Long-term contracts vital in EU free gas market

Long-term supply contracts will play a more important role in the new European Union free gas market than originally planned, contends London-based analyst Prospex Research Ltd. in a recently released report. It has long been held that such contracts would stifle competition in the EU's free gas market—scheduled for full opening to nonhousehold gas consumers by July of this year and for complete market opening by July 2007.

However, gas supply security has become a growing concern because of Europe's increasing reliance on imported gas. Half of Europe's consumption will be imported by 2020, Prospex said, and long-term contracts are now being viewed as "an essential part of the European gas market."

The original 1998 directive to end gas monopolies—many of which were state-owned—and to create a single open market assuring third-party access (TPA) throughout Europe within 10 years was superseded in 2003 by a directive that accelerated the timetable. It also defined more-specific requirements for independent market regulation, TPA, and the separation of infrastructure operations from gas trading dealings. Public service and environmental protection also were given importance almost equal to competition in the later directive.

Market openings

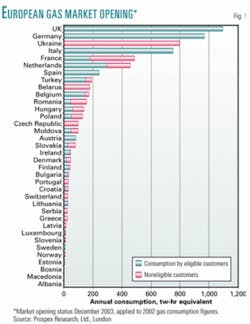

By yearend 2003, the gas markets of Austria, Italy, Spain, the UK, and the Flanders area of Belgium were already 100% open. "On paper the German market is also fully open," Prospex reported, "but the complexity of the German TPA arrangements and the dominant positions of large incumbent players have left this huge and crucially located gas market largely closed to new entrants."

Other national markets are partially open in line with the directive timetable, Prospex said, although the European Court of Justice had to force France to implement necessary legislative changes in 2003. "Overall the western European gas market is 85% open," the analyst reported (Fig. 1).

The original 15 EU countries consist of Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain, the UK, and Sweden. Another 10 countries became members May 1: Cyprus, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Slovakia, and Slovenia.

Market fundamentals

Gas demand in Europe has grown about 4%/year since 1990, driven by increased use of gas-fired power generation, especially in combined-cycle gas turbine plants, and by industrial energy consumers' switching from more-expensive and environmentally less-friendly fuels such as oil and coal.

In 2002, Europe's gas demand represented 24% of world gas consumption, Prospex said, and the region produced enough gas to meet 67% of its requirements. However, all European gas production, except that of Norway, has passed its peak and is in decline, the analyst added. "Overall, Europe has sufficient reserves for around 16 years of production at 2002 rates," the analysts contend, after which imports are expected to supply at least half of Europe's consumption.

More than half of the gas Europe now uses crosses at least one national border via interconnections with the 187,000 km of gas transmission pipelines that traverse the region, most operated on a national basis within each country. The system links to production in the North Sea and to delivery pipelines from Algeria and Russia, which provide most of the EU's gas imports. Underground storage facilities, used to meet seasonal demand fluctuations, have capacity to hold 14% of Europe's total annual consumption, the analyst said.

LNG volumes, which accounted for 10% of imports in 2002, are expected to double or quadruple when currently planned receiving terminals, regasification facilities, and pipelines are in place. Long-term supply contracts predominate, but some spot cargo trading occurs, "and independent traders are starting to obtain the necessary access to LNG terminals to allow opportunistic trading," said Prospex.

Players

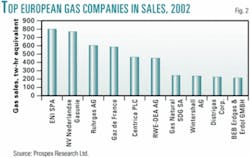

Although international oil majors dominate European gas production—with ExxonMobil Corp. and Royal Dutch/Shell Group playing the leading roles—national or regional gas supply companies continue to dominate the supply market, said Prospex (Fig. 2). These companies, many state-owned, are in various phases of privatizing their companies and unbundling vertically integrated monopolies, especially separating transportation and operations divisions from gas trading companies. But the process is far from complete.

In Austria, Belgium, France, Ireland, Luxembourg, the Netherlands, and Sweden, for example, as well as in many central and eastern European countries, former monopolies remain the leading players, controlling as much as 80-100% of the wholesale gas supply in their markets.

At the same time, many former monopolies are expanding, forging new partnerships, and acquiring assets in new markets in western and central Europe to retain a dominant market position. "Such moves do not help to create a level playing field for new entrants within the home market," Prospex noted.

Outlook

In addition to the forging a single pan-European gas market by yearend, several other important changes are anticipated for this year, Prospex reported. "The introduction of an independent regulator for the German gas market and a change in German TPA arrangements may help to reduce some significant barriers to trading within this important market," the report emphasized. "Throughout Europe, in fact, TPA arrangements are being improved and simplified, with moves towards entry-exit (rather than distance-related) pricing of transmission and improvements in the flexibility and transparency of capacity allocation."

At the same time, infrastructure operations unbundling will be completed, all of which should encourage cross-border trading and smooth the way for new market entrants.