CMAI: On-purpose propylene production will increase share of future global demand

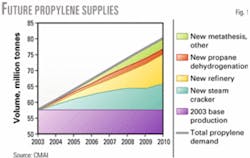

Worldwide supply of propylene will increase to 80.3 million tonnes in 2010 from 57.6 million tonnes in 2003 (about 5%/year), according to Steve Zinger, global business director of heavy olefins and elastomers for Chemical Market Associates Inc. (CMAI).

In a presentation at CMAI's 2004 World Petrochemical Conference, Mar. 23-25, 2004, Houston, Zinger said that increased propylene supplies would come from a greater emphasis on "on-purpose" propylene production via propane dehydrogenation, metathesis, and other technologies such as deep catalytic cracking, higher olefin cracking, and methanol-to-olefins.

The traditional classification of propylene as a "by-product" is beginning to evolve into more of classification as a "coproduct" or even a "primary product."

Massive ethane-based ethylene investments in the Middle East, unabated rapid demand growth in Asia, and propylene demand growing faster than ethylene and gasoline demand will all cause the supply dynamics of the propylene market to change, according to Zinger.

Supply, demand

In 2003, the world propylene market of 57.6 million tonnes came from steam crackers as a by-product of ethylene (67%), refinery FCC units as a by-product of gasoline and distillate production (30%), and "on-purpose" production units such as propane dehydrogenation and metathesis (3%).

According to Zinger, the world propylene market supply in 2010 will shift to 59% from steam crackers, 33% from FCC units, 3% from propane dehydrogenation, and 5% from other on-purpose technologies (Fig. 1).

New supplies to meet this additional propylene demand of 22.7 million tonnes will consist of 35% from steam crackers, 40% from refinery FCC units, 10% from propane dehydrogenation, and 15% from other sources.

During first-quarter 2003 and first-quarter 2004, the global propylene markets were extremely short. Most propylene consumers scrambled to secure adequate suppliers. Such an extreme shortage situation has not occurred since 1994-97, but Zinger feels that this situation appears to be occurring annually.

In the long term, propylene availability does not appear to be expanding as quickly as demand, particularly from the traditional by-product sources. In addition, petrochemical companies in Asia are receiving more imports of competitive ethylene derivatives from the Middle East with little or no associated propylene derivatives, resulting in a significant impending shortage of propylene in Asia. According to Zinger, many propylene consumers are considering on-purpose propylene production technologies, but in most cases these processes are untested or relatively expensive.

Demand for propylene is dominated by the polypropylene industry (64% of supply). Global polypropylene demand growth has historically increased at 5.0-6.0%/year, and this trend will continue.

There are five other significant, yet smaller propylene derivatives: acrylic acid, acrylonitrile (10% of supply), cumene (4%), oxo-alcohols (8%), and propylene oxide (7%).

According to Zinger, strong demand growth rates for polypropylene—and the slightly slower yet still strong demand growth rates for propylene's other primary petrochemical derivatives—will lead to a global demand growth rate of about 5%/year for polymer and chemical-grade propylene.

Trade

Some propylene and propylene derivative consumers will import product to satisfy incremental demand in areas of tight supply, according to Zinger.

Historical trade patterns for propylene and propylene derivatives have been from regions long on propylene (North America and West Europe) to regions short on propylene such as Asia.

International trade of propylene monomer is expensive because propylene usually ships as a high-pressure gas or refrigerated liquid. Propylene trade, therefore, generally only covers temporary shortages of propylene due to operational outages, supply disruptions, etc., rather than for longer-term structural shortages of propylene, according to Zinger.

The international trade of propylene contained in propylene derivatives mostly occurs as polypropylene or acrylonitrile—about 3-4 times as much propylene is typically shipped internationally in the form of derivatives compared to propylene monomer.

There will be two primary changes in the global trading patterns of propylene and propylene derivatives through 2010 (Fig. 2):

1. West Europe will change from a net exporter to a slight net importer.

2. The Middle East will become a major net exporter of propylene and propylene derivatives mainly due to the start-up of several export-oriented propylene-polypropylene facilities based on propane dehydrogenation and propane steam cracking.

Propylene production

Propylene supplies from steam crackers have not and will not keep pace with growth in propylene demand for petrochemicals because world propylene demand has consistently outpaced ethylene demand over the past 10 years.

CMAI feels this trend will continue for the next 10 years.

Also, new ethylene capacity added in the Middle East is mostly based on ethane feedstocks, with almost insignificant propylene yields.

Petrochemical producers outside of the Middle East are positioning themselves to make their steam crackers more competitive by trying to maximize increasingly valuable propylene production, according to Zinger.

These steam cracker operators are investing in infrastructure to take advantage of integration and other synergies with oil refineries.

In particular, they are investigating feedstock flexibility projects (to crack more butanes, naphthas, condensates, and gas oils) as a way to increase propylene yields.

Most planned steam cracker investments associated with large propylene volumes are in areas such as China, Taiwan, US, Poland, and Mexico (Table 1).

Most of the potential opportunities for propylene recovery from refineries are from existing FCC units because only a few major grassroots FCC units are planned (Table 1). These sources are grouped into two categories, according to Zinger.

The first source of additional propylene is to recover propylene currently consumed for refinery fuels production, which CMAI estimates is about 14.4 million tonnes/year. Second is additional propylene production from using high-olefin-yield catalyst additives.

New investments in propane dehydrogenation will only be justified in areas that can access cheap or stranded supplies of propylene, according to Zinger. Four new propane dehydrogenation units are planned (Table 1) based on low-cost supplies of propane feedstock.

During the next 10 years, however, only countries in the Middle East appear to have enough local propane supplies that could be priced below values in developed markets that would result in more propane dehydrogenation units.

Metathesis is normally an auxiliary unit to a steam cracker or FCC unit for easy access to ethylene and butylene feedstocks. Metathesis is best economically justified when propylene prices are high relative to ethylene prices.

According to Zinger, the rise of propylene-ethylene price ratios will be particularly pronounced in Asia; therefore, Asian propylene producers and consumers have taken a keen interest in the metathesis technology.

There are two other basic technologies that have generated recent interest to help relieve anticipated propylene shortfalls: higher olefin cracking and methanol-to-olefins.

Higher olefin cracking technologies are most economically viable when there is an inexpensive source of olefinic feedstock, particularly in areas that have excess C4 olefins from steam crackers or in areas where FCC olefinic naphtha has a low value. The economic viability of methanol-to-olefins depends on the cost and availability of methanol feedstocks, according to Zinger.