Continuing high oil prices have improved the attractiveness of France's E&P scene.

Operators are showing great willingness to drill this year, noted Carole Mercier, head of Hydrocarbon Exploration-Production at the Industry Ministry. "The trend was already noticeable in 2003 when investments picked up after the historical investment low of 37 million Euros in 2002.

E&P investments grew to 50 million Euros in 2003 and should jump to 71 million Euros in 2004. Besides continental France, activity is planned in French overseas territories.

Paris basin

Interest remains surprisingly constant in the Paris Basin despite its mature status.

Six wells to be sunk to 2,500-3,000 m and six shallower wells are scheduled.

In particular, Vermilion Rep's deep development well La Torche 2 could double reserves of its Champotran oil field on the St. Just en Brie Permit.

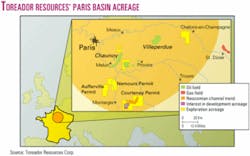

Toreador Resources Corp., Dallas, is to spend $3-4 million on exploration and development in France in 2004. Toreador is operator and 100% owner of Charmottes field and the four-field Neocomian complex (see map).

After initial rehabilitation in the Neocomian fields, the company plans 3-5 exploratory wells on the 183,000-acre Courtenay Permit. It also plans a multizone horizontal development well in Charmottes.

Aquitaine and offshore

Significant investments are due in the Aquitaine basin, where costs are higher than in the Paris basin.

Esso REP's Les Pins 5 development well on Permis de Lège, southwest of Les Arbousiers, went on production at the end of 2003 and is slated to become France's most productive well at 1,100 b/d.

France's offshore has still not yielded any returns. The English Channel Western Approaches permit that expired in 2003 will not be renewed.

Hunt Oil Co. requested a Bay of Biscay permit, and Esso Rep's Cap-Ferret Océan Permit was transferred to Vermilion, which plans seismic surveys.

Also disappointing was the 2003 Polkerris 1 wildcat drilled by Canadian Natural Resources Ltd., Calgary, on the Finistère Atlantique Permit.

On the Rhône-Maritime Permit in the Mediterranean, TGS-Nopec Geophysical Co. found promising features on seismic surveys.

Oil, gas production

Workovers in old fields, reopening of depleted fields to try new interpretations, and new development wells retarded production decline in France's main oil fields.

Production fell 7% last year to 24,000 b/d but should increase this year with new activity. France's oil comes 55% from the Paris basin and 44.5% from Aquitaine.

Esso Rep, Total E&P France, and Vermilion Rep each account for 25% of overall production, while Lundin Oil 13.6%, Madison Energy France 4.25%, and Géopétrol 4.8% held their 2003 production rate at the 2002 level.

Two old fields produce 22% of France's oil. Esso Rep's Chaunoy field remained in 2003 at the high level of 2,540 b/d, and Vermilion Rep's 45-year-old Parentis concession in the Aquitaine basin yielded 2,940 b/d.

Gas production of 85 bcf in 2003 was unchanged, coming essentially from three fields: Total's Lacq Profond 70%, Vermilion's Meillon 15.5%, and Gazonor's (GdF) Poissonnière 4.5%.

French possessions

Following interpretation of seismic surveys in 2002 off French Guyana on the Guyane Maritime permit, Planet Oil, an affiliate of Australia's Hardman Resources, defined several prospects. It is looking for partners to drill a wildcat before 2006.

RSM Production Co., an affiliate of Grynberg & Associates Inc., Denver, applied for permits off Martinique and Guadeloupe islands in the Caribbean Sea and east of Saint Pierre et Miquelon in the Atlantic south of Newfoundland. ExxonMobil Corp. and ConocoPhillips have asked for a renewal of their Saint Pierre et Miquelon permit.

TGS-Nopec sought a two-year nonexclusive permit in the Mozambique Channel. The permit is near Juan de Nova, part of the Eparses archipelago off western Madagascar and east of northern Mozambique.