OGJ Newsletter

Market Movement

OPEC hikes production quota

At a special June 3 meeting in Beirut, members of the Organization of Petroleum Exporting Countries hammered out a compromise agreement to immediately raise their total crude production quota by 2 million b/d, with another hike of 500,000 b/d starting in August. The group also agreed to meet again July 21 to review the policy.

The first quota hike apparently will put no new crude supplies into the market; OPEC exceeded its existing quota by 2.3 million b/d in May.

Mixed reactions

Some analysts promptly dismissed the quota change as disappointing. Nauman Barakat of Refco Group Ltd. LLC, New York, told Reuters news service, "Forget the promise of another 500,000 [b/d], this is just plain 2 million [b/d]. The market was convinced it would get 2.5 million [b/d], so this could wave a red rag to the bulls."

However, analysts at Deutsche Bank AG, London, said, "Actual OPEC production could rise by over 1.5 million b/d from May levels for at least part of the third quarter, thereby refilling inventories by taking OPEC output some 800,000 b/d above our (admittedly low) estimate of the third quarter call on OPEC."

They said, "Saudi Arabia, in sync with Oil Minister [Ali al-Naimi's] comments last month, has already raised output from 8.2 million b/d in May to 9 million b/d currently and could probably do another 500,000 b/d, if markets warrant. A further 500,000 b/d of short-term response could come from the UAE (200,000 b/d), Kuwait (100,000 b/d), Qatar (100,000 b/d), and Iran (100,000 b/d) through inventive attention to storage and loading schedules."

Nevertheless, Deutsche Bank analysts noted, "Tense geopolitics and persistent US gasoline [supply] tightness that OPEC can't reverse in the near-term could stall the correction. The next steps could prove tricky, not least because terrorists seem to be successfully disrupting heavily guarded compounds in the Kingdom."

Schizoid markets

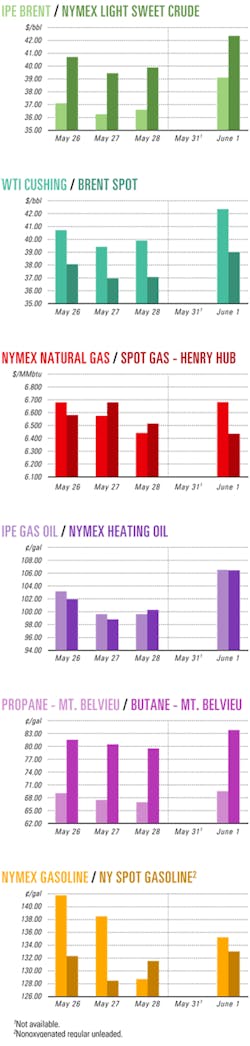

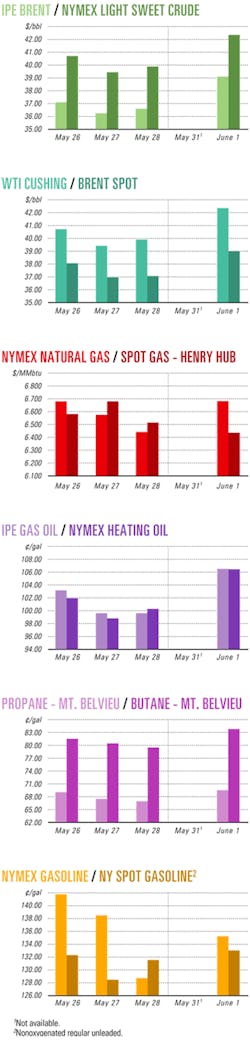

International energy futures markets appeared schizophrenic for several days prior to OPEC's most recent meeting, torn between the psychological comfort of a near-certainty that the organization would raise its quota—if not actual production—and growing fears that terrorist attacks might disrupt Middle East oil supplies.

Previously declining energy future prices rebounded May 24 on the New York Mercantile Exchange after Shell Oil Co. reported an "inadvertent shutdown" of the safety valves on the 250,000 b/d capacity, 18-in. Mars oil pipeline in the Gulf of Mexico (see Quick Takes, p. 8). Consequently, the platform was shut in. It had been producing 150,000 b/d of crude oil and 170 MMcfd of natural gas, the company said.

Gasoline for June delivery hit a record high of $1.4578/gal on that date because of tight supplies on the cusp of the May 31 official start of the peak US summer driving season.

However, energy futures prices then fell in profit taking May 25-27, as Al-Naimi pushed OPEC to hike its quota by 2.5 million b/d.

Meanwhile, energy futures prices rebounded once again in the shortened May 28 NYMEX session, with traders afraid to hold uncovered sales positions ahead of the long Memorial Day holiday in the US.

When trading resumed June 1, crude futures prices leaped to a new 21-year high of $42.33/bbl on NYMEX, wiping out the previous week's losses as traders reacted to the May 30 terrorist attacks on oil firms and westerners in Saudi Arabia.

Fear of possible disruption of Middle Eastern oil supplies through additional terrorist attacks overrode continued signals that OPEC members were prepared to increase their production quota at the upcoming meeting in Beirut.

"Well-funded energy funds went on a buying spree as if there was no tomorrow," one source reported. "The turmoil in the energy market influenced every aspect of the financial markets." The US dollar—the currency in which crude oil is priced on world markets—weakened against most of its traded counterparts, except against the yen.

In London, the July contract for North Sea Brent crude shot up by $2.50 to $39.08/bbl June 1 on the International Petroleum Exchange—one of the largest single-day increases ever recorded in that market. Brokers reported that market was in "a bullish frenzy" and speculated that Brent crude futures soon would hit $40/bbl and could rally through $41/bbl, the 1990-91 Persian Gulf crisis high, regardless of whether or not OPEC increases its production quota.

However, by June 2, the market's outlook had flip-flopped again as energy futures prices plummeted, wiping out most of the gains from the previous session. Analysts said the market had already factored into those lowered prices the expectation of up to 2.5 million b/d increase in OPEC production.

Industry Scoreboard

null

null

null

null

Industry Trends

AN ESTIMATED 120 floating production systems (FPSs), costing a total of $32 billion, are expected to be installed worldwide during the next 5 years, UK analyst Douglas-Westwood Ltd. said in a recent report.

According to the fourth edition of the study, World Floating Production Report 2004-08, capital expenditures for FPSs are on track to exceed $8 billion/year.

Most of this amount, some 68%, will be spent on an estimated 84 floating production, storage, and offloading vessels, said the report's chief author, Steve Robertson.

"The overall picture is one of strong market growth from 2004 onwards, with annual global expenditure in the FPS sector rising from an estimated $4.8 billion in 2004 to reach $7.8 billion in 2008," Robertson said. "An expenditure peak is expected in 2007, when the annual spend is expected to reach $8.3 billion."

He expects West Africa to lead expenditures during the next 5 years at $10 billion, including floating units of all types. Brazil also will see "a strong surge in investment," the study noted. North America will see "good growth," with a forecast outlays of more than $7 billion.

"The other main characteristic of the market will be the continuing shift to deepwater," said Robertson. "We forecast that 70% of the global spend will be on floaters moored in water depths of 500 m or greater."

The Gulf of Mexico and Brazil dominated the deepwater market during the last 5 years, accounting for more than 75% of the total spend, Robertson said.

"The market distribution for the 2004-08 period is markedly different, the main change being the high growth in the value of deepwater activity off the west coast of Africa," Douglas-Westwood reported.

The analyst forecast capital expenditures of about $8.5 billion associated with deepwater FPS installations in Africa, "making the region the world's leading deepwater FPS theater."

The other regions also will experience increases in deepwater FPS activity, the analyst said, with North America's spend rising to $7 billion and Latin America's to $4.9 billion.

US NATURAL GAS PRODUCTION continues to drop despite a 20% increase in US drilling activity since April 2003, the St. Petersburg, Fla.-based Raymond James & Associates Inc. said in survey results released last month.

The survey covered companies responsible for 60% of US gas production. It indicated that first-quarter production by publicly traded exploration and production companies this year dropped 4.2% from first-quarter 2003 and 0.5% from fourth-quarter 2003.

The year-over-year change represented a 9.2% plunge in production by the majors and integrated gas firms, which provide the largest proportion of US supply. Independents increased their number of working rigs by 34%.

Meanwhile, independents' production grew 0.8% year-over-year and decreased in the first quarter by 0.1% from the fourth quarter 2003.

Although independents are driving the drilling boom, RJA analysts do not foresee them turning around production figures during the next several quarters.

Government Developments

OIL TECHNOCRAT Thamir Ghadhban is Iraq's new oil minister under a new interim government announced June 1. An Iraqi exile with 20 years of experience with the state-owned Oil Marketing Association, Ghadhban ran the oil ministry immediately after US-led forces drove out Saddam Hussein in April 2003. Ghadhban served in that position for about 7 months and later continued on as an advisor when the US-led Coalition Provisional Authority named Ibrahim Bahr al-Ulum, a member of the country's Shiite Muslim majority, to the top post in November 2003.

Ghadhban is well-respected in the international oil community and is expected to leverage that goodwill to build relationships with potential foreign investors who are staying away for the short term because of security concerns and profound political uncertainties.

On June 1, US President George W. Bush indicated that Iraq oil production is now about 2.5 million b/d. But exports are not quite what US officials anticipated last year; Iraqi officials estimate that level to be about 1.8 million b/d.

Oil ministry officials expect production to increase to 3 million b/d by yearend, but it is unclear when or how levels will climb back up to the 3.7 million b/d peak capacity reached in 1979.

CPA is slated to cede power to the new government June 30, and a democratically elected government is to be phased in during 2006, according to the latest Pentagon scenario. But until that time, it is unclear who will control and monitor oil revenues. Interim Iraqi officials, along with international watchdog groups, want the US to give the Iraqi provisional government full authority over oil revenues and reconstruction, effective June 30. The United Nations also wants to continue monitoring how petroleum revenues will be spent while an interim government is in place.

THE CANADIAN GOVERNMENT, seeking to cut greenhouse gas (GHG) emissions and reduce fuel costs, is sponsoring a $1.4-million (Can.) pilot program in Ontario, Alberta, and British Columbia to encourage the use of on-road vehicles fueled by compressed natural gas (CNG).

Natural Resources Canada (NRC) is funding the pilot project, which the Canadian Natural Gas Vehicles Alliance (CNGVA) will implement, offering fleet managers $3,000 toward the purchase of each CNG vehicle.

The project is the first initiative funded under the $9.9 million Natural Gas for Vehicles measure announced in Canada's 2003 federal budget. The initiative will enable NRC to explore the opportunities and obstacles inherent in CNG vehicle use in the commercial fleet sector, particularly in urban areas. It also will provide data for developing a successful long-term program.

"This incentive program will build on the success of programs like the Toronto Better Transportation Partnership that have realized significant reductions in fleet emissions," said John Finch, president and CEO of CNGVA.

In addition, the pilot project will investigate issues such as a made-in-Canada emissions verification system and the regulation of modified CNG vehicles, which NRC said produce 21% fewer GHG emissions than those fueled by conventional gasoline.

Quick Takes

A SMALL OIL LEAK on May 22 shut down the 250,000 b/d capacity Shell Oil Co.-operated Mars oil pipeline in the Gulf of Mexico, subsequently also shutting down units on the Mars tension-leg platform on Mississippi Canyon Block 807. About 3.3 gal of oil was released during the incident, Shell said, causing a sheen and automatic-valve shutdowns. The pipeline from the Mars TLP remains shut-in until repairs can be made, which industry sources speculate could take 10-60 days. Mars design production capacity is 220,000 b/d of oil and 220 MMcfd of natural gas. Shell Deepwater Production Inc., operator of Mars, holds 71.5% interest in the project, while BP Exploration Inc. holds 28.5%. The 40 mile, 18-in. pipeline is part of a complex pipeline system delivering oil to Louisiana Offshore Oil Port storage facilities at Clovelly, La. Shell Deepwater and BP claimed several records with the July 8, 1996, start-up of the $1.2 billion Mars development project (OGJ, Aug. 26, 1996, p. 21). It is not known what effect, if any, the shut-down will have on the controversial Strategic Petroleum Reserve fill currently under way.

Petróleo Brasileiro SA (Petrobras) halted oil and natural gas production May 27 from the Brasil floating production, storage, and offloading vessel operating in the Módulo 1A area of Roncador field off Brazil because of a reported abnormality in the flare stack. Petrobras said the anomaly posed a risk to the structure and to the safety of the crew. At presstime, Petrobras was determining what repairs were needed, and it was not known when production would resume. FPSO Brasil facilitates production of 95,000 b/d of oil and 1.6 million cu m/day of gas. Gas exports from the FPSO were suspended May 22 to link a new stretch of gas pipeline to the main network in the northern Campos basin. FPSO Brasil is owned by Single Buoy Moorings Inc., Marly, Switzerland.

Shell Exploration & Production Co. and partners Amerada Hess Corp. and ExxonMobil Corp. have brought oil and natural gas on producion from Llano field on Garden Banks Blocks 385 and 386 in the deepwater Gulf of Mexico. Llano field, about 200 miles southwest of New Orleans in about 2,600 ft of water, is producing 10,500 b/d of oil and 26 MMcfd of gas from a single well through a subsea system tied back, via a pipe-in-pipe looped flow line, 11.5 miles to Shell's Auger TLP. A second well is expected to be producing later this month, operator Shell said.

SAUDI BASIC INDUSTRIES CORP. (Sabic), Riyadh, has awarded a lump sum, turnkey contract to Linde AG of Germany for the engineering, procurement, and construction of a 150,000 tonne/year linear alpha olefins plant at the site of subsidiary United Petrochemical Co.'s plant at Jubail Industrial City. The olefins plant, the first of its kind to use the a-Sablin technology that Sabic and Linde jointly developed, will use ethylene as feedstock for a one-stage homogenous reaction that produces alpha olefin cuts C4-C20, which are then fed to conventional separation columns to obtain specified cuts and quality. The facility is scheduled for completion by third quarter 2006.

UNDER A COMPLEX DEAL, ExxonMobil and Apache Corp., Houston, have agreed to jointly explore for deep natural gas on more than 800,000 acres of Apache properties, both onshore and off Louisiana for an initial 5 years. And in Alberta, ExxonMobil Canada Energy agreed to transfer part of its interest in 300,000 acres of undeveloped property in mature areas to Apache Canada Ltd., which plans to drill and operate more than 250 wells during an initial 2-year period. ExxonMobil Canada will retain a 37.5% interest lessor royalty on fee lands and 35% of its working interest on ExxonMobil leaseholds as to any production resulting from the drilling. In addition, Apache will pay $385 million for interest in part of ExxonMobil's stake in mature, producing oil and gas fields in the US and Canada, including 28 oil and gas fields in West Texas and New Mexico that currently produce 10,000 boed. ExxonMobil will retain a revenue interest indexed to oil prices through 2009 and a 50% working interest in all currently producing properties.

A subsidiary of independent Newfield Exploration Co., Houston, signed two production-sharing contracts with Petronas Carigali Sdn. Bhd., the exploration and production subsidiary of Malaysia's state-owned Petronas, for two blocks off Malaysia: PM 318 and deepwater Block 2C. Petronas Carigali will operate PM 318, which covers about 400,000 acres off Peninsular Malaysia. Newfield holds a 50% interest in PM 318. Newfield will operate Block 2C, which covers more than 1.1 million acres off Sarawak and will hold a 60% interest in it. The partners will acquire and evaluate 3D seismic data during the next year and expect to begin drilling in 2005.

WOODSIDE ENERGY LTD., operator of Thylacine and Geographe gas discoveries in the Otway area off southwestern Victoria, said partners have approved a $1.1 billion (Aus.) development plan for the fields. The fields, 55-70 km south of Port Campbell, are expected to supply 950 bcf of gas, 12.2 million bbl of condensate, and 1.7 million tonnes of LPG. Production is slated for summer 2006. Construction on the $810 million (Aus.) Thylacine field facilities on Tasmanian permit T/30P will begin in October. They include a remotely operated platform, offshore and onshore pipelines, and a new gas plant near Port Campbell. Geographe field, on Victorian permit Vic/P43, will be connected later to the main offshore pipeline. Woodside holds a 51.55% interest in the blocks. The other joint venturers are Origin Energy Resources Ltd. 29.75%, Benaris International NV 12.7%, and CalEnergy Gas (Australia) Ltd. 6%. Oil Search Ltd., Port Moresby, formed a strategic alliance with Halliburton Co. and its KBR unit for services, including oil and gas prospect evaluation, development, and long-term field operations support in Papua New Guinea. The company is developing its Northwest Moran oil discovery, due on production by early 2005, and Southeast Mananda field, due to start producing through Agogo field facilities in mid-2005. It also is developing and appraising Gobe, Moran, and Kutubu fields. The 2004 exploration schedule calls for drilling Kapul 1 on APPL 240, Iehi 1A on PPL 190, and Arakubi 1 on PDL 2. To commercialize the 12 tcf of gas reserves, Oil Search will move a first-gas field development project to front end engineering and design during 2004 to support construction of a gas pipeline to Australia.

NV NEDERLANDSE GASUNIE, Groningen, the Netherlands, plans to construct 235 km of 36-in. natural gas pipeline across the North Sea from Balgzand in the Netherlands to Bacton in the northeastern UK. The company expects the 500 million euro pipeline, known as the BBL, to be completed at yearend 2006. The project also will require construction of a compressor station in the province of Noord-Holland, a short section of onshore pipeline, a 5 km crossing of the coastal sand dunes in the Netherlands, and landfall and receiving facilities in Bacton. Gasunie also will add tie-in facilities to the Dutch domestic network. Norsk Hydro ASA and partners awarded a $35 million contract to Stolt Offshore SA to lay two 125 km, 6-in. pipelines from the gas processing plant under development at Nyhamna on Norway's west coast to Ormen Lange field offshore. The field lies on Block 6305/5 more than 100 km northwest of Aukra, Norway, in 3,300 ft of water. Stolt Offshore also will lay a 3.6 km, 6-in. pipeline between two production manifolds in Ormen Lange. The natural gas-condensate field, which has reserves of 14 tcf of gas and 180 million bbl of condensate, is slated to begin producing 2.5 bcfd of gas in October 2007. The $9.5 billion project is the largest in Norway's history.

HUSKY OIL OPERATIONS LTD., a unit of Calgary-based Husky Energy Inc., has awarded a contract to engineering firm Peter Brotherhood Ltd. (PBL) of Peterborough, UK, to supply a reciprocating gas compressor for Husky's 10,250 b/d refinery at Prince George, BC. PBL will design, manufacture, install, and commission the $1 million (Can.) hydrogen compressor system as part of Husky's clean fuels program; the partially skid-mounted compressor will be used to remove sulfur from produced gasoline. Equipment is slated for delivery in November. Husky has selected Montreal-based SNC-Lavalin Inc. to conduct the project's procurement and installation work.

THE 2-YEAR OLD FIRM DKRW Energy LLC, Houston, (OGJ Online, May 26 2004) plans to build an LNG terminal at Puerto Libertad on the Gulf of California in the state of Sonora, Mexico. DKRW subsidiary Sonora Pacific LNG has signed a cooperation agreement with the government of Sonora tentatively authorizing the purchase of uninhabited industrial land. Construction of a 1.3 bcfd regasification and storage terminal is slated for mid-2005, with start-up expected in mid-2008. The proposed project includes distribution pipelines in Sonora, a proposed export pipeline through Nogales to interconnect with an El Paso Pipeline system east of Tucson, and possibly lines to serve the state of Sinaloa, said Tom White, Sonora Pacific LNG managing partner. Financing, gas supply contracts, and Mexican federal permits are not yet in hand, White said. The US Environmental Protection Agency May 20 issued air and water permits setting limits for air emissions and water discharges for ChevronTexaco Corp.'s 1.6 bscfd Port Pelican project, a deepwater LNG receiving, storage, and regasification facility in the Gulf of Mexico 37 miles off Louisiana. The terminal is slated to start up in 2007. ChevronTexaco officials say the project will use existing gas supply and gathering systems in the gulf and Southern Louisiana; product then will be delivered to shippers via interstate pipelines. Company officials expect Port Pelican to be the first deepwater LNG plant of its kind in the US, saying the facility is far enough offshore to somewhat ease local fears about safety. US government and industry analysts say more than 2 dozen proposed LNG projects are planned in or near US waters.

Ras Laffan Liquefied Natural Gas Co. Ltd. II (Rasgas) reported that the company's second dedicated LNG carrier, Maersk Ras Laffan, loaded its first cargo at Ras Laffan Port in Qatar in May. The vessel is the second of six LNG carriers serving RasGas. It is owned by Qatar Shipping Co. The vessel is a Gaztransport-Technigaz Mark III membrane type LNG tanker, with a cargo carrying capacity of 138,000 cu m.

KEYSPAN ENERGY CANADA and Ferus Gas Industries Trust, both of Calgary, have opened a $12.4 million (Can.), jointly owned carbon dioxide liquefaction facility adjacent to the KeySpan operated Rimbey gas plant in central Alberta. The new facility—the first of five gas liquefaction facilities Ferus is building in Alberta this year—cleans and liquefies as much as 285 tonnes/day of CO2 that Ferus will move via truck to nearby energy markets. The CO2 will be used primarily for miscible flooding in oil reservoir pilot projects during the initial reservoir study phase and as a well completion fluid for stimulating gas wells, Ferus said.

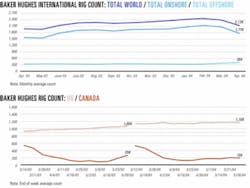

US DRILLING ACTIVITY dipped slightly the week ended May 28, with 1,169 rotary rigs working. That was down 3 from the previous week, which had continued pushing to new 21/2 year highs, but up from 1,059 a year ago, said Baker Hughes Inc. officials. Land operations registered the only gain—up by 3 units with 1,059 working that week. Offshore operations were down by 2 rigs to 91 in the Gulf of Mexico and 93 in US waters as a whole. Drilling activity in inland waters declined by 4 rigs to 17. Canada's rig count was down by 6 to 195 rotary rigs working that week, down from 258 during the same period last year. Sarawak Shell Bhd., a subsidiary of Royal Dutch/Shell Group, has reinstated a contract with Atwood Oceanics Inc., Houston, to use the Atwood Falcon semisubmersible for drilling wells off Malaysia. The contract calls for drilling two firm wells with options to drill an additional three. The drilling program is expected to start in August. If all three option wells are drilled, the program could extend into December, Atwood Oceanics said. Day rates vary with the water depths involved: $83,000 for water deeper than 2,500 ft, $68,300 for water 1,0000-2,500 ft, and $53,000 for water less than 1,000 ft.