Few operators equipped to exploit gulf's deep shelf gas opportunities

Deep shelf gas production from then-existing fields in the Gulf of Mexico peaked at 1.2 bcfd in 2003 and is expected to remain at these levels in the short to medium term.

More recent discoveries such as JB Mountain (South Marsh Island 223), Alex Deep (Brazos A-19), and West Cameron 47 are sustaining the deep shelf production, concludes Wood Mackenzie Consultants, Edinburgh, in a study released to clients in late 2003.

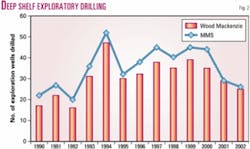

Minerals Management Service data suggest that 1,277 deep shelf exploration wells have been drilled since the 1955, and 456 of those were completed in 1990-2002. Most are off Louisiana (Fig. 1).

Commercial success rates have averaged 30% in recent years, and the annual trend is extremely positive, Wood Mackenzie said. Also, the average size of discovery, although small by global standards, has risen steadily since 1990 and especially since the mid 1990s.

Strong gas prices, federal tax incentives, and a "seemingly incessant positive news-flow from a growing band of pioneering explorers" have rekindled interest in exploring for gas below 15,000 ft subsea.

"Behind all of the hype, only a handful of players are well placed to fully exploit this opportunity, being in the enviable position of having access to acreage, exploration capital, and technical expertise," the consultant said.

The study included no figures for the yet untested ultradeep shelf play. Through the end of 2002, fewer than a dozen shelf exploration wells went below 23,000 ft TVD and only one reached 25,000 ft.

Drilling and success

MMS data show steady deep shelf drilling from 1955 to 1968, followed by an 8-year lull.

A second surge of drilling lasted from the late 1970s to the mid-1980s, when drilling reached a peak of 62 wells in 1984 before dropping off to 29 wells in 1986. That decline corresponded to the fall in oil prices during the same period.

Wood Mackenzie highgraded the MMS well count to separate true exploration wells from appraisal and development wells on the deep shelf and delete wells that had shallower primary objectives.

This brought the number of 1990-2002 deep shelf exploration wells to 380.

The Wood Mackenzie data also show that 30-40 deep shelf wildcats have been drilled per year declining to 25-30 wells in recent years, that 1994 was the peak year with 45 wells drilled, and that the MMS's view generally overstates exploration by 20% (Fig. 2).

Commercial success rates ranged from 15-40% and averaged 30% since 1990. The general trend has been positive with steady increases in commercial success rates in the last 13 years, with Wood Mackenzie's 30% average comparing with MMS's 34% (Fig. 3).

Gross reserves added per year from new deep shelf discoveries have risen steadily in the past 13 years and peaked in 2002.

In 1990-2002, the rolling 5-year average discovery rate has ranged from 25 bcfe/well to 10 bcfe/well and averaged 15 bcfe/well.

The top 10 deep shelf fields contributed a disproportionately large 55% of all deep shelf gas output in 2002, and the next 35 fields contributed 32%.

However, most of the key fields are in their infancy and offer little well production history.

Deep shelf future

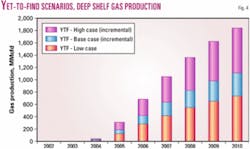

The consultant also extrapolated yet-to-find reserves (Fig. 4).

Drilling 40 wildcats/year through 2010 finding 15 bcfe/well in 2003-2010 could elicit base case additional gas production of almost 1.2 bcfd by 2010. The figure could be as small as 700 MMcfd or as large as 1.8 bcfd.

Future annual discovery rates, including both successful and unsuccessful wells, were generally assumed to decline through 2010.

Again, the decline in production excludes any potential contribution from the ultradeep shelf play.

"Industry conjecture suggests that the ultimate potential of the ultradeep shelf could be huge (e.g., prospect sizes of the order of 1-10 tcf, although there is little firm evidence to support these theories given the enormous uncertainties surrounding industry's ability to map and/or drill such prospects at depth," Wood Mackenzie said.

In general, the supply conclusions are that the "production contribution from deep shelf fields may have already reached plateau, with incremental production from yet-to-find fields barely keeping pace with the rapid decline from existing commercial fields. This is in spite of relatively buoyant future exploration levels and an arguably aggressive view on future prospectivity.

"By 2010 our base case profile rises a mere 0.1 bcfd from the current gas production rate of around 1.2 bcfd."