China will continue leading product demand growth in Asia-Pacific

Asia continues to play an important role in global petroleum demand growth, and China leads the way with 451,000 b/d of growth in 2003. Japan also played an important, albeit temporary, role as its nuclear crisis contributed to a demand growth of 84,000 b/d in 2003.

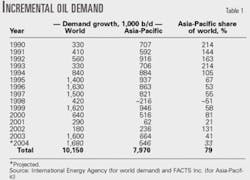

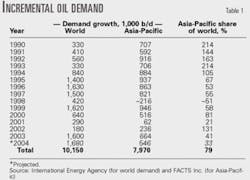

Overall, Asia accounted for 664,000 b/d of the 1.6 million b/d of global incremental demand growth in 2003.

China is the key market that will drive regional consumption growth and affect regional product trade, prices, and refining margins. India is also likely to return to higher growth, and the region's midsized markets, such as Thailand and Indonesia, will post strong growth.

In contrast, the Japanese market is stagnant and the South Korean and Taiwanese markets are relatively mature; so, although these markets are large, they will not be the driving forces in the region.

In 2004, we expect demand growth of 386,000 b/d in China, 22,000 b/d in South Korea, and 31,000 b/d in India.

But demand in Japan will shrink by 127,000 b/d. The region as a whole will post demand growth of 546,000 b/d.

After 2004, average petroleum product demand will increase 2.5-3.0%/ year, or about 550,000-750,000 b/d/ year. Asia will continue to lead global demand growth, accounting for about half of the incremental consumption growth.

China's rapidly growing demand for electricity led to a rapid rise in fuel oil demand for 2003, a trend that is unlikely to continue in the long term. Simultaneously, improving global economic conditions have led to increased demand for petrochemicals and, therefore, naphtha.

Whereas crude prices are relatively high, depreciation of the US dollar has helped limit the impact of high crude prices on demand.

This is true in many parts of the world, but in an effort to maintain the competitive position of their exports to the US market, many Asian countries (especially China) have attempted to limit the rise in their domestic currencies relative to the US dollar. The impact of this varies from country to country in the region.

Global demand growth

Asia continues to play a leading role in global demand growth, with China contributing an incredible 451,000 b/d to an overall global demand growth of 1.6 million b/d in 2003 (Table 1).

Japan is also a key contributor, with an estimated 84,000 b/d of growth in 2003. Japan's 2003 growth, however, is an anomaly in an otherwise stagnant-to-declining market.

The country's nuclear-power crisis led to increased consumption of fuel oil and heavy sweet crudes for direct burning in the power sector.

Overall, Asian demand grew 664,000 b/d in 2003.

In contrast, South Korea and India, the two other big players in Asia-Pacific, experienced a period of relatively slow growth in 2003.

South Korean consumption grew only approximately 21,000 b/d, or just less than 1%, which is due to a lackluster economy and relatively high petroleum prices.

Conversely, India's economy grew quite rapidly in 2003, but its demand growth was stagnant; there were signs of improvement at yearend 2003, especially in diesel consumption, which helped to counteract dismal growth performance in early 2003. Interfuel substitution in the power sector, relatively high petroleum prices, and the rise of CNG in public transport vehicles have all contributed to India's anemic demand situation.

Of the midsize consumers in the region, Thailand experienced robust growth of 5-6%, while Taiwan's consumption grew approximately 3.5% in 2003.

In 2004, Asian growth may cool somewhat, albeit temporarily. This may be surprising given that the regional economy is generally on the upswing. The two largest markets in the region (Japan and China) are likely to slow, however, which will drag down regional growth compared to 2003.

In the past, growth spurts in Chinese petroleum demand preceded slower growth periods in which the infrastructure takes time to adjust. There are indications that this is currently taking place.

Likewise, Japanese demand is likely to decrease in 2004 when the short-term impact of the nuclear crisis abates and the power sector adjusts to reduce demand for relatively high-priced oil.

India should post higher growth in 2004 vs. 2003, but this will not dramatically alter the regional growth picture.

In summary, we expect 2004 demand growth of 386,000 b/d in China, 22,000 b/d in South Korea, and 31,000 b/d in India.

Demand in Japan will shrink by 127,000 b/d. The region as a whole should experience demand growth of 546,000 b/d in 2004.

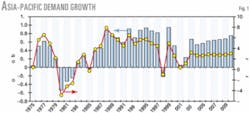

After 2004, petroleum product demand will grow 2.5-3.0%/year on average, or about 550,000-750,000 b/d/year (Fig. 1). Asia will continue to lead global demand growth, accounting for about half of the incremental consumption growth.

Exchange rates, petroleum demand

Even though crude prices are relatively high, depreciation of the US dollar has helped limit the impact of high crude prices on demand.

This is true in many parts of the world, but in an effort to maintain the competitive position of their exports to the US market, most Asian countries have made concerted efforts to limit the rise in their domestic currencies relative to the US dollar.

In fact, China, which is a key petroleum consumer in Asia, has not allowed its domestic currency to appreciate at all against the US dollar.

Most other currencies in the region have appreciated vs. the US dollar, but not to the same extent as the Euro, for example. Whereas the declining value of the US dollar has helped limit the impact of high crude prices on demand in Asia, the impact of this varies from country to country.

Product market outlook

For individual petroleum products, a relatively warm winter, rapid growth in power-sector fuel use in China, and the global economic recovery have driven the regional product market in recent months.

For example, due to the relatively warm winter (especially compared to the exceptionally cold winter of 2002), consumption of heating fuels such as kerosine and gas oil is down in Japan and Korea.

Although fuel oil demand may be dropping off in Japan, it played a critical role in the latter half of 2003 in helping to satisfy China's tremendous demand growth for electricity.

While China's recent thirst for fuel oil has had an impact on the regional product markets, this growth is an anomaly; in the longer term China's demand for fuel oil will be relatively flat.

Improved global economic conditions are contributing to increased demand for petrochemicals and, correspondingly, an increase in regional demand for naphtha.

This trend will continue as regional economies expand.

Interestingly, additions and changes to automobile fleets are substantially affecting consumption of transport fuels.

In China, automobile sales increased dramatically when the SARS scare induced those who could afford it to purchase automobiles to avoid public transportation.

In South Korea, the growing popularity of diesel-powdered sport utility vehicles is contributing to a decline in gasoline consumption (diesel is priced lower than gasoline).

Another factor is the fuel additive Cenox, which is sold as a substitute for gasoline and allows consumers to avoid South Korea's high gasoline tax.

Cenox sales reduced gasoline consumption by about 3,000 b/d in 2003, but the government's crackdown on its sale should limit its impact in 2004.

In the long-term, transport fuels will lead demand growth (Fig. 2). The graph shows annual average consumption growth for key products in the pre-Asia economic crisis years (1990-97), the crisis and recovery years (1998-2002), and our projections for the period 2003-15.

The author

Jeffrey Brown is chief economist at FACTS Inc. and a fellow at the East-West Center, Honolulu. His research focuses primarily on downstream oil and natural gas, energy policy, and environmental issues in the Asia-Pacific region. Brown holds a PhD in economics from the University of Hawaii, Manoa, and a masters from the LBJ School of Public Affairs at the University of Texas, Austin.