OGJ Newsletter

Market Movement

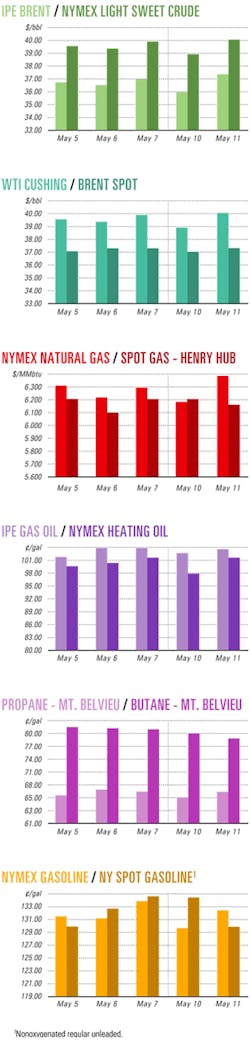

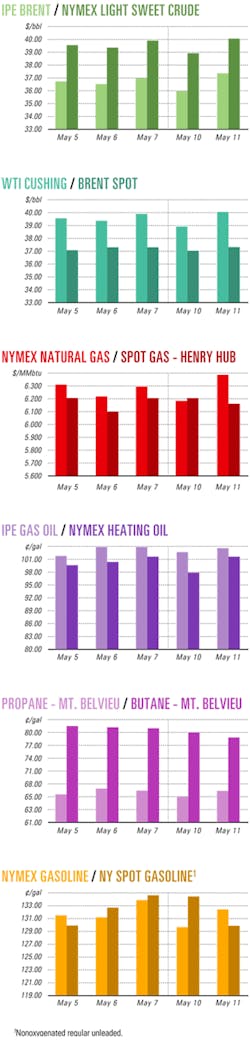

Energy futures prices hit record highs

Crude and gasoline futures prices hit record highs May 12 and were expected to continue trending upward, despite a push by members of the Organization of Petroleum Exporting Countries for an informal discussion of tight world oil markets at a meeting to be held May 22-24 in Amsterdam.

"The longer prices stay above $40[/bbl], the harder it will become to pull them back down," said Paul Horsnell, Barclays Capital Inc., London. Once traders realize "that there is nothing magical about $40[/bbl crude] that derails economic growth or results in any extra supply or inventory, then they will start getting comfortable with prices at this level," he said. "If prices are still above $40[/bbl] in a month, we would not be surprised to see them stay above that level for the rest of the year."

The June contract for benchmark US light, sweet crudes hit a record high closing price of $40.77/bbl May 12 on the New York Mercantile Exchange, surpassing the previous record of $40.42/bbl set Oct. 11, 1990, shortly before the United Nations issued an ultimatum for Iraq to pull its invading troops out of Kuwait. Prior to the May 12 closing, the near-month contract had sold as high as $40.92/bbl as traders shrugged off an earlier call by Ali I. Naimi, Saudi Arabia's energy minister, for a 1.5 million b/d hike in OPEC's oil production quota at the group's scheduled June 3 meeting in Beirut.

Energy prices were volatile as Naimi's proposal triggered a drop of $1 to $38.93/bbl in May 10 trading on NYMEX. If OPEC members were to follow through on Naimi's suggestion, it would mark the first official hike in the group's production since January 2003 and would eliminate its most recent production cut of 1 million b/d to 23.5 million b/d that went into effect Apr. 1.

However, energy futures prices rebounded May 11 as analysts and traders dismissed Naimi's proposal as essentially meaningless. According to various sources, OPEC is already producing 2-3 million b/d more than its current quota of 23.5 million b/d, with most members now running at full capacity.

Algerian Energy Minister Chakib Khelil noted that an increase in OPEC production probably would have no major effect on oil prices, which he said are likely to remain high for the rest of this year, with demand for oil increasing this summer and autumn in both the US and Europe.

Nonetheless, Purnomo Yusgiantoro, Indonesia's energy minister and OPEC conference president, said the group may meet to discuss the international oil market prior to the scheduled June 3 session.

Claude Mandil, International Energy Agency executive director, called for OPEC to take action to curb soaring prices. Most OPEC officials, however, attribute current high energy prices to a variety of factors outside of the group's control, including geopolitical tensions, speculation in the futures markets, stringent US requirements for reformulated gasoline, and US specifications on imported gasoline.

Gasoline prices

Meanwhile, the June gasoline contract jumped by 3.9% to a record high NYMEX closing of $1.3735/gal on May 12, after hitting as high as $1.375/gal, another record, during trading that day.

The near-month gasoline contract had registered consecutively record-high closing prices in 9 of the previous 13 NYMEX sessions, starting Apr. 22, as traders worried that US gasoline stocks remained at critically low levels prior to the traditional start of summer demand on Memorial Day, May 31.

The May 12 jump in gasoline futures prices followed a government announcement that US gasoline stocks fell by 1.5 million bbl to 202.5 million bbl during the week ended May 7, despite a 1.1 million bbl increase in commercial US crude inventories to 300 million bbl during the same period.

US imports of crude increased by 135,000 b/d to an average 9.9 million b/d during that same period, while crude input into US refineries increased by 465,000 b/d to an average 16 million b/d. That decline in US gasoline inventories was "to some extent a payback for the overly large rise" recorded during the week ended Apr. 30, Horsnell said. Examination of changes in US gasoline stocks over that 2-week period shows an overall increase 2.5 million bbl during that time. "It is heading in the right direction but is still too low a rate of increase compared [with] seasonal norms," said Horsnell.

The June natural gas contract also hit a new high May 12, inching up by 1.9¢ to $6.40/Mcf that day, following a 20.2¢ jump to $6.39/Mcf on May 11, which marked the highest price for a front-month contract since late January, analysts said.

Industry Scoreboard

null

null

null

Industry Trends

CHINA's OIL DEMAND is helping support robust oil prices, and India's oil demand is expected to steadily increase.

Many forecasters underestimate Chinese demand on a 2004 full-year basis, suggests St. Petersburg, Fla.-based Raymond James & Associates Inc.

The International Energy Agency recently increased its 2004 Chinese demand forecast to 600,000 b/d of oil demand growth for a total Chinese oil demand of 6.05 million b/d, or 10.5% higher than last year.

RJA analyst Marshall Adkins of Houston said, "What we find amazing about this new forecast is that it is still well below the recent February data that suggests Chinese demand is actually growing at a year-over-year rate closer to 1 million b/d (an annual growth rate of over 18%).

"Even if China's economic expansion moderates, we think its oil demand will grow by more than 700,000 b/d this year, implying a very strong 14% annual growth rate," Adkins said.

"Energy investors should note that India is beginning to exhibit traits similar to China," he said.

Indian oil demand as a percentage of global oil demand has increased from 1.8% in 1990 to 2.8% in 2000. RJA anticipates that Indian oil demand could reach 3% of global demand in 2004.

"India's recent past shows one of the best economic track records of any country in the world. Due to a rapidly rising population, robust foreign investment, and expansionary fiscal policy, its intermediate-term growth prospects are excellent," Adkins said.

A large proportion of Indian private and public investors are targeting energy-intensive sectors such as construction, heavy manufacturing, and petrochemicals. Meanwhile, India's rising middle class will buy more automobiles, boosting gasoline de- mand.

"Consequently, even though India is starting from a smaller oil demand base than China, their longer-term growth rates could be very similar," Adkins said.

KAZAKHSTAN stands on the threshold of becoming an important destination for oil companies and service companies, Ernst & Young LLP tax analysts said last month at a UK-former Soviet Union seminar in Aberdeen.

Kashagan, one of the largest oil discoveries in the last 30 years, is projected to have ultimate production of as much as 13 billion bbl (OGJ Online, June 28, 2002).

Capital investment for Kashagan's full field development currently is estimated at $29-30 billion during 15 years, with the first phase—currently under way—expected to amount to $10 billion (OGJ Online, Feb. 24, 2004).

Meanwhile, total oil and gas investment nationwide could be worth $150 billion by 2015, said Gerard Anderson, Ernst & Young tax partner in Kazakhstan. Much of this capital is expected to come from Russian and Western investors. International capital and expertise became available to Kazakhstan after the Soviet Union collapse, he said.

The Kashagan discovery has broadened the opportunities for companies, including independents, to explore and develop the Caspian Sea region, Anderson said.

Traditional North Sea operators and suppliers are among the companies most apt to benefit, forecast Derek Leith, Ernst & Young UK director of oil and gas taxation.

Government Developments

NEW US SANCTIONS against Syria pose mostly a political impact on US companies wanting to invest in the country, according to industry and government officials.

US President George W. Bush signed an executive order May 11 that bans US exports other than food and medicine to the country, but his action does not preclude US-based energy companies from making or maintaining investments, including oil trading.

In December 2003, Bush signed the Syria Accountability and Lebanese Sovereignty Restoration Act of 2003—which like other existing sanctions laws on the books—gives the White House wide discretion on what actions, if any, the administration may take against the Middle Eastern nation.

The act requires the US.Secretary of State to submit an annual report to Congress, beginning in June, on Syria's progress toward meeting the conditions set forth in the legislation, any connections between Syrian-based terrorists and terrorist attacks on the US or its allies, and US efforts against Hizballah and other terrorist organizations allegedly supported by Syria.

Speaking on condition of anonymity, US officials suggested that even though US companies technically still will be allowed to conduct business, they could find it extremely problematic.

The White House's latest move also freezes some Syrian assets that the US suspects could be a conduit for terrorist activity. But more importantly for US companies, the new sanctions restrict US financial institutions from corresponding with Syria's state-owned bank.

According to the US Energy Information Administration, trade between the US and Syria is a modest $400 million/year, but there are US companies involved in developing Syria's oil and gas sectors.

Syria now markets all of its crude oil, including that produced by foreign companies, through state marketing company Sytrol.

US companies with upstream interests in Syria include Occidental Petroleum Corp., which has a 25% stake in a Petro-Canada-led proposal to develop natural gas, and independents Stratic Energy Corp., Calgary; Devon Energy Corp., Oklahoma City; and privately held Gulfsands Petroleum Ltd., Houston.

EIA said that oil exploration activity in Syria has been slow in recent years due to unattractive contract terms by state-owned oil company Syrian Petroleum Co. (SPC), and poor exploration results.

"For these reasons, only a few companies out of more than a dozen operating in the country in 1991 remain in Syria at present," EIA said.

The agency said that a recent bid round attempted to reverse this trend, but its success remains unclear.

EIA noted that Total SA publicly expressed its intention to scale-down its Syrian operations in May 2002, and ConocoPhillips announced in February that it was ending its operations in Syria.

Nevertheless the European Union, perhaps seeing a potential business opportunity because of the sanctions, announced it will send a high-level trade delegation to Damascus this month to encourage oil and gas exports to Europe. Syria is offering 14 onshore blocks to companies this year.

Quick Takes

TRINIDAD AND TOBAGO has selected contractors for nine offshore blocks in its latest bid round of production-sharing contracts (PSCs). The Ministry of Energy & Energy Industries will negotiate with Calgary-based Petro-Canada for Blocks 1(a) and 1(b); Canadian Superior Energy Inc., Calgary, for Block 5(c), and the joint venture of Kerr-McGee Oil & Gas Corp. and Primera Oil & Gas Ltd., Trinidad, for Block 3(b). Discussions also will be held with Houston-based EOG Resources Inc. and Primera for Block 4(a), Melbourne-based BHP Billiton Ltd. and Total SA for Blocks 23(a) and 23(b), and BHP Billiton and Talisman Energy Inc., Calgary, for Block 24. Discussions will be held with Norway's Norsk Hydro AS and Petro-Canada before ratifying a preferred bidder for Block 22. Block 2(ab), not awarded, will be rebid in the next round. Both Oklahoma City-based Kerr-McGee and Petro-Canada will be new players on the Trinidad and Tobago energy scene. BG Group PLC, which bid on two blocks, failed to win either—a blow to its plans for increasing its business in the twin island republic. BG is the second largest investor in ALNG Co. of Trinidad & Tobago's four trains, and it sells more than 700 MMcfd of natural gas to Atlantic LNG and National Gas Co. Ltd. from Dolphin and North Coast Marine Area fields. Houston-based Vanco Energy Co., operator of the Ras Tafelney exploration permit off Morocco, spudded that country's first deepwater exploration well May 4. The Saipem 10000 drillship is drilling the Shark B-1 well about 130 km off Morocco in 2,120 m of water. The main objective is the Top Cretaceous and Albian reservoirs, while a Lower Tertiary turbidite play at shallower depths is a secondary target. Planned TD is 4,162 m. Vanco formed the Vanco Group consortium earlier this year to explore and develop the acreage. Partners include Vanco Morocco Ltd. 33.75%, ENI Morocco BV 30%, Morocco's national oil company Office National de Recherches et d'Explorations Pétrolières 25%, and CNOOC Morocco Ltd. 11.25%.

Dominion subsidiary Dominion Exploration & Production Inc., Houston, reported a natural gas discovery in its San Jacinto prospect on Desoto Canyon Block 618, about 100 miles off Louisiana in the eastern Gulf of Mexico. The well, drilled to 15,829 ft TMD, encountered 100 net ft of natural gas pay in multiple reservoir sands. The well is being cased to TD and temporarily abandoned for future use. Dominion is operator and holds 53% interest, while Spinnaker Exploration Co. 27% and Kerr-McGee 20% are partners. Noble Energy Inc. subsidiary Noble Energy EG Ltd., Houston, has signed a PSC with the Republic of Equatorial Guinea covering Block O off Bioko Island. Block O, in more than 500 m of water, covers 1,772 sq km adjacent to Alba field, which contains estimated gross resources of 1 billion boe. Technical operator Noble Energy holds a 45% working interest, and the national oil company of Equatorial Guinea, GE Petrol, will be administrative operator with 30%. The third partner is Glencore Exploration Ltd., a unit of Glencore International AG of Switzerland, 25%. Noble will drill two exploration wells within the first 3 years, beginning in 2005. F

TAIWAN's cabinet-level Council of Mainland Affairs has given the go-ahead for Formosa Plastics Group to import 5,000 foreign workers that FPG says are necessary for the timely completion of the fourth-stage expansion project at its planned Mailiao petrochemical complex in Taiwian. In all, 15,000 workers will be needed to complete the $3.76 billion project, which has been delayed 2 months awaiting that approval. Importation of foreign workers also is expected to save FPG more than $302 million in construction costs. Completion of the expansion project—setting up 27 new upstream, midstream, and downstream petrochemical plants—will make FPG one of the world's five largest petrochemical producers, with annual revenues of more than $30 billion. Separately, FPG is set to launch pilot production at its new Ningbo petrochemical complex this month in Zhejiang province, China. An FPG spokesman said that a plant operated by Formosa Chemicals & Fiber Corp. would begin production of ABS in May, while a second facility, operated by Formosa Plastics Corp., will launch production of PVC in August. The plants' output will be sold in China. F

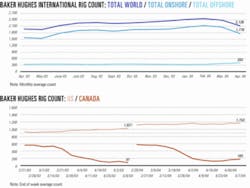

US DRILLING ACTIVITY continued to seesaw at a 31-month high level, down by 8 rotary rigs to 1,153 working the week ended May 7, compared with 1,021 during the same period a year ago, Baker Hughes Inc. reported. All of the week's loss was in US land operations, down by 8 units to 1,032 active. Activity in inland waters was unchanged at 23 rigs. Offshore activity also remained stable, with 98 rotary rigs working in the Gulf of Mexico and 98 in US waters as a whole. Canada's rig count increased by 30 to 185—up from 91 a year ago. Petroleos Mexicanos (Pemex), the state-owned oil company of Mexico, awarded contracts to Halliburton de Mexico, a subsidiary of Halliburton Co., to drill five wells in southern Mexico. Parker Drilling Co., Houston, will supply five land rigs—Parker rigs 121, 122, 165, 174, and 260—to drill in Samaria, Iride, and Cunduacan fields in the state of Tabasco. The rigs will be moved to Mexico from Bolivia and Colombia, and drilling is slated to begin in June. In addition, Pemex directly awarded Parker a 2-year contract for its barge rig 53 for work in the Macuspana basin in Tabasco's inland waters. Operations are expected to start this month.

EXXON MOBIL CORP. and TransCanada PipeLines Ltd. have successfully demonstrated the suitability of the new high-strength X-120 steel line pipe for use in commercial applications. The world's strongest line pipe, X-120 is 50% stronger than X80, the strongest steel line pipe currently used for gas transmission pipelines (OGJ, Dec. 1, 2003, p. 56). Construction of a 1 mile pipeline section of X-120 pipeline in February—part of a longer looping operation in Northern Alberta—demonstrated that the X-120 steel is compatible with standard pipeline construction practices, even under severe winter conditions, ExxonMobil reported. The construction rate was comparable to rates expected for winter installation, and the weld defect rate was lower than rates commonly reported for major pipeline projects. The pipeline was constructed to TransCanada's specifications under Canadian standards. ExxonMobil, Mitsui & Co. Ltd., and Nippon Steel Corp., which supplied the steel, jointly developed the pipe. The X-120 line pipe is expected to greatly reduce pipeline project costs and enable development of resources in remote areas. Louisbourg Pipelines Inc. was installation contractor, and CRC-Evans supplied the welding equipment and worked with ExxonMobil to develop the welding procedures. Alberta Energy and Utilities Board authorized the assets to be fit for operation.

Calgary-based Enbridge Inc. applied to Alaska to negotiate commercial agreements for construction and operation of the segment of the Alaska Highway Pipeline Project proposed to be built in that state. "With this application, we are formalizing our intention to take a leadership position within a broad coalition of commercial interests focused on bringing Alaska gas to market," said Patrick D. Daniel, Enbridge president and CEO. "The magnitude of capital investment and risk required by this project will necessitate a partnership of producers, pipeline companies, and other potential participants." Daniel added that he thought Enbridge's application would provide a "competitive alternative to other pipeline proposals." Repairs to the crude oil pipeline at Escravos, near Warri, Nigeria, are expected to be completed by early June, OPEC News Agency reported. Nigeria's presidential adviser on petroleum and energy Edmund Daukoru said the Nigerian refineries would resume full production in late August following turnaround maintenance at the Warri refinery and completion of repairs on the pipeline and the FCC unit at the Port Harcourt refinery. The refineries were shuttered and 140,000 b/d of crude oil from ChevronTexaco oil fields shut in during March 2003 when the pipeline was rendered inoperable by insurrectionists. Area violence caused majors to leave the area until this spring when returning ChevronTexaco personnel and others were murdered on River Benin in Delta (OGJ Online, Apr. 26, 2004).

PETROKAZAKHSTAN INC., Calgary, is turning part of its attention to maximizing gas utilization and evaluating enhanced oil recovery on its properties in west-central Kazakhstan's Turgai basin. A 50% partner in the Kazgermunai Joint Venture, PetroKazakhstan is participating in the construction of a 30 MMcfd gas processing plant to serve Akshabulak field. The plant will extract 2,900 b/d of LPG and 600 b/d of condensate. Dry gas will be shipped to Kyzylorda through a pipeline to be built by state KazTransGas.

The company started up a 55 Mw power plant in Kumkol field in late 2003. The plant consumes part of the gas previously flared from Kumkol South, separate South Kumkol, and Kumkol North fields (See map, OGJ, Nov. 25, 2002, p. 52). PetroKazakhstan is designing a pilot project for miscible gas injection for EOR in one of the Kumkol fields and is evaluating a gas processing plant for Kumkol. A gas injection system is to start up in the second quarter in Aryskum field, where as many as 16 new production wells may be drilled this year. The company expects to resume production from and development of East Kumkol field in the third quarter. PetroKazakhstan produced 142,919 b/d in the quarter ended Mar. 31, up 1.5% from first quarter 2003. Field developments in first quarter this year included a 700 b/d oil well on the recently acquired Kolzhan license that confirmed a northern extension of Kyzylkiya field. As many as three delineation wells will be drilled this year. PetroKazakhstan will further evaluate the prospectivity of deep horizons in the Saralyn graben north of Kumkol field. The company also was drilling a well projected to 4,450 m to explore horizons beneath the main Aryskum reservoir on the Aryskum license. The government awarded PetroKazakhstan two exploration areas totaling 146 sq km north and south of Kyzylkiya field. The northern area is believed to contain an extension of Kyzylkiya field and potential in the Kumkol formation, and the southern area may contain Kyzylkiya satellites. A 3D seismic survey is planned for later this year. The company received approval to become a 75% equity partner in License 951-D, which covers the Doshan and Zhamansu blocks totaling 4,290 sq km in the South Turgai basin. It spudded a well on the northern Doshan block south of Aryskum field and plans to drill two wells on the southern Zhamansu Block this year.

null

Shell Exploration & Production Co., operator of ultradeepwater Coulomb gas field in the Gulf of Mexico 144 miles southeast of New Orleans, now has Coulomb subsea systems in place in 7,600 ft of water, a world-record depth for a subsea completion, Shell said. FMC Technologies Inc., Houston, manufactured and installed the facilities as part of its alliance with Shell for multiwell subsea development of projects within Shell's deepwater portfolio. Coulomb development is a two-well subsea tieback to the Na Kika host facility, which will serve six fields—four oil and two gas—in the Mississippi Canyon area (OGJ, Sept. 15, 2003, p. 73).

FALCON GAS STORAGE CO. INC., Houston, has launched an open season through May 28 to measure customer interest in expanded capacity at its Hill-Lake gas storage facility 100 miles east of Dallas in Eastland County. Falcon, which has had previous open seasons for Phase II capacity, said that market sentiment appears to have shifted in favor of longer-term contracts. Falcon converted Hill-Lake into a high deliverability, multicycle facility after acquiring it from TXU Lone Star Pipeline Co., Dallas (OGJ Online, Apr. 3, 2001). Incremental peak-day injection and withdrawal capacity could be increased by 150 MMcfd to 300 MMcfd. A Phase III expansion to 450 MMcfd each is planned.