Unconventional gas fields gain in US

This sidebar contains summary information on performance of many of the largest gas fields in the US Lower 48 states.

The recent production data generally reflect the shift by some operators toward production from unconventional formations such as tight gas sands, shales, and coalbed methane and less involvement with fields that produce from conventional formations (OGJ, Dec. 8, 2003, p. 34).

Another trend is the addition in recent years of more large gas fields in the Gulf of Mexico.

A number of fields in Alaska produce gas, but it is either reinjected or otherwise unavailable to Lower 48 markets thus far.

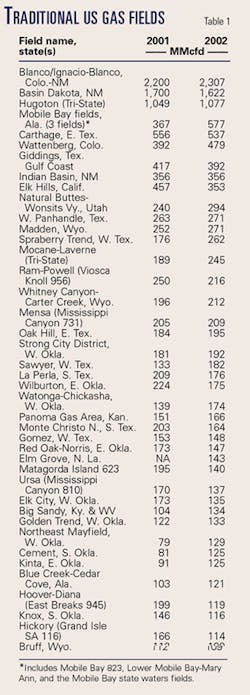

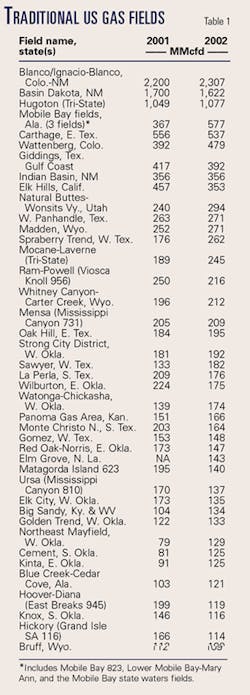

The 2001-02 production data for the more traditional fields are adapted from the US Energy Information Administration list of top 100 US fields, but we have included only the largest fields (Table 1). No EIA data are yet available for the fields for 2003.

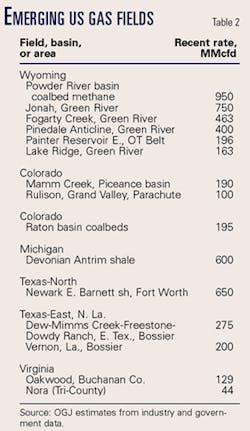

Table 2 contains 2002 or more recent production data or estimates of the production from less-known, emerging fields.

A few fields fit both the traditional and emerging categories in that redevelopment, infill drilling, and other expansions are under way, but we have listed each field only once.

This was not meant as an exacting, quantitative exercise in that how much any gas field produces can be a function of pipeline capacity, pipeline take, as well as ability to deliver. It was meant more as a general look at the volumes being delivered from the various fields.

In general, we attempted to show gas fields or plays that deliver 100 MMcfd or more. We omitted a few fields that listed raw gas produced streams that contain large percentages of nonmethane gases. Fully half of the listed traditional fields showed production increases in 2002 compared with 2001, according to EIA.

Interesting details

By far the largest Lower 48 gas source is the Blanco and Ignacio-Blanco field complex in the San Juan basin, which EIA says delivered 2.3 bcfd in 2002. This volume is believed to include production from the Cretaceous Fruitland coals.

Basin Dakota field in the San Juan delivered another 1.6 bcfd.

The Powder River basin coalbeds of eastern Wyoming have collectively grown to become one of the largest Lower 48 gas producing areas at a recent output of 950 MMcfd, which has been essentially flat for several months due to drilling permit limits.

Another relatively recently developed formation is the Mississippian Barnett shale play in the Fort Worth basin of North Texas, centered on Newark East field, at 650 MMcfd.

Drilling is intense with several dozen rigs employed in the Powder River and Barnett plays.

One of the larger gas volumes comes from Elk Hills oil field in California. Operator Occidental Petroleum Corp. said Elk Hills averaged 246 MMcfd in 2003.

On a play basis, Advanced Resources International Inc., Arlington, Va., listed the following figures for 2002: Texas Gulf Coast Vicksburg 1.1 bcfd, Denver-Julesburg tight sands 520 MMcfd, Appalachian Clinton/Medina sands 320 MMcfd, and Anadarko basin Cherokee/Red Fork sands 470 MMcfd.