Spending for offshore wells to reach $189 billion in 5 years

The oil and natural gas industry will spend a total of $189 billion drilling wells offshore over the next 5 years, according to a study released this month by Canterbury, UK-based energy analyst Douglas-Westwood Ltd.

This sum will include more than 15,000 offshore wells worldwide, the report said. "Of these wells nearly 4,500 will be exploratory, costing $75 billion, and around 10,500 will be development, costing $114billion."

Douglas-Westwood's study, entitled "The World Offshore Drilling Report," also estimated that drilling and completion expenditure in 2003 was $36 billion. "Spending levels are expected to grow somewhat over the next 2 years and then decline slightly, stabilizing at about $37 billion/year," they said.

Deepwater growth

In its second year of being published, the study found that the biggest forecast change was the continuing growth in deepwater drilling (those wells drilled in more than 500 m of water). These wells contrast with a long-term decline in shallow-water activity, Douglas-Westwood reported.

"In the last decade, reductions in available shallow-water drilling opportunities have been counterbalanced by increasing deepwater activity," the analyst said. An average of 3,000-3,200 offshore wells are drilled every year, of which 12% are now in deep water, the study found.

In 2008, these wells are expected to increase to about 17% of all wells drilled, with $56 billion forecast to be spent globally on drilling and completing deepwater wells over the next 5 years, said study author Michael R. Smith of EnergyFiles Ltd.

For the first time since 2003, the report said, Africa and Latin America saw deepwater drilling expenditures exceed that for shallow-water drilling; this gap will increase in both regions through the forecast period, Douglas-Westwood said. "With the exception of the Middle East, where there is no deepwater activity, all other regions should see some shift from shallow to deep water."

Regional changes

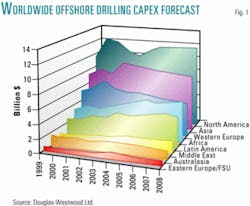

"There will be significant changes in some regions," the study reported. North America, for example, will again have the highest share of the total spent at $57 billion, which is expected to increase by $3.4 billion compared with the previous 5-year period, it said. This will occur despite the slight decline of the total number of wells drilled over the forecast period.

Latin America and Africa, meanwhile, are forecast to see an increase in expenditures of $6.1 billion and $8 billion, respectively. "Although Asia's forecast 5-year spend is about the same as the previous period, the outlook for Western Europe is a decline of 12%, despite cost escalation," Douglas-Westwood reported.

Rig demand

The analyst forecast that the deepwater and ultradeepwater rig market will remain at high utilization rates throughout the forecast period, especially for drillships and fifth-generation semisubmersible rigs with water depth rated greater than above 1,500 m, the study said. Also, "Water depth capabilities will continue to grow beyond the current drilling record of 3,053 m."

Generally weaker will be the shallow-water semisubmersible market, but "a decline in the Gulf of Mexico and in the North Sea will be counterbalanced by a pick-up in demand in West Africa, India, and China, at least over the first 2 years of the 5-year [forecast] period," Douglas-Westwood said.

"Demand for high-specification jack ups is likely to remain strong as new gas projects are identified, particularly for Gulf of Mexico deep-reservoir gas drilling. Consequently, most new expenditure on drilling rigs is expected to be directed at upgrades of both jack ups and floating rigs to allow faster drilling and deeper water and/or deeper-reservoir drilling," the study said.

Conclusions

"Drilling levels increased through the 1990s in an environment of increasing energy demand and stable energy prices linked to improvements in technology," Douglas-Westwood reported. "However, over the next 5 years, drilling levels will become opportunity-constrained, and a slight decline is forecast of around 8%.

"Numbers of wells drilled and expenditures may not increase dramatically even if there is real oil price growth. Furthermore, better development wells mean fewer will be needed per field."

In the Persian Gulf, "some growth is possible," the study said, "but this would depend on the controlling governments, primarily Iran and Saudi Arabia, encouraging investment to a much greater extent than they do now."

There will be "steady, rather than dramatic improvements" to drilling equipment and services over the next 5 years, Douglas-Westwood said. "These [improvements] will facilitate wells to be drilled in more-extreme situations, in greater water depths and reservoir depths, at higher temperatures and pressures, and in areas prone to greater hazards.

"However, no radical new processes are expected to make a major impact on expenditure within the period," the analyst said.