Market Movement

OPEC denies changed price formula

The Organization of Petroleum Exporting Countries denied news reports that the group is using a new formula to calculate the daily price of its basket of seven benchmark crudes.

OPEC cited an Apr. 20 report by Reuters News Service that the group "is running a new trial crude oil basket in parallel with the existing one." According to that report, the new formula involves exchange rates of the weakened US dollar vs. other key currencies, particularly the euro, since many OPEC members purchase goods from European Union countries.

OPEC said its basket price still is "calculated using the same formula, which is based on a simple average of closing quotations of the seven crudes that make up the basket."

Nonetheless, OPEC's average basket price has exceeded its $22-28/bbl target range for some 20 consecutive weeks through Apr. 21. OPEC ministers claim market prices are beyond their control and that the world is well supplied with crude.

Some analysts claim OPEC is supporting higher oil prices to satisfy the budget requirements of its member governments (OGJ, Apr. 19, 2004, p. 5), while others join OPEC in blaming speculators.

During the first quarter, the US cude futures market price registered the highest quarterly average in 23 years—"since the early stages of the second Iran-Iraq war in 1981"—despite supply-demand fundamentals that actually eased spot market price pressures for that crude, said Merrill Lynch Global Securities Research & Economics Group, New York.

In an Apr. 15 report, Merrill Lynch analysts said benchmark US crude prices on the New York Mercantile Exchange "have a 'justified value' of about $29.50/bbl as compared with current prices near $37[/bbl]. We see the gap between this justified price and currently traded values as being largely a reflection of a still massive amount of speculative length (that is, a net long position held by hedge funds)."

OPEC-10 production unchanged

As it had for the previous 6 months, crude production remained virtually unchanged, at an average 25.8 million b/d in March among the 10 OPEC members (excluding Iraq) subject to the group's output quota. That averaged 2.3 million b/d more than their new quota that became effective Apr. 1, according to the monthly crude market report published Apr. 9 by the International Energy Agency. In its report, IEA again raised its forecast for the growth in world demand for crude in 2004, hiking it by 60,000 b/d to a growth rate of 1.7 million b/d.

The world's total supply of crude increased by 410,000 b/d to 82.3 million b/d during March, primarily due to increased output by Iraq, the only OPEC member currently exempted from the group's production quota. Meanwhile, non-OPEC production declined by 100,000 b/d, reflecting supply reductions among members of the Organization for Economic Cooperation and Development that offset increased production from Russia and Brazil.

Total OPEC production increased by 490,000 b/d to 28.2 million b/d in March, spurred by a rise of 510,000 b/d in Iraq's output and a 450,000 b/d hike in its crude exports. "Barring unforeseen developments, Iraqi exports are set to grow to prewar levels of around 2 million b/d in the months ahead," said IEA officials.

However, escalating resistance against US-led coalition forces in Iraq this month undermined market confidence in any further resurgence of that country's oil industry.

Meanwhile, the April reduction in OPEC's production quota to 23.5 million b/d "may be purely symbolic, with OPEC having concluded that any formal reversal of [its] February decision would have been interpreted extremely bearishly by speculative players holding unprecedented net long positions," said IEA officials.

"In reality, cuts in actual April supply are likely to be modest, confined to perhaps Saudi Arabia, UAE, and possibly Iran, and limited to around 500,000-600,000 b/d," they said. "Indeed, after notifying term customers in March of reduced supplies for April lifting, all three producers have subsequently been reported to be offering extra volumes for lifting this month and assuring customers that they would supply their requirements."

IEA raised its forecast for world oil demand by 260,000 b/d during the second quarter, with China continuing to account for the bulk of that increase. That more than offset a cut of 80,000 b/d in first quarter demand as a result of lower-than-expected Japanese electric power generation requirements.

"Taken together, the two adjustments point to a shallower-than-expected seasonal drop in demand of 2 million b/d from the first to the second quarter, compared to 3.08 million b/d last year," said IEA. F

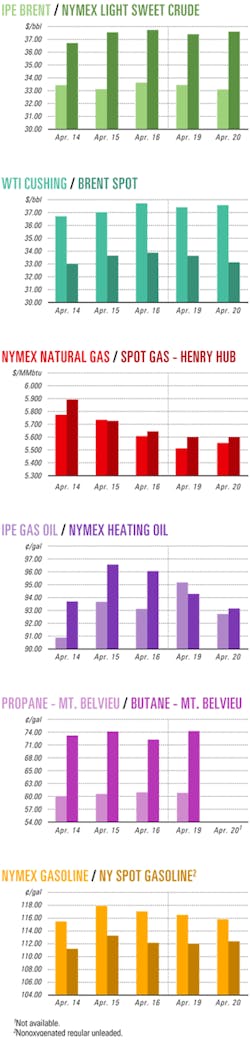

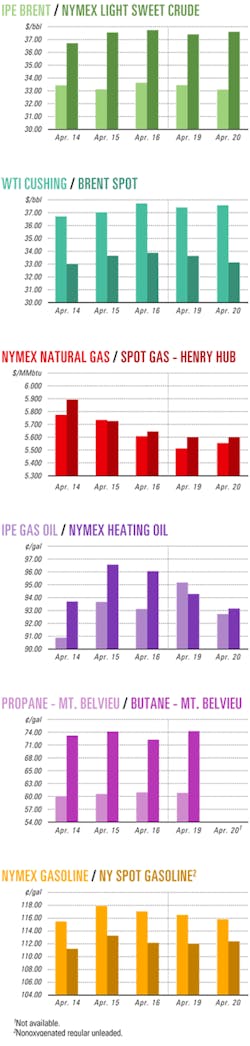

Industry Scoreboard

null

null

null

Industry Trends

Too much cash is chasing too few opportunities in North America.

Scott D. Scheffield, the chairman, president, and CEO of Dallas-based Pioneer Natural Resources Co. outlined that trend during a luncheon speech for the Independent Petroleum Association of America's recent investment symposium in New York.

He said he observes a "lack of opportunities to grow without a commitment to international" projects.

Scheffield estimated that $50 billion in surplus cash flow of independent producers, plus private equity, is available for North American prospects worth perhaps $2 billion.

The oil and natural gas producing industry is liquidating in North America because of the relative lack of opportunities outside the deepwater Gulf of Mexico, Scheffield said. Producers have surplus cash available that has been generated from higher oil and gas prices, but they also face "much higher" costs. For instance, China's economic boom is driving up steel prices.

Oil companies also are apt to more closely monitor reserves estimates and audit those sections of their financial disclosures, he said, noting a recent series of adjustments to reserves estimates.

"People are pushing the envelope with regard to reserves bookings," he said.

Higher steel prices are expected to weigh more heavily on oil and gas exploration and production companies rather than on service and supply companies.

In a recent research report, Banc of America Securities LLC analyst James K. Wicklund of Houston said the price of hot-rolled coiled steel has increased 71.2% since yearend 2003. The primary cause for the rise in price is increased steel demand in China, which consumes about 30% of the world's supply. The higher price has affected raw material costs and overall expenses for many energy companies, Wicklund said.

For example, he noted that Dallas-based casing, tubing, and line pipe producer and marketer Lone Star Technologies Inc. reported a $42/ton surcharge at the start of the year for all of its oil field product shipments. The surcharge increased to $60/ton in February and to $125/ton in March.

Robert Morris, BAS exploration and production analyst, reported that steel represents 5-15% of total drilling costs, with onshore drilling programs experiencing the greatest impact. Morris also said that a few E&P firms indicated a 0.3-1.9% budget increase for every $100/ton increase in steel prices.

Wicklund said that, "Within our coverage universe, the drillers, casing-tubing service providers, and capital equipment providers will most likely be affected by higher steel prices, though any impact should not be significant.

"For the land drillers, higher drill pipe costs represents less than 5% of total operating costs, and these costs are generally passed on as higher day rates. Higher costs incurred in newbuilds and upgrade programs for the offshore drillers could be an issue if the steel has not already been purchased.

"For other companies, most have been able to pass on the higher steel costs, mitigating any potential margin weakness. We expect to hear confirmation and greater clarification during the upcoming [earnings] conference calls," he concluded.

Government Developments

US COMPANIES could move closer to doing business again in Libya.

At presstime last week, US President George W. Bush appeared poised to remove, possibly as soon as this month, certain unilateral sanctions against Libya so that US-based oil companies can make or expand investments there, government and industry sources said. Companies likely will be allowed to trade Libyan oil, too.

Former President Ronald Reagan effectively shut down US oil business interests through a 1986 executive order. But Libya's recently rigorous efforts to renounce state-sponsored terrorism, especially in the aftermath of the Sept. 11, 2001, attacks on the US, likely will give multinational companies the chance to make investments, although it could take several years, given the country's dilapidated infrastructure, analysts said.

Other sanctions on the books, specifically the Iran Libya Sanctions Act, passed in 1996 and renewed in 2001, will require formal removal by the US Congress. But the existing legislation is not much of a stumbling block because it gives Bush significant leeway to relax or waive sanctions if that is deemed to be in the national interest. The law, which is scheduled to sunset in 2006, seeks to punish international oil companies that invest $20 million in either country. Sanctions never have been applied under the law.

Another potential complication for US companies could occur if Libya remains on the US Department of State's terrorism list. If the White House chooses to keep that restriction some oil service companies would require special licenses from the US Department of the Treasury's Office of Foreign Asset Control (OFAC). Industry sources called that scenario "annoying" but not particularly damaging to potential investment opportunities. Additionally, US service companies might not be able to garner loan guarantees from the US Export-Import Bank.

As relations with Libya have improved, US companies with frozen assets, such as Occidental Petroleum Corp., Amerada Hess Corp., Marathon Oil Co., and Conoco Inc. (now ConocoPhillips) received permission by OFAC to travel to Libya to open offices or begin negotiations (OGJ Online, Apr. 19, 2004).

These companies have over the past several months enthusiastically endorsed the US's evolving probusiness stance regarding Tripoli, which became clearer after Libyan leader Moammar Gadhafi's agreed to accept responsibility for the 1988 Pan Am 103 flight bombing over Lockerbie, Scotland, and to renounce terrorism.

Meanwhile, US companies with no holdings in the country also are eager to cut deals.

"In the case of Libya, we are planning our resources to be able to respond rapidly in the event that US sanctions are lifted," a ChevronTexaco Corp. spokesman said. "As a company with a substantial prior history in Libya, we are encouraged that the US government is engaged in direct discussions with the Libyans to resolve the issues that continue as impediments to the removal of US sanctions." The company further stated that it looks "forward to the full opening of Libya for all international investors. We have been involved in discussions with Libyan officials to understand what opportunities might exist there."

Quick Takes

THE US MINERALS MANAGEMENT SERVICE Apr. 15 announced an oil and natural gas lease sale in Alaska's Cook Inlet in federal waters 3-30 miles offshore. The 2 million acres, in 30-650 ft of water, extend from south of Kalgin Island to northwest of Shuyak Island. The sale, opening relatively unexplored areas, will be held May 19. MMS estimates that offshore potential could exceed 1 tcf of conventionally recoverable natural gas. Economic incentives include a primary term of 8 years, minimum bids of $25/hectare, $5/hectare/year rental rates, and royalty suspension volumes for both oil and gas.

Kerr-McGee Corp., Oklahoma City, discovered more than 250 ft of high-quality hydrocarbon pay, primarily oil, with its deepwater Ticonderoga well and sidetrack on Green Canyon Block 768 in the Gulf of Mexico. The independent estimates that Ticonderoga, drilled to 13,556 ft TMD in about 5,250 ft of water, offers potential resources of 30-50 million boe. Operator Kerr-McGee and partner Noble Energy Inc., Houston, hold equal shares in the well, which could be developed as a subsea tieback to Kerr-McGee's planned Constitution truss spar 5 miles north of the area. Kerr-McGee is performing reservoir modeling and plans additional appraisal work this year.

Dominion Exploration & Production Inc., a unit of Dominion Resources, Richmond, Va., discovered oil on its Goldfinger prospect on deepwater Mississippi Canyon Block 771 in the Gulf of Mexico. The well, drilled in 5,423 ft of water, found 57 net ft of oil-bearing sand at 15,000 ft subsea. The well likely will be tied back to the Devils Tower spar on neighboring MC Block 773, Dominion said. A subsea system will connect the Triton discovery, MC 772 No. 4, and the MC 728 No. 1 well to the Devils Tower host platform, expected to start production in the second quarter. Dominion E&P is operator of Devils Tower, Triton, and Goldfinger fields, with a 75% working interest; partner Pioneer Natural Resources Co., Irving, Tex., holds the remaining interest.

Statoil ASA and Norsk Hydro ASA awarded a $44.25 million contract to Stavanger-based Ocean Rig ASA to drill three oil-gas exploration wells in the Barents Sea, starting in the fourth quarter—with an option to first drill a well for Norsk Hydro in the North Sea. Ocean Rig will use either its Leiv Eiriksson or Eirik Raude semisubmersible rigs, which would be upgraded to an eight-point anchoring system. Statoil will be operator for a well on Production License 202 or in Seismic Area F and one in Seismic Area G. Norsk Hydro plans a well in Seismic Area C. Any gas discovered and developed would be piped to the liquefaction plant under construction at Melkøya. BHP Billiton Ltd.'s Neptune-7 appraisal well, drilled on Atwater Valley Block 618 in the central Gulf of Mexico, found a hydrocarbon column with 114 ft of net oil pay. The Explorer drillship, operated by Houston-based GlobalSanteFe Corp., drilled the well to more than 18,700 ft TD in 6,260 ft of water 135 miles off Louisiana. Development prefeasibility studies for the Neptune prospect area are expected to be complete by yearend. The Neptune prospect is in the Atwater foldbelt region, which includes Mad Dog and Atlantis fields. BHP Billiton is the operator of Block 618 with 35% working interest. Partners are Marathon Oil Co. 30%, Woodside Energy (USA) Inc. 20%, and Repsol-YPF SA unit Maxus (US) Exploration Co. 15%. GDF Britain Ltd., operator, and its two partners have suspended a Monroe natural gas discovery as a potential producer in the Caister Murdoch System (CMS) in the UK North Sea. The 44/17b-7 discovery well was spudded Feb. 16 and drilled to 12,611ft. Subject to the outcome of predevelopment studies, it is the partners' plan to reenter this well and tie it back to the CMS III production network operated by partner ConcocoPhillips (UK) Ltd. First production is expected by mid-2005. GDF Britain has 39% interest in the discovery, while ConocoPhillips has 46% and Tullow Oil UK 15%.

TRINIDAD AND TOBAGO Prime Minister Patrick Manning is leading an intervention to end a 10-week workers' strike that is delaying construction of Train 4 at Atlantic LNG Co. of Trinidad & Tobago Ltd.'s (ALNG) Port Fortin LNG plant. Lead contractor Bechtel Corp. already has sent employees home and threatens to quit the project. Workers are seeking $7.50/hr in wages—a 100% increase that Bechtel says would increase by $200 million the project's already lofty $1.2 billion cost. Train 4, scheduled to come on stream in early 2006, will produce 5.2 million tonnes/year of LNG, largely for export to the US. Upon completion, the ALNG plant will produce 15 million tonnes/year of LNG.

A SUBSIDIARY of Sempra Energy Global Enterprises (SEGE), San Diego, is planning to develop Pine Prairie Energy Center—a 24 bcf salt cavern natural gas storage facility in Evangeline Parish, La., near the Henry Hub trading center. The facility could interconnect with as many as nine pipelines. Pine Prairie, scheduled to begin operations by fourth quarter 2005, currently is seeking interest in storage capacity at the facility. SEGE also is developing the 27 bcf Bluewater gas storage facility in St. Clair, Mich., which is slated to begin operations in May.

AMERADA HESS CORP. and BG Group have formed final development plans for Atlantic and Cromarty gas and condensate fields in the North Sea, which hold estimated gross reserves of 118 bcf and 106 bcf, respectively. Production will be mixed offshore and exported to SAGE (Scottish Area Gas Evacuation) terminal at St. Fergus, Scotland. BG, holding 75% interest, operates Atlantic field on Block 14/26a; Amerada Hess holds 25%. Cromarty field, on Block 13/30a, is operated by Amerada Hess, with 90% interest; BG holds the remaining 10%. First production is slated for late 2005 or early 2006, with peak production expected to reach 220 MMscfd. India's state-owned

Oil & Natural Gas Corp. plans to invest 24.84 billion rupees in its Mumbai High oil field off Mumbai during the financial year begun Apr. 1. Half will support an ongoing production enhancement program that has yielded an additional 50,000 tonnes/day of oil and oil-equivalent gas since 2001 and is expected to recover another 75 million tonnes by 2030. The balance of the investment will fund new projects, including five of nine wellhead platforms planned for Mumbai High (South) and 261 km of oil trunkline and 246 km of gas pipeline from Mumbai High to Uran onshore.

Ras Laffan Liquefied Natural Gas Co. Ltd. (Rasgas II) awarded McDermott International Inc. subsidiary J. Ray McDermott Eastern Hemisphere Ltd. a turnkey contract for a platform deck and intrafield pipeline off Qatar. McDermott will perform project management, design engineering, procurement, fabrication, and installation of the 2,200-ton WH9 wellhead deck, which will handle 1.2 bscfd of gas condensate and water production for supply to the onshore Rasgas II plant. Installation is scheduled for late 2006. The contract also includes installation of 7 km of 28-in. pipeline and 10 km of subsea cable. RasGas II is a partnership of Qatar Petroleum Co. and ExxonMobil RasGas Inc.

Chevron USA Inc., operator and 58% stakeholder in deepwater Tahiti field on Green Canyon Blocks 640, 641, and 596 in the Gulf of Mexico, awarded Technip Offshore Inc. the front-end engineering and design (FEED) contract for a truss spar floating production facility. Mustang Engineering Inc., Houston, will perform FEED for topsides oil and gas processing facilities. Construction will be awarded in second quarter 2005. FEED work is to begin this quarter. One appraisal well encountered more than 1,000 ft of net pay, ChevronTexaco said. Partners are EnCana Gulf of Mexico LLC 25% and Shell Exploration & Production Co. 17%.

ALASKA, in a memorandum of understanding, agreed to resume processing TransCanada Corp.'s long-pending right-of-way permits to construct a natural gas pipeline through Alaska and Canada. TransCanada already holds federal authorizations, including ROW, for that construction, said Alaska Gov. Frank H. Murkowski. Once the state issues the ROW lease and commercial arrangements support project financing, TransCanada indicated it would convey the ROW lease to the entity that would develop the project in Alaska and sign exclusive agreements for connecting the Alaska segment to TransCanada's system at the Alaska-Yukon border. TransCanada also has indicated its willingness to assume leadership of the Alaska segment as an independent pipeline sponsor. Upstream issues related to the project must still be resolved, the parties agreed. TransCanada said it is willing to accept Alaska partners in the pipeline development project and will reimburse the state for ROW processing costs and as much as $1.5 million for its Stranded Gas Act application processing costs. Transwestern Pipeline Co., Houston, applied to the US Federal Energy Regulatory Commission seeking approval for a $138.4 million expansion of its San Juan lateral to provide an additional 375 MMcfd of firm natural gas capacity. Transwestern's proposal involves modifications at compressor stations and construction of 72.6 miles of pipeline from the Blanco Hub in San Juan County, NM, to an interconnection with Transwestern's mainline. The company expects construction to begin in late 2004, with a projected operational date of mid-2005.

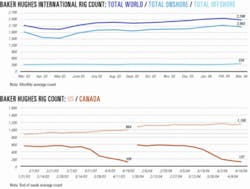

US DRILLING ACTIVITY the week ended Apr. 16 increased by 12 units to 1,150 rotary rigs working, the highest weekly total since the week ended Sept. 28, 2001, when the count was at 1,168 and falling, Baker Hughes Inc. officials said. That compares with a rig count of 994 the same time a year ago. All of the week's gain was in land operations, up by 12 rigs to 1,043 working. Offshore activity was unchanged at 89 rigs in the Gulf of Mexico and 91 in US waters as a whole. Drilling in inland waters was unchanged at 16 active units. Canada's rig count declined by 11 to 137 that week, but rose from 109 a year ago. Upon completion by mid-May of a well ExxonMobil Exploration & Production Malaysia Inc. is drilling from a platform off Malaysia, ExxonMobil temporarily will suspend its contract for the Vicksburg jack up—leased from Houston-based Atwood Oceanics Inc. The Vicksburg will be moved to Thailand for a 5 month drilling program for Chevron Offshore (Thailand) Ltd., then redelivered to Malaysia in November to continue another 12 months of its drilling program for ExxonMobil. Meanwhile, Helis Oil & Gas Co. LLC, New Orleans, has contracted for Atwood's Richmond cantilever submersible to drill four wells with options for an additional four, all in the Gulf of Mexico. The rig will move to the first Helis drilling location upon completion of its current contract with Houston-based Bois D'Arc Offshore Ltd., which should be completed in late June.

FINNISH FIRM Fortum Oil & Gas Oy has commissioned ThyssenKrupp Group's engineering arm Uhde GMBH to design and supply equipment for a 140 MMscfd hydrogen production plant at Porvoo, about 30 km east of Helsinki and adjacent to Fortum's 200,000 b/d refinery. The 25 million euro contract includes the license and engineering for the Uhde steam reformer, supply of equipment, and supervision of the construction and commissioning work. The facility's output will be used to convert residual oil to "sulfur-free" transportation fuels, Uhde said. In addition to natural gas as a feed for the steam reformer, liquid petroleum gas and other refinery gases also can be used in various ratios to the refinery's needs, Uhde noted. The plant is due to come on stream in late autumn 2006. Petro-Canada plans to upgrade its Montreal refinery to produce ultralow-sulfur diesel using the Spider Vortex reactor technology created by ExxonMobil Research & Engineering Co. The 30,000 b/d grassroots ultralow-sulfur diesel hydrotreater will process a mix of virgin and processed feedstocks to meet Canada's 2006 onroad diesel fuel sulfur specifications.

ACETEX CORP., Vancouver, BC, and National Petrochemical Industrialization Co. (Tasnee Petrochemicals, a joint public-private Saudi company) plan a $1 billion project to construct world-class acetic acid, vinyl acetate monomer (VAM), and methanol facilities at Tasnee's petrochemical complex at Jubail, Saudi Arabia. The projects, which will utilize Acetex's proprietary acetic acid-methanol coproduction technology, will have production capacity of 500,000 tonnes/year (tpy) of acetic acid, 275,000 tpy of VAM, and 1.8 million tpy of methanol. Production is expected to begin in 2007. Acetex will own 50% of the acetyls (acetic acid and VAM) company and 25% of the methanol company.

CORRECTION

Tokyo-based Tomen Corp. was incorrectly identified as Tonen Corp., also of Tokyo, in a story about a Japanese group's involvement in developing Azadegan oil field in Iran (OGJ, Apr. 19, 2004, p. 26).