World's LNG industry surges, pushed by confluence of factors

Worldwide LNG demand is surging, driven by several factors:

- Substantial reduction in LNG costs over the past decade.

- Favorable economics of gas fired, combined-cycle power generation.

- Restructuring of the gas and electricity industries, especially in Asia and Europe.

- Surplus production in LNG plants driving the spot trade.

- Gas producing companies' desire to monetize their gas reserves.

- Prospects for natural gas pricing that will support greater gas production and the costs of liquefying it for world trade.

- Strong economic growth, especially in India and China.

In 2003 global LNG demand surged 10.8% to a record 125 million tonnes, or 155 billion cu m (bcm), several times faster than world gas consumption, which rose 3.3% to 2,686 bcm.

According to Cedigaz, the Paris-based natural gas statistical center, internationally traded volumes of natural gas grew 7.1% to 761 bcm.1

Pipeline exports rose 5.8% to 593 bcm, including 135 bcm in shipments within the countries of the former Soviet Union.

LNG thus accounted for a record 28% of all traded volumes in 2003, 37% if intra-FSU shipments are excluded.

Fig. 1 shows that LNG demand has grown 6.4%/year over the past decade.2

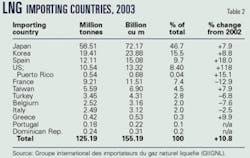

In the past 18 months, Portugal, the Dominican Republic, and India received their first direct shipments of LNG, bringing the total number of importing countries to 15.

The US surpassed France to become the world's fourth largest importer as imports more than doubled to nearly 11 million tonnes/year (tpy).

In 2003, spot and short-term sales rose 45% to 13.45 million tonnes. This was equivalent to 10.8% of global LNG production, compared with 8% in 2002, less than 6% in 2001, and slightly more than 1% in 1997.

About 48% of spot cargoes went to the US, 32% to Asia, and 24% to Europe.

LNG demand will expand by at least 10% in 2004. Economic growth rates averaging 7%/year in developing Asia, especially India and China, will place increasing demand on energy and natural gas markets.

Over the longer term, Cedigaz projects that LNG demand could reach 185-218 million tonnes by 2010 and 286-350 million tonnes by 2020.

LNG exports

At yearend 2003, liquefaction plants were operating at 15 sites in 12 countries with 70 trains and a combined capacity of 140 million tonnes for an average utilization rate of 89%.2 This surplus continues to drive the spot and short-term markets. Those plants' total storage capacity of 5 million cu m of LNG equals more than 6 days of production.

Four new trains have come on line since the beginning of 2003: the first two trains of Malaysia LNG Tiga, the third train in Trinidad and Tobago's Atlantic LNG project, and Train 3 at the Ras Laffan project in Qatar.

Table 1 shows LNG exports by country; Table 2, imports.

Of the production, 46.4% is in the Asia Pacific, 24.0% in Africa, 21.0% in the Middle East, and 8.1% in the Western Hemisphere. Particularly striking compared with 2002 production figures is the steady growth of production in Nigeria, up 49.5%, and in Trinidad and Tobago, which more than doubled in 2003. Trinidad barely edged out Nigeria to become the fifth largest exporter

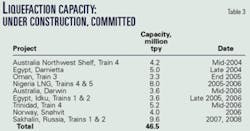

Table 3 shows liquefaction capacity that is under construction or committed.

Major projects

What follows is an update on current major projects under way around the world.

Algeria

On Jan. 19, 2004, an explosion destroyed three of the six trains at Algeria's Skikda plants and resulted in the loss of 2.8 million tonnes of capacity, killed 27 persons, and injured 58.

The exact cause of the explosion awaits an investigation's final report due any day. Initial reports, however, pointed to a leak of a cold gaseous or liquid hydrocarbon that caused pressure in a boiler to soar. Early reports cited a malfunctioning boiler; later ones cited the source of the leak as a nearby pipeline (OGJ Online, Feb. 18 and Feb. 27).

At a gathering of the world's LNG experts in Doha, Qatar, in March, a Sonatrach presentation noted the difficulty of pinpointing the source of the leak due to the extensive damage of equipment in the area.

Sonatrach nevertheless was able to make up the lost capacity by optimizing operations at its other LNG plants and maximizing pipeline exports to Europe. To meet its longer-term contractual commitments, Sonatrach plans to build a new 4-million tpy train at Skikda and is also considering a new project with a capacity of 6-8 million tpy based on gas from the Gassi Touil and other fields.

The potential implications of this incident were serious, since it intensified fears about LNG safety, especially in the US, where more than 30 terminals have been proposed.

Australia

The Northwest Shelf project's fourth train will start production in 2005 and sell its 4.2 million tpy of production to a planned terminal at Shenzhen, China, Japan, and South Korea. A fifth 4.2-million tpy train is likely to be approved.

On May 9, 2004, construction began on Australia's second LNG project, the Darwin LNG plant that is part of the $2.3-billion development of the Bayu-Undan gas field in the Timor Sea Joint Zone of Cooperation. Partners are the operator ConocoPhillips, Tokyo Gas Co., and Tokyo Electric Co. The project will start supplying Japanese customers in 2006.

The Gorgon project, being developed by ChevronTexaco Inc., Royal Dutch/Shell Group, and ExxonMobil Corp., targets markets in the US, Japan, and Korea.

Egypt

Spanish-Egyptian Gas Co. (Segas), a joint venture of Union Fenosa Gas with 80%, Egyptian General Petroleum Corp. (EGPC) and Egyptian Natural Gas Holding Co. (EGAS), will start up the first 5.5-million-tpy train at Damietta, Egypt.

The production will be sold to Spain and possibly to the Isle of Grain terminal in the UK. A second train is under consideration.

The first 3.6-million-tpy train of the Egyptian LNG (ELNG) project at Idku will begin operations in 2005 and deliver its entire output to Gaz de France for 20 years.

Initial work has begun on a second 3.6-million-tpy train, which will sell its output to BG LNG Services for delivery to the Lake Charles, La., terminal. Participants are EGCP, EGAS, BG, Malaysia's Petronas, and Gaz de France.

Nigeria

Nigeria LNG's Trains 4 and 5, each with a capacity of 4 million tpy, will go into production in 2005, raising the country's total nameplate capacity to 17 million tpy.

A final investment decision has not yet been made on Train 6, which would come on stream in mid-2006. Shell has signed an initial multiple destination contract to buy 1.4 million tpy from Train 6 for 20 years.

Three more Nigerian LNG projects are being studied: the West Niger Delta project (ExxonMobil, ChevronTexaco, and ConocoPhillips); the Brass River LNG Project (ENI and ConocoPhillips); and an offshore floating LNG project (Statoil ASA, ChevronTexaco, and Total SA).

Trinidad and Tobago

A recent debottlenecking raised the capacity of Train 1 at the Atlantic LNG plant by 10% to 3.6 million tpy. The three trains, owned by BP PLC, BG, and Repsol YPF SA, are currently producing around 10.4 million tpy, most of which goes to the US.

Construction is proceeding on a fourth, 5.2-million-tpy train that will go on stream in 2005.

The gas will be supplied by subsidiaries of BP and BG. Owners of Train 4 are BP with 37.78%, BG 28.89%, Repsol 22.22%, and the National Gas Co. of Trinidad and Tobago 11.11%. Construction was halted for 10 weeks by a strike but resumed in April. Trains 5 and 6 are being discussed.

Qatar

In March 2004 the third train of Qatar's Ras Laffan Liquefied Natural Gas Co. Ltd. (Rasgas) went on stream 2 months ahead of schedule. Its capacity of 4.7 million tpy makes it the largest train in the world.

The output is sold to India's Petronet, which opened its first terminal at Dahej in February 2004. Rasgas's Train 4 (also 4.7 million tpy) is to start up in fourth-quarter 2005 and will produce LNG targeted for European markets.

New projects being pursued include the two-train, 15.6-million-tpy Qatar Liquefied Gas Co. Ltd. (Qatargas) II project proposed by ExxonMobil with 30% and state-owned Qatar Petroleum Co. 70% that would sell its entire output to a receiving terminal at Milford Haven, UK, and a single-train, 7.8-million-tpy project (Qatargas III) to export LNG to the US proposed by Conoco- Phillips for the 2008-09 time frame.

Qatar's Energy Minister recently announced that the country has set a target of producing 1 million b/d of liquids-from-gas by the end of the decade. He noted that the country has 900 tcf of natural gas reserves, equivalent to about 180 billion bbl of crude oil and that it is much cheaper to transport GTL (gas-to-liquids) products than natural gas. Anticipated higher oil prices also brighten the economic outlook for GTL.4

Qatar's first GTL project, Oryx GTL, will begin producing 34,000 b/d in 2006. Qatar Petroleum and Sasol Chevron Consulting Ltd. have agreed to expand the project to 100,000 b/d in 2009 and to develop a new 130,000 b/d integrated GTL project.

Shell has signed heads of agreement to build a 70,000 b/d GTL plant by 2009 that will expand to 140,000 b/d. Other GTL projects are being negotiated with ExxonMobil, Marathon Oil Corp., and ConocoPhillips.

Russia

Sakhalin II is building a two-train plant that will eventually produce 9.6 million tpy. Sakhalin Energy Investment Co. Ltd., a consortium established in April 1994 to manage Sakhalin II, consists of Royal Dutch/Shell Group unit Shell Sakhalin Holdings BV (55%), Mitsui & Co. Ltd. subsidiary Mitsui Sakhalin Holdings BV (25%), and Mitsubishi Corp. subsidiary Diamond Gas Sakhalin BV (20%).

According to Shell, project costs are a third lower than plants designed a decade earlier. Sakhalin Energy has signed heads of agreement for the first train for the delivery of up to 1.5 million tpy to Tokyo Electric Power Co., up to 1.1 million tpy to Tokyo Gas Co. Ltd., up to 0.7 million tpy to Kyushu Electric Co., and 300,000 tpy to Toho Gas Co. Ltd.

Tokyo Electric also has the right to take up to 0.7 million tpy in each of 2007 and 2008. However, firm sales and purchase agreements (SPAs) have yet to be signed. Marketing for the second train continues in Asia and North America.

Norway

Five of the seven licensees in the Snøhvit field in the Barents Sea—Statoil ASA (with a 22.3% share in the license), Norsk Hydro ASA (10%), RWE-DEA, Amerada Hess Corp., and Svenska Petroleum Exploration AB—have signed separate contracts for the sale of LNG originally to El Paso Global LNG Co., which will buy 2.4 bcm/year, and Iberdrola SA, 1.6 bcm/year.

In late 2002, Statoil agreed to buy both El Paso's 250-MMcfd capacity at Cove Point, Md., and the purchasing rights to the Snøhvit LNG.

The remaining two licensees, Gaz de France (12%) and Total (22.3%), will lift their own gas, some 1.7 bcm/year. The Norwegian state also has a 30% interest in the project.

Construction has begun on the first 4.2-million-tpy train, with deliveries set to begin in 2006.

In October 2002, Statoil acquired El Paso's one-third share of capacity in Dominion Resources Inc.'s Cove Point, Md., terminal, equivalent to 2.58 bcf/year. Pending deliveries of Snøhvit gas, Statoil will buy LNG from Trinidad and Algeria for 3 years. In early 2004, Dominion agreed to sell Statoil the entire capacity of a planned expansion that would double the terminal's vaporization and storage capacity.

LNG markets;

receiving terminals

As of May 2004, 47 receiving terminals operated in 13 countries. Since the beginning of 2003, new terminals have opened in Sines, Portugal; Bilbao, Spain; Nagasaki, Japan; and Dahej, India.

The Cove Point, Md., terminal reopened as an import facility in the summer of 2003.

What follows is an update of selected, important world markets.

Iberian Peninsula

Spain's gas consumption continues to rise at a rapid pace, soaring 13.3% to 23.7 bcm in 2003.

A fourth terminal with a capacity of 2.7 bcm opened at Bilbao in the northern Basque region.

It is owned by Repsol-YPF, BP, Iberdrola, and the Basque government's holding company Ente Vasco de Energia. Plans are already under way to double its capacity.

Enagas SA's existing three terminals at Barcelona, Cartagena, and Huelva regasified 11.45 bcm in 2003. Two more terminals are being built at Sagunto and El Ferrol.

Portugal's first terminal at Sines began operating in mid-2003 and has already announced plans to double its capacity.

Spain's main long-term suppliers are Algeria, Nigeria, Trinidad and Tobago, and Qatar. So effective has Spain been in lining up supplies that Spanish terminals have received capacity reservations larger than their existing capacities and Spain's energy regulator recently warned that supply could exceed demand by 35% by 2006.

France, Italy

Gaz de France plans to build a new terminal at Fos-Cavaou, next to its existing terminal at Fos-sur-Mer, that would start receiving LNG from Egypt in 2007. It will have a sendout capacity of 8.25 bcm/year and accommodate 160,000-cu m tankers, a reflection of the trend toward larger tankers that is driving LNG newbuildings.

The main source of supply will be a liquefaction plant being built at Idku in Egypt.

As many as 10 terminals have been announced for Italy, although probably only a couple will ultimately be built.

BG has received most of the necessary authorizations for an offshore terminal at Brindisi on the southeast coast of Italy to receive an initial 3 million tpy of LNG from Egypt starting around 2006. Italian electricity agency ENEL holds a letter of intent to take up to a 50% interest in this terminal. ExxonMobil and QP are proposing a terminal in the North Adriatic off the province of Rovigo that would receive Qatari LNG.

Japan

In 2003 Japan's LNG imports soared nearly 10% to 59.1 million tpy, 43% of the world's total trading volumes, and are expected to surpass 60 million tpy in 2004. This growth reflects the continued need for gas-fired power to offset Tokyo Electric Power Co.'s nuclear plant shutdowns due to a maintenance-data cover-up scandal, which led Tokyo Electric Power to increase its LNG purchases by around 4 million tpy to 20 million tpy in 2003.

Last year 9 of the world's 12 exporters sold LNG to Japan, including Trinidad and Tobago, as companies diversified their supply sources and increased their spot-market purchases. The new terminal at Nagasaki brought the number of Japanese terminals to 24.

South Korea

In 2003 Korean LNG demand rose a strong 9%, in part due to unscheduled maintenance at the country's nuclear plants.

Three LNG plants are operating and a fourth is being built on the south coast. Korea Energy Economics Institute projects that LNG demand will grow 6.9% to 20 million tpy in 2004 and grow an average 7.4% to reach nearly 2 million tpy by 2007 driven by power-generation demand.

The share of LNG in total energy consumption will rise to 13.3% in 2008 from 11.3% in 2003, largely at the expense of oil products.3

India

In March, India's first 5-million-tpy terminal opened at Dahej on the west coast. The owners are Petronet LNG, a consortium of Indian state-owned companies, Gaz de France, and the Asian Development Bank.

Petronet has decided to double the terminal's capacity to 10 million tpy and is considering another terminal at Kochi once sales contracts are lined up.

Another terminal at Hazira developed by Shell is set to open with an initial capacity of 2.5 million tpy at the end of 2004. It will be the first merchant terminal in Asia. Total recently acquired a 26% interest in this facility.

BG has reportedly put on hold plans to build a terminal at Pipavav.

Both India and China have reportedly negotiated very favorable terms in their contracts, with base FOB prices in the $2.20-2.50/million-btu range (about 40% lower than those in contracts with traditional buyers Japan and Korea) and much more favorable oil-escalation linkages.

China

China National Offshore Oil Corp. (CNOOC) has forecast that Chinese gas demand will reach 160-210 bcm by 2010, of which 39% would be LNG.

China's first terminal at Guangdong, Shenzhen, is to open in 2006 with a capacity of 3 million tpy. The project also involves construction of two new gas-fired power stations, the conversion of three oil-fired stations, and construction of 215 km of trunk lines.

The LNG will be supplied from Australia's Northwest Shelf project. Phase II will add 2 million tpy of terminal capacity and extend the trunkline to other cities by 2008.

A second terminal at Fujian will be supplied from Indonesia's Tangguh project. State-owned companies are considering at least eight other terminals. The government is expected to introduce new policies to accelerate the approval process for new terminals.

China has also signed a framework agreement to import Iranian LNG starting in 2008.

US

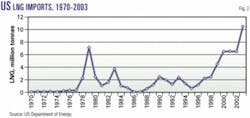

According to the US Department of Energy's Office of Fossil Energy, US LNG imports more than doubled to a record 11 million tpy (526 billion cu ft) in 2003, 12.6% of all US natural gas imports (vs. 5.6% in 2002) and about 2% of natural gas supply.5

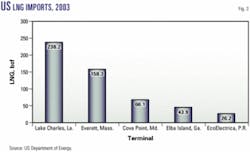

With the reopening of the Cove Point terminal for imports in August 2003, all four mainland terminals were receiving cargoes for the first time since 1979 (Fig. 2). As Fig. 3 shows, nearly half of all imports went into Lake Charles. This upward trend will continue: LNG imports doubled to 150 bcf in first-quarter 2004 from 75 bcf in first-quarter 2003.

In 2003, seven companies imported LNG into the US:

BG LNG Services Inc. imported 269 bcf into the Lake Charles and Elba Island terminals.

Distrigas Corp. imported 158.3 bcf into the terminal at Everett, Mass.

The remaining 79.2 bcf were imported by BP Energy Co., El Paso Merchant Energy-Gas LP, Shell North America LNG LLC; Statoil Natural Gas; and Total Gas & Power North America.

LNG was imported from six countries, with Trinidad and Tobago accounting for more than 75% of the total (Fig. 4). Historically, the US has imported LNG from every exporting country except Libya and itself (Alaska).

Spot and short-term sales accounted for 87% of all imports, compared with only 16% in 1997. The average landed price for imports was $4.50/MMbtu, up 40% over 2002. The actual range was from $3.38 to $7.70/MMbtu.

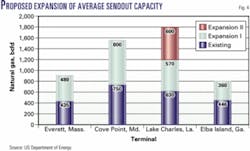

The four mainland terminals have an estimated average sendout capacity of 18.5 million tpy (2.2 bcfd) and a peak sendout capacity of around 26 million tpy (3.2 bcfd). All four terminals plan to expand their capacities (Fig. 4). By 2008, they will have combined capacities of 5.0 bcfd (38 million tpy).

Five planned terminals have received the necessary approvals from government regulatory bodies: two offshore terminals in the Gulf of Mexico (Port Pelican and the Excelerate Energy Bridge), one onshore terminal (Sempra's Cameron LNG terminal in Louisiana), and two pipelines to Florida from planned terminals in the Bahamas. They have a combined sendout capacity of 5 bcfd or nearly 40 million tpy.

Six more projects have filed formal applications with the US Federal Energy Regulatory Commission or with the US Coast Guard, and five more are holding prefiling discussions.

At least 30 terminals have been announced or planned, including 4 in California, 9 in the Gulf of Mexico, 7 along the US East Coast, 3 in Canada, and 4 in Mexico.

Outlook for US LNG

In its September 2003 report on US natural gas, the National Petroleum Council forecast that traditional North American producing areas will provide just 75% of long-term US gas needs.6 Meeting projected demand will require construction of arctic pipelines, increased energy efficiency, success in Lower 48 permitting, and substantial LNG imports.

Depending on various factors, LNG imports in 2025 could range from 6.5 bcfd (8% of total supply) to 15 bcf (17% of supply; Fig. 5).

What factors will determine the fate of LNG in the US?

Despite the LNG industry's exemplary safety record, public opposition to new terminals has been intensive and well organized and led to the demise of several terminals. To obviate siting problems, companies have been turning to offshore systems and terminals outside the US, as the previous list indicates.

[Editor's note: As imports come from more sources, the composition of the LNG could become an important consideration. The second article in this special report discusses the general issue of natural gas quality, with specific reference to increased imports of LNG into the US.]

Considerably more pipeline capacity will be needed to move gas from terminals on both coasts and the Gulf of Mexico.

This could entail additional regulatory delay, especially if it generates local opposition, and would add to the cost of LNG supplies. Port congestion is another issue of growing concern, especially in the Gulf Coast.

US prices must remain high enough to support LNG imports in the face of competition from other markets in Europe and Asia, especially since the continuing decline in the cost of LNG production seems to have bottomed out.

Costs of liquefaction plants and ships are rising in the face of shortages of key materials and labor, in part caused by the construction boom in China, and the pool of contractors and shipyards that have experience in LNG projects is relatively small. With more than 60 new ships on the orderbooks, , the price of 135,000-cu m LNG tankers has risen from $135-140 million a year ago to $165 million today. The declining US dollar is also driving up costs. F

References

1. Cedigaz, The 2003 Natural Gas Year in Review, first estimates, Apr. 8, 2004.

2. Groupe international des importateurs du gaz naturel liquefie (G.I.I.G.N.L.), The LNG Industry 2003.

3. Mid-Term Energy Outlook; http: //www.keei.re.kr/keei/main_eng.html.

4. Petrostrategies, Vol. 19, No. 871, May 10, 2004, pp. 1-2.

5. 2003: Year in Review; US Department of Energy, Office of Fossil Energy, Office of Natural Gas Import and Export Activities, March 2004. http://www.fe. doe.gov/programs/gasregulation/ analyses/focus/4th03foc.pdf.

6. Balancing Natural Gas Policy: Fueling the Demands of a Growing Economy, National Petroleum Council, September 2003.

The author

Colleen Taylor Sen is senior advisor, LNG, for the Gas Technology Institute, Des Plaines, Ill., having served previously as associate director for LNG research for GTI. She is also editor of the World LNG Source Book and organizes courses and seminars on all aspects of the LNG industry. Sen holds a BA and MA from the University of Toronto and a PhD from Columbia University.