mesaba energy project will have a net output capacity of 532 Mw of electricity and will feature ConocoPhillips' E-gas technology, which converts coal, petroleum coke, and other low-grade feedstocks into synthesis gas containing hydrogen and removes most pollutant-forming impurities, including mercury from coal. The Mesaba project will further refine the technology, possibly utilizing an advanced combustion turbine with other process units in the facility. It is expected to be operational in 2010. Scottish Power PLC unit PPM Energy Inc. and partner Shell WindEnergy Inc., Houston, dedicated the Colorado Green Wind Power project in Lamar, Colo., last month. Construction began in December 2003, and the commissioning phase began in February. Situated on more than 11,000 acres south of Lamar in southeastern Colorado, the wind farm—the fifth largest in the US—can deliver 162 Mw of power from 108 General Electric turbines. Prime customer Xcel RFP said that, compared with the current high cost of natural gas, the wind farm is expected to save its customers about $6 million/year.

INDIA said it is willing to consider the gas pipeline from Iran via Pakistan if Islamabad provides international security guarantees, according to K. Natwar Singh, external affairs minister. Asked about his recent remark that peace talks with Pakistan would not be stopped even if there were a terror attack in occupied Kashmir, Singh replied, "We are for the closest relations with Pakistan, but [these are] based on reciprocity and realism." Singh said that when he meets with Pakistani Foreign Minister Khurshid Mehmood Kasuri in August, he would seek Pakistani help in stopping terrorism in Kashmir. "There can be no compromise on terrorism."